⚠️Clif High - Panic! 2022!⚠️

(Dinarian Note: Something to think about: If the evil petro-dollar is on it's way out.. is any stablecoin pegged to it really a safe-haven? Or is it better to be in Cryptos and silver during the transformation? 👉Not financial advice, just something to be thinking about as we move forward.)

Remember! Deep, slow, breathing!

Panic, it turns the mouth into a dessert with the tongue a rough and scaly petrified log resting on the sand. It heats the throat, pressurizes the lungs, constricts the heart, and empties the bowels and bladder with force that feels like it is draining away your very life.

Panic! It’s the most powerful of our active emotional complexes.... the one that can destroy the mind and all reason, in an attempt to preserve the body during assault. Panic drives the body and mind into an intensity equaled by no other emotion. Panic! It’s designed by universe as the last employable strategy when your mind is saying that Life Itself is about to be lost.

Panic grabs all the millions of bundles of existing stress in your body into a rope, twisting until they all start screeching under the strain, demanding of the Mind and Will some form... any form of release from the pressure.

Panic! As with all emotions, it’s contagious.

Panic spreads rapidly. The speed of transmission through a population is a defining characteristic of panic. Panic jumps from person to person with the very spark of communication, faster than electricity, at nearly the speed of Thought. Panic spreads fast.

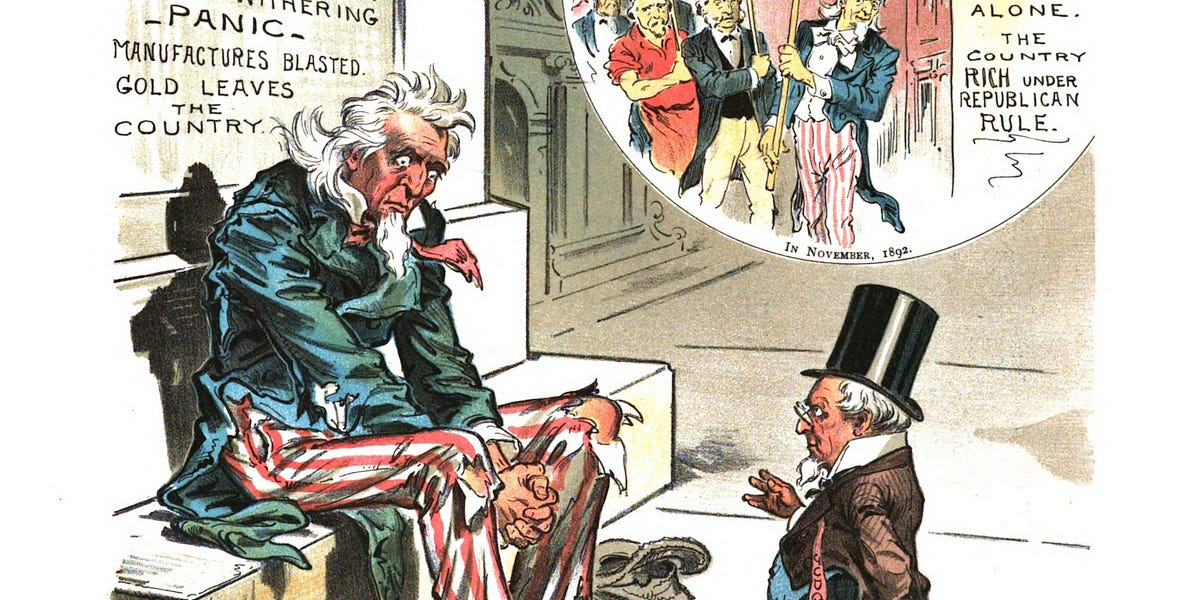

There is no panic like a banking panic. Especially for speed of transmission, though it is the depth of penetration of the panic that is remembered in history, not usually the rapidity of its spread, as banking panics always are followed by society changing periods that last for years.

The Panic of 1893 led to four hard years that nearly destroyed the middle class in the USA. This panic also prompted political changes that participated in the Anti-Masonic movement that produced the ‘anti-mason laws’, as well as two, new, national political parties, one of which would go on to take the Presidency in just 10 years time.

The Panic of 1893 took out 500 banks, over 15,000 businesses, 4 major railroads, the nascent steel industry, and nearly sent Washington State back to the status of Territory. The Panic struck just 4 short, exuberant years following statehood being granted to Washington. During those 4 years, Washington had the fastest growing population on the North American continent. Census figures record some areas growing 20 fold over those first four exciting years of statehood as men, machinery, and money, moved in to harvest the plentiful resources of timber, fish, and irrigation free (due to rainfall) farming. Washington was a ‘booming’ place.

In fact, it was so ‘booming’ that the sentiment became a sales slogan.

Seattle boosters called their city "the boomingest place on the earth," and British author Rudyard Kipling described Tacoma in 1889 as "literally staggering under a boom of the boomiest" (Kipling, 43). www.historylink.org/file/20874

Always, both booms and banks will fail, and the banking Panic of 1893 sparked across the minds of men, igniting the explosion of confidence that ruptured the Washington state, as well as national, confidence. First the capital flow into the state shrunk, then reversed sharply, until funding on any commercial venture could be characterized as ‘impossible to obtain’. Within just 18 months following the panic, Washington state, the fastest growing state in the Nation, began to see municipalities fail, the infrastructure crumble, and the population abandon the area. The effects of the Panic of 1893 on Washington were still being felt four decades later in the 1940s as the state was best known for being the home of ‘Ma and Pa Kettle’ of movie fame, the iconic example of the form of American ‘genteel poverty’ at the time.

The confidence in the banking system in 1893 was due for an implosion based purely on internal dynamics of rampant fraud, poor-to-no accounting, a corrupt judicial system that favored the ‘special interests’ (today called ‘TPTB’, or the Deep State), and no political will to tackle the problems.

Sound familiar?

These days we have the financial system delicately balanced around a dying currency. Conditions are ripe for another banking panic.

There are notable differences between banking panics, and banking manipulations that produce crashes. The Panic of 1893 was structurally unlike the Great Depression of the 1930s. We even memorialize them in history based on their key differences. While the Great Depression was an engineered financial system ‘conversion event’ in which the controllers of the fractional reserve fiat system were converting their interest based ‘gains’ within the system into physical goods such as farm lands, thus creating the waves of ‘farmer suicides’ in the Midwest of USA in the 1930s, the Panic of 1893 was an event exogenous to the financial system of the day.

The Great Depression, and subsequent World War 2, were engineered to create just the results that history witnessed. The only time there was real panic within the financial system in the 1930s was in 1933, when the engineered slow down of the flow rates intended to allow assets to be seized by the banksters came perilously close to unleashing the Central Bank Killer, aka “deflation” as the commercial and government bonds moved towards implosion. At that point there was Big Panic within the system that originated at the top, eventually even spilling out into small scale runs against regional banks. The fear of deflation resulted in the Banksters, via the Federal government ‘authority’ of the office of the Presidency, going to great lengths to seize gold, and to outlaw it’s use by the populace.

The Panic of 1893, in contrast, was a sudden event outside the control of the ‘special interests’, today called the ‘elites’. The Panic, unlike the 1930s, was not engineered, and was the result of a loss of confidence in a bank issued currency during conditions of naturally occurring deflation, amid a period of the stabilization of commercial and consumer demand rates, while the economy was digesting the influx of inflation from gold discoveries of the previous 5 decades. Specifically, the Baring Bank issued demand notes based on illusions of growth within the Argentine economy, which failed to materialize. The Baring Bank, so the history back story goes, then paid to foment a coup in Argentina to try to force conditions to support their demand note issuance. When the news of the failure of the coup reached North America, the inevitable loss of confidence precipitated a great cascading fault Panic against over 500 banks’ demand notes which all rolled back into confidence in the dollar. As the demand notes, and other, mostly fraudulent currencies were destroyed, deflation roared to life within the global banking system.

The Panic of 1893 was not named by history for the subsequent massive Depression that changed America, and the World far more than was observed during the Great Depression of the 1930s. The difference is that the depression years following the 1893 Panic, and banking system collapse, was a period of decentralized growth, whereas during the Great Depression, it was rebuilding within the same, flawed, fraudulent financial centralized system that had created the conditions.

THE basic difference was the existence of the American Central Bank, aka ‘the Federal Reserve Bank’, which is not part of the federal government, has no reserves, and is not a bank.

The Panic of 1893 changed the political landscape across America, and the subsequent depression altered the world with innovation and inventions. Think airplanes, automobiles, electric communications, asphalt roads, soda pop, vitamins, and many other inventions made the US & world patent offices very busy places from 1897 through into 1929. There was a boom in patents, both applied, and granted, not equaled since. All of this emerged during the depression following the Panic of 1893. It was noted by economic forecasters of those years that the Panic had a great and deep ‘cleansing’ effect on the economy, and the minds of the people, and that the resulting institutional ‘poverty’ was significant in removing barriers placed on the populace by those, mostly corrupt, institutions.

The pace of innovation withered following 1929 as invention and commercial creation was brought under control of the CBI (central bank infrastructure) of academic and corporate and government funded research centers. The Great Depression of 1930s merely hardened the control of the Deep State, and eliminated avenues of freedom for the populace as the fractional reserve banking system set out to conquer the planet.

Which it did, conquer the planet, that is. We are there now. Central banking owns the earth, and all its resources, including you. At least that’s what the banksters think, and say. Just go listen to any of the speeches at the World Economic Forum. You will hear them say it. And their corrupted courts will enforce that thinking on you.

The recovery from the Panic of 1893 was visible within a single year as the prompted political and systemic changes began to be backed by the populace. It took four years, until 1897, for the impacts of the Panic period to fully emerge, for the 15,000 businesses to go bust, for the 500 + banks to implode, for the people to resettle, but by then, efforts to rebuild through replacing flawed institutions, and thinking, were already being seen in both National, and international publications.

The recovery from the engineered Great Depression is arguably still on-going as the Central Banking powers granted by law during the early years of that depression are still in effect. We are still using the degraded, failed, flawed, and fraudulent Federal Reserve Note (aka ‘the dollar’), and the same political infrastructure is still in place, in fact, more entrenched, and more pervasive, than ever seen in past Ages.

The conditions we face now are remarkably similar to those in existence prior to 1893 in character, though greatly magnified by population size, and thus economic, as well as financial activity. The pressures on the financial system, now, from popular culture, capital flows, government stability, banking controller actions are all much more resembling those of the late 1880s than the 1920s.

In spite of the very large, and very public, levels of social engineering by the Central Banks of the world, trying to cause yet another Great Depression, and follow on World War, 👉it is my opinion that we will instead witness a Banking Panic erupt.

👉The Panic that will erupt will be a ‘central’ banking panic. This panic, as in 1893 (and previous banking panics) will be at the level of ‘confidence in the currency’…at the level of the Federal Reserve itself. That is, like the Panic of 1893, the coming Great Panic of 2022 (or maybe 2023, though personally it seems unlikely that they can hold it together that long), will be all about faith and confidence in central bank issued currencies.

👉This Great Panic of 2022 will destroy the ‘full faith and credit’ of the US Federal Government. And its institutions. This will lead to the period that was labeled as Secrets Revealed within my ALTA reports.

👉The Secrets Revealed period will emerge due to the failure of the petrodollar financial structure that causes the Deep State to no longer have effective ways to bribe people at all levels of the ‘corruption career ladder’. This in turn leads to a great outpouring of Secrets, both large and small. The Secrets being revealed create an environment of ‘disclosure’ that was shown in my work to alter our concept of ‘transparency’, as well as ‘government’.

👉Deflation is again here, though caused this time by the covid scam and subsequent die-off from the vaccines. The ill, dying, and dead people from covid don’t make many demands on our consumer society. The failed war of NATO versus Russia in the Ukraine occupies the place of the failed coup in Argentina in 1893. When the reality of the failure becomes visible 👉due to some singular event, some example that can be discussed by the populace as a meme illustrative of the emerging failure, 👉then will the Panic of 2022 manifest.

👉There is not enough Xanax on this planet to calm a banking Panic.

👉As the Panic of 2022 unfolds, there will be mass histrionics, much from government, and banking ‘officials’ (most of whom will be gone from their positions within the next 12 months), as well as hysterics, and bad reactions within the populace.

People you know will go batshit crazy. The important thing to know when you see your relatives, friends, and neighbors acting out inappropriately, is that likely no one will remember the small incidents such your sister-in-law crying while shaking her nude fiddly bits in public.

👉So breathe deep and slow and remember that we are all going to be in it in a serious way, but that a cleansing Panic is a hell of a lot better than the alternative!

https://clifhigh.substack.com/p/panic-2022