The Great Reset is upon us.

All things as we have known and have becomecomfortably numbwith, such as zero interest rates, negative real interest rates, quantitative easing (digital money printing), and Pax Americana, [and central bank dominance of the U.S. bond market] are being upended and overturned. Beware ofrecency bias, folks, as the global structural shifts and changes are now ubiquitous. –GMM, Sep 23rd

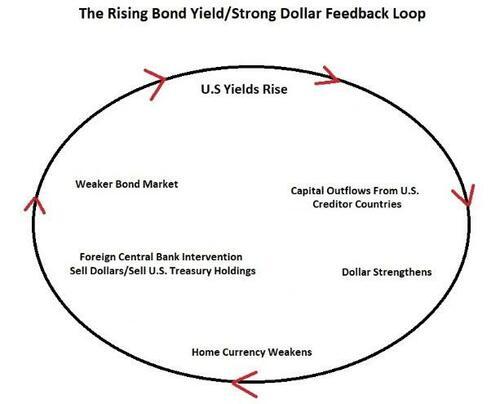

Here’s a quick primer that may explain the current global macro dynamic between the strong dollar and rising bond yields. We’ve been beating this drum for years.

Central Banks Will Be Net Sellers Of Treasury Securities

Central banks, both foreign and the Fed, who are and have never been price and market sensitive, have been the predominant buyers of Treasury coupon securities over the past 20 years.

Look at the following table from aJuly 2021 post, which set the stage for the inflation we are now experiencing.

Granted, the massive ramp in the budget deficit during COVID – to a 12-month trailing high of19 percent of GDP in March 2021– is unlikely to repeat, but ditto for the Fed’s Treasury purchases. The markets did not have the ability to absorb such a massive new issuance without a major financial disruption and a spike in interest rates.

The markets will now have to absorb or step in and replace both the Fed’s demand as the balance sheet runs off (effective net Treasury selling) and the foreign central bank selling. Both have now morphed from the largest buyers to net sellers.

Also, note from the above table the Fed’s purchase of almost 200 percent of TIPs issuance during the period; that is, all of it and then some. Inflation expectations? Managed!

China Selling Treasury Holdings

Once the largest foreign holder of U.S. Treasury securities, China has sold down its holdings by over 26 percent from its November 2013 peak. We also have no doubt Japan’s holdings are down from the latest observation in July. However, the Bank of Japan (BoJ) seems more comfortable with a weakening yen but not at the recent rapid clip, which forced them to intervene in the currency market.

Japan intervened in the foreign exchange market on Thursday to buy yen for the first time since 1998, in an attempt to shore up the battered currency after the Bank of Japan stuck with ultra-low interest rates. –Reuters, Sep 22nd

Global Capital Flows And The Great Financial Crisis

Before the Great Financial Crisis (GFC), the Fed raised its policy rate by 425 basis points, and long-term yields barely budged. Were financial markets efficient in anticipating the GFC?

Hardly. The technical position of the yield curve contributed to and helped cause the GFC.

Alan Greenspan argued that the Fed lost control of the U.S. yield curve. Foreign central banks recycled their massive dollar purchases back into the U.S. bond market after intervening in home markets to keep their currencies from appreciating. Central banks were still reeling from the 1997 Asian Financial Crisis, which taught them a hard lesson about letting currencies become too overvalued.

The foreign central bank Treasury purchases suppressed long-term rates and allowed the credit and housing bubble to continue for much longer than the Fed anticipated and desired.

Looking back, he [Alan Greenspan] says today: “We tried in 2004 to move long-term rates higher in order to get mortgage interest rates up and take some of the fizz out of the housing market.But we failed.” Something besides Fed policy was at work. Both Mr. Greenspan and his successor, Ben Bernanke, point to an unanticipated surge in capital pouring into the U.S. from overseas. –Council of Foreign Relations

Are We Now In A Rising Bond Yield/Strong Dollar Feedback Loop?

In our 2017 post,Orwellian Monetary Policy, we posited that tighter domestic monetary policy in a globalized capital market could, in effect, and paradoxically, create looser domestic financial conditions as foreign capital is sucked back into the U.S. markets. We suspect that is what happened before the GFC and agree with Greenspan and Bernake on this point.

We wrote in the dystopian 1984 language,

“Tightening is Easing”

Today’s World

The moves in exchange and interest rates over the past few months have been violent.

We suspect we are now in a bond yield-dollar feedback loop, where many central banks are forced to intervene in their home currency markets, selling their Treasury holdings to raise the dollars to ease the pressure on the home currency.

On the margin – and prices are set by marginal buyers and sellers — their actions put downward pressure on U.S. bond prices, causing yields to rise.

We are unsure whether this is a reality or GMM fitting reality to a nice theory, but we deduce it fits the action we are currently witnessing in the global markets.

The same is true forall central banks whose currenciesare under pressure. Witness the positive feedback loop.

Reflexivity

Reflexivity in economics is the theory that a feedback loop exists in which investors’ perceptions affect economic fundamentals, which in turn changes investor perception. The theory of reflexivity has its roots in sociology, but in the world of economics and finance, its primary proponent isGeorge Soros. –Invetopedia

We don’t know if the markets are in a period of Soros’ reflexivity, where traders and investors understand the above model and are trading on it, causing yields to rise and the dollar to strengthen even further in a self-fulfilling prophecy.

We suspect it is so; in the same spirit of Milton Friedman’s pool player analogy, acting as if they understand the laws of physics even though they don’t.

Consider the problem of predicting the shots made by an expert billiard player. It seems not at all unreasonable that excellent predictions would be yielded by the hypothesis that the billiard player made his shots as if he knew the complicated mathematical formulas that would give the optimum directions of travel, could estimate accurately by eye the angles, etc., describing the location of the balls, could make lightning calculations from the formulas, and could then make the balls travel in the direction indicated by the formulas. Our confidence in this hypothesis is not based on the belief that billiard players, even expert ones, can or do go through the process described; it derives rather from the belief that, unless in some way or other they were capable of reaching essentially the same result, they would not in fact be expert billiard players. – Milton Friedman,Essays in Positive Economic, 1953

Where Are The Dollars Going?

Moreover, where is all the liquidity going from the King-Kong dollar strength?

Our priors are more, or some are being transferred from foreign central bank holdings of Treasuries into private sector hands and recycled back into the U.S. short-end bond and money markets.

Nobody knows for sure, but after three 75 bps rate hikes and quantitative tightening well underway, one would think that money liquidity would be shrinking. However, it doesn’t seem to be the case as the Fed’s overnight reverse repo facility remains at record highs.

We suspect foreign capital is flowing into the short-end, which now provides decent yields of 3-4 percent, giving the gorilla strength to the U.S. dollar.

Are Financial Conditions Tight?

After the jumbo rate hikes and $90 billion per month being drained from the domestic financial markets as the notes and bonds roll off the Fed’s balance sheet, one would think so.

Our favorite indicator of U.S. financial conditions,, theChicago Fed’s National Financial Condition Index (NFCI), a weighted average of a large number of variables (105 measures of financial activity). tells a different story, however. Financial conditions remain slightly loose.

Upshot

The U.S. financial markets are still flush with too much money, and the Fed has once again lost control of events. Something big will eventually break, but in the words of the great-late MIT professor Rudy Dornbush,

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.–Rudiger Dornbusch

Because we have reached the tipping point of excess money, liquidity, capital, or however you define it, which are creating global inflationary pressures, don’t count on the monetary cavalry coming to the rescue anytime soon or returning to the good old days of hurricane force central bank headwinds.

Look how markets reacted to the U.K.’s unfunded tax cuts this week.

Britain’s new government announceda sweeping series of tax cutson Friday, betting it had found the path to economic growth despite high inflation.

But the market verdict was swift and negative: The value of British stocks and bonds fell sharply, while the pound sank to lows against the U.S. dollar not seen since 1985. –NY Times

⚠️The Great Reset is upon us, folks. Don’t fight it⚠️

We expect global policymakers will eventually be forced to coordinate their actions.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.