The Fed’s next crisis is already brewing. Unlike 2008, where “subprime mortgages” froze counter-party trading in the credit markets as Lehman Brothers failed, in 2022, it might just be the $27 Trillion Treasury market.

When historians review 2022, many will remember it as a year when nothing worked. Such is far different than what people thought would be the case.

Throughout the year, surging interest rates, the Russian invasion of Ukraine, soaring energy costs, inflation running at the highest levels in 40 years, and the extraction of liquidity from stocks and bonds whipsawed markets violently. Since 1980, bonds have been the defacto hedge against risk. However, in 2022, bonds have suffered the worst drawdown in over 100 years, with a 60/40 stock and bond portfolio returning a horrifying -34.4%

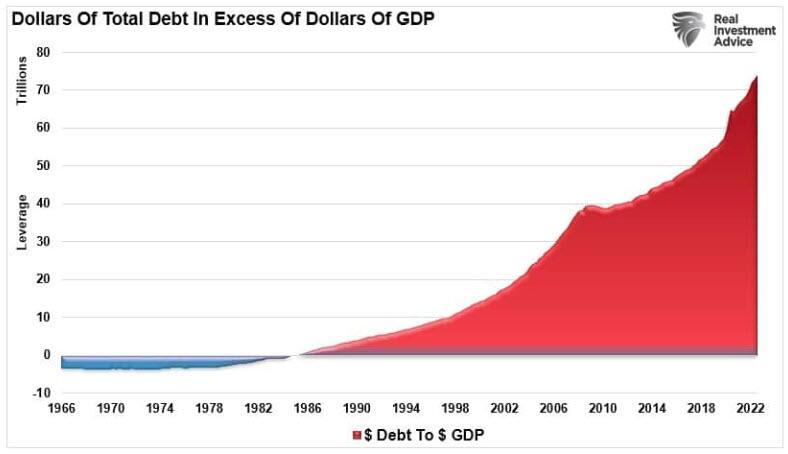

The drawdown in bonds is the most important. The credit market is the “lifeblood” of the economy. Today, more than ever, the functioning of the economy requires ever-increasing levels of debt. From corporations issuing debt for stock buybacks to operations to consumers leveraging up to sustain their standard of living. The Government requires continuing debt issuance to fund spending programs as it requires the entirety of tax revenue to pay for social welfare and interest on the debt.

For a better perspective, it currently requires more than $70 Trillion in debt to sustain the economy. Before 1982, the economy grew faster than the debt.

Debt issuance is not a problem as long as interest rates remain low enough to sustain consumption and there is a “buyer” for the debt.

A Lack Of A Marginal Buyer

The problem comes when interest rates rise. Higher rates reduce the number of willing borrowers, and debt buyers balk at falling prices. The latter is the most important. When debt buyers evaporate, the ability to issue debt to fund spending becomes increasingly problematic. Such was a point made by Treasury Secretary Janet Yellen recently.

“We are worried about a loss of adequate liquidity in the [bond] market.”

The problem is that outstanding Treasury debt has expanded by $7 trillion since 2019. However, at the same time, the major financial institutions that act as the “primary dealers” are unwilling to serve as the net buyers. One of the primary reasons for this is that for the past decade, the banks and brokerages had a willing buyer to which they could offload Treasuries: The Federal Reserve.

Today, the Federal Reserve is no longer acting as a willing buyer. Consequently, the primary dealers are unwilling to buy because no other party wants the bonds. As a function, the liquidity of the Treasury market continues to evaporate. Robert Burgess summed it up nicely:

“The word “crisis” is not hyperbole. Liquidity is quickly evaporating. Volatility is soaring. Once unthinkable, even demand at the government’s debt auctions is becoming a concern. Conditions are so worrisome that Treasury Secretary Janet Yellen took the unusual step Wednesday of expressing concern about a potential breakdown in trading, saying after a speech in Washington that her department is “worried about a loss of adequate liquidity” in the $23.7 trillion market for U.S. government securities. Make no mistake, if the Treasury market seizes up, the global economy and financial system will have much bigger problems than elevated inflation.”

Such isn’t the first time this has happened. Each time the Federal Reserve previously hiked rates, tried to stop “quantitative easing,” or both, a “crisis event” occurred. Such required an immediate response by the Federal Reserve to provide an “accommodative policy.”

“All this is coming as Bloomberg News reports that the biggest, most powerful buyers of Treasuries, from Japanese pensions and life insurers to foreign governments and U.S. commercial banks, are all pulling back at the same time. ‘We need to find a new marginal buyer of Treasuries as central banks and banks overall are exiting stage left.” – Bloomberg

It’s Not A Problem Until Something Breaks

As discussed previously, while there are actual “warning signs” of fragility in the financial markets, they are not enough to force the Federal Reserve to change monetary policy. The Fed noted as much in its recent meeting minutes.

“Several participants noted that, particularly in the current highly uncertain global economic and financial environment, it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook.”

While the Fed is aware of the risk, history suggests the “crisis levels” necessary for a monetary policy change remain in the distance.

Source: Bank Of America

Unfortunately, history is riddled with monetary policy mistakes where the Federal Reserve over-tightened. As the markets rebel against quantitative tightening, the Fed will eventually acquiesce to the selling deluge. The destruction of the “wealth effect” threatens the functioning of both equity and credit markets. As I will address in an upcoming article, we already see the early cracks in both the currency and Treasury bond markets. However, volatility is rising to levels where previous “events” occurred.

As noted in “Inflation Will Become Deflation,” the Fed’s primary threat remains an economic or credit crisis. History is clear that the Fed’s current actions are once again behind the curve. Each rate hike puts the Fed closer to the unwanted “event horizon.”

“What should be most concerning to the Fed and the Treasury Department is deteriorating demand at U.S. debt auctions. A key measure called the bid-to-cover ratio at the government’s offering Wednesday of $32 billion in benchmark 10-year notes was more than one standard deviation below the average for the last year.” Bloomberg News.

When the lag effect of monetary policy collides with accelerating economic weakness, the Fed will realize its mistake.

A crisis in the Treasury market is likely much greater than the Fed realizes. That is why, accordingto Bloomberg, there are already potential plans for the Government to step in and buy back bonds.

“When we warned last week that Treasury buybacks might begin to enter the debt management conversation, we didn’t expect them to jump so abruptly into the limelight. September’s liquidity strains may have sharpened the Treasury’s interest in buybacks, but this is not just a knee-jerk response to recent market developments.”

If something is breaking in the Treasury market, it will likely be time to buy both stocks and long-dated Treasuries as the next “Fed or Treasury Put” returns.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.