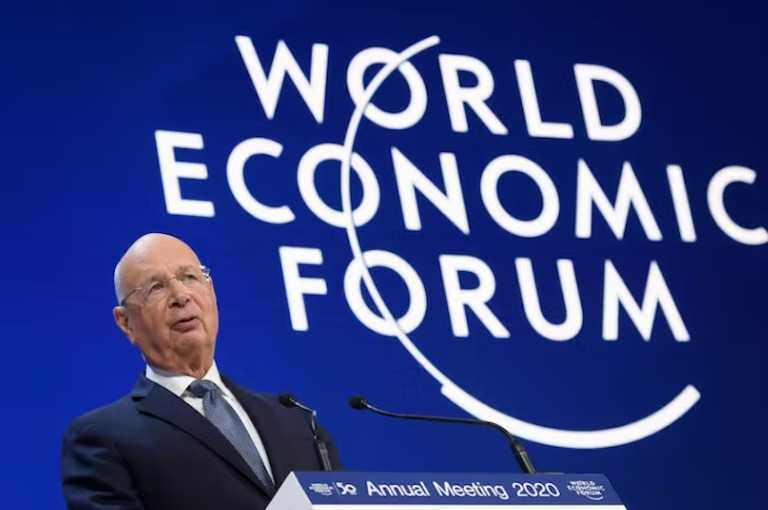

The World Economic Forum (WEF) and its long-serving founder and Executive Chairman, Professor Klaus Schwab, are the subjects of many insane conspiracy theories. This NGO, which again this January will bring together politicians, business leaders, journalists, academics, and assorted celebrities in Davos, has been accused, among other things, of being a secret cabal of paedophiles who used the Covid-19 pandemic to harvest children’s blood so as to hasten in a Satanic New World Order.

It isn’t mad, however, to regard the WEF as a dangerous force in global politics. The WEF is a dangerous force in global politics. To adapt Joseph Heller, just because you are paranoid, doesn’t mean the WEF isn’t after you. A shared distrust of the WEF brings together anti-capitalists on the left and culture-warriors on the right. But that distrust is based on a misunderstanding of what the WEF is these days really all about.

For many WEF critics, the vileness of the organisation can be encapsulated in one word: ‘neoliberalism.’ It’s a term that conjures up images of plutocrats and untrammelled markets ravaging the planet and exploiting blue-collar folk in the name of profit. Funnily enough, Chairman Schwab agrees with that assessment of the world’s ills. Once upon a time, the WEF prioritised the necessity and benefits of economic globalisation. That has not been the case for many years, however. In October 2020, Schwab stated that:

[S]hibboleths of our global economic system will need to be re-evaluated with an open mind. Chief among these is the neoliberal ideology. Free-market fundamentalism has eroded worker rights and economic security, triggered a deregulatory race to the bottom and ruinous tax competition.

Precisely how and where ‘free-market fundamentalism’ has run amuck remains a mystery. After all, we live in a world in which most governments in developed nations routinely control 40 per cent or more of their nation’s GDP.

Nor does the regulatory and welfare state’s relentless growth in, say, the European Union, Britain and America suggest that free market radicals have been in charge in Brussels, London or Washington for decades. As for China, since 2008, its Communist party leadership has been steadily reasserting state control over an economy that was only ever very partially liberalised.

To adapt Joseph Heller, just because you are paranoid, doesn’t mean the WEF isn’t after you

Ignoring these inconvenient facts, Schwab believes that the world needs a ‘Great Reset.’ Covid, according to the WEF’s website explaining the global reboot awaiting the world, revealed all the ‘inconsistencies, inadequacies and contradictions of multiple systems – from health and financial to energy and education.’ The entire planet needs a new ‘social contract’ to reshape ‘the future state of global relations, the direction of national economies, the priorities of societies, the nature of business models, and the management of a global commons.’

That’s quite a list. But what adjectives, I ask, should be used to describe an outfit that proposes to coordinate the reorganisation of 8 billion souls, 195 countries, international relations, social policy writ-large, and a $104 trillion global economy? Words like ‘delusional’ and ‘megalomaniacal’ come to mind.

A key concept for Schwab’s vision of a reset world is ‘stakeholder capitalism.’ In his 2021 book Stakeholder Capitalism: A Global Economy that Works for Progress, People and Planet, Schwab defines it as ‘a form of capitalism in which companies do not only optimise short-term profits for shareholders, but seek long-term value creation, by taking into account the needs of all their stakeholders, and society at large.’

By value-creation, Schwab partly has in mind economic prosperity. But he also calls for the promotion of three other values: ‘People,’ ‘Planet,’ and ‘Peace.’ These rather broad concepts illustrate just how all-embracing Schwab’s stakeholder capitalism seeks to be.

So who are the stakeholders who will collaborate to usher in the four Ps? For Schwab, they are ‘governments,’ ‘companies,’ and ‘civil society’ (NGOs, unions, etc.). At this point we arrive at the essence of Schwab’s grand redesign. For all his invocation of the predictable woke pieties, Schwab’s core commitment is to political and economic arrangements which used to be known as corporatism.

Schwab is quite explicit about this. In one article describing the origins of his present outlook, he writes:

This approach was common in the postwar decades in the West, when it became clear that one person or entity could only do well if the whole community and economy functioned. There was a strong linkage between companies and their community. In Germany, for example, where I was born, it led to the representation of employees on the board, a tradition that continues today.

Corporatism is a broad concept. It can run the gamut from the hyper-authoritarian version embraced by Mussolini’s Italy to worker-boss structures of the type described by Schwab in postwar western Europe. All forms of corporatism, however, share some common themes.

One is the necessity of limiting market competition in order to preserve social cohesion. Another is mandating cooperation between representative groups of different social and economic sectors – a process overseen and, if necessary, enforced by government officials for the sake of the common good.

What, you might ask, could be wrong with this? The answer is: plenty.

For a start, corporatism – including its Schwabian expression – isn’t big on freedom. It’s all about forming and then maintaining a consensus on economic and social policies. For this reason, corporatism doesn’t cope well with dissent. Indeed, it discourages any questioning of the consensus, whether the issue is tax-rates or climate change.

The language of corporatism, like that of Schwab’s WEF, may be one of coordinated consultation, but the agenda is one of control. For what matters is the harmonisation of views, no matter how absurd the idea and or how high the cost in liberty.

Not only does this generate groupthink. It encourages the marginalisation of those who dispute the consensus. If you have reservations about, say, open borders, don’t be surprised if you are branded a xenophobe. If you decline to have your workforce unionised, you’re likely be labelled a market fundamentalist who treats his employees as mere objects.

Another problem is the collusion and cronyism fostered by corporatism. Corporatist structures facilitate client-patron relations between businesses and governments. That in turn produces insiders and outsiders.

Insiders are those companies who sign up to the consensus, play the corporatist game, and consequently do very well out of their cosy relationships with governments. Outsiders are those who lack the resources to grease the wheel. An example might be the young entrepreneur with a great idea that might revolutionise an entire economic sector but who doesn’t enjoy the political connections. Long-established companies rarely hesitate to use their connections to try and establish regulatory environments, which makes it hard for such entrepreneurs to compete in the marketplace.

Lastly, corporatist-style stakeholder capitalism is decidedly ambivalent about democracy. The emphasis is upon insiders negotiating with each other, and then presenting the populace with a series of faits accomplis about anything ranging from fossil fuels to ESG.

There’s not much room for contributions from the wider populace to the decision-making process in Schwab’s stakeholder capitalist model, let alone popular assent to decisions taken. Indeed, the model reflects a positive distrust of bottom-up initiatives because these are harder to control and less likely to buy into the established consensus.

As nations have discovered, considerable costs are associated with corporatist ways of running economies and societies. On an economic level, corporatism discourages innovation, produces inflexible labour markets dominated by unions whose priority is maintaining the status quo, and riddle the marketplace with privileges for well-connected businesses.

In political terms, even mild forms of corporatism significantly disenfranchise voters and put an ever-growing number of important decisions in the hands of unaccountable bureaucracies. In many ways, the EU’s governance structures – and the democratic deficit which they personify – exemplify such arrangements.

Which brings us back to the WEF. It wields no formal political power and can’t make anyone do anything. Nonetheless, since its founding in 1971, the WEF has become an organisation which embodies supreme confidence in the imperative of a particular type of person running the world from the top-down. In his famous 2004 essay entitled ‘Dead Souls,’ the political scientist Samuel P. Huntington called this prototype ‘Davos Man.’

A clever moniker that neither Schwab nor the WEF have ever succeeded in shaking off, Davos Man was Huntington’s short-hand description of ‘academics, international civil servants and executives in global companies, as well as successful high-technology entrepreneurs’ who thought alike and tended to view national loyalties and boundaries ‘as residues from the past.’ Davos Man also looked with undisguised disdain, Huntington suggested, upon those who weren’t getting with the programme – whatever the content of the programme happened to be.

Therein lies the deepest problem with the WEF. It’s one thing for people to come together in international settings to discuss problems, share insights, and network. Business leaders, politicians, and NGO-types do this all the time.

It’s another thing for an outfit such as the WEF to decide that the time has come to rearrange the world from the top-down and remake the planet in a corporatist image. The ideal for which Schwab is aiming, judging from his speeches and writings, is something akin to a globalised EU, with its supranational and ingrained bureaucratic ways being transposed to an international level, and the levers of power vested in the hands of reliable Davos men and women.

In short, it’s easy to caricature the WEF and Schwab as something akin to Ian Fleming’s fictious Spectre and its criminal-mastermind Ernst Stavro Blofeld. Yet the agenda now being pursued at settings such as Davos is sufficiently alarming that anyone who believes in preserving things like liberty, sovereignty, and the decentralisation of power should be concerned.

Davos Man should be put on notice: his Great Reset won’t go uncontested.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.