Most people don’t understand how close to the edge was the US banking system with the collapse of Silicon Valley Bank and Signature Bank.

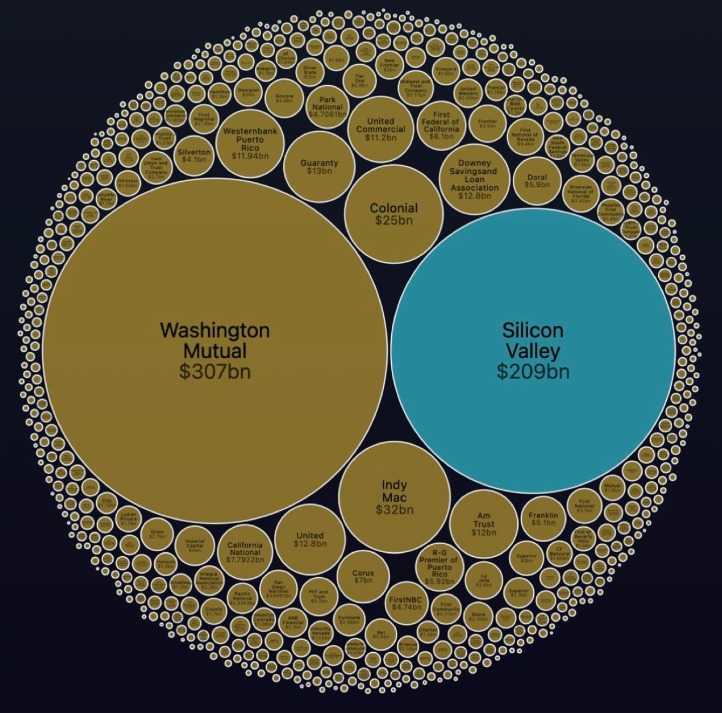

💡The chart below shows the size of the balance sheets of the biggest US failed banks in history, with the bankruptcy of Washington Mutual in 2008 the biggest, with $307 billion of clients assets. The bankruptcy of SVB and Signature Bank that happened over the weekend, was in fact the 2nd and 3rd largest bankruptcy in US banking history with $209 billion and $118 billion of clients assets, respectively. (PROBLEM)

Help US Government Help US.. (Reaction)

✅ The Federal Reserve Board, in alignment with U.S. Department of the Treasury and Federal Deposit Insurance Corporation (FDIC) went through extraordinary efforts to preserve the stability of the U.S. monetary system, making sure all depositors are made whole and de-facto putting in place a bail-out of the mentioned banks. (Solution)

Goal: Further DEVALUE the USD worldwide...

A great discussion from a Goldbug, that explains the further devaluation of the USD.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.