As Simon White writes today, "a full guarantee of all bank deposits would spell the end of moral hazard disciplining banks and mark the final chapter of the dollar’s multi-decade debasement." And yet that's where we are headed, even if with a few hiccups along the way, because as White also notes, with the latest banking crisis in the US, it’s the clean-up that could end up doing far more lasting damage. That's because with the failure of SVB et al prompted the FDIC to guarantee that all depositors will be made whole, whether insured or not

And so, the precedent is being set, with Treasury Secretary Janet Yellen commenting on Tuesday that the US could repeat its actions if other banks became imperiled. She was referring to smaller lenders, and denied the next day that insurance would be “blanket”, but given the regulatory direction of travel over the last forty years, this will inevitability apply to any lender when push comes to shove.

Realizing it's just a matter of time before the next systemic crisis tips the banking sector over, over the weekend, a coalition of midsize US banks asked federal regulators to extend FDIC deposit insurance for the next two years, so as to alleviate any fears which could result in a wider deposit run on regional and community banks.

But what would deposit insurance of all $18 trillion US deposits - not just the $11 or so trillion in deposits that are currently "insured" by the FDIC - look like? As BofA's rates strategist Mark Cabana writes, deposit insurance has been a very effective solution to stabilize deposit outflows historically. Deposit insurance can be done in a variety of ways: (1) all domestic bank deposits; (2) increase coverage to a higher amount vs. the $250k currently.

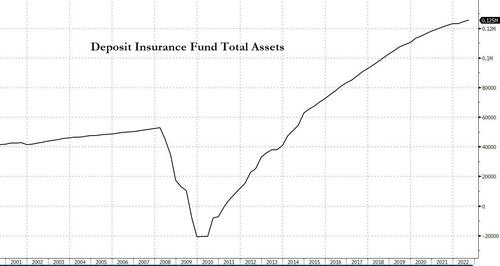

If policymakers consider extending deposit insurance coverage it would impact reserves held in the Deposit Insurance Fund (DIF).

What is DIF? One way the FDIC maintains stability and public confidence in the U.S. financial system is by providing deposit insurance. The primary purposes of the Deposit Insurance Fund (DIF) are:

- to insure the deposits and protect the depositors of insured banks and

- to resolve failed banks.

While the DIF is backed by the full faith and credit of the United States government, it has two sources of funds: i) assessments (insurance premiums) on FDIC-insured institutions and ii) interest earned on funds invested in U.S. government obligations. The government guarantee of insured deposits is not limited by the amount in the DIF. One can think of DIF as a "first loss" tranche absorbed by assessed bank funds in DIF.

Where does the DIF stand today? The DIF's reserve ratio (the fund balance as a percent of insured deposits) was 1.27% (or $128.2bn) on Dec 31, 2022. The FDIC was aiming to increase the reserve ratio to 1.35% by Sep 30, 2028 or ~$8bn increase.

What % of deposits are insured? Estimated insured deposits stood at $10.1 trillion or 56.8% of total deposits held at FDIC insured institutions of $17.8trn as of Dec 31, 2022. Recent proposals would increase insurance coverage; the extent of insurance increase differs by proposal.

DIF increase needed to provide more insurance? Assuming the 1.35% target reserve ratio is applied to the uninsured deposits, this would imply a reserve build of $104bn.

Cost to insure all deposits? $104bn in reserve build to cover uninsured deposits compares to net income across all FDIC insured banks of $263bn reported for 2022. Obviously, this reserve build would need to happen over several years to limit the impact on industry profitability in any given year. Assuming that this additional assessment is spread over ten years, implies an approximately 50bp drag on annual ROE for the industry.

Of course, all this assumes the DIF is never really used, but the statutory amount is meant to serve as a confidence booster. After all, the total expanded DIF amount of $230 billion would be insufficient to bail out the uninsured depositors of even one TBTF bank like JPM. In fact, if all deposit insurance had to be used, it would mean the US government somehow has to fund a total of $18 trillion in deposits, an amount equal to 75% of US GDP. It's ain't happening.

Is any of this a viable option? While we are skeptical confidence can be restored with some accounting sleight of hand, Mark Cabana is optimistic and sees deposit insurance as one way for policymakers and the banking industry to address sensitivity among deposit customers. Absent such broader insurance, the industry risks losing some deposits to money market funds or the Treasury market as customers diversify their excess liquidity.

Cabana's conclusion:

We believe that the last few days have introduced investors/ banks/ policymakers to the new risk of deposit-runs in the age of social media. We believe that absent a change to deposit insurance coverage, corporate CFOs/Treasurers will likely be proactively looking to diversify their deposits away from any single institution. While this may be viewed as a reasonable outcome by some, regional banks could be at the losing end under such a scenario. If maintaining the community banking structure is a priority for policymakers, a higher threshold of deposit insurance seems worth considering.

Alas, if Janet Yellen is to be believed, this isn't on the horizon, at least not until we have another sharp deterioration in the banking crisis.

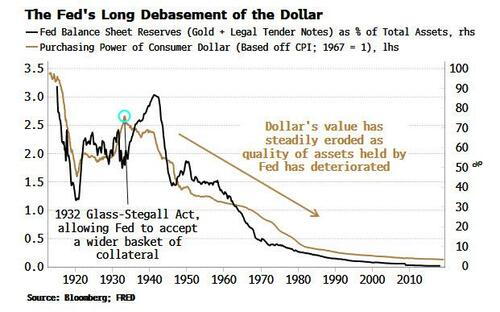

Stepping back from the accounting intricacies of how the US can backstop the impossible sum of $18 trillion without actually doing so - because it's simply impossible - and turning to the bigger picture implications, we go back to BBG's Simon White who notes that since the dollar is the primary liability of the US central bank; "this would mean further erosion of its real value, compounding the decimation of its purchasing power seen over the last century."

But why is deposit insurance linked to the strength of the dollar... and by extension its persistence as world reserve currency? Simple: it all has to do with that ultimate backstopper of the US financial system (where deposits are the largest liability) and the assets on its balance sheet. Here are some more observations from White:

The 1932 Glass-Stegall Act was the beginning of the end, allowing the Fed to accept a wider basket of collateral it could lend against: riskier assets such as longer-term Treasury securities. The falling quality of collateral has continued, with the Fed lending against corporate debt in recent years

The end result is the Fed’s balance sheet has steadily deteriorated, and with it the real value of the dollar

Obviously, then, an expansion of insurance to all deposits will lead to a further erosion in the Fed’s balance sheet. Why?

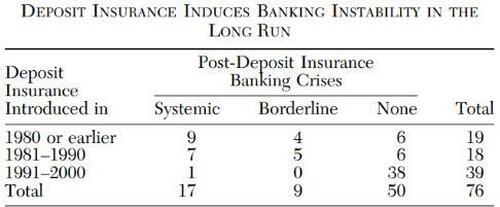

- First: deposit-insurance schemes typically lead to less, not more, bank stability. Several studies have shown that countries with deposit-insurance schemes tend to see more bank failures. The more generous the scheme, the greater the instability.

- Second: Moral hazard instills discipline in depositors as they pay attention to the bank’s credit risk (something many depositors in SVB signally failed to do.) It also imposes discipline on banks, incentivizing them to structure their cash flows so that they match through all time, thus mitigating the risk of bank runs (cue SVB again)

Why, then, would greater banking instability lead to a further deterioration in the Fed’s balance sheet? It comes down to how US banking has evolved over the last century.

Banks must manage cash flows from assets and liabilities, and their preference is to minimize their cash position each night in order to maximize the productive use of their capital. There is always a “position making” instrument, a liquid asset that banks can use to park excess cash or make up for shortfalls each day. In the early days of the Federal Reserve system it was commercial loans and USTs; now it is principally the repo market. A bank can “make position” if it can repo in or repo out securities for funds. But if the market for that collateral freezes up, they’re dead.

This is where the Fed steps in - but as the “dealer of last resort” rather than the lender of last resort. To ensure market liquidity, the Fed must underwrite funding liquidity. And to do that it must be willing to accept as collateral whatever the banking sector’s position-making instruments are.

If it doesn’t, the game’s up.

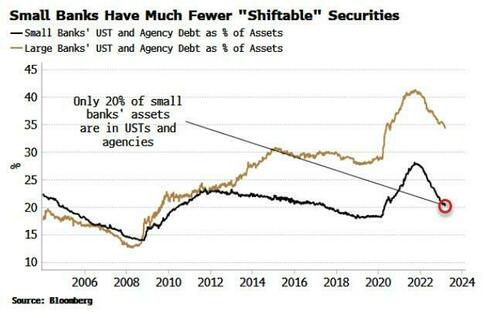

SVB happened to have a high proportion of USTs and mortgage-backed securities on its balance sheet, making the Fed’s life easy in creating the BTFP (Bank Term Funding Program), which accepts government and government-backed collateral. But this does not get to the heart of the problem. Only a fifth of small banks’ assets are currently shiftable on to the Fed’s balance - less than for larger lenders — leaving them considerably exposed!

Ultimately, deposit insurance only mitigates banks’ vulnerability to bank runs; it does not insulate them from liquidity or insolvency risk; and it certainly does not "insure" that a full-scale bank run will see every depositors' money made whole: after all there is just $128BN in the DIF and there are $10 trillion in insured deposits. At best, the DIF provides a first loss backstop only to those who panic first!

But the punchline is that SVB et al are very likely not the only fragile US banks, and as the economy slows, asset prices fall and delinquencies and bankruptcies rise - especially in commercial real estate, where small banks also happen to be the biggest lenders - we are likely to see more banks needing support

The logical outcome is that the Fed will have to increasingly accept poorer quality collateral — especially from smaller banks, with their large exposure to residential and commercial real estate. We have been here before, when during the pandemic the Fed began to accept the corporate debt of even junk-rated companies (and when gold and bitcoin hit record highs).

Minsky himself stressed the centrality of banking to financial stability, noting that imprudent banks (read: operating without moral hazard) are more likely to finance unproductive projects, which then leads to inflation.

So there we have it. As White concludes, after the US inevitably implements deposit insurance, what comes next is inflation and much more debasement of the Fed’s balance sheet: "with an abnegation of moral hazard, the long-term value of the dollar doesn’t stand a chance."

Which is also why US authorities are doing everything in their power to rapidly kill-off such counterparty-free money as bitcoin and gold, with headlines such as these now a daily occurrence:

- U.S. SECURITIES AND EXCHANGE COMMISSION ISSUES INVESTOR ALERT URGING CAUTION AROUND CRYPTO ASSET SECURITIES

...they know very well that during the next crisis - which is imminent - the monetary tidal wave will flow toward them as the bank failure dominoes begin to fall.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.