Project Atlas will create an open-source data platform that sheds light on the macroeconomic relevance of cryptoasset markets and decentralised finance (DeFi). Together with the project partners within the Eurosystem – Deutsche Bundesbank and De Nederlandsche Bank – Atlas will provide insights on market capitalisation, economic activity and international flows of cryptoassets.

What is the economic significance of cryptoassets and DeFi?

Cryptoassets and DeFi applications are part of an emerging financial ecosystem that spans the globe. While they introduce new technologies, these markets often lack transparency and present new risks. Beyond the interest in price levels and total market capitalisation, the economic use cases of DeFi and crypto are not always clear. For example, Bitcoin, Ethereum and other native cryptoassets are of only limited usefulness in payments due to their huge price swings. This has led to the emergence of various so-called stablecoins seeking to bridge the gap between traditional financial markets and crypto.

How important are cryptoasset and DeFi markets, for example for cross-border transactions? And what are the risks to financial stability? The collapse of some stablecoins and DeFi platforms has highlighted the difficulty of making such assessments today. Although blockchain transactions are in theory transparent, information on macro-financial linkages, such as capital flows, is hard to obtain. It is possible that capital flows in cryptoassets could be significant for certain corridors, but further data are needed.

More broadly, there is a pressing need for the public sector to gain first-hand knowledge of cryptoasset and DeFi markets. Currently, there is a dearth of vetted and tailored data for such purposes. For policymakers to make informed decisions, it is crucial that they understand the underlying data that feed into aggregate indicators. Since it is often unclear how these data are generated, their reliability is difficult to judge.

Project Atlas aims to fill this gap. It will develop a data platform to provide reliable insights into the macroeconomic relevance of DeFi and cryptoasset markets. Tailored to the needs of central banks, it will fuse reported data gathered from crypto exchanges and stablecoin issuers (off-chain data) with data from public blockchains (on-chain data) on an open-source platform. By connecting various sources, Atlas will offer a layered approach to data-vetting, allowing users to accurately evaluate the economic significance of these markets.

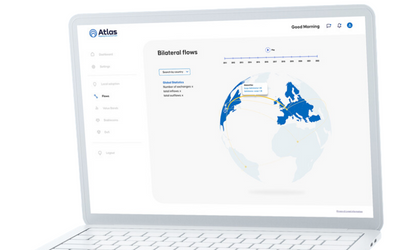

The initial focus of Project Atlas is on flows across geographic locations. By mapping blockchain transactions to crypto exchanges and their geographic locations, Atlas will be able to derive and visualise cross-border flows around the globe. The project envisions making these data publicly available and easily accessible via dashboards.

By providing greater insights into DeFi and crypto markets, starting with a better understanding of the data and technologies used in the industry, Project Atlas will aid policymakers and enhance central banks' analytical and technical capabilities as well as their overall understanding of the underlying technology.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.