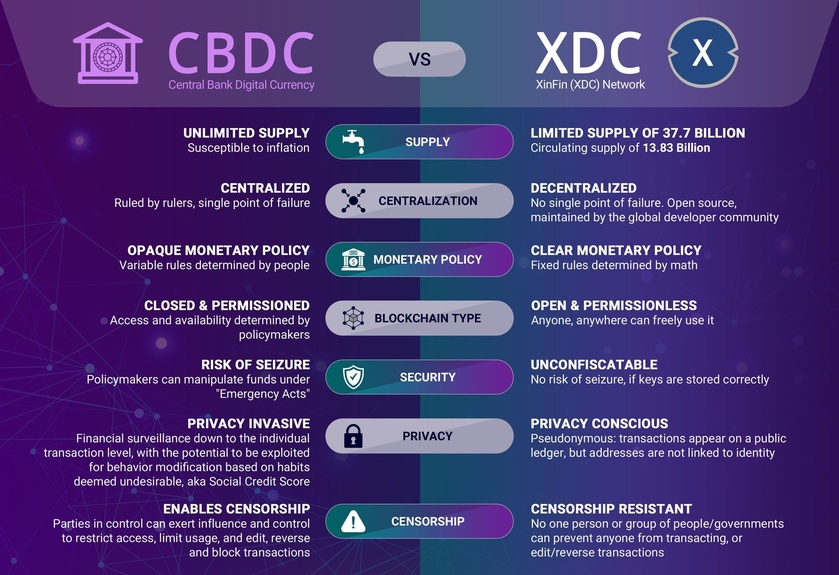

The future of money should be open-source, permissionless and decentralized. There has been a lot of discussion lately about CBDCs, the role of XDC & cryptocurrencies in general. It's important to point out the differences and clear up misconceptions.

Central Bank Digital Currencies (CBDCs) and crypto offer vastly different visions for the future of money. While CBDCs are government-backed digital currencies - basically another form of digital fiat, cryptocurrencies like Bitcoin and XDC offer a decentralized alternative.

Privacy is a fundamental human right, and it's essential for a free and open society. With CBDCs, the government can have full visibility into every transaction. This lack of privacy raises concerns about government surveillance and the potential for abuse of power.

In contrast, decentralized cryptocurrencies are built on blockchain technology, which offers a high level of privacy and pseudonymity. Transactions on these blockchain networks are recorded on a public ledger, but the identities of the participants are not revealed.

Censorship resistance is another critical feature of decentralized money. With CBDCs, the government has the power to censor transactions and freeze accounts at will. This centralized control puts the system at risk of manipulation, corruption, and censorship.

Using blockchain, distributed network, makes it virtually impossible for any one person or entity to manipulate or control the system. This decentralization ensures that the system is transparent, fair, and secure.

Where does XDC stand?

XDC is another cryptocurrency based on a decentralized network and because of its high speed and low costs, it can be used by both individuals and banks for payments and as a potential bridge between CBDCs.

There is a benefit for digitizing fiat currencies, which can lead to faster payments with reduced transaction costs, as well as improving financial inclusion for people without bank accounts, but privacy, censorship and security are some of the biggest issues.

Crypto and blockchain provide all these benefits above without the issues. As the world moves towards a digital future, it's important to consider the implications of CBDCs and decentralized money on our financial lives and on society as a whole.

Bridging the traditional system with cryptocurrency & blockchain is essential for mass adoption, but it should be done in a way that innovation, decentralization & privacy are embraced, otherwise governments and banks will be on the wrong side of the history.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.