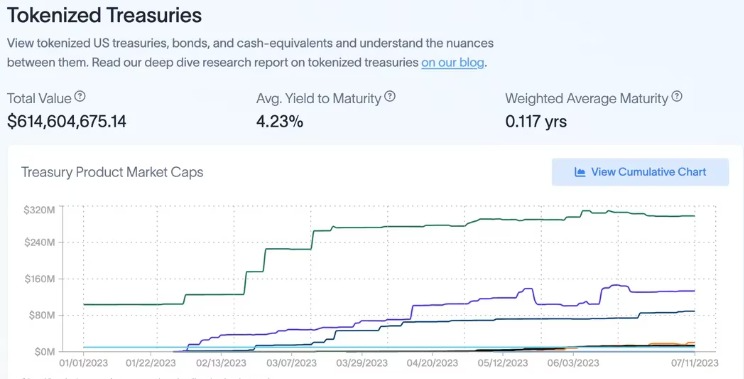

The market value of blockchain-based investment products that wrap U.S. Treasury bills, bonds and money market funds into a form of a token total $614 million, according to real-world asset data firm RWA.xyz’s compilation.

DeFi yields plummeted as demand for borrowing and leverage collapsed during the crypto market downturn. Meanwhile, bond yields in traditional finance (TradFi) rose significantly as the Federal Reserve Bank jacked up interest rates to the highest level since 2007 to combat rampant inflation.

This year, a slew of new entrants such as OpenEden, Ondo Finance and Maple Finance released blockchain-based Treasury products targeting sophisticated investors, digital asset firms and decentralized autonomous organizations.

Tokenization of real-world assets has become one of crypto’s hottest trends and could reach $5 trillion market value over the next five years, wealth management firm Bernstein said in a research last month.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.