July 17, 2023

We are excited to announce that the Chainlink Cross-Chain Interoperability Protocol (CCIP) has entered the Mainnet Early Access phase on the Avalanche, Ethereum, Optimism, and Polygon blockchains. Leading DeFi protocols in derivatives and lending are adopting CCIP, including Synthetix, which is live on CCIP mainnet, as well as Aave, with BGD Labs now integrating CCIP on mainnet into the protocol.

On July 20, CCIP will become available to all developers across five testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli, and Polygon Mumbai.

Connecting a Multi-Chain World

Web3 is now a multi-chain landscape. There are hundreds of blockchains, layer-2 networks, sidechains, subnets, appchains, parachains, and other environments for developers and users to choose from. While the launch of new on-chain ecosystems has driven innovation and adoption, it has also fragmented applications, on-chain assets, and market liquidity across different, disconnected blockchains. Furthermore, existing cross-chain solutions are complex—generally involving a multitude of technology stacks across protocols and chains—and often insecure, with $2B+ stolen due to cross-chain exploits. This lack of interoperability results in slower innovation and is holding back the progress and mass adoption of Web3.

But solving this problem is very hard. It’s not just about building the right product. It’s about building a standard that the whole industry can embrace to interoperate and build on top of each other. Building a cross-chain standard requires security, flexibility, and community. Security because moving value across chains needs to be highly reliable. Flexibility because the standard needs to accommodate all the use cases that developers will come up with and all the chains they want to build on. And finally community, because this standard is only as valuable as the community that adopts it. Chainlink has already built the industry-defining secure standard for Data in Web3, and thanks to all our users and partners, has built an incredible community. For all these reasons, Chainlink is uniquely positioned to extend this standard to solving the cross-chain problem and unlock a new wave of innovation in Web3.

Just like Web2 needed TCP/IP to connect isolated islands of computer networks, Web3 needs an interoperability standard to connect islands of blockchain networks.

CCIP is the most secure, reliable, and easy-to-use interoperability protocol for building cross-chain applications and services. Not only are developers given the flexibility to build their own cross-chain solutions on top of CCIP using Arbitrary Messaging, but CCIP also provides Simplified Token Transfers—which enables protocols to quickly start transferring tokens across chains using audited token pool contracts they control without writing custom code and in a fraction of the time it would take to build on their own.

CCIP is powered by Chainlink decentralized oracle networks, which have a proven track record of securing tens of billions of dollars and enabling over $8 trillion in on-chain transaction value. Since CCIP is built on the same foundation as existing Chainlink services, it requires little-to-no additional trust assumptions. If a dApp already relies on Chainlink for Price Feeds, then relying on CCIP for cross-chain interactions is an obvious choice. CCIP also features additional safety mechanisms that go above and beyond other cross-chain solutions, such as customizable rate limits on token transfers and a separate Active Risk Management (ARM) Network that monitors the validity of all cross-chain transactions.

Developers, applications, and enterprises can use CCIP to unlock a variety of use cases, such as:

- Cross-chain tokenized assets: Transfer tokens across blockchains from a single interface and without having to build your own bridge solution.

- Cross-chain collateral: Launch cross-chain lending applications that allow users to deposit collateral on one blockchain and borrow assets on another.

- Cross-chain liquid staking tokens: Bridge liquid staking tokens across multiple blockchains to increase their utilization in DeFi apps on other chains.

- Cross-chain NFTs: Give users the ability to mint an NFT on a source blockchain and receive it on a destination blockchain.

- Cross-chain account abstraction: Build smart contract wallets with native CCIP capabilities to improve the user experience of making cross-chain function calls. For instance, enable users to approve transactions on any chain using a single wallet.

- Cross-chain gaming: Create blockchain-agnostic gaming experiences that enable players to store high-value items on more secure blockchains while playing on more scalable blockchains.

- Cross-chain data storage and computation: Employ data storage solutions that enable users to store arbitrary data on a destination chain and execute computations on it using a transaction on a source chain.

Market Leaders Are Using CCIP To Interact Cross-Chain

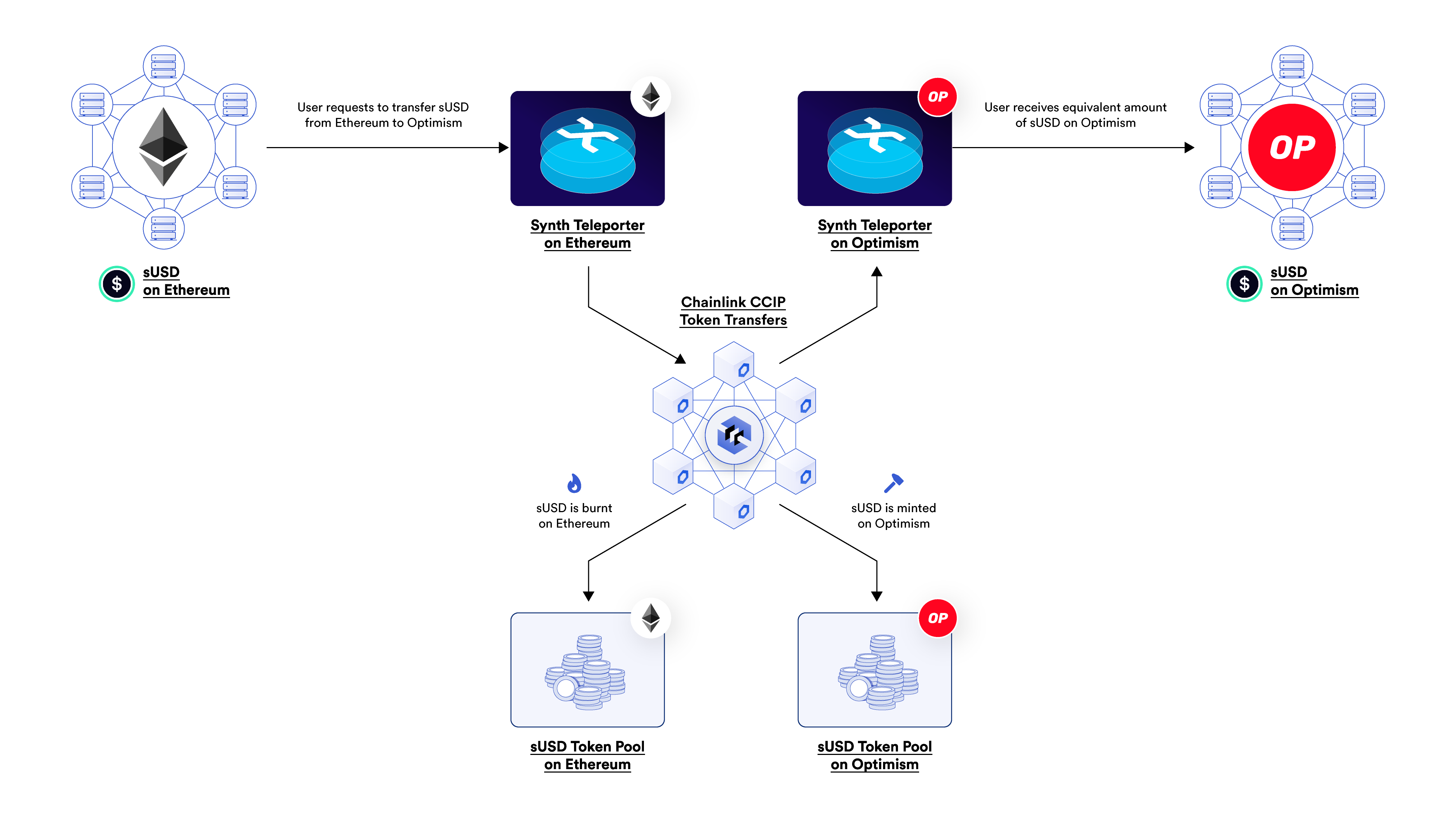

Cross-Chain Liquidity With Synthetix

Synthetix is a DeFi protocol that acts as a liquidity layer for an ecosystem of on-chain derivatives and financial instruments. One of its recent additions to Synthetix V3, the Synth Teleporter, provides users with a streamlined method for transferring Synth liquidity between chains. This feature operates by burning sUSD (the protocol’s unit of account) on the source chain, then minting an equivalent amount of sUSD on the destination chain.

The Synth Teleporter employs Chainlink CCIP to burn and mint tokens across chains safely and accurately, ensuring security and reliability. This unique burn-and-mint model promotes higher capital efficiency without the need for liquidity pools. In doing so, Synth Teleporters enable Synthetix liquidity to flow toward areas with the highest demand, bypassing constraints associated with traditional token bridges.

“Security is critical when dealing with on-chain assets, which is why we leverage Chainlink CCIP for our cross-chain Synths Teleporter. As one of the first users of Chainlink Data Feeds, we’re thrilled to get first access to CCIP and all the functionality it unlocks for Synthetix.”—Kain Warwick, Founder, Synthetix

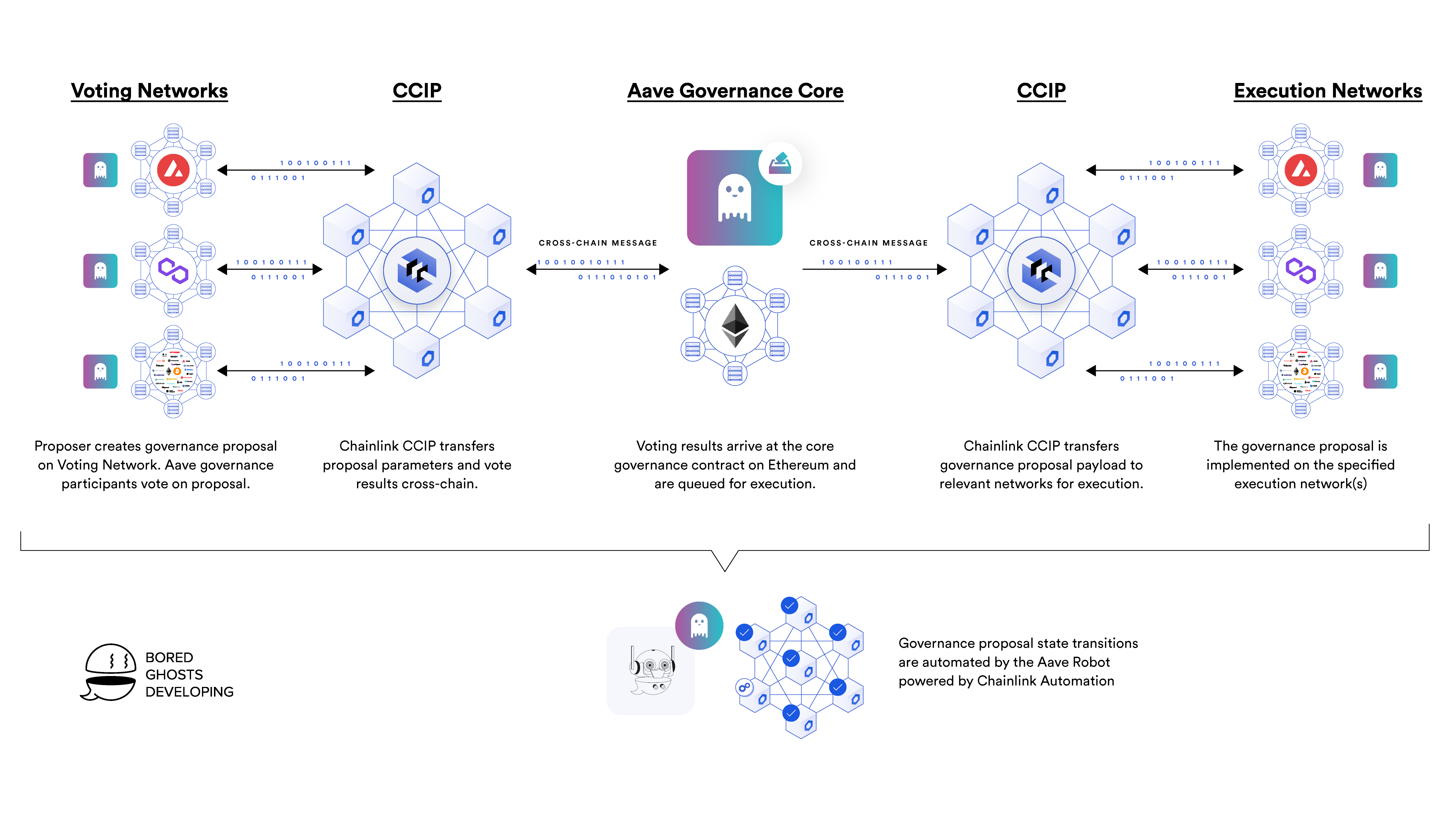

Cross-Chain Governance on Aave

Aave is a non-custodial liquidity protocol that allows users to borrow and lend assets on-chain. Aave previously used several different chain-native bridges to support its multi-chain governance mechanism and used Ethereum as the voting network. This cross-chain architecture made it expensive for participants to vote and created substantial development and maintenance costs. Once Chainlink CCIP became available, the Aave community voted to integrate the protocol because of its gas-efficient design, time-tested infrastructure, scalability to new networks, and ease of integration. Thus, BGD Labs, a Web3 development initiative, is integrating Chainlink CCIP into the Aave Governance V3 to future-proof the cross-chain system.

“We’re excited to leverage Chainlink CCIP for secure, reliable, and scalable cross-chain communication on the next iteration of the Aave protocol. With seamless integration into the cross-chain governance mechanism, CCIP is set to save valuable developer time that can be better spent enhancing the core features of Aave.”—Ernesto Boado, Co-founder, BGD Labs

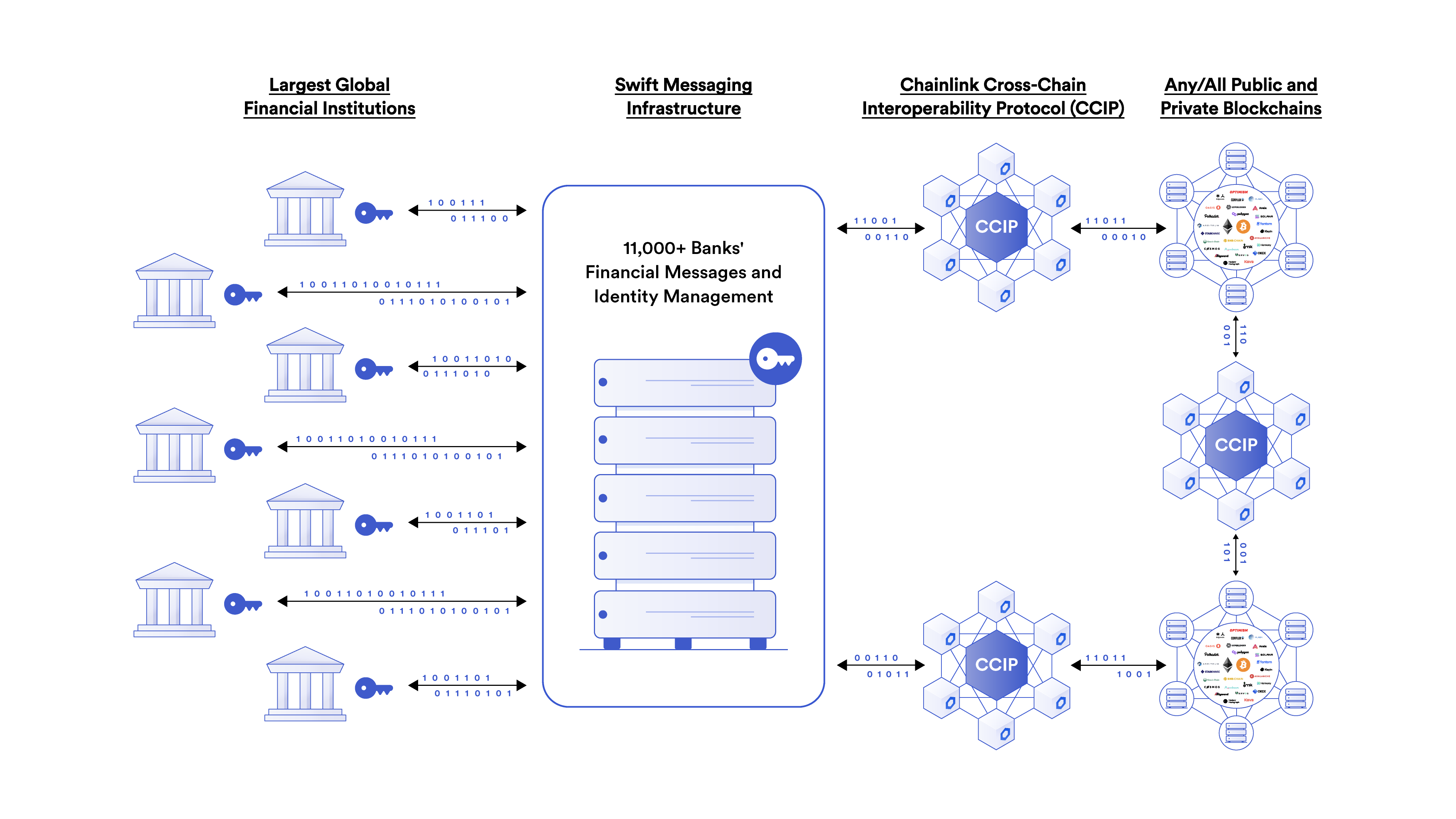

Cross-Chain Connectivity for Capital Markets

CCIP serves as a blockchain abstraction layer that allows enterprises to connect with and interoperate across any public or private blockchain environment directly from their existing backend systems. Swift and over a dozen financial institutions and financial market infrastructure providers have already begun exploring CCIP for instructing token transfers across public and private chains through existing Swift messaging infrastructure. The blockchain interoperability collaboration includes Australia and New Zealand Banking Group (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust and Clearing Corporation (DTCC).

Setting a New Standard in Cross-Chain Utility, Security, Reliability, and Developer Experience

Some of the notable features of CCIP that set it apart from other cross-chain solutions include:

Simplified Token Transfers

CCIP Simplified Token Transfers is a plug-and-play solution consisting of audited token pool contracts that handle the complexity of burning and minting or locking and unlocking tokens across chains while ensuring token sponsors maintain full control over their Token Pool contract. Simplified Token Transfers provide additional security features, such as Rate Limits, and enhance the composability around protocols’ native tokens so ecosystem partners can easily transfer and build new capabilities around a protocol’s token via a single CCIP interface.

Programmable Token Transfers

Token transfers can include additional instructions about their intended use to a receiving smart contract on a different blockchain, such as swapping or staking assets once they arrive at the destination chain. With programmable token transfers, messages (tokens + data) are one atomic cross-chain transaction, and the tokens can always be assumed available when the instructions passed are executed at the destination.

Active Risk Management (ARM) Network

ARM is a separate, independent network that continually monitors and validates the behavior of the primary CCIP network, providing an additional layer of security by independently verifying cross-chain operations for erroneous activity. The ARM Network utilizes a separate, minimal Rust implementation of the Chainlink node software, creating a form of client diversity for increased robustness while also minimizing external dependencies to prevent supply chain attacks.

Rate Limits

CCIP supports customizable rate limits on the amount of tokens able to be transferred within a given time period. Rate limits can be configured on a per-token per-lane level, and are set up in alignment with the token issuer. There are also aggregate rate limits across all tokens for a given lane to ensure every token’s rate limit can not be maximally abused. This feature is part of the heavily audited CCIP code base and is only available for CCIP Token Transfers and not arbitrary messaging.

Smart Execution

CCIP utilizes a gas-locked fee payment mechanism, referred to as Smart Execution, to help ensure the reliable execution of cross-chain transactions regardless of destination chain gas spikes. For developers, this means you can simply pay on the source chain and CCIP will take care of execution on the destination chain.

Timelocked Upgradability

All on-chain security-critical configuration changes and upgrades to CCIP must either pass through a timelock smart contract, where proposed changes can be vetoed by a quorum of node operators securing CCIP, or explicitly approved by such a quorum without a timelock. This enables users and protocols depending on CCIP to inspect on-chain changes before they take effect. Any on-chain update that passes the timelock without a veto becomes executable by anyone. The community can run a timelock-worker to process executable upgrades. This approach to on-chain upgrades represents a step forward in the increased decentralization and robustness of the Chainlink Network.

Payment Model

As noted in the recent Chainlink Network in 2023 and Sustainable Oracle Economics blogs, we’re currently in the process of architecting enhanced payment models to support the monetization and long-term sustainability of Chainlink services. One of the primary goals is to reduce payment friction for dApps, enterprises, and end-users using Chainlink services so a greater amount of fees can directly support Chainlink’s various service providers over time.

With CCIP built to be the most secure and easy-to-use cross-chain solution, and the potential for fee payments to eventually originate across a multitude of independent blockchains, a low-friction payments solution for users is necessary for CCIP to quickly scale and support new blockchains. As such, CCIP supports fee payments in LINK and in alternative assets, which currently take the form of native blockchain gas coins and their ERC20 wrapped version. Payments made in alternative assets will be charged at a higher rate versus LINK payments.

We are working on an automated on-chain conversion mechanism where fee payments made in alternative assets are auto-converted into LINK. Before this conversion mechanism is deployed, payments made in alternative assets will be withdrawn to separate maintenance pools and replaced within the CCIP contracts with LINK based on the exchange rate at the time of payment. LINK will then be paid to service providers (e.g., node operators). After an on-chain conversion mechanism has been deployed, alternative assets residing in maintenance pools can be converted to LINK.

Fee payment premiums for CCIP Messaging will be a flat fee per message, while fees for using CCIP to enable token transfers will be a percentage of the value transferred. CCIP fees also include gas cost overhead. The premium portion of fees paid in alternative assets will have a surcharge of 10% versus LINK payments. Current CCIP premium fees are in line with industry standards within the cross-chain ecosystem, although these values are subject to change.

As Chainlink Staking expands over time to support more oracle services, such as CCIP, a portion of the user fees paid for those services are planned to be directed to stakers in exchange for increasing the service’s cryptoeconomic security.

CCIP Summer Is Here

We’re kicking off CCIP Summer in the runup to CCIP Mainnet General Availability, which will feature a global series of in-person and virtual CCIP events, workshops, and more. Look out for:

We are also beginning a phased onboarding process, where users that participated in the testing program are transitioned to Mainnet Early Access. This security-focused approach will enable us to closely monitor all aspects of CCIP and ARM Network and help ensure user success by providing hands-on support. We’ll also continue to work with various token sponsors and dApps to add support for more tokens to CCIP over time.

Solving the cross-chain connectivity problem will unleash an unprecedented wave of innovation in Web3. We look forward to building this standard with our community.

To get notified once CCIP is available on testnet on July 20, sign up here. If you want to learn more about CCIP’s underlying architecture and code, check out the CCIP developer documentation.

Link

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.