Coinbase, a major cryptocurrency exchange, has requested the dismissal of an SEC lawsuit against it, arguing the SEC lacks authority. This move follows a recent favorable court ruling for Ripple's XRP classification, which has implications for the wider crypto industry.

The Ripple case's legal win led Coinbase to reference it 13 times in their dismissal motion. This ruling has brought clarity to U.S. crypto regulations and positively impacted the market, boosting cryptocurrencies like ETH and BTC.

Coinbase had recently asked a judge to drop an SEC lawsuit, referring to a recent ruling regarding Ripple Labs’ XRP classification. The motion, filed in federal court in Manhattan, argues that the SEC lacks authority over Coinbase’s activities.

In the Ripple case, US District Judge Analisa Torres’ ruling on July 13 differentiated between institutional XRP sales (considered securities) and public sales (deemed not securities). The crypto sector saw this as a win, leading to a surge in the value of most coins.

Last year, the crypto market in the US has been uncertain due to regulations. This court ruling has helped make the regulations clearer, and many experts and lawmakers have shared their opinions on what might happen next.

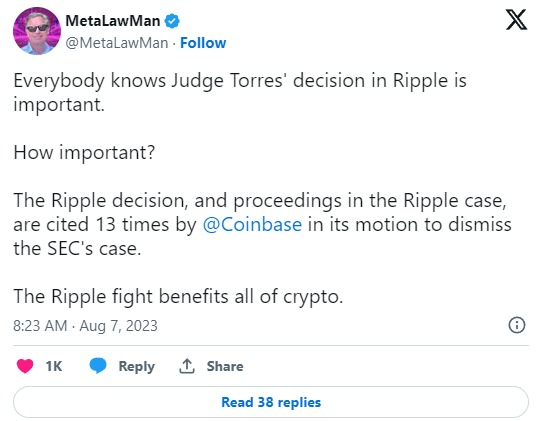

Now, prominent Financial Services Lawyer, James A. Murphy (MetaLawMan), took to his Twitter handle and explained why Judge Analisa Torres’ decision was important for Ripple and the rest of the cryptocurrency sector.

He explained that the importance of the Ripple verdict, along with the entire legal process, is underscored on 13 occasions in Coinbase’s motion to request the dismissal of the SEC’s lawsuit.

The big announcement boosted the crypto markets in a slow summer. Although the case was about XRP, it had positive effects on the broader crypto world, including ETH and even BTC. The lawsuit, initiated in December 2020 against Ripple Labs, along with co-founder Christian Larsen and CEO Brad Garlinghouse, claims that the company conducted unregistered securities offerings, amassing $1.3 billion since 2013.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.