UK banks can experiment more freely with distributed ledger technology under new laws designed to modernise financial services. They should embrace this opportunity to stay at the forefront of innovation.

The UK government’s Financial Services and Markets Act received royal assent in June, representing an overhaul in financial services regulation.

The FSMA puts DLT at the heart of its mission to enable enduring financial services innovation in three ways: by creating a sandbox, enabling better regulation and reshaping banking.

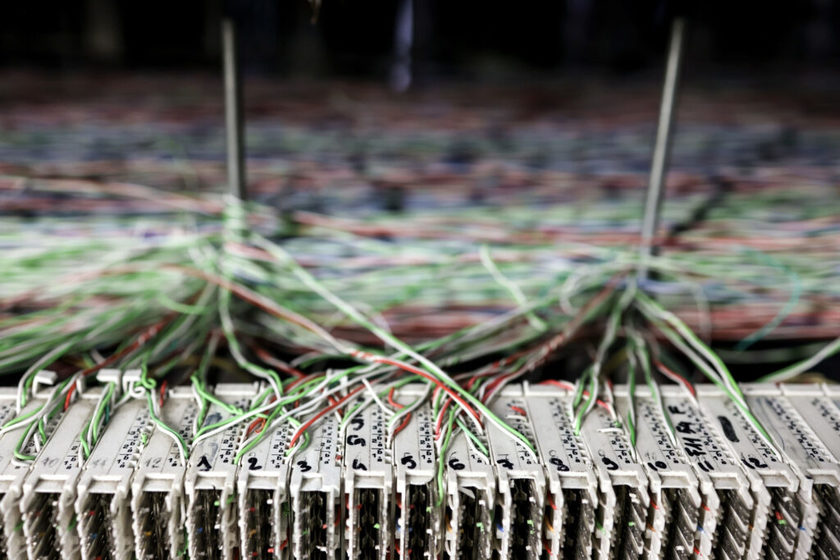

Distributed ledger technology — which allows secure real-time access, validation and record updating across a networked database — has emerged as a core technology that banks are experimenting with to future-proof their operations.

It is estimated that more than four in ten banks (43%) are engaged in either DLT proofs-of-concept or production implementation, according to a report in January from global tech firm Appinventiv. The recent confidence crisis in banking has only accelerated this journey. With balance sheet management now at the top of banks’ agendas, many are exploring how to harness technologies such as DLT to better manage intraday risk.

Sandbox: moving to ‘next-generation systems’

The Financial Markets Infrastructure sandbox — a key provision of the FSMA — has been widely dubbed the UK’s equivalent of the EU’s DLT pilot regime. The EU regime, which went live in March, exempts firms from existing legislation. Banks in the bloc can now experiment with DLT and blockchain for the issuance and trading of tokenised stocks, bonds, and funds, including money market funds, to see if a DLT-based market infrastructure has a future.

The UK’s sandbox operates in a similar vein. Banks can harness the sandbox and DLT as a means of digitising asset management processes and preparing for upcoming settlement updates. These include:

- Real Time Gross Settlement Renewal Programme. This Bank of England infrastructure, which holds accounts for banks and settles interbank payments, is being upgraded in June 2024. Banks can safely tap into the sandbox to test and implement the updates.

- Tokenisation. This has the potential to unlock faster settlement times and lower costs; it is estimated by research and brokerage firm Bernstein that $5tn in assets could be tokenised on DLT over the next five years.

- Smart contracts. These can speed up transactions by going one step beyond keeping an immutable record of financial transactions to automatically implementing the terms of multi-party agreements.

Innovation through regulation

The FSMA also further establishes smarter crypto asset regulation. Firms engaging in activities relating to stablecoins or crypto assets for payment will become subject to numerous regulatory requirements.

This includes: authorisation by the Financial Conduct Authority; capital, insolvency and money laundering requirements; rules for ensuring the quality and safekeeping of reserve assets; and more robust risk management and governance.

This sets out a similar path to Europe’s Markets in Crypto Assets legislation, which also introduces more stringent risk management and requirements on capital reserve and disclosures.

Regulatory measures will be critical in potentially bridging the gap between banking and crypto asset services. This gap is currently quite wide in the UK; concerns around volatility and fraud mean that almost half of major UK banks do not allow transfers and withdrawals from crypto exchanges.

The introduction of smart regulation will not only help embed greater consumer safeguards into crypto, but also serve as a platform on how the underlying technology is applied.

Reshaping banking

The banking ecosystem faces multiple challenges, from settlement risk to siloed legacy systems and rising operating costs. Permissioned distributed ledgers can help by providing real-time verification of transactions, removing time- and cost-consuming reconciliation while also maintaining security and scalability.

For banks, the FSMA is both an opportunity and necessity. It will not only help them adapt to future regulations, but also stay at the forefront of innovation as global competition rises.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.