Dear fellow XRP Community members,

Are you excited to embark on a revolutionary journey that’s set to propel the XRP community on a revolutionary leap forward? Brace yourselves, because we are heading into the deep end the introduction of Automated Market Maker (AMM) pools on the XRP Ledger is nothing short of a game-changer. Ripple’s CTO and XRP Ledger Co-Creator had this vision for over a decade, and now, it’s finally here! In this blog post, we’ll explore the significance of AMM pools and how they will transform the XRP ecosystem. So, XRP enthusiasts, let’s embark on this exciting journey together!

In an insightful paper “Steps towards an ecology of money infrastructures: materiality and cultures of Ripple” by Ludovico Rella

The Genesis of AMM Pools:

Imagine a scenario where the perennial challenge of liquidity, often likened to the “chicken and egg” paradox, is ingeniously and brilliantly solved. XRPL AMM pools are set to deepen liquidity across numerous tokenized Fiat Stablecoins, and blue chip crypto pairings to XRP.

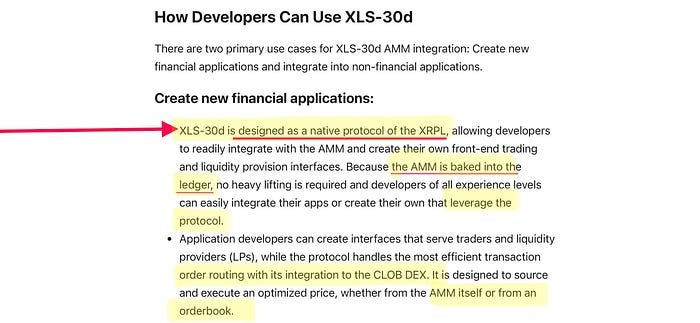

What sets XRPL’s XLS30D AMM Liquidity Pools apart is their innovative approach to maximize the revenue potential earned by Liquidity Providers, which is accomplished in two ways:

David Schwartz has said Harvesting of Volatility for Yield.” In this twitter thread below 👇 he sheds some light on that how that’s related to the “Continuous Auction Mechanism.” David is actually responding to my tweet in twitter thread explaining the continuous auction mechanism to someone and he flat out says there are “TWO things going on.” 🤯

Besides earning from FEES generated by AMM from traders swapping, XLS30D AMM offers Liquidity Providers TWO uniquely novel ways to earn additional revenue, is “Harvesting of Volatility for Yield”

- “Continuous Auction Mechanism” — which winning bid from Arbitrageurs pay with LP tokens and they are destroyed but the underlying 2 assets they are a claim on are redistributed to all the other Liquidity Providers LP tokens. The quantity of XRP and the other asset in the pool remains unchanged, the 2 assets underlying the burned LP tokens were redistributed proportionally to all LP tokens.

- “Harvesting Volatility for Yield” — The AMM enacts a trading strategy that earns a spread from orders it offers on the DEX orderbook. This is where XRP’s ultra low txn fees and blazing fast 3–5sec settlement really shine ✨ Over a long duration the AMM continues to capture small amounts in a spread over and over and this VALUE CAPTURED is actually added to the AMM Pools total value. The AMM Pools policy is designed so that it will never accept offers that decrease the total value of the pool, only that keeps it the same or increases the value. As volume increases and/or volatility increases these profits the AMM earns from its “Trading Strategy” are amplified. This is only possible because of the Trio of technologies that all working in unison and the XLS30D AMM’s have been designed to always enforce the policy in its code.

Software automatically reads from AMM’s bonding curve and employs the Fibonnaci sequence to provide orders on CLOB using LP capital from AMM Pool. We should expect to hear more about this in near future from David Schwartz and RippleX Devs. It was only very recently that I was able confirm that this is a separate action from the continuous auction mechanism. This actually adds value to the pool by earning that spread. This is the beauty of having this trio of technologies operating together like a symphony at the PROTOCOL LAYER.

It’s important to note that the “Continous Auction Mechanism” and “Harvesting Volatility for Yield” will BOTH be amplified in times of high volatility, which is defined as large horizontal movements within a price range or channel.

Liquidity providers’ earnings persist within the pool, continually compounding in real-time.

When XRP or any crypto is paired with fiat and experiences increased volatility, it almost invariably accompanies a surge in global market trading volume for that asset. Consequently, this results in higher fees earned by the Automated Market Maker (AMM). These fees come from trades and payments between the two assets in the pool. Continuous Auction Mechanism auctions off 24hrs of No trading fees in its AMM Pool. Winning arbitrageur of auction has the LP tokens they bid to win, redistributed proportionally to all liquidity providers.

The AMM capitalizes on this volatility by harvesting yield through executing synthetic offers as part of its “Trading Strategy” on the DEX order book. Impermanent loss is a concern for many crypto owners, but the XLS30D specification offers three ways to earn yield for liquidity providers, specifically designed to maximize yields during periods of high volatility.

It’s a well-known fact that cryptocurrencies don’t follow a linear upward trajectory. This also means that depositing liquidity in XRP alone as a single asset within a USD/XRP Pool can reduce exposure to downside volatility by nearly 50%. The AMM takes care of this by automatically swapping half of the value of the XRP deposited into the other asset in the pool. For instance, in an XRP/USD pool, half of the deposited XRP will be automatically swapped to USD, and you’ll only incur the fee percentage rate of that particular AMM Pool on the 50% of value you initially deposited in XRP.

“This reduction in exposure to downside volatility, combined with a continuous and steady yield flow, will significantly enhance XRP’s allure for institutional investors and long-term XRP holders.”

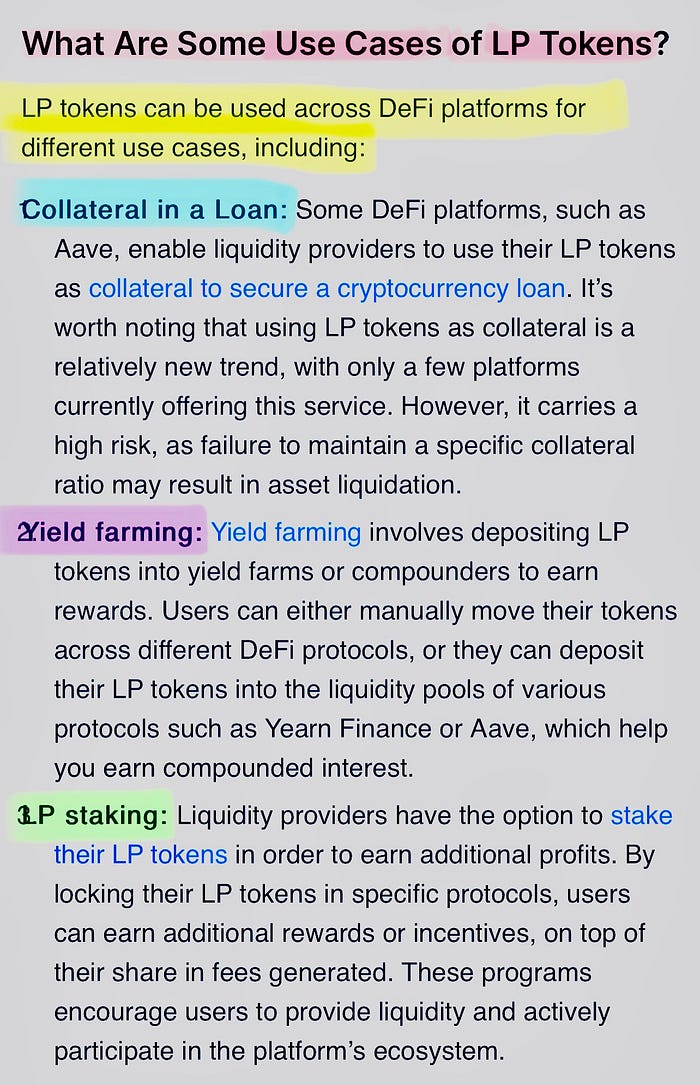

LP Tokens — Yield-Bearing Premium Collateral

In the world of XRP Community, discussions about Automated Market Makers (AMMs) often miss a crucial point. When you become a liquidity provider, you’re essentially staking the pool, and in return, you receive LP tokens. These tokens represent your ownership share of the assets in the pool. Each pool has its unique LP tokens, and various apps will show you the percentage of the pool that your LP tokens signify. It’s vital to note that these LP tokens are independent of the issuer of the other asset in the pool.

XRP is a WEALTH MACHINE

XRP Ledgers huge benefits for XRP Institutional DeFi #AMM🚀

XRPL Private CBDC XRPL networks allow for the ability to bring together market participants to support testing of institutional DeFi Applications using CBDC’s And stablecoins.

They are full throttle ahead building a Top Down Institutional DeFi ecosystem with multiple acquisitions and partners building in coordination, all the necessary modular components necessary to support the inevitable TSUNAMI 🌊 OF INSTITUTIONAL VALUE that will pour in from fiat to this new on-ledger token based financial ecosystem.

Equipped with multiple secret weapons and aligned incentives of market participants to expand the Primary Liquidity Market in a sustainable manner that evolves into the ultimate value exchange and liquidity system that is simply going to be unmatched.

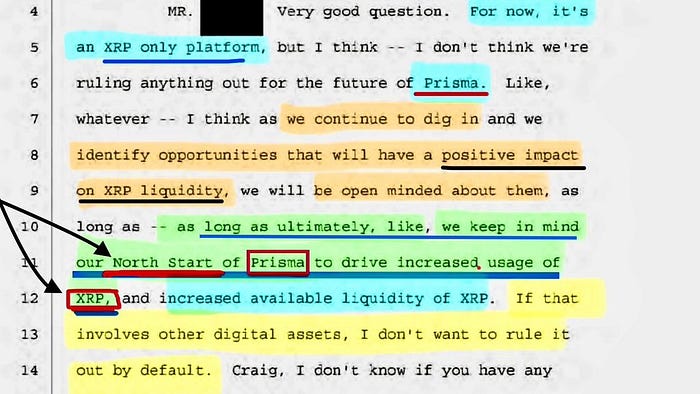

The AMM’s powerful architecture is designed to maximize Liquidity providers yields in revolutionary ways. XRP will be an investable asset that doesn’t sacrifice its utility but instead amplifies it to drive a consistent DEMAND for XRP in Liquidity Pools. Increasing transactional demand and spinning the liquidity flywheel to record speeds. PRISMA will provide the continuous volume that demands a level of liquidity and if it drops then yields shoot up attracting new investors and with so much interest in finding ALPHA from Wall Street, XRPL AMM Pools is built on a foundation of providing a service that utilizes XRP’s Utility as LIQUIDITY. Forget overnight flip switch, price sets, gold backed, and buy backs, all are waste of time and honestly any seasoned investor would rather be on the first train of the WEALTH MACHINE and hold the asset you believe in and add on a continuous stream of yield that will amplify in times of volatility.

The Unique XRP Ledger Guarantee

Consider the example of the XRP/USD Pool on the XRP Ledger. Here, liquidity providers receive LP Tokens that represent their proportional ownership of the pool’s assets based on their deposits. What makes this different from other AMMs is that, instead of being issued by a Dapp smart contract, the XRP Ledger itself guarantees that you can redeem these LP tokens at any time for the current value of a 50:50 XRP/USD pair. You can withdraw to XRP directly without even setting up a trustline to the issuer of the other asset paired with XRP in the pool. However, it’s essential to understand that you are indirectly exposed to 50% of the issued USD in the pool while you hold the LP token.

Stablecoin Issuers and the Future of XRP/USD Pools

As the Amendment passes an 80% Governance vote by XRPL validators and the Node community for two weeks, we can anticipate the creation of multiple XRP/USD pools on the mainnet XRP Ledger. Stablecoin issuers also have the option to add a transfer fee to the stablecoins they issue, allowing them to earn additional revenue with each transfer. Furthermore, with increasing regulatory clarity, especially in the United States, we can expect easier on/off ramps for fiat stablecoins directly from bank accounts and other digital wallets that connect to traditional fiat payment systems.

The XRP Ledger was intentionally designed to support Financial Institutions (FI’s), Banks, Exchanges, Custodians, and even Central Banks in issuing tokenized assets onto the XRP Ledger. These assets can represent off-chain assets such as fiat currencies, physical commodities, real estate, securities, and more. The trustlines combined with the clawback amendment provide essential security guarantees, ensuring that only XRPL accounts with authorized trustlines can access the pool for both single and two-asset withdrawals.

XRP Ledger’s protocols trio of technologies:

AMM,Central Limit Order Book (CLOB) DEX, and the Payment Execution Engine. These elements form a seamless and network of liquidity on the XRP Ledger, giving XRP its Primary Liquidity Market. The “OG DEX” as David Schwartz has referred to it. Broader crypto community has overlooked the XRPL DEX for many years but they are in for a surprise they never saw coming when this trio of programmable technologies are fully integrated with each other after AMM proposal XLS30D is officially passed governance vote by validator and Node community

XRP Unique Offering:

Unlike other cryptocurrencies that rely on “secondary market liquidity,” XRP boasts a Primary Liquidity Market powered by its native protocols, offering programmability like no other. The native DEX central limit order-book by itself was not able to provide the deep pools of liquidity to match secondary market liquidity on CEX’s. With the upcoming addition of the groundbreaking XLS30D unique AMM implementation has novel features that generate multiple streams of continuous compounding yield. This will undoubtedly attract liquidity providers to deposit XRP and a variety of other assets into the pool, as well as fiat Stablecoin issuers and arbitragers. This creates a powerful sustainable foundation of unified liquidity that aligns all the interests of the market participants.

Then the real fireworks will begin when Ripple’s intelligent Liquidity Aggregator, PRISMA is able to intelligently route ODL volume through the XRPL DEX and AMM pools. Considering ODL is designed to use XRP as a bridge asset to instantly settle international fiat cross border FX payments, there needs to be deep pools of organic sustainable liquidity that’s not dependent fragmented liquidity from speculative trading on 600 global crypto exchanges. That global fragmentation of liquidity has meant Ripple has had to subsidize liquidity in certain corridors by paying incentives to professional market makers. PRISMA’s Implementation in 2020/2021 to power ODL and Liquidity Hub, has had a significant impact on expanding ODL into 45+ corridors, reducing reliance on Ripple to payout incentives to market makers. But it’s still dependent on speculative crypto trading volume and is never going to be able to scale to the levels liquidity necessary for XRP to reach its full potential. Many people in XRP Community tend to over focus on only XRP the digital asset and completely overlook the fact that its native network the XRP Ledger was purpose built to be a global distributed exchange powered by its protocols, a sophisticated payment execution engine that allows for multi pathfinding and and cross currency autobridging and the worlds first ever DEX aka Decentralized Exchange with a an automated matching trading engine that works in unison with the payment execution engine. The Ledger itself was designed to facilitate payments and trades between multiple fiat currencies, cryptocurrencies and other assets like gold or securities that were issued onto the XRP Ledger.

The integration of AMM Liquidity Pools is the single biggest enhancement to the XRP Ledger, its brilliant design provides XRP the digital asset with the native economic model it has sorely been lacking the past decade. With its underlying programmable protocols that give it intrinsic value as a global value exchange, primary market liquidity for XRP, and a multi asset payment execution engine.

I will be covering primary market liquidity, XRPL AMM LP Tokens, and deeper dive into a real valuation framework for XRP based off its demand to be staked in the AMM pools as its predominant driver for demand of XRP. Keep a lookout for this in an upcoming YouTube video and blog post in this series.

The Power of the Payment Execution Engine:

XRP’s payment execution engine is a marvel, with programmable payment capabilities that can navigate complex trading paths. It always seeks the best path, utilizing both order-book “offers” and AMM pools, a feature unmatched by other networks.

Ripple recently released a white paper 📄 on XRPL Payment Execution Subsystem

Who Can Participate in AMM Pools:

• The XLS30D AMM Spec is designed to attract a diverse range of participants, from financial institutions to hedge funds, corporates, crypto VC’s, DAOs, and even retail investors. Anyone on the planet can deposit XRP into AMM pools, and the possibilities are endless.

Growing the Pie:

AMM pools may contain a pair of any two assets issued natively on the XRPL or bridged over from another network. Although the AMM is fully decentralized in that no single entity has any additional administrative powers than any other entity, if an AMM pool contains a centralized issued asset like a Fiat stablecoin, then that issuer requires trustlines and likely KYC/AML verification for someone to swap into or hold that asset in their account. Providing liquidity in the other asset, say it be XRP, is not required to have any direct exposure to issuer. Yet it’s still a centralized issuer issuing one of the two assets. Also note that even the creator of the AMM pool has no authority over AMM pool, they cannot blocked anyone from providing liquidity to the pool in the other asset but anyone trading into or out of the asset they issued will need to have an authorization from them which is what makes the trustlines such a powerful assistant to regulatory compliance for issuers. Proposed clawback amendment will extend their ability to have more fine grained control over the asset they issued but it still has NO control or authority over single deposit liability providers of the other asset in the pool, nor their LP tokens. LP tokens trustlines go to the special root account at are set at zero. Meaning there’s no credit or debit relationship. Only that LP token is guaranteed to redeem its ownership share of assets in the pool. A single asset withdraw is possible.

There will be pools that have 2 decentralized assets that. neither asset has a centralized issuer. For example, this would include native XRP, a XRP-collateralized stablecoins and assets bridged from the Flare Network through a trustless gateway. With XLS38D Side Chain amendment set to be proposed on the heels of XLS30D AMM, which will open up the floodgate for for EVM based chains native assets and ERC20's, ERC721 NFT’s via the purpose built EVM side chain. Which is a collaborative between RippleX snd Peersyst. It is currently live on DevNet with a two-way EVM-XRPL bridge. David Schwartz has been adamant about the need to bridge over blue-chip crypto assets like BTC, ETH, LTC, SOL, ADA, and DOT in a DECENTRALIZED manner that they can then seamlessly be integrated into AMM pool paired to XRP. Broadening liquidity for payment execution engine to draw down multiple XRP paired pools and orders on CLOB to achieve the best price.

This is the beauty of having a unified liquidity system, it’s as true to being a “primary market” as possible. This is something that cannot be replicated in its entirety, it provides a unique advantage in competing to be the dominant asset for global liquidity in the future tokenized world. The message has always been consistent from Ripple and David Schwartz, it’s the positioning of XRP and enhancing its native distributed exchange and payment execution engine. Placing XRP in an advantageous position to capture additional liquidity in the “Long Tail,” if an asset is liquid to XRP then it’s liquid to any other asset liquid to XRP. No public crypto asset will be chosen by central banks or agreed upon by global banks to be the next global reserve currency. Instead, in a world where the INTERNET of Value allows for the seamless transfer of value between any two assets or currencies in the same way information is transferred today. The rise of a dominant asset for global liquidity will happen organically by natural market forces of a capitalist society.

The Economic Model:

With the addition of AMM pools, liquidity on the XRP Ledger will be unified. These pools are designed to generate fees, profit from arbitrage opportunities, and harvest volatility for yield. This unique model helps mitigate impermanent loss and reduces the impact of downside volatility on XRP.

Unveiling the Power of Continuous Yield:

In the dynamic realm of XRP, we stand on the cusp of a profound shift in perspective. Instead of fixating solely on short-term capital appreciation, it’s time for the XRP Community to embrace a new era of understanding — one that delves into the intricacies of how XLS30D AMM Pools orchestrate the generation of yield through the strategic deployment of XRP as liquidity. This is no ordinary feat; it’s a novel design that transcends the realm of conventional Uniswap DEX forks. It’s a protocol ingeniously woven into the very fabric of the network layer, seamlessly intertwining a value exchange DEX order book with a sophisticated payment execution engine.

What sets this apart?

It’s the achievement of UNIFIED LIQUIDITY across the entire network, a rare gem in the crypto universe.

This gem is destined to shine even brighter, thanks to the organic and consistent demand for liquidity generated by RippleNet’s ODL and Liquidity Hub Volume, artfully channeling transactions through the AMM Pools, orchestrated by PRISMA. Unlike the often gimmicky liquidity mining rewards and artificial yield incentives meant to compensate for impermanent loss, high gas fees, and the extractable value on platforms like Uniswap V2 and others, XRPL AMM Liquidity Pools emerge as nothing less than a WEALTH MACHINE.

The magic lies in the multitude of ways to earn yield beyond just FEES. There’s no upper limit; the ecosystem can flourish when high volumes yield high rates compounded daily. And then there’s the LP token, a super-premium collateral that assures liquidity providers that their assets in the pool are forever redeemable, regardless of market fluctuations. Their composition may have changed since depositing, but the LP token offers an unwavering guarantee.

Now, you might wonder about calculating potential APY percentages. As AMM’s come to life post-validator vote amendments, we can anticipate comprehensive documentation and an array of community projects sprouting forth. These will equip liquidity providers with tools and resources to estimate earnings based on various metrics and market conditions.

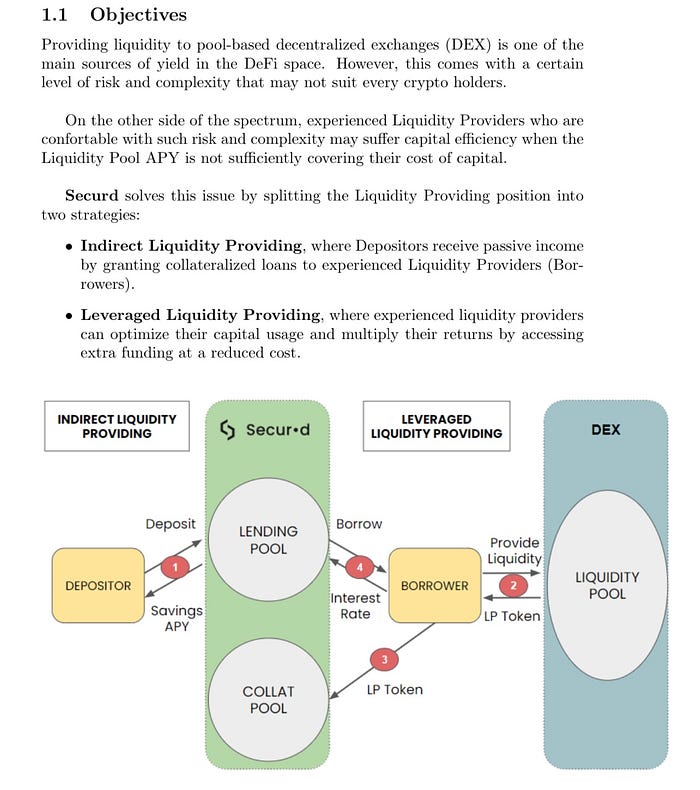

Depositing liquidity in AMM’s on XRPL is a leap into a world without counterparties, without permissions. It’s an entryway into the realm of native compounding yield, paid through Fees accrued from asset swaps within the pool. Every XRP owner can join this venture, utilizing non-custodial wallets to infuse XRP liquidity into any AMM pool featuring XRP as one of the two assets. Brace yourselves for the burgeoning DeFi ecosystem around AMM Pools, offering XRP holders conservative options and opportunities, starting with DeFi Protocols like lending and borrowing seamlessly integrated with XRPL AMM’s.

In the world of XRP, its Decentralized Exchange (DEX) is the beating heart at the center of the XRP Ledger (XRPL) — pumping fast,ow-cost and expansive LIQUIDITY throughput the network.

Typically “Volatility” (large horizontal price movements within a channel” are considered a negative for XRP’s quick settlement speed makes liquidity the key factor. AMM pools transform asset volatility into a revenue stream, increasing the pool’s value by leveraging LP’s assets.

Liquidity provisioning is not merely participation; it’s a service that enhances network liquidity, facilitating programmable offers, cross-currency pathfinding, and instant settlement. AMM Pools and DEX aren’t mere add-ons; they’re intrinsic components of the network, unlike Ethereum’s complex smart contract DApps. The rewards? A continuous stream of yield, compounding daily, amplified during bouts of high volatility and heightened volume, tempered when the markets calm.

Now, imagine this: depositing XRP into an XRP/USD pool significantly reduces downside volatility risk. You accumulate more XRP, and half of your value in the pool is spread evenly between the two assets. This is a game-changer, especially for institutions. They’ll experience far less exposure to XRP’s inherent volatility while reaping the rewards of daily compounding yield, accentuated during tumultuous market phases. They also receive an LP token, XRPL LP tokens are issued at the protocol layer by the Ledger itself, unlike the spaghetti web of different Liquid Staked ETH tokens that are issued at Application Layer and by Dapps, DAO’s and even Centralized Exchanges. For anyone unaware, this is the single biggest growth area in all crypto and has recently exceeded previous highs set during 2021 bull run. The power of composable yield bearing asset has potential to be used in a wide range of DeFi Dapps and protocols in a growing Borrowing /Lending, Derivatives, Options, Yield Farming, stablecoin creation and many more.

The DeFi ecosystem is the most advanced on Ethereum mainnet. ETH staking combined with the “Merge” are part of ETH economic model as more than a gas token but an “internet bond” is what it is being pitch as to institutional investors. After the merge roughly $300-$500 million is burned in ETH every month, which is extracted from the users of the network, paying exorbitant fees, with a small percentage, going to award the validator’s and delegators which is 4 to 5% APY. We need to keep a close eye on the impacts of this economic model cause this is significant deflationary pressure that Innoway is artificially being generated at the expense of uses of the network which won’t be sustainable.

Where is on the XRP LEDGER a AMM, Liquidity and Pools are designed with novel features that align incentives of all the participants of the ecosystem to drive sustainable demand for a XRP as Liquidity in the AMM Pools as more Pools are spun up and volume in thanks to RippleNet’s ODL and Liquidity Huh which are under a major effort to be integrated to the XRPL DEX CLOB, AMM, and payment execution engine, which all operate in perfect unison based on mathematical policy at the protocol later.

An LP token can be a hybrid stablecoin if the liquidity provider deposited/staked liquidity into a XRP/USD AMM Pool. This XRP/USD LP token can be used in multitude of ways but the 3 simplest strategies are:

⚠️ WARNING ⚠️ THIS IS *NOT* FINANCIAL ADVICE and is for educational purposes only. I am only trying to demonstrate the different opinions that wil be available for different users

- Borrow XRP against your LP token to maintain nearly the same amount of XRP you originally had before depositing the XRP single deposit into pool. This in of itself removes impermanent loss. Since the LP token is comprised of 50:50 XRP/USD this minimizes the chance of liquidation by nearly 50% which is huge. Also, keep in mind you can lower your collateral ratio at any time.

- A single deposit USD from an institution may want to limit their exposure to XRP downside volatility as much as possible, by borrowing XRP against against LP token collateral and immediately selling the XRP provides short exposure to XRP Price. There’s a number of other ways to hedge upside and downside volatility using Options and perpetual futures that are maturing in DeFi and have gained significant traction (DyDX, GMX)

- You can leverage your Yield Earnings by 3–5X by borrowing the same two assets secured by the LP token as collateral.

Interestingly, the leveraged Yield position creates a market for conservative XRP and stablecoin owners to lend their XRP without any exposure to the AMM Liquidity pools. They can simply lend XRP or Fiat stablecoins and earn the interest the leveraged yield farmer pays in interest. Best of all they always guaranteed to get back the assets that they want because they are guaranteed by the Ledger itself. This is called secured lending and will be very appealing to many XRP owners. Interestingly, their assets do end up contributing equality to the AMM. They just are not exposed to the AMM pool or any impermanent loss.

This is the beauty of implementing at the Protocol Layer, because it increases safety and reduces risk for users of applications that typically have much higher risk and lower safety.

This transformation is monumental, and XRP is poised to become one of the world’s most enticing investments. It can be seamlessly deposited as liquidity, subsequently tokenized into a hybrid, semi-decentralized yield-bearing super-premium collateral asset. This asset offers lower volatility than holding traditional cryptocurrencies, making XRP an irresistible investment opportunity. Its utility as liquidity will soon be accessible to ALL, from retail to institutional investors, once the amendment passes.

💦 LIQUIDITY’ is the LIFEBLOOD🩸 of the “ INTERNET of VALUE”

Ripple’s Expanding Role:

- Ripple is not stopping at AMM pools; they will are building powerful infrastructure for data analytics used by machine learning and AI. RippleNet is evolving into an application layer network, supported by PRISMA, the intelligent Liquidity Aggregator system, which interacts seamlessly with different blockchains and exchanges.

XRP Ledger was designed and built as a public permission-less blockchain that is readily accessible retail and help enhance compliance for Enterprises. An Application Platform for everyone:

RippleNet is evolving beyond being an enterprise payment network. It’s becoming an application platform that supports additional utility for XRP as liquidity. The ultimate goal is to channel all liquidity and volume onto the XRP Ledger, creating a primary market and an economic model for XRP. This is not speculation but fact, David Schwartz has confirmed in recent Twitter spaces that “THERE’S A MAJOR EFFORT UNDERWAY TO INTEGRATE ODL INTO THE XRP LEDGER DEX/AMM’s"

Prepare for a paradigm shift — XRP is about to redefine investment as we know it. ✨

The Dinarian On Locals is a labor of love that I pour my heart and soul into during my personal time. Countless hours are dedicated to delivering you the most up-to-date, unfiltered, and authentic news and information. Your support means the world to me, and I invite you to consider making a donation or becoming a dedicated supporter of this project. Any amount of XRP donations can be sent to XRP address: rqEy1PDACRg3p9RaVEZz6jU1g9RgguP91 or by scanning the QR code below and are not only appreciated but needed...

To those of you already backing my efforts, I extend my deepest gratitude. Your generosity fuels this mission, and I genuinely thank you from the depths of my heart. Together, we can continue to bring you the best results and make a significant impact in everyones future! ~D

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.