Introducing LavitaAI, the pioneering private health data marketplace fueled by the dynamic synergy of AI, blockchain, and YOU! Built on the Theta Blockchain.

LAVITA stands at the forefront as a next-generation healthcare platform, harmonizing blockchain and AI technologies. It empowers the utilization of extensive biomedical datasets for groundbreaking research, all while safeguarding individual privacy and maintaining data ownership.

Our mission is to inaugurate a revolutionary era of privacy-preserving genomic and health data sharing and analysis. By doing so, we aspire to positively impact the lives of 8 billion individuals worldwide. Join us in shaping the future of healthcare through responsible and transformative innovation!

Lavita AI is revolutionizing the health data marketplace with its pioneering AI+Web3 healthcare platform. By combining AI, blockchain, and privacy-preserving technologies, Lavita empowers individuals to control their health data through a decentralized marketplace.

With a $5M seed financing round led by Camford Capital, Lavita is developing an AI-first platform, supported by esteemed advisors from Harvard Medical School, KAIST (often described as the "MIT of Korea"), and Indiana University.

In a strategic collaboration, Lavita has partnered with Theta Labs to leverage blockchain infrastructure as a subchain of Theta Metachain. This alliance propels the development of Lavita's AI-first platform, positioning Lavita to transform global health data management, enhance healthcare access, and empower individuals worldwide.

Please see our whitepaper for more details.

How To Buy Lavita Tokens and Stake Them

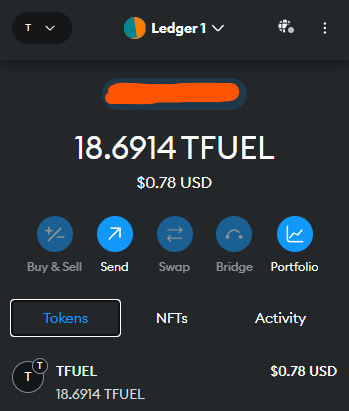

First things first, you will need to download and install the latest Metamask extension wallet. Next, go to Chainlist and connect your Metamask to add the Theta blockchain to your wallet. After doing so, you will see 0 Tfuel, the gas token for Theta listed at the top. Next, transfer enough Tfuel for both the amount you wish to invest in LavitaAI as well as about 20 extra Tfuel for transaction gas. Eg. I want to invest $100 into LavitaAI, I would send around $105 worth of Tfuel to my Metamask.

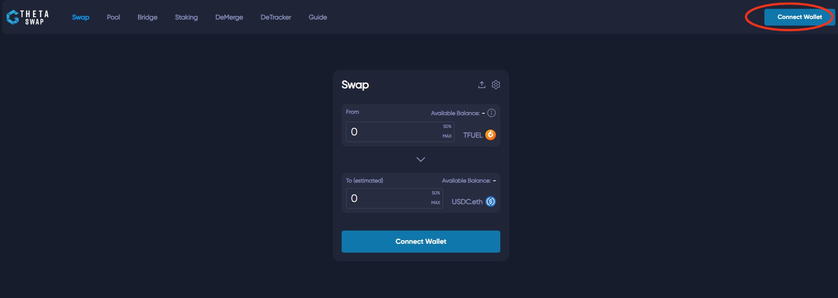

Next you will head over to THETASWAP and Connect your Metamask by clicking "Connect Wallet" on the upper right hand side of the page.

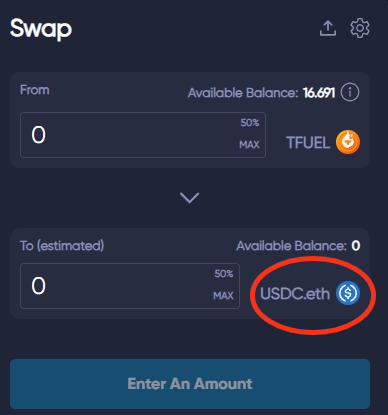

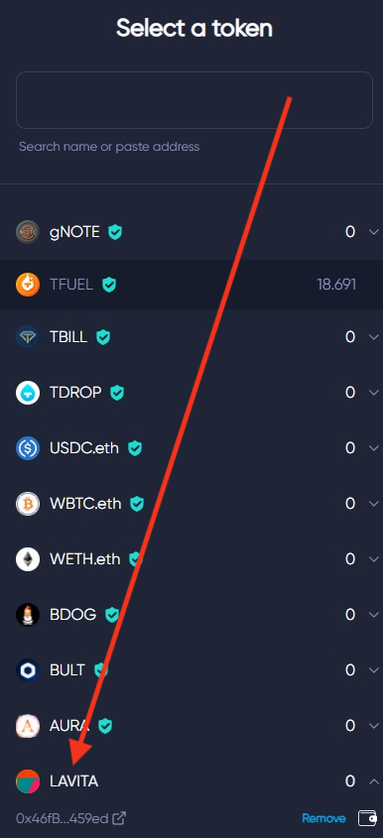

The next thing you will want to do is change the receiving token from USDC to Lavita by clicking on the USDC icon on the bottom of the swap and typing Lavita in the search bar that comes up or by selecting in the dropdown menu. If it does not populate, copy and paste the Lavita address 0x46fBF4487fA1B9C70d35BD761c51c360dF9459ed from the Lavita token webpage.

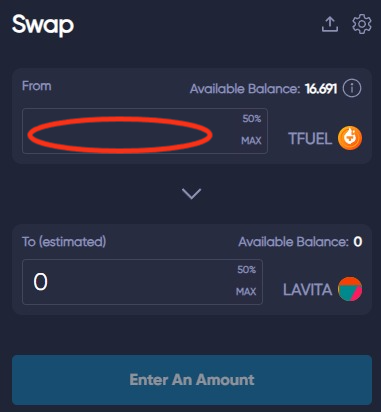

The next thing we want to do is put in the amount of Tfuel you wish to swap for the Lavita token in the top box of the swap interface. Remember to leave enough Tfuel in your wallet for gas. Next click "SWAP", and follow the prompts in your Metamask wallet.

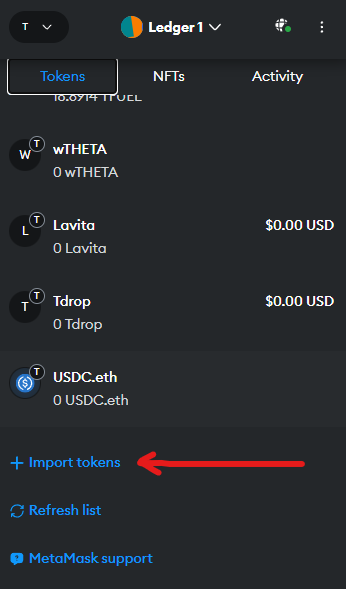

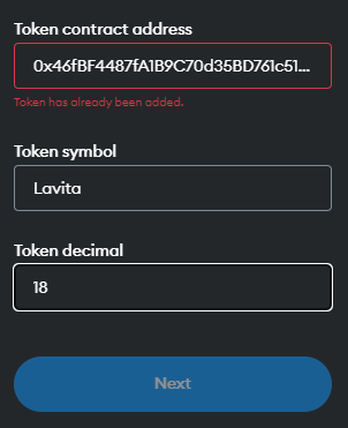

You should also be prompted to add the LavitaAI token to your Metamask, you will want to do this so you can visually see the tokens in there once the swap completes. If for some reason you are not prompted you can manually add the token in Metamask by using the "Import Tokens" feature at the bottom of your token list and adding the same address used above for your Thetaswap 0x46fBF4487fA1B9C70d35BD761c51c360dF9459ed and type "Lavita" in the token symbol as well as "18" in the token decimal as shown below.

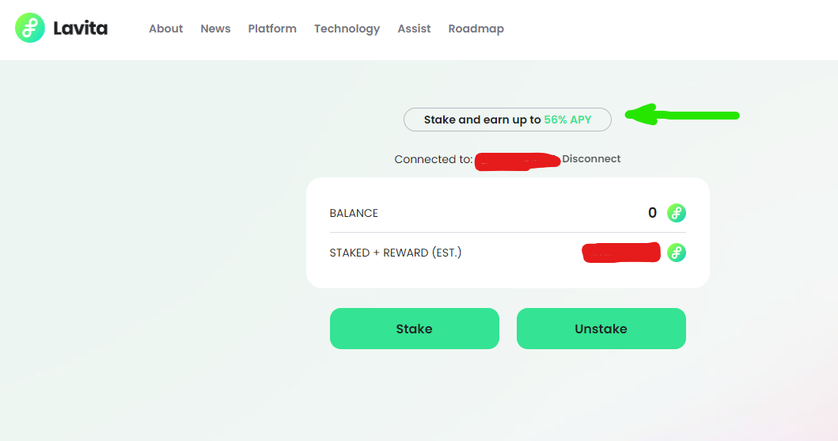

If done correctly, you should now have Lavita in your Metamask, Now it's time to go stake these tokens on the Lavita staking page. You will need to connect your Metamask wallet as you previously did on Thetaswap. Next you will have two transactions to process, the first being authorization of the Lavita token itself, and second, the staking transaction itself.

That's it, your now helping to secure the LavitaAI metachain and will be earning more Lavita tokens for your stake, currently 56% APY at the time of this writing. The rewards will automatically be compounded into your stake. You can always check on your rewards by coming back to the staking page.

In conclusion, the staking of LavitaAI tokens represents more than a financial investment; it symbolizes a commitment to the transformative potential of decentralized healthcare innovation. By participating in the staking process, you not only stand to benefit from potential financial gains but actively contribute to the advancement of a privacy-centric, AI-driven healthcare ecosystem.

Your decision to stake LavitaAI tokens is an endorsement of a future where health data is not only a valuable asset but a securely managed and ethically utilized resource. As we embark on this journey together, envision a landscape where individuals have greater control over their health information, researchers access unprecedented insights, and global well-being is elevated.

Thank you for being a crucial part of the LavitaAI community. Your trust and participation fuel the engine of progress, propelling us toward a future where blockchain, AI, and personal empowerment converge to redefine the boundaries of healthcare excellence. Here's to a healthier and more connected world powered by the innovations we create today.

I do hope this helps someone, Happy Staking ~D

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.