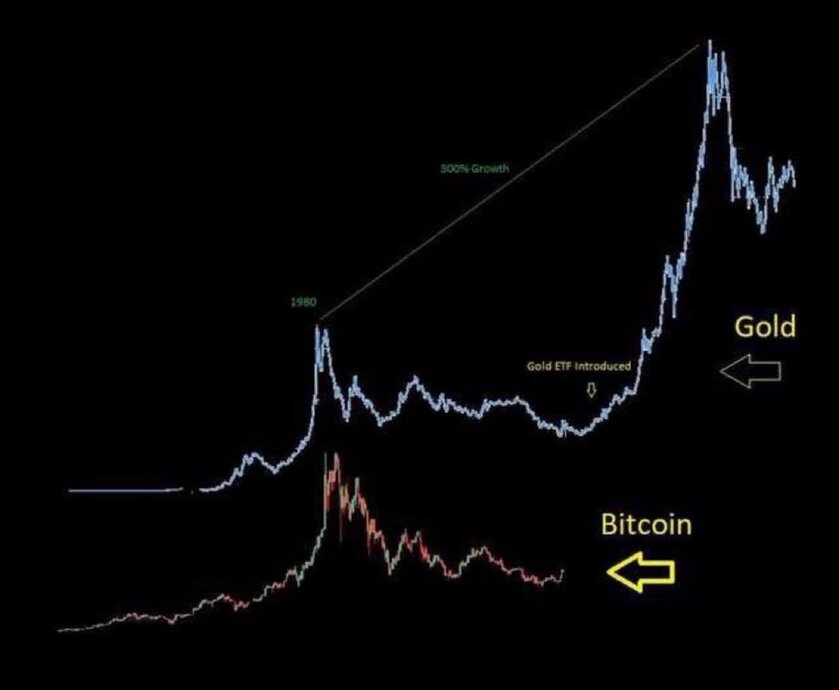

In the ever-evolving landscape of finance, the recent regulatory approval of Bitcoin ETFs in the U.S. has ignited a wave of excitement among everyday investors. This development draws intriguing parallels to historical trends, notably the introduction of gold ETFs in 2003, which catalyzed significant investments in gold and a substantial surge in its price from $332 to $1,800, with total gold ETF assets under management reaching $105 billion.

Historical Comparison - Gold vs. Bitcoin: The introduction of the first gold ETF in 2003 led to a surge in demand for gold, resulting in a price increase from $332 to $1,800, with total gold ETF assets under management reaching $105 billion.

Recent Regulatory Approval: Bitcoin ETFs recently received regulatory approval in the U.S., generating significant excitement among EVERYDAY investors.

Comparison to Previous Financial Trends: There is a parallel drawn to past financial trends, such as the introduction of gold ETFs two decades ago, which led to substantial investments in gold and a significant increase in its price.

Potential Price Gains for Bitcoin: Standard Chartered predicts that Bitcoin could experience substantial price gains similar to gold's quadrupling after the introduction of gold ETFs. The firm forecasts a rise to $100,000 by the end of the year.

Institutional and Retail Impact: With major companies like BlackRock obtaining approval to offer Bitcoin ETFs in the U.S., there is anticipation of a surge in both institutional and retail investments in the cryptocurrency market.

Market Size Projections: Analysts suggest that spot Bitcoin ETFs, if developed into a $100 billion product, could bring about a significant shift in the cryptocurrency industry.

Investment Options for Institutions: Without Bitcoin ETFs, institutional investors have limited options for investing in Bitcoin, resorting to futures ETFs or closed-ended funds, each with its drawbacks.

Potential Market Size: Bernstein expects the spot Bitcoin ETF market to reach 10% of Bitcoin's market capitalization in two to three years, translating to a substantial inflow of capital.

Bitcoin ETF Approval as Validation: Approval of a Bitcoin spot ETF by traditional institutions is seen as significant validation for the cryptocurrency space, potentially positioning Wall Street as a more dominant player globally.

Integration of Crypto and Traditional Finance: Bitcoin ETFs signify the merging of the traditionally separate worlds of crypto and traditional finance, with potential collaboration and a reshaping of industry dynamics.

Role of Financial Advisers: Financial advisers and institutions may recommend small allocations to Bitcoin ETFs, contributing to increased exposure to crypto assets within traditional finance portfolios.

Organic Demand for Bitcoin: The approval of Bitcoin ETFs could lead to organic demand for Bitcoin itself, potentially increasing its value as institutional allocators seek exposure through the regulated vehicle of an ETF.

Impact on Industry Dynamics: The approval of Bitcoin ETFs reflects a growing acknowledgment of cryptocurrencies within traditional finance, paving the way for increased collaboration between crypto and Wall Street.

In the grand tapestry of financial evolution, the recent green light for Bitcoin ETFs in the U.S. stands as a historic milestone, echoing the transformative impact witnessed during the introduction of gold ETFs two decades ago. As we traverse this juncture where traditional finance and crypto converge, the implications are profound, with the potential to reshape industry dynamics and redefine investment landscapes.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.