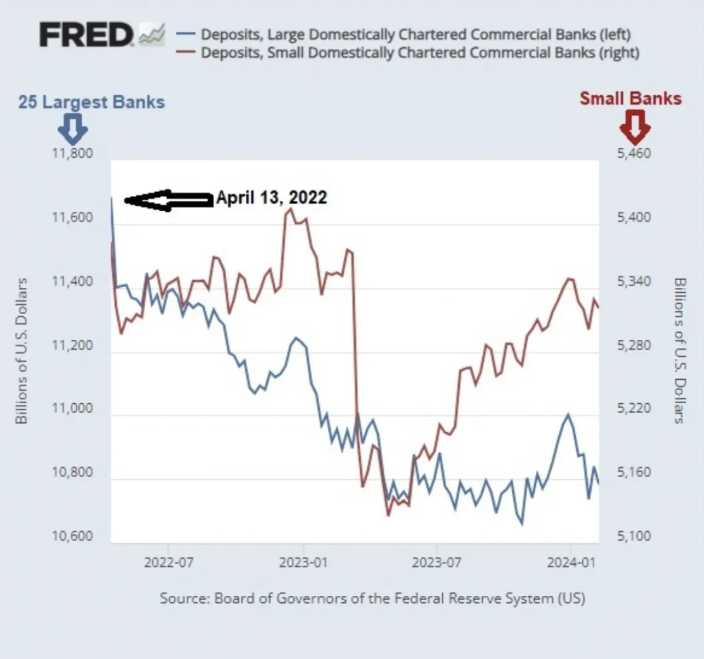

According to Federal Reserve data, we have never seen what we are seeing today. The largest 25 banks are bleeding deposits at historic rates not seen in the 4 decades of data tracked by the Federal Reserve. The chart below shows smaller banks saw a dramatic decline after the banking collapses mid 2023, but have been steadily recovering. The story for large commercial banks is quite different:

As reported by Wall Street on Parade:

According to Federal Reserve data dating back to July 3, 1985 – a span of close to 39 years – there has not been a time when the largest 25 banks were bleeding deposits on the scale that has been happening for the past 22 months.

There has also never been a time comparable to the last 22 months when the largest 25 banks were bleeding deposits while the smaller banks were growing deposits. (See the chart above.)

Why are bank deposits critical for the health of banks?

Deposits are the lifeblood of banks. All banks. Without deposits, banks cannot lend or invest. They cannot earn money. When banks lose approx. 50% of it’s deposits, like they have over the past 22 months, that has a direct impact on their ability to be profitable. A huge impact.

Banks pay you very little for parking your cash in their vaults (or on their digital ledger). The average interest banks pay is .024% interest on the money they store for you. Basically banks are given loans from you and me at ridiculous low rates. Banks use this money mostly to meet capital requirements for lending and receiving money from the Federal Reserve.

But, contrary to popular opinion, banks don’t really need your money to loan. Here is a good explanation on how the racket works:

The Revolving Money Myth: Your Deposits Don’t Fund Bank Loans

Common mythology says that banks take the money that customers deposit into their savings accounts and lend it out to borrowers for a profit. The bank makes only the smallest interest payments on the deposits it receives, charges much higher interest rates on the loans it extends and pockets the difference as a handsome profit. Basically, in this scenario, banks act as middlemen, playing the matchmaker between savers who want to earn a return on their excess capital and borrowers who are willing to pay for a loan.

In painfully simplified terms, that’s sort of true, but only in the most indirect of ways.

Banks Create the Money They Lend

Banks don’t need your money to extend loans. The loans themselves create new money.

Each and every time a bank makes a loan, the laws of double-entry accounting require them to create a new account for the borrower and make a deposit equal to the loan amount.

According to Forbes, this means that banks create money every time they lend money. They’re able to do this because banks are allowed to lend much more money than they have.

The Money They Lend Isn’t Really There

Banks operate on a system called fractional reserve, which allows them to keep only a small fraction of the money they lend available on hand as withdrawable cash reserves. Also, the 1913 Federal Reserve Act requires banks to maintain the minimum cash reserves needed to clear outgoing checks.

One of the cheapest ways to meet those reserve requirements, according to Resilience, a program under the Post Carbon Institute, is through “retail deposits” — that’s the money you keep in your savings account. If they can’t attract new customers to borrow cheap retail deposits from, banks have to meet their cash reserve requirements by paying more to borrow wholesale deposits from the Fed.

In short, banks don’t take the money that you deposit, turn around and loan it at a higher interest rate. But they do use the money you deposit to balance their books and meet the necessary cash reserves that make those loans possible.

So why do deposits matter if banks don’t need deposits to lend? The last 2 paragraphs explain why it matters so much to banks. First, deposits are the cheapest way for banks to meet reserve requirements. Its hard to beat a loan at .025% from you. Like all business, if the cost to operate substantially increases, it puts the entire enterprise at risk.

Perhaps the most important point of this entire article is the fact that this points to a huge shift in economic activity.

People are increasingly leaving the traditional banking systems and moving towards cryptos, gold & silver, and other investments. When major shifts in money management occurs, it represents changes in attitudes and expectations of consumers. This change is massive. A 50% decline in banking deposits is a seismic shift that is almost unimaginable in the past. It cannot be ignored and it is a glaring red flag that significant change is coming.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.