Introduction

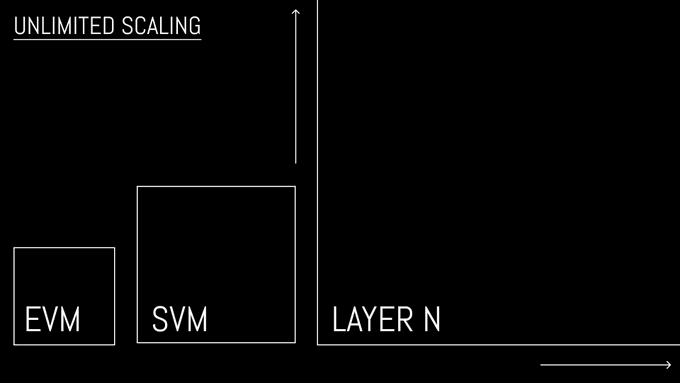

In the last few years, we’ve seen many blockchains built to tackle some of the current challenges facing blockchain applications but up till now, the most used smart contract-based blockchain is still slow and very expensive to use. Another difficulty with the blockchains we have is the composability of blockchains. This is the ability for an application to connect with other applications on a different blockchain without hiccups. This is still a challenge in the crypto ecosystem.

Layer N

A new blockchain tech Ethereum layer 2, Layer N, is being developed to address these challenges. Layer N is a layer two network designed to improve blockchain application development and the user experience on Ethereum. It aims to achieve feature and performance parity with centralized systems and enable the seamless composability of applications. In the following section, I will explain the pieces of Layer N that make it a great solution for the blockchain industry.

Components of Layer N

The Layer N suite consists of many moving parts to provide a comprehensive platform for scaling blockchain infrastructure.

Cross-Virtual Machines (XVM)

In blockchains, virtual machines (VMs) are like interpreters for a main computer which consists of many individual computers working together. These VMs ensure all computers run the same instructions for smart contracts and applications, creating a secure and standardized way to execute them on the blockchain network. The most popular VM is the Ethereum Virtual Machine.

A virtual machine (VM) defines the execution environment, and state access rules for programs built on it. Each VM is run on a single rollup in the Layer N StateNet and has access to the wider network of VMs through a shared communication and liquidity layer. There are 2 types of VMs: Generalized VMs and application-specific VMs.

A Cross-Virtual Machine is a custom platform that allows smart contract code written on a blockchain with its specific virtual machine to interact with other smart contract ecosystems. To understand it better, I broke down the functions of a cross-virtual machine:

Defines the Execution Environment: An XVM sets the stage for programs to run. It provides the necessary resources and tools, like memory and processing power, for the program to function on Layer N.

State Access Rules: The XVM determines how programs access and interact with data. This ensures programs operate securely and efficiently within the XVM's boundaries.

Single Rollup Execution: Each XVM runs on a specific rollup within the StateNet. Rollups are a way to bundle transactions on the blockchain, making them more efficient.

Network Communication & Liquidity: While running on a single rollup, XVMs can communicate and share resources with other XVMs through a dedicated layer. This allows programs built on different XVMs to interact and access shared data or liquidity pools.

Types of XVMs:

Generalized VMs (XVMs): These are versatile virtual machines and can run any kind of code. This makes them ideal for developers who want to build a wide range of applications on Layer N.

Example: N-EVM

NEVM is Layer N's super-fast blockchain built for everyone. It lets developers use familiar tools (Solidity) to build powerful applications that can interact seamlessly with other parts of the Layer N network.

Application-Specific VMs: These are tailored for specific purposes. They have pre-configured settings and limitations that optimize them for a particular type of application, to improve performance and security.

Example: NordVM

NordVM is the first app-specific powerhouse on Layer N. It works as a lightning-fast exchange built specifically for high-speed trading (think tens of thousands of orders per second!). It connects seamlessly with other Layer N features (coming soon) for added flexibility. Unlike some exchanges, NordVM keeps everything transparent and on-chain for extra security.

The StateNet: A Game Changer from Layer N

StateNet is a system designed by Layer N to expand the capabilities of blockchain technology. It achieves this by providing the performance of modular standalone rollups while retaining the synchronous composability benefits of the monolithic stack. This means it offers the benefits of both modularity and composability.

In simpler terms, StateNet allows developers to create faster and more efficient blockchain applications that can interact with each other more easily. It accomplishes this through a network of virtual machines (VMs) that can communicate with each other. These VMs can be general-purpose or designed for specific applications. StateNet also includes features like message queues, routers, and a gatekeeper to handle communication and asset flow.

In a simpler way:

Modular Standalone Rollups (Speed) as used above: Imagine mini-blockchains acting like independent shops in a big marketplace. Transactions within them happen quickly because they don't rely on the main server. Imagine each shop has its own efficient cash register, processing transactions much faster. This is what it means to have the performance of such apps in Layer N.

Synchronous Composability (Working Together): Unlike separate shops on different streets as I mentioned above, these shops can still communicate with each other easily. This allows you to move your assets (crypto) between them seamlessly, just like you could walk between shops in the same marketplace.

So, think of StateNet as a platform running just like the system I have described.

StateNet represents a significant leap forward in achieving Layer N's vision. Current on-chain applications often struggle with performance limitations and difficulty interacting with each other (composability). StateNet tackles both issues. By employing a combination of Generalized VMs (GVMs) and Application-Specific VMs (XVMs), StateNet empowers developers with flexibility and efficiency. GVMs allow for building smart contracts in any language, while Application-Specific VMs offer optimized performance for specific applications.

The Benefit of StateNet For Ethereum Mainnet

StateNet acts as a powerful scaling solution for the Ethereum network. By processing transactions off-chain (Layer 2), StateNet helps alleviate congestion and reduce transaction fees on the main Ethereum blockchain. This translates to a more scalable and cost-effective environment for developers to build decentralized applications. Moreover, StateNet maintains its security by leveraging Ethereum's robust security infrastructure, ensuring a safe and reliable environment for users.

Benefit of StateNet To Users

StateNet ultimately aims to enhance the user experience within the blockchain space. Faster transaction processing times achieved through StateNet will lead to quicker confirmations and a smoother user experience. With StateNet, there is also a guarantee of low fees across transactions on-chain.

Additionally, the composability of StateNet allows for the development of more complex and interconnected dApps, providing users with a wider range of innovative applications and functionalities.

StateNet, with its specialized virtual machines, bridges this fragmentation of liquidity by enabling smoother communication between many isolated liquidity pools on Ethereum.

Interoperable VMs: StateNet uses VMs that can communicate with each other. This allows DeFi applications built on different VMs (even different blockchains) to interact and access shared liquidity pools.

Reduced Friction: By facilitating communication between VMs, StateNet could reduce the friction involved in moving assets between different DeFi applications. This could involve features like:

Liquidity Swaps: Imagine a "currency exchange" within StateNet that allows users to easily swap tokens between different liquidity pools residing on different VMs.

Cross-chain Bridges: StateNet can act as a bridge between different blockchains, allowing DeFi applications on separate chains like Optimism, Arbitrum and Base to access each other's liquidity.

By addressing the scalability and composability challenges, StateNet paves the way for a more user-friendly ecosystem.

Testnet Stage

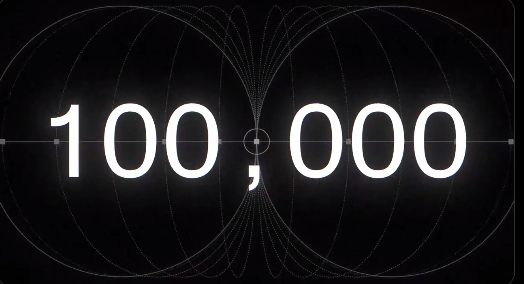

Layer N conducted a successful closed testnet showcasing the innovative Nord Engine, a rollup engine specifically designed for high-speed trading. This engine enabled the network to process a staggering 120,018 transactions per second (TPS), exceeding the performance of current Ethereum scaling solutions by a factor of 100. This breakthrough paves the way for near-instantaneous transactions, a significant advancement considering the limitations of traditional blockchains.

The impressive testnet results stem from a two-pronged approach. Firstly, Layer N leverages EigenDA, a separate data availability layer that allows for secure and cost-effective storage of transaction data, reducing the burden on the main Ethereum blockchain.

Secondly, the Nord Engine itself is optimized for efficient transaction processing. This combination creates a powerful infrastructure for high-throughput trading within the decentralized finance (DeFi) ecosystem. The upcoming public launch of the testnet will allow a wider audience to experience Layer N's capabilities and contribute to further development.

Null Studios, the team building Layer N will be conducting the public testnet of Layer N in three distinct phases for the solutions that are being developed.

The stages are as follows:

Phase I - NordVM

Phase II - NEVM

Phase III - StateNet

Stay connected with Layer N by joining the N-armies using the following links:

Website: https://www.layern.com/

Documentation: https://docs.layern.com/

Socials

Twitter: https://x.com/layern_official

Discord: https://discord.gg/layern

Telegram Announcements: https://t.me/LayerN_Announcements

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.