TABLE OF CONTENTS

- Introduction

- The call for standards

- Defining standards

- A comprehensive overview of current standards on digital assets

- Lessons learned from standard-setting efforts

- Establishing standards

- Key themes for a CBDC framework

- Conclusion

Abstract

Over the past few years, the global financial landscape has undergone a significant transformation marked by the emergence and integration of digital assets. Looking ahead, the global financial terrain is set to include a spectrum of both sovereign and nonsovereign digital currencies and both centralized and decentralized networks. This future brings the promise of enhanced efficiency, inclusion, transparency, and choice to global payments. To fulfill this promise, the international community must develop interoperability standards that prioritize a fast, highly scalable, and resilient architecture. The flexibility of this architecture to adapt configurability based on policy and economic considerations is critical to its success.

This working paper is a foundational step toward a broader, global dialogue about digital asset standards. The Digital Dollar Project and the Atlantic Council’s GeoEconomics Center hosted a global convening titled “Exploring Central Bank Digital Currency: Evaluating Challenges and Developing International Standards” in November 2023. A version of this paper was released as a working paper to level set the attendees of the conference and provide a call to engage the public and the private sector in standard-setting efforts. This paper was further developed based on feedback from the conference and outreach afterward. The paper now reflects what we learned from our convening and incorporates the most recent developments in standard-setting efforts globally. The rapid growth of central bank digital currencies (CBDCs) worldwide underscores the importance of aligning approaches to their development, adoption, and implementation across technical, regulatory, and governance levels. Today, there is a patchwork of first steps undertaken by both public-and private-sector entities, aimed at achieving different objectives. These efforts have focused on frameworks, guiding principles, and, in some cases, the development of standards for digital assets broadly, as described below. Some are CBDC-specific and others have general applicability in the payments sector. As governments and stakeholders collaborate to establish consistent benchmarks for CBDC development, it’s crucial to identify, organize, and align standard-setting endeavors. This process involves assessing existing efforts to pinpoint gaps and create a foundation for international standards that remain open and flexible for future development and innovation. Through this paper, we show the crucial element of interoperability, which is needed for the furtherance of standards on CBDCs and digital assets. We attempt to build the pressing themes around which standards will have to be addressed through existing and new efforts.

Introduction

In recent years, the global financial landscape has witnessed a profound transformation characterized by the accelerated rise and integration of digital assets. As a subset of these assets, central bank digital currencies (CBDCs) have captivated the interest of countries worldwide.1 The CBDC landscape has rapidly evolved with 130 countries, representing 98 percent of the global economy, actively researching and, in some cases, deploying CBDCs. A recent survey by the Bank for International Settlements (BIS) revealed that the number of central banks likely to issue a CBDC within the next three years has grown in the past year from 15 percent to 18 percent for retail CBDCs (rCBDC) and from 8 percent to 15 percent for wholesale CBDCs (wCBDC).2

CBDCs, in their promise and potential, are emblematic of a broader shift—a movement toward a more efficient, frictionless digital infrastructure, shaping the future of international trade, cross-border payments, and global financial integration. However, with transformative potential comes inherent complexity. As fiat currencies become more intertwined with technology there are significant implications for privacy, human rights, cybersecurity, digital financial inclusion, and the movement of money across borders for international trade, aid, investment, and other payments. If designed without a common framework of standards and collaboration, a shortsighted and fragmented approach to CBDC development could lead to the emergence of walled gardens.

At the core of establishing standards lies the concept of interoperability—the ability for diverse systems to interact seamlessly and reduce friction. In this context, interoperability extends beyond technical objectives alone; it requires a broader framework including regulatory and governance standards, paving the way for streamlined cross-border transactions, reduced operational friction, and bolstered trust among participating entities. While not a panacea, technical, regulatory, and governance benchmarks are instrumental in navigating the complexities of the international payments systems. In order to achieve interoperability, CBDC exploration should prioritize a thorough discussion on establishing technical, regulatory, and governance standards. (See Annex 1 for definitions relevant to this discussion.)

This paper is intended as a catalyst to stimulate a broader, global dialogue about CBDC standards. It takes stock of existing activities, begins to define how these efforts may be coordinated and aggregated into a set of globally accepted best practices, and offers a baseline for addressing gaps or deficiencies in defining best practices.

The call for standards

CBDCs are a digital form of a country’s national currency, issued and backed by the country’s central bank. They come in two forms: retail CBDCs (rCBDC), accessible to individual consumers and usable for everyday purchases and peer-to-peer payments, and wholesale CBDCs (wCBDC), utilized by financial institutions or other major entities for interbank settlements and large financial transactions. The motivations behind rCBDCs and wCBDCs are distinct. The deployment of rCBDCs is usually motivated by financial inclusion, payment efficiency, privacy, and safety. Interest in wCBDCs is aimed at addressing cross-border friction to improve international payments—including limited operating hours, long transaction chains, restrictions on legacy technology platforms, data fragmentation, high costs, complex funding, and compliance issues.3

Ultimately, rCBDCs and wCBDCs would operate in conjunction with each other to achieve both the domestic and cross-border needs of a country.4 Therefore, the deployment of domestic CBDCs must not be considered in isolation or the result will be walled gardens that stand apart from global commerce and economic trends. Creating a CBDC in a silo is unlikely to achieve the desired outcomes in the short or long term, as it will replicate the friction of the existing payments systems. CBDCs’ potential to provide a simpler and more efficient way to move money can only be realized as long as the CBDCs can interoperate with one another.

If deployed, a CBDC must be able to operate across various transactions, institutions, and users. Many CBDC initiatives and explorations recognize the complex and interconnected ecosystem in which financial activity takes place and the interdependencies of the different participants in transaction settlements. By agreeing on standards upfront—which is by no means a simple task—CBDCs can hopefully escape some of the growing pains that we have seen with the development of new financial technology (such as automated teller machines that could only be used by customers of a specific bank) or new digital technology (such as the challenges posed by the early years of closed-loop email).

Concentrating on developing and implementing clear and accessible global standards can enable greater industry collaboration and competitiveness through interoperability, transferability, consistency, and safety across various industries and economies. With this clarity, countries can direct their efforts toward aligning and promoting key principles such as privacy, free enterprise, the rule of law, and economic liberty within the global financial landscape.5

Defining standards

At the heart of this paper is the effort to promote interoperability in payments systems and prevent the creation of walled gardens. We therefore define standards as the technical, regulatory, and governance benchmarks needed to achieve interoperable systems in the long run. It is crucial to recognize that standards do not emerge arbitrarily; instead, they evolve from fundamental principles, embodying intentional consideration and consensus.

Standards specific to CBDCs are not unchanging; they must reflect and be responsive to technological development, market shifts, and experience. Standards are established by technical and governance bodies, often made up of diverse stakeholders, and reflect a consistent floor for pragmatic implementation across jurisdictions. Therefore, they must have built-in flexibility to adjust to changing circumstances across a variety of market structures.

Our use of a narrow definition of standards as a means to achieve interoperable payments systems helps navigate the complex technical, governance, and regulatory environment. In the following section, we catalog existing standards for digital assets and the institutions responsible for setting them.

A comprehensive overview of current standards on digital assets

Methodology

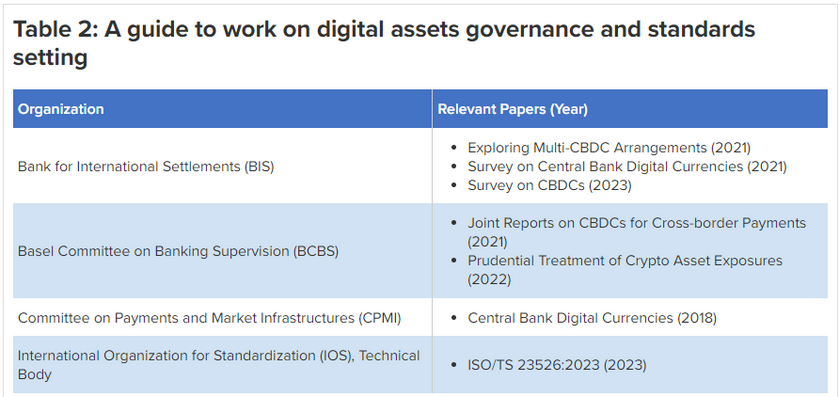

Due to their rapid growth, global standard-setting bodies have had to regulate and harmonize the adoption and use of digital assets across borders. In this section we provide an overview of the prominent organizations that play a pivotal role in shaping the digital asset landscape. Understanding the functions, roles, and importance of these bodies is critical for fostering a safe, competitive, and inclusive digital economy. We explore global governance institutions—the International Monetary Fund (IMF) and Bank for International Settlements—as well as regulatory standard setters—the Basel Committee on Banking Supervision (BCBS), the Financial Action Task Force (FATF), the International Organization of Securities Commissions (IOSCO), the Committee on Payments and Market Infrastructures (CPMI), and the Financial Stability Board (FSB)—and technical bodies like the International Organization for Standardization (ISO). Since rCBDC projects have largely been in the pilot, development, and research stage while wCBDC projects are currently limited, standard-setting efforts in some bodies have focused on broader digital asset developments.

International Monetary Fund

As a key institution in international monetary cooperation and exchange rate stability, the IMF is instrumental in assisting its 190 member countries in managing economic change. Its expertise in macrofinancial surveillance can help identify vulnerabilities associated with digital assets and it can offer policy advice to enhance the resilience of economies.

In November 2023, the IMF released a virtual handbook on CBDCs, designed as a comprehensive guide for policymakers and experts in central banks and finance ministries. The plan for this evolving handbook is to offer about twenty chapters by 2026, with periodic updates to reflect the latest findings and viewpoints.6 The initial chapters address key topics like the framework for exploring CBDCs, product development, impacts on monetary policy, capital flow management, and financial inclusion.

A publication called, "IMF Approach to Central Bank Digital Currency Capacity Development", released in April 2023, outlines the IMF’s efforts to facilitate peer learning and develop analytical underpinnings for advising member countries on CBDCs. In addition to research, the IMF provides technical assistance, including the XC platform initiative.7 The XC platform, proposes a global centralized ledger to simplify and streamline cross-border payments. This initiative builds on the concept of wholesale CBDCs, but the platform includes commercial banks, payment providers, and central banks within a single, streamlined system. The XC model aims to reduce transaction costs and settlement times, making it an attractive option for countries looking to enhance their cross-border payment systems.

Described as a “digital town square,” the XC platform would build a three-layer architecture: a settlement layer that acts as the primary ledger, a programming layer for executing smart contracts, and an information layer designed to protect personal data while ensuring compliance and facilitating currency controls as needed.8 The platform’s architecture is designed to be open and upgradeable, ensuring its longevity and adaptability to future innovations. Instead of adopting CBDCs, central banks can issue certificates of escrow (CE) for use exclusively on the XC platform. CEs enhance financial accessibility by granting more entities, including nonbank financial institutions (NBFIs), payment-system providers (PSPs), and nonresidents, direct access to central bank reserves. These certificates share characteristics with CBDCs and can later be converted into central bank reserves by financial institutions. According to the IMF, a key advantage of using CEs is that it allows countries to prioritize domestic use cases for their CBDC projects, while CEs can be used solely for cross-border transactions.9

The XC model is designed for wide-ranging compatibility with existing systems, requiring central banks to make only minor technical updates. The model is a policy and regulatory framework; it encourages countries to adopt consistent and supportive regulations for cross-border payments, potentially incorporating tokens and distributed ledger technologies (DLTs). In order for the model to work, however, it will need compatible legal and regulatory frameworks to effectively manage risks and ensure compliance across various jurisdictions. Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department at the IMF, further explained this point at our conference in November 2023.

Bank for International Settlements

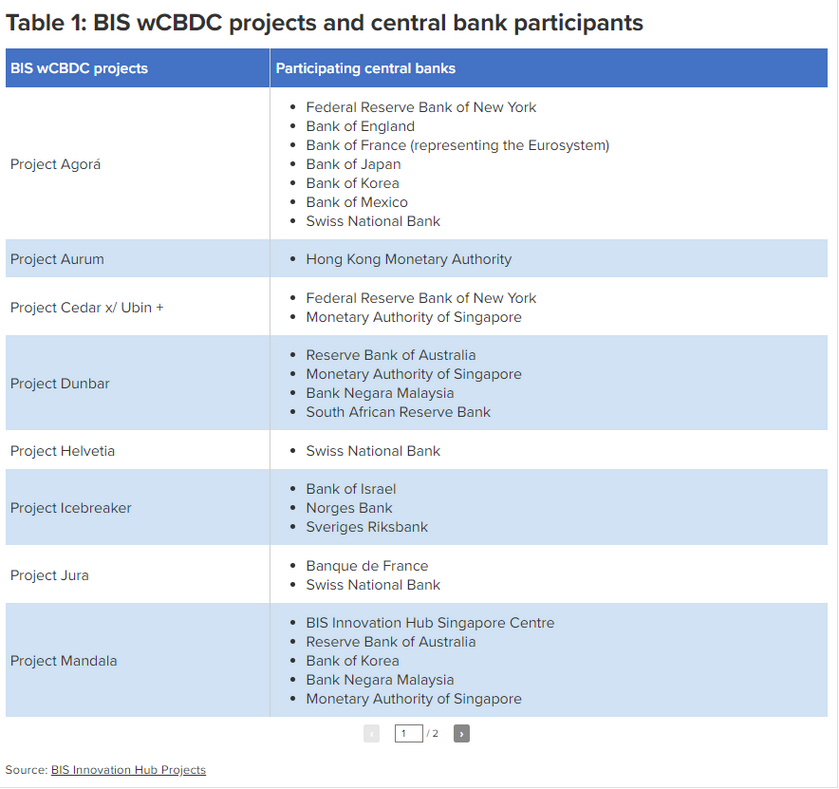

The BIS acts as the central bank for central banks, fostering monetary and financial stability globally. It actively explores the impact of digital currencies on the financial system and central bank operations. The BIS Innovation Hub facilitates research and development on digital innovation, helping member countries adapt to the rapidly evolving digital asset landscape. Its membership consists of sixty-three central banks and monetary authorities.10

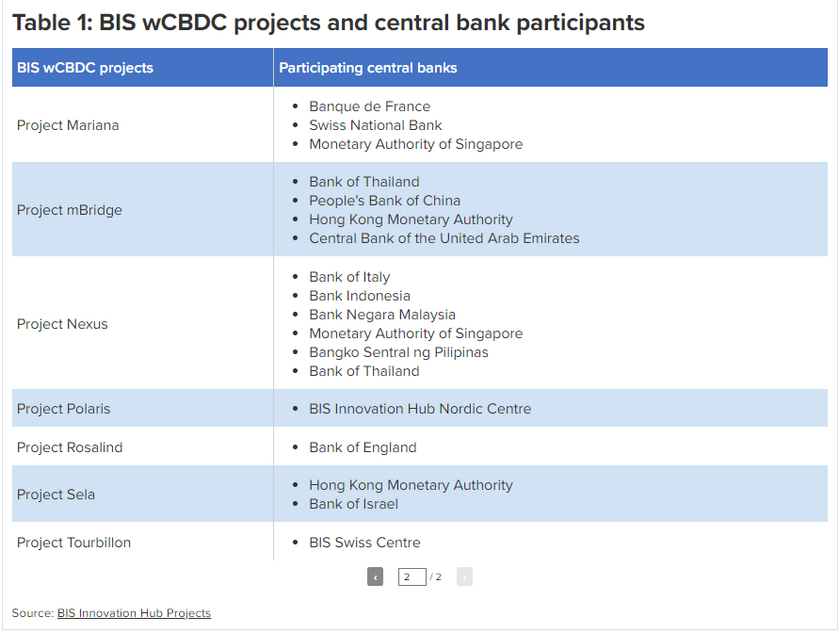

Recent significant projects include Project Mariana, which tested cross-border trading using CBDCs and decentralized finance technology, and Project Icebreaker, which focused on using retail CBDCs for international payments through a novel hub-and-spoke model, both completing their testing phase in 2023.11 Most recently, Project Sela, a collaboration between the BIS Innovation Hub Hong Kong Centre, the Bank of Israel, and the Hong Kong Monetary Authority, focused on exploring rCBDC features including accessibility, cyber security, and effective public-private collaboration, with an emphasis on central banks overseeing retail ledgers and private intermediaries managing customer-facing services.12

In July 2023, the BIS presented the results of a survey showing that 93 percent of central banks are engaged in CBDC work, with retail CBDC development more advanced than wholesale CBDC.13 The survey reveals most central banks recognize the value of having both a retail CBDC and a fast payment system.14 By 2030, there could be fifteen retail and nine wholesale CBDCs publicly circulating, while stablecoins and crypto assets are rarely used for payments outside the crypto ecosystem.15 This BIS finding followed its June 2021 report discussing its survey on CBDCs, which found that many central banks had not decided on issuing a CBDC, but had a tentative inclination toward allowing cross-border use by tourists and nonresidents. In March 2021, the BIS explored the potential for multi-CBDC (mCBDC) arrangements to improve cross-border payments by leveraging interoperable central bank digital currencies. Technology could play a role in addressing inefficiencies, and the paper discusses the dimensions of payment system interoperability and the benefits of mCBDC arrangements.16

The BIS Universal Ledger interoperability model advocates for a shared global ledger that integrates various forms of money—including CBDCs, tokenized deposits, and other digital financial assets—into a single, programmable environment. The BIS aims to address the inefficiencies and silos present in the financial system by enabling safer transactions and atomic settlements within a transparent framework.

The architecture of the unified ledger model is designed to be secure, scalable, and interoperable, with a strong emphasis on privacy and regulatory compliance. At its core, the architecture includes a data environment for securely storing digital asset representations, like CBDCs and tokenized deposits, in organized partitions managed by authoritative entities such as central banks and commercial banks. The execution environment facilitates the automation of complex financial operations and secure, efficient transaction processing. This environment supports atomic settlement, ensuring comprehensive transaction success or complete rollback. In addition, to safeguard sensitive data and transaction privacy, the model implements cryptographic methods like homomorphic encryption and secure multiparty computation. These technologies enable encrypted data computation without exposing the actual data, reinforcing the system’s privacy and security. An important component of the BIS project is the governance framework that establishes operational and regulatory compliance protocols, while also detailing the responsibilities of all involved parties, including central and commercial banks.

Unlike the XC model, which builds on blockchain solutions, the BIS’s unified ledger approach uses application programming interfaces (APIs), creating a more centralized system where transactions have to be processed and validated by authorized entities, such as central banks or designated financial institutions. 17 Within this system, central bank money can circulate on a platform that is not owned and operated by the central bank, which can present risks. It also raises questions about the security, control, and integrity of central bank money when it is managed outside the traditional central banking systems.

The BIS favors a system grounded in central bank money, offering a sounder basis for innovation, stable and interoperable services across borders, and a virtuous circle of trust through network effects.18

Basel Committee on Banking Supervision

The BCBS is the global body for setting prudential standards for banking supervision and regulation. With the emergence of digital assets and their potential impact on banking operations and risk management, the BCBS is studying the implications for financial institutions. The committee’s membership includes central banks and banking supervisory authorities from twenty-eight countries.19

The BCBS standard for prudential treatment of crypto asset exposures integrates crypto assets into the Basel Framework for banks.20 Joint reports by CPMI, BIS, the IMF, and the World Bank on central bank digital currencies for cross-border payments emphasize CBDCs’ potential to enhance cross-border payments through international cooperation and coordination.

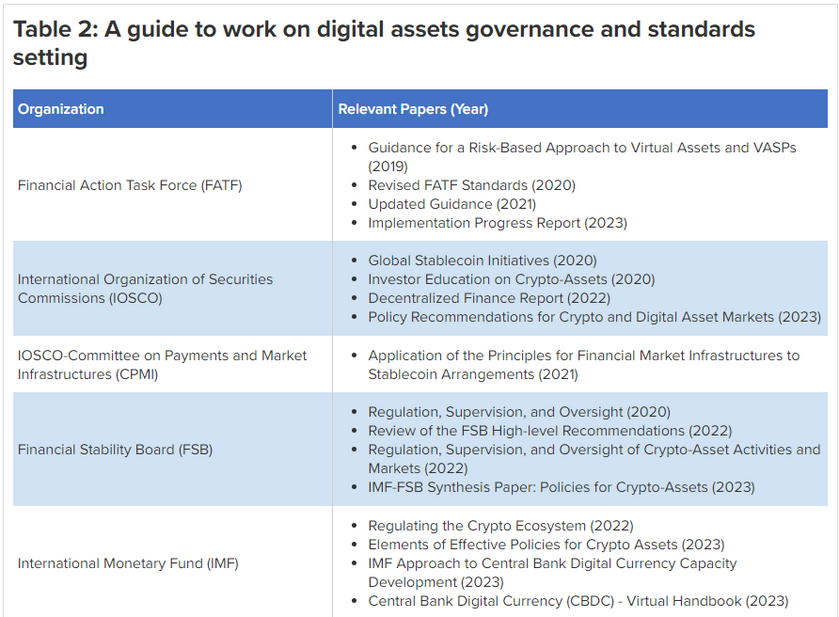

Financial Action Task Force

FATF primarily focuses on combating money laundering and terrorist financing and has had less emphasis on specific guidelines for CBDCs. Its recommendations function as guidance on regulating virtual assets and virtual asset service providers (VASPs) to ensure the prevention of illicit financial activities. More than 200 jurisdictions have committed to implementing FATF standards, making the organization a key player in shaping regulatory frameworks to maintain transparency and security in the digital asset sphere.21 FATF has thirty-eight member countries, including major economies and financial centers worldwide.22

FATF has published several papers related to virtual assets and VASPs. The first version of its Guidance for a Risk-Based Approach to Virtual Assets and VASPs, released in June 2019, focused on risk assessment and monitoring, particularly for issues of anti-money laundering and combating the financing of terrorism (AML/CFT).23 A twelve-month review of the revised FATF standards on virtual assets and VASPs was conducted in July 2020, showing progress in implementing these standards among some jurisdictions, but not yet sufficient progress to create a global AML/CFT regime for virtual assets.24 A second twelve-month review in June 2022 revealed continued progress, but indicated that implementation was still insufficient and certain challenges remained, such as the implementation of the “travel rule.”25 This rule is a legal obligation that requires financial institutions—such as banks and cryptocurrency service providers—to collect and share detailed information about the parties involved in a financial transaction.

To address these challenges and based on the two reviews, FATF published Updated Guidance for a Risk-Based Approach to Virtual Assets and VASPs in October 2021. This guidance includes updates in six key areas, including clarifying the definitions of virtual assets and VASPs, guidance on stablecoins, and additional guidance on peer-to-peer transactions and information-sharing among VASP supervisors.26 However, the latest update on the implementation, published in June 2023, indicated that jurisdictions still struggle with fundamental requirements.27 The report also emphasizes the need for appropriate risk identification and mitigation measures, especially for decentralized finance (or DeFi) and unhosted wallets (e.g., controlled by the owner rather than a platform or exchange manager), which have the potential for misuse. In 2020, FATF has also reported to the Group of Twenty (G20) on stablecoins, outlining its specific views on the application of anti-money laundering and counterterrorist financing requirements.28 There is ongoing work needed to ensure consistent and effective implementation of FATF standards in the digital asset sphere, and some jurisdictions are still struggling with fulfilling the fundamental requirements outlined by FATF.

International Organization of Securities Commissions

As the leading international standard-setting body for securities regulation, IOSCO plays a critical role in ensuring the stability and efficiency of capital markets. With a growing interest in digital securities, IOSCO’s principles on issuer and investor protection, market integrity, and risk mitigation have significant implications for the global adoption of tokenized assets. IOSCO has more than 120 members, including national securities regulators and exchanges from various jurisdictions.29

While debates on which digital assets count as securities are ongoing in the United States, IOSCO has been actively engaged in providing insights into the realm of digital asset markets through a series of consultation reports and public reports. Policy Recommendations for Crypto and Digital Asset Markets, published in November 2023, stands out as a comprehensive consultation report proposing eighteen recommendations that address six key areas of concern. These areas include conflicts of interest resulting from vertical integration, market manipulation, cross-border risks, custody and client asset protection, operational and technological risks, and retail access, suitability, and distribution.30

In March 2020, IOSCO released Global Stablecoin Initiatives, a public report emphasizing the applicability of principles for financial market infrastructures to stablecoin arrangements with systemically important functions. IOSCO’s work on exchange traded funds and crypto-asset trading platforms may also apply to global stablecoins.31 In March 2022, IOSCO presented its public report on decentralized finance, highlighting regulatory concerns like fraud risks, flash loans, cybersecurity, and spillover effects on traditional markets. Additionally, in December 2020, the organization published Investor Education on Crypto-Assets, a report to educate the public and investors on crypto assets and risk mitigation.32

Committee on Payments and Market Infrastructures

Under the BIS, the CPMI provides a platform for central banks to promote the safety and efficiency of payment systems worldwide. With digital assets gaining recognition, the CPMI is actively engaging in discussions concerning the potential role of CBDCs and their interplay with private cryptocurrencies. The CPMI has twenty-eight members, representing major central banks and monetary authorities.

A 2018 Markets Committee report titled Central Bank Digital Currencies introduces and defines CBDCs, assessing their potential implications for monetary policy and central bank operations.33 It recommends further research on various aspects including interest rates, financial stability, and exchange rates. The report also warns against the risks of private digital tokens due to their volatility and lack of protection for investors and consumers, making them unsuitable for widespread use in payments.

Financial Stability Board

The FSB’s mandate is to oversee and coordinate global financial regulation, identifying and addressing systemic risks to foster stability in the financial system. Recognizing the growing importance of digital assets, the FSB monitors developments and potential risks arising from their use and ensures that the digital asset market operates within established stability parameters.34The FSB is broadly focused on the global regulatory framework for crypto-asset activities, and has not released any specific research or guidelines on CBDC development. The board’s membership includes a combination of G20 economies, other major economies, and international organizations.35

International Organization for Standardization

The ISO fosters agreement on best practices and processes, and publishes standards and technical specifications (TS), including on the security aspects for digital currencies. ISO/TS 23526:2023 focuses on providing a security framework for the issuance and management of digital currencies in general, using cryptographic mechanisms standardized by ISO and other references. The document aims to integrate security aspects into the design of digital currency systems, as opposed to adding them later as an extra layer, to accommodate legacy infrastructures.36 ISO does not have any explicit references or guidelines on CBDCs’ technical security, but instead has a broader focus on digital currencies overall.The following organizations below were added after the conference and depict wide-ranging efforts for interoperability occurring both in the private and public sector.

Society for Worldwide Interbank Financial Telecommunication

Building on its legacy in global financial messaging, the Society for Worldwide Interbank Financial Telecommunication (Swift) has introduced a model to enhance its existing infrastructure for cross-border payments, making them faster, more transparent, and cost-effective. Currently in beta testing, this model facilitates the connection of disparate national CBDC networks, enabling them to communicate and transact with one another while leveraging Swift’s existing infrastructure and security protocols—best thought of as a hub-and-spoke arrangement between various central banks with Swift at the center. This initiative is part of a broader Swift effort to prevent the fragmentation of the global payments landscape into “digital islands.”37

The project began in March 2023, with over eighteen participants, including the Monetary Authority of Singapore and the Banque de France. Within a twelve-week period, they were able to process over 5,000 transactions. In September 2023, Swift further broadened the initiative by announcing the participation of three new central banks: the Hong Kong Monetary Authority, the Central Bank of Kazakhstan, and an additional, anonymous central bank.

Following the insights and successes from Phase 1, Swift released the takeaways from the Phase II CBDC sandbox project in March 2024, engaging thirty-eight central banks, commercial banks, and market infrastructures from around the globe. This project was designed to tackle complex use cases and assess solutions within a controlled sandbox environment. The second phase involved over 125 participants, who collectively executed more than 750 transactions. The sandbox was hosted on Kaleido, a Web3 platform for blockchain applications, where central banks were able to simulate CBDC transactions. Swift’s technology stack included a combination of the Corda, Hyperledger Fabric, and Hyperledger Besu platforms.38

Phase II explored four new use cases. First, it demonstrated the automation of trade payments through CBDC networks and smart contracts, aiming to improve trade efficiency and minimize costs. Second, it evaluated two models for foreign exchange trade and settlement: an International Foreign Exchange Marketplace and a Continuous Linked Settlement (CLS) inspired system, both of which underscored the integration of CBDC trade and settlement. Third, the project focused on delivery versus payment (DvP), facilitating atomic DvP for tokenized bonds by ensuring interoperability between tokenization platforms and CBDC networks. Finally, it investigated mechanisms to mitigate liquidity fragmentation across various currencies and platforms, utilizing smart contracts and netting algorithms. The report established three foundational principles for interoperability: linking networks via ISO 20022 messaging, providing a unified point of access through Swift, and ensuring coexistence with traditional market infrastructures.39

This model leverages Swift’s global reach and the existing network effects among financial institutions. It also offers flexibility for countries to maintain their own domestic CBDC infrastructure while ensuring global connectivity.

The Internet Engineering Task Force

The Internet Engineering Task Force (IETF) is deeply involved in the development of standards to enhance blockchain interoperability, focusing on the Secure Asset Transfer Protocol (SATP).40 This protocol is designed to enable seamless transfers of digital assets across diverse distributed ledger technologies (DLTs) by leveraging a network of trusted gateways, akin to the role border gateway routers played in the early internet. Such an approach offers a scalable and ledger-agnostic solution for the rapidly evolving digital asset ecosystem.

SATP facilitates asset transfers through a structured process that includes three main stages: Transfer Initiation, Lock-Evidence Verification, and Commitment Establishment. The protocol ensures that digital assets are exclusively valid within one network at any given time, adopting a transfer mechanism that maintains the asset’s integrity and uniqueness.41 This is achieved through the strategic use of gateway endpoints which manage the transfer process, ensuring secure, transparent, and auditable transactions that adhere to Atomicity, Consistency, Isolation, and Durability (ACID) principles.42 The SATP framework comprises a comprehensive set of API endpoints and resources for the initiation and execution of asset transfers. It also aims to facilitate the integration and management of digital asset transactions, contributing to a more efficient and secure digital economy.

Hyperledger, an open-source community focused on blockchain technologies, plays a role in implementing and advancing SATP through projects like Hyperledger Cacti.43 Cacti serves as a blockchain integration framework that enhances interoperability by allowing operations across multiple enterprise-grade blockchain networks. It achieves this through a pluggable architecture that supports Business Logic Plugins (BLP) and Ledger Connectors, enabling seamless interaction with various DLTs.

Global Blockchain Business Council

The GBBC has launched the fourth iteration of the Global Standards Mapping Initiative (GSMI 4.0), a comprehensive project designed to map and analyze the blockchain and digital assets landscape.44 This initiative provides an extensive overview of regulatory developments across 230 jurisdictions and six global bodies, compiles a taxonomy of 350 terms and definitions, maps sixty-three technical standards bodies, and identifies more than 2,000 stakeholders in the blockchain ecosystem. Additionally, it offers access to 1,500+ courses from accredited educational institutions and includes four in-depth reports focusing on AI convergence, digital identity, supply chain, and sustainability, with a special spotlight on Brazil. GSMI 4.0, building on the work since 2020, aims to present a holistic view of global industry activity. The initiative’s resources, including an interactive map of blockchain and digital asset regulations and a series of reports, are available on the GSMI site (https://gbbcouncil.org/gsmi/). All materials produced by the GSMI are crowd-sourced and open access, ensuring they serve as a reliable information source for those interested in blockchain and digital assets.

The Internet Governance Forum

The Internet Governance Forum (IGF), primarily serves as a multistakeholder platform for policy dialogue on internet governance issues.45 While not directly implementing or proposing specific financial systems, the IGF’s contribution lies in facilitating discussions, building consensus, and sharing best practices among stakeholders to influence the governance frameworks that underpin these technologies. First convened in 2006 by the United Nations secretary-general as a result of the World Summit on the Information Society (WSIS) held in 2003 and 2005, IGF gathers governments, the private sector, civil society, and technical communities to debate and share insights on enhancing internet security, ensuring digital privacy, fostering the digital economy, and expanding internet access.

Security, trust, and privacy are central to the IGF’s discussions on digital financial services. The forum encourages dialogue on how to protect against fraud, ensure the integrity of digital transactions, and safeguard users’ privacy and data in an increasingly digital global economy. Key areas of focus for the IGF also include the development of governance frameworks that protect user data and ensure a secure online environment. The forum also emphasizes the importance of digital inclusion, advocating for equitable access to the internet and digital services across different regions and communities. Through its annual meetings and intersessional work, the IGF indirectly supports the infrastructure and policies that impact the digital economy and financial inclusivity.

As the above section shows, there have been some efforts in creating standards for interoperability of digital assets. From feedback after the conference, we added the work of organizations such as Swift, IETF, GBBC, and IGF in standard creation. All the organizations listed above have led to important standard making efforts as described. However, these efforts are concentrated in specific areas and, as explored below, some crucial gaps exist that must be addressed in any evolving framework for standards.

Lessons learned from standard-setting efforts

As we evaluate the above models of governance, it is important to assess growth opportunities for the next stage of standard developments. In this section, we identify the critical learnings and gaps in standards development for interoperability of digital assets.

First, the rCBDC experimentation space has provided countries with some experience in building CBDCs, largely driven by domestic objectives. These experiments are at very different stages and use a range of private-sector vendors that are not subject to the same regulations due to a slower pace of crypto-asset regulation globally.

Second, within wCBDC experimentation, operating frameworks in technology and regulation have emerged, led by entities like the BIS Innovation Hub, the global financial-messaging cooperative Swift, and other private-sector players. However, they are constrained by the limited number of participating countries, furthering the issue of fragmentation in cross-border CBDCs. Current experimentation should incorporate standards-setting bodies (SSBs) such as FSB, BCBS, CPMI, ISO, and FATF as participants or observers to ensure better collaboration in the development of standards.

The membership structure of SSBs significantly influences the establishment of the goals and priorities of these institutions. Additionally, while emerging market economies often surpass developed economies in the development of digital infrastructure, including CBDCs, they sometimes find themselves underrepresented in setting norms and establishing benchmarks. This underrepresentation can result in an inadequate consideration of their technological advancements within the organization’s priorities.

Moreover, apart from the FATF, there seems to be a shortage of robust frameworks for assessing the global standards’ impact and implementation lags. To address the evolving landscape of financial technologies, it is imperative that new and non-financial SSBs be actively involved in these discussions, leveraging their expertise in technological matters and regulatory concerns.

Finally, some of the above frameworks have actively involved private sector participants in influencing standard development and creation. As intermediaries, the private sector has a crucial role in the entire lifecycle of standards, from actively influencing the creation of standards to ultimately adopting and implementing them.

Towards establishing standards

A transparent and collaborative multi-stakeholder approach is crucial for establishing frameworks for standards related to digital currencies. Standardization is driven by consultation processes with governments, industry specialists, consumers, regulators, and civil society organizations (CSOs). Historically, governments have provided the necessary legal and governance paradigms, in turn creating environments conducive to standard development and assimilation across multi-stakeholder groups. Central banking authorities, driven by the imperative of maintaining financial stability and directing monetary policy, contribute a nuanced perspective essential for shaping these standards. The private sector’s technological advancements and practical exposure play a critical role, not just in ideation, but in the tangible implementation of these standards, ensuring their practical efficacy. Lastly, the participation of CSOs provides reflection and inclusion of key social elements, serving as a check by society on the suitability of resulting standards.

The goal of this collaborative process is the establishment of a guiding framework for standards. To begin this process, we outlined the following themes for CBDC framework creation, which align with the G7 principles proposed in 2021, to identify the key themes necessary to begin building a framework. These key themes are governance; privacy and data protection; competition and consumer protection; global impact and sustainability; and transferability and accessibility. Through conversations at the conference and outreach afterward, we aimed to test the robustness of these themes through a survey (see Annex 2 for survey questions). Within each theme, we describe the areas of framework development needed for the establishment of standards. Conference attendees and survey respondents identified thematic overlaps and largely agreed with these themes, which have allowed us to set policy priorities for CBDC frameworks.

A thematic approach to CBDC and digital asset standard creation

- Governance

Effective governance of CBDCs requires a nuanced approach, placing a focus on maintaining public policy objectives and central bank mandates including monetary and financial stability. To achieve this, the framework should involve the creation of dynamic mechanisms that not only monitor, but also proactively mitigate potential destabilizing effects. Stress-testing frameworks are essential tools for central banks to assess the comprehensive impact of CBDCs on economic stability. The principle of “do no harm” dictates that economic stability must be safeguarded at every stage of CBDC implementation, through concrete guidelines and risk assessments. In parallel, there is an imperative to establish legal and governance frameworks, offering clear definitions of regulatory benchmarks. Governance is the biggest challenge that emerges as we analyze existing efforts for standard setting, as each of the technical models discussed at the conference envisions an operator of an inherently global system. This is a complex and difficult endeavor, likely to have many challenges and phases.

- Privacy and Data Protection

The protection of privacy and data involves specifying requirements for user data protection, consent, and disclosures.46 Mechanisms for cross-border data transfer should be designed to navigate the complexities of various data protection laws across jurisdictions, ensuring compliance, individual privacy protections, and seamless transactions. Operational resilience and cybersecurity require technology standards for resilience against cyber, fraud, and operational risks, including security measures, encryption standards, and incident response protocols.47 There was widespread agreement at the conference that piecemeal privacy protections will not be sufficient for the evolving financial system, and that comprehensive privacy protections will have to be regulated for. Additionally, all models of digital asset interoperability have highlighted the importance of built-in privacy frameworks.

- Competition and Consumer Protection

CBDCs should coexist with existing means of payment and should operate in an open, secure, resilient, transparent, and competitive environment that promotes choice and diversity in payment options. Promoting fair competition and consumer protection requires the development of international standards for open-access APIs, ensuring competition and interoperability, thereby enhancing the overall efficiency of the CBDC ecosystem. It also is crucial to strike a balance between the demand for faster, more accessible payments and the necessity to combat illicit finance and protect the right to personal privacy. Establishing protocols for collaboration between CBDC operators and regulatory authorities, including law-abiding information sharing, joint investigations, and the development of responsive regulatory frameworks, is vital to address and mitigate potential risks associated with illicit finance.48

- Global Impact and Sustainability

Considering the global impact and sustainability of CBDCs, spillovers can begin to be addressed by establishing technical principles for cross-border transaction reporting and information sharing. Energy and environmental considerations are crucial; hence, international standards for the energy efficiency of CBDC infrastructure should be created, specifying benchmarks for sustainable operations. This has to be built into the next phase of testing and experimentation at the domestic and international levels.

- Transferability and Accessibility

Ensuring interoperability with existing and future payment solutions is necessary to achieve the goal of transferability and accessibility. Technical standards should be formulated for integrating CBDCs with emerging digital payment solutions, and interoperability protocols should be specified to facilitate seamless transactions between CBDCs and other payment instruments. Additionally, for payments to and from the public sector, protocols for cross-border collaboration among central banks and organizations must be defined, addressing the international dimensions of CBDC design. Technical requirements for cross-jurisdictional compatibility and seamless integration into global financial systems should be established. Additionally, technical reporting requirements should be instituted to ensure transparency in the utilization of CBDCs for international development initiatives. A lot of recent experiments have shown “token agnosticism” or the ability to support a wide variety of tokens, demonstrating that builders do not want to be overly prescriptive and provide consumers with a range of options.

These key themes illuminate the areas of framework development needed to achieve comprehensive standards for CBDCs. These are not an exhaustive list, but provide primary recommendations as the public sector, policymakers, and the private sector engage in CBDC development.

Through conversations at the conference, it was evident that the G20 payments roadmap is used as an industry benchmark by the public and the private sector as they address modernization efforts. The identified themes speak to some of the priorities outlined by the G20, but seek to go beyond the existing priorities. As G20 targets evolve to include leveraging the digital asset ecosystem, the above described themes can provide crucial benchmarks for standards creation. As governments draft regulations and the private sector engages in experimentation, often along with the public sector, they must address these themes. It also is imperative that global standard-setting bodies address the current gaps in their guidance and participate in these discussions—especially in the development of cross-border flows. Through the conference, it also became clear that many of the standard setters in this space are working across overlapping areas of work—which makes the need for communication channels essential going forward. Crucially, as was repeatedly emphasized at the conference, interoperability is imperative as any standards for CBDCs or digital assets broadly are developed, so that future systems of money do not increase friction in the global payments landscape.

Conclusion

As countries worldwide explore CBDCs’ potential for an advanced and seamless digital infrastructure, a unified standard framework will become necessary to foster harmony, quality, and trustworthiness worldwide. Our working paper served as a call to action for both public and private stakeholders to actively engage in standard-setting efforts with the goal of ensuring interoperability and efficiency, as well as embedding democratic norms, values, and rules of law in CBDCs. It also set some common definitions and understanding of the current state of international standards for those seeking to understand the current state of international standards and existing gaps and areas for improvement. As previously noted, standards ensuring consistency and seamless functionality are not static; they must be flexible enough to accommodate advancements in digital currency technology, shifts in economic priorities, and changing societal perspectives on digital assets.

To further global dialogue on these topics, The Digital Dollar Project and the Atlantic Council GeoEconomics Center hosted a first-of-its-kind convening, “Exploring Central Bank Digital Currency: Evaluating Challenges & Developing International Standards,” on November 27-29, 2023. This event brought together international policymakers, technologists, financial services providers, innovators, and consumer and privacy advocates to discuss the ongoing impact of emerging technologies on the future of money, its infrastructure, and global payment systems. The convening explored the complexities around digital currency, focusing on key technology and policy considerations, outlining areas for future public-private cooperation, and identifying potential pathways to standards that embed privacy protections, democratic values, and interoperability. Following the conference, this paper was revised to reflect what we learned from the conference, incorporate recent developments in international standard setting, and build on the framework offered in the working paper in consideration of future global interoperability standards efforts.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.