Highlights:

- Hedera has partnered with South Korea’s Shinhan Bank to revolutionize Finance.

- The HBAR Foundation is deepening its foothold in the Asian market.

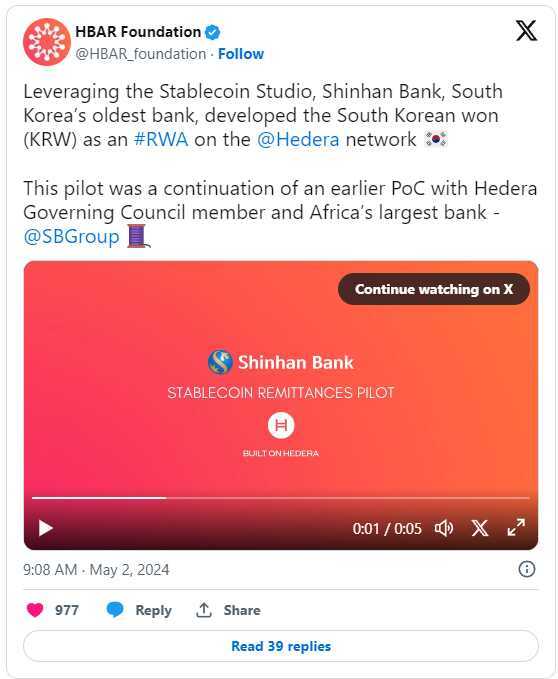

Hedera Hashgraph (HBAR) has grown to become a force to be reckoned with in the finance industry. In a recent development, the HBAR Foundation announced the launch of South Korean Won (KRW) as a Real World Asset (RWA) on the Hedera network by the Shinhan Bank.

Shinhan Bank Completes Pilot Phase

As previously reported by Crypto News Flash, this pilot phase is a continuation of Shinhan Bank’s Proof-of-Concept (PoC), which began in 2021 when it partnered with Standard Bank, Africa’s largest bank on stablecoin international remittances.

The PoC is compatible with Ethereum Virtual Machine (EVM), which means that any EVM-based stablecoin issuers can use the framework. Issuers benefit from the high scalability of Hedera Token Service at 10,000 TPS and EVM’s increased programmability, which unlocks unmatched stablecoin flexibility and power.

In a test environment that matches current production capabilities, the pilot accomplished real-time settlement and real-time foreign exchange (FX) rate integration for KRW, Thai Baht (THB), and New Taiwan dollar (NTD). Throughout this pilot, Shinhan Bank collaborated with multiple corporations including SCB TechX, a digital technology-focused subsidiary of the SCBX Group.

The launch of the KWR on the Hedera network by Shinhan Bank is borne out of current obstacles that exist with sending and receiving an international remittance. Some of the existing issues in legacy systems include slow processing times, a lack of system standardization, limited operating hours, expensive transaction fees, and complexity in the system.

Hedera’s technical prowess, therefore, presents a competitive advantage for Shinhan Bank, providing the financial institution with infrastructure that is highly secure, scalable, and easy to manage.

Shinhan Bank is South Korea’s oldest bank with over KRW 664.4 trillion in assets. The company provides a full range of banking services to individual consumers, SMEs, and large organizations. Reflecting on Crypto News Flash’s prior findings, the bank made history as the first bank in South Korea to offer real-name cash-to-crypto trading accounts for institutions.

Hedera’s Focus on Asia Market

Asia has become a key focus area for The HBAR Foundation. The symbiotic relationship between businesses and consumers in Asia may be the reason why Web3 adoption is interdisciplinary, with Non-Fungible Tokens (NFTs) and gaming standing out. In addition to this, there is clear institutional interest and participation.

Shinhan Bank is one of many financial institutions exploring RWA solutions on Hedera in Asia. Hedera network has formed partnerships with Nomura Bank and DBS Bank.

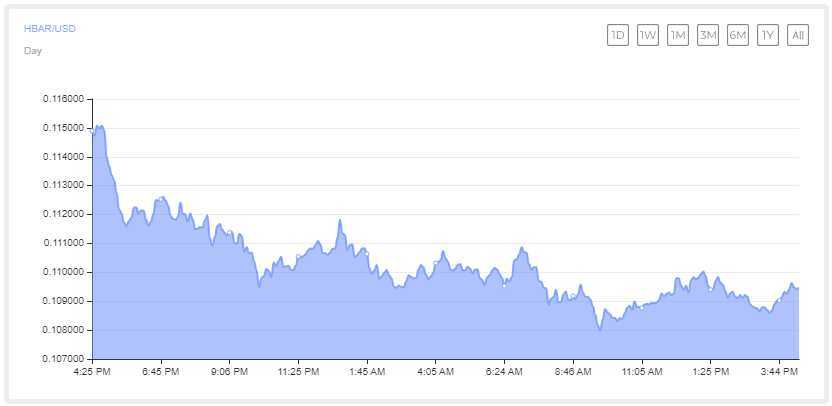

Meanwhile, HBAR, the native digital asset of Hedera recently saw its price spike and subsequent plummet due to a misunderstanding involving BlackRock, as highlighted in a Crypto News Flash YouTube video.

The excitement began when blockchain startups Archax and Ownera tokenized shares of BlackRock’s ICS US Treasury Money Market Fund on the Hedera platform. However, BlackRock quickly refuted the news, stating that it had no direct role in the tokenization process, resulting in a 25% drop in the price of HBAR.

Within the past 24 hours, HBAR has increased by 5% to trade at $0.1096. The market is standing at $3.9 billion, while trading volume is pegged at $246 million.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.