Theta has entered a new era in 2024 with the release of EdgeCloud, one of the most advanced decentralized software platforms in edge computing. Its mission is to provide developers, researchers and enterprises large and small with unlimited access to GPU processing power for any AI or video task, at the most optimal cost. EdgeCloud’s vast processing power and Theta’s access to an additional 800+ PetaFLOPS through its strategic cloud partners can deliver upwards of 2500 equivalent NVIDIA A100s. This approach brings the best of Cloud computing to a decentralized system, powered by the Theta Edge Network.

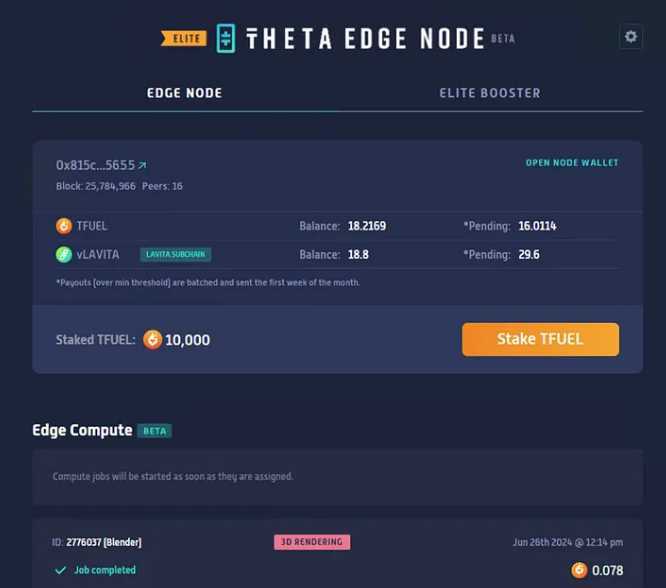

Now with the release of the Elite Booster upgrade (Edge Node v5.0.2), users are empowered to earn TFUEL and partner TNT-20 tokens for performing GPU AI tasks. This new phase for EdgeCloud means edge node earnings have greatly increased. With the first paying EdgeCloud customers being onboarded now, this new era of EdgeCloud promises to be a successful one!

(If you want to skip straight to instructions on how to upgrade your node to Elite Booster, please see the support article and FAQs).

On May 1st the first version of EdgeCloud was released, giving AI developers the tools and dashboards they need to start using EdgeCloud. From Stable Diffusion text-to-image and text-to-video, to Meta Llama 2 and Google Gemma LLMs, to the CodeLlama coding model, EdgeCloud supports jobs from the top open-source AI models. V1 includes these open-source AI models as templates to choose from, and provides easy configuration and deployment in a few clicks.

Now, the next phase of EdgeCloud is here with the release of the Elite Booster feature, enabling all edge node operators to participate in next-gen AI and computing jobs enabled by EdgeCloud. After staking the maximum 500k TFUEL, elite edge node users can earn even more from EdgeCloud jobs by locking additional TFUEL for various time periods from 3 to 12 months, earning up to 50% more job rewards. Currently, earnings are primarily based on cloud-based GPU performance, utilization and total amount of TFUEL locked by Elite Booster users.

Elite Booster users can expect compute jobs reward as much as 2x-4x the current TFUEL staking-only rewards. These figures are for reference only and can vary widely depending on a number of factors but over time we expect earnings to track the adoption and utilization of EdgeCloud.

For all the details on running an Elite Booster node, see the instructions here and the FAQs here. With edge node earnings greatly increasing, new job types available to customers, and the first paying customers onboarding to EdgeCloud now, this new phase for Theta will be the most impactful yet!

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.