Theta Labs has now been awarded U.S. Patent 12,056,730 for “Edge Computing Platform supported by Smart Contracts with Off-Chain Solution Verification”, validating the innovative and novel approaches to a decentralized Edge Network built by the Theta team. The patent can be viewed here by accessing the USPTO website, or directly as a PDF here.

This patent approval follows numerous other Theta patents issued for highly scalable, decentralized systems, peer to peer methods, digital rights management and edge networks. The complete list of Theta’s patents can be found here. This new patent focuses on off-chain verification of distributed compute tasks, a crucial element to training large scale AI models over decentralized networks.

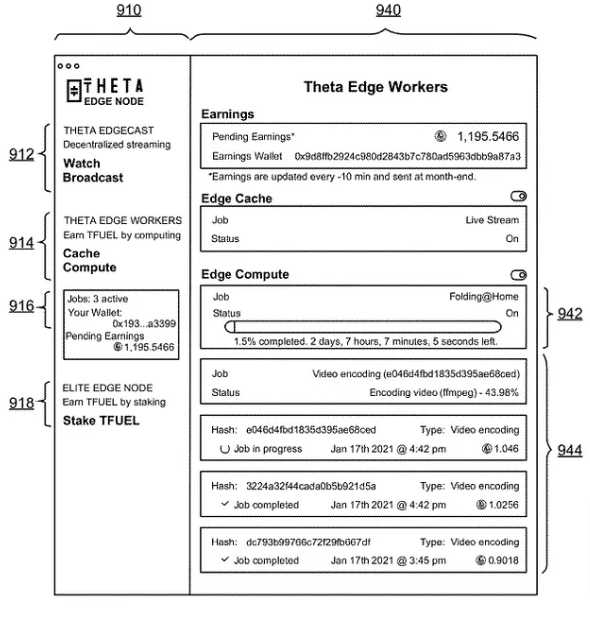

While EdgeCloud already supports GenAI, custom AI models, and decentralized streaming and video encoding/transcoding, there is a massive opportunity to expand this to general compute use cases — from other AI use cases to smart grids, IoT to cloud gaming, rendering and much more. Not only can an edge network like Theta’s deliver this compute power cheaper by relying on untapped resources, it can do so more flexibly with pay as you go models using Theta-based tokens (TFUEL or TNT20). As these use cases grow, so will the opportunities for node operators as nodes come into higher demand. This new patent sets the foundation for these many generalized compute tasks to be processed via EdgeCloud.

In the example, a computation task from a task initiator node is registered on the blockchain by invoking a smart contract, and assigned to an Edge Node within the decentralized edge network. The task initiator and Edge Node may select each other using peer discovery methods based on reputation scores. The Edge Node then determines a solution to the computation task. The solution may be verified off-chain by the task initiator node, and a token reward may be given to the Edge Node by the smart contract upon solution verification.

This latest innovation, to allow asynchronous off-chain solution verification, is a critical enabler for EdgeCloud to perform complex AI model training. One of the core benefits of EdgeCloud is the ability to leverage the compute power of 10s of thousands, or eventually millions of distributed Edge Nodes around the world to perform the most GPU intensive model training demanded by today’s AI models. To train these models with millions of parallel devices, it would create a significant bottleneck to require onchain verification before any subsequent tasks could be completed. With off-chain verification, these devices can continue to work together as one seamless network.

Existing distributed computing projects can somewhat efficiently utilize computing time on their network of user computers, but such platforms are still centralized in the sense that only specialized project servers hosted by large companies or institutions can assign tasks and manage resource usage. That is, smaller companies and individuals can hardly tap into such distributed computing networks for use on projects having much smaller scales. In addition, individual users in such distributed computing networks typically participate on a volunteer basis, motivated only by interests in contributing to scientific research, while shouldering the costs of energy, bandwidth, and equipment wear. Therefore, there is an unsolved need to provide a decentralized computing platform such as EdgeCloud that allows fast and secure resource sharing by any user with any other user, with many more users incentivized to actively share available resources.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.