For "The Truth Shall Set You Free" file... ~Dinarian

Story at a Glance:

•There is a widespread belief that elevated cholesterol is the “cause” of cardiovascular disease. However, a large body of evidence shows that there is no association between the two and that lower cholesterol significantly increases one’s risk of death.

•An alternative model (which the medical industry buried) proposes that the blood clots the body uses to heal arterial damage, once healed, create the characteristic atherosclerotic lesions associated with heart disease. The evidence for this model, in turn, is much stronger than the cholesterol hypothesis and provides many important insights for treating heart disease.

•The primary approach to treating heart disease is to prescribe cholesterol lowering statin drugs (to the point, over a trillion dollars have now been spent on them). Unfortunately, the benefits of these highly toxic drugs are minuscule (e.g., at best taking them for years extends your life by a few days) and the harms are vast (statins are one of the most common pharmaceuticals that severely injure patients).

•In this article we will explore the specific injuries caused by statin drugs, the forgotten causes of cardiovascular disease, and our preferred treatments for heart and vascular diseases.

The more I study science, the more I come to see how often fundamental facts end up being changed so that a profitable industry can be created. In the case of heart disease, I very much believe that is the case and in this publication, I’ve tried to expose the erroneous information that predominates our understanding of this subject (e.g., previously I’ve discussed why our model of how the heart pumps blood in the body is incorrect and in an article that will be released in a few weeks, I will detail the major misconceptions about blood pressure management).

Within cardiology, I believe one of the most damaging falsehoods is that cholesterol causes heart disease and that taking statins (or their newer equivalents), which lower cholesterol, are the key to preventing heart disease. This is because, in addition to those “facts” being incorrect, statins are also some of the most dangerous and widely used pharmaceutical drugs on the market.

Cholesterol and Heart Disease

Frequently, when an industry harms many people, it will create a scapegoat to get out of trouble. Once this happens, a variety of other sectors that also benefit from that scapegoat existing will jump on the bandwagon. Before long, a false belief that harms society becomes an unquestionable dogma that becomes very difficult to overturn because many corrupt parties have a vested interest in maintaining the lie.

For example, various easily addressable factors (which often exist in the first place because they benefit an industry) are responsible for the chronic diseases we face in society and our vulnerability to infectious diseases (e.g., the obese and diabetics were much more likely to catch COVID-19). However, by saying all diseases result from insufficient vaccination, it gets all those destructive industries off the hook and creates a huge market for selling vaccines and treatments for these illnesses. Thus, since there are so many vested interests behind the vaccine paradigm, it is very difficult to overturn—despite the fact the existing evidence shows vaccinations are responsible for the massive epidemic of chronic disease that is sweeping our country.

In the 1960s and 1970s, a debate emerged over what caused heart disease. On one side, John Yudkin effectively argued that the sugar being added to our food by the processed food industry was the chief culprit. On the other side, Ancel Keys (who attacked Yudkin's work) argued that it was due to saturated fat and cholesterol.

Note: a case can also be made that the mass adoption of vegetable oils lead to this increase in heart disease. Likewise, some believe the advent of water chlorination was responsible for this increase.

Ancel Keys won, Yudkin's work was largely dismissed, and Keys became nutritional dogma. A large part of Key’s victory was based on his study of seven countries (Italy, Greece, Former Yugoslavia, Netherlands, Finland, America, and Japan), which showed that as saturated fat consumption increased, heart disease increased in a linear fashion.

However, what many don’t know (as this study is still frequently cited) is that this result was simply a product of the countries Keys chose (e.g., one author illustrated that if Finland, Israel, Netherlands, Germany, Switzerland, France, and Sweden had been chosen, the opposite would have been found).

Fortunately, it gradually became recognized that Ancel Keys did not accurately report the data he used to substantiate his arguments. For example, recently an unpublished 56 month randomized study of 9,423 adults living in state mental hospitals or a nursing home (which made it possible to rigidly control their diets) that Keys was the lead investigator of was unearthed. This study (inconveniently) found that replacing half of the animal (saturated) fats they ate with vegetable oil (e.g., corn oil) lowered their cholesterol, and that for every 30 points it dropped, their risk of death increased by 22 percent (which roughly translates to each 1% drop in cholesterol raising the risk of death by 1%)—so as you can imagine, it was never published.

Note: the author who unearthed that study also discovered another (unpublished) study from the 1970s of 458 Australians, which found that replacing some of their saturated fat with vegetable oils increased their risk of dying by 17.6%

Likewise, recently, one of the most prestigious medical journals in the world published internal sugar industry documents. They showed the sugar industry had used bribes to make scientists place the blame for heart disease on fat so Yudkin's work would not threaten the sugar industry. In turn, it is now generally accepted that Yudkin was right, but nonetheless, our medical guidelines are still largely based on Key’s work.

However, despite a significant amount of data that now shows lowering cholesterol is not associated with a reduction in heart disease (e.g., this study, this study, this study, this review, this review, and this review) the need to lower cholesterol is still a dogma within cardiology. For example, how many of you have heard of this 1986 study which was published in the Lancet which concluded:

During 10 years of follow-up from Dec 1, 1986, to Oct 1, 1996, a total of 642 participants died. Each 1 mmol/L increase in total cholesterol corresponded to a 15% decrease in mortality (risk ratio 0–85 [95% Cl 0·79–0·91]).

Note: when people are diabetic (which leads to the liver having to process too much sugar) the liver will convert to fat and then create more cholesterol to transport some of that fat. In these instances, I would argue the actual issue is an excess of sugar rather than elevated cholesterol levels it causes.

Statins Marketing

One of the consistent patterns I’ve observed within medicine is that once a drug is identified that can “beneficially” change a number, medical practice guidelines will gradually shift to prioritizing treating that number and before long, rationals will be created that require more and more of the population to be subject to that regimen. In the case of statins, prior to their discovery, it was difficult to reliably lower cholesterol, but once they hit the market, research rapidly emerged stating that cholesterol was more and more dangerous and, hence that more and more people needed to be on statins.

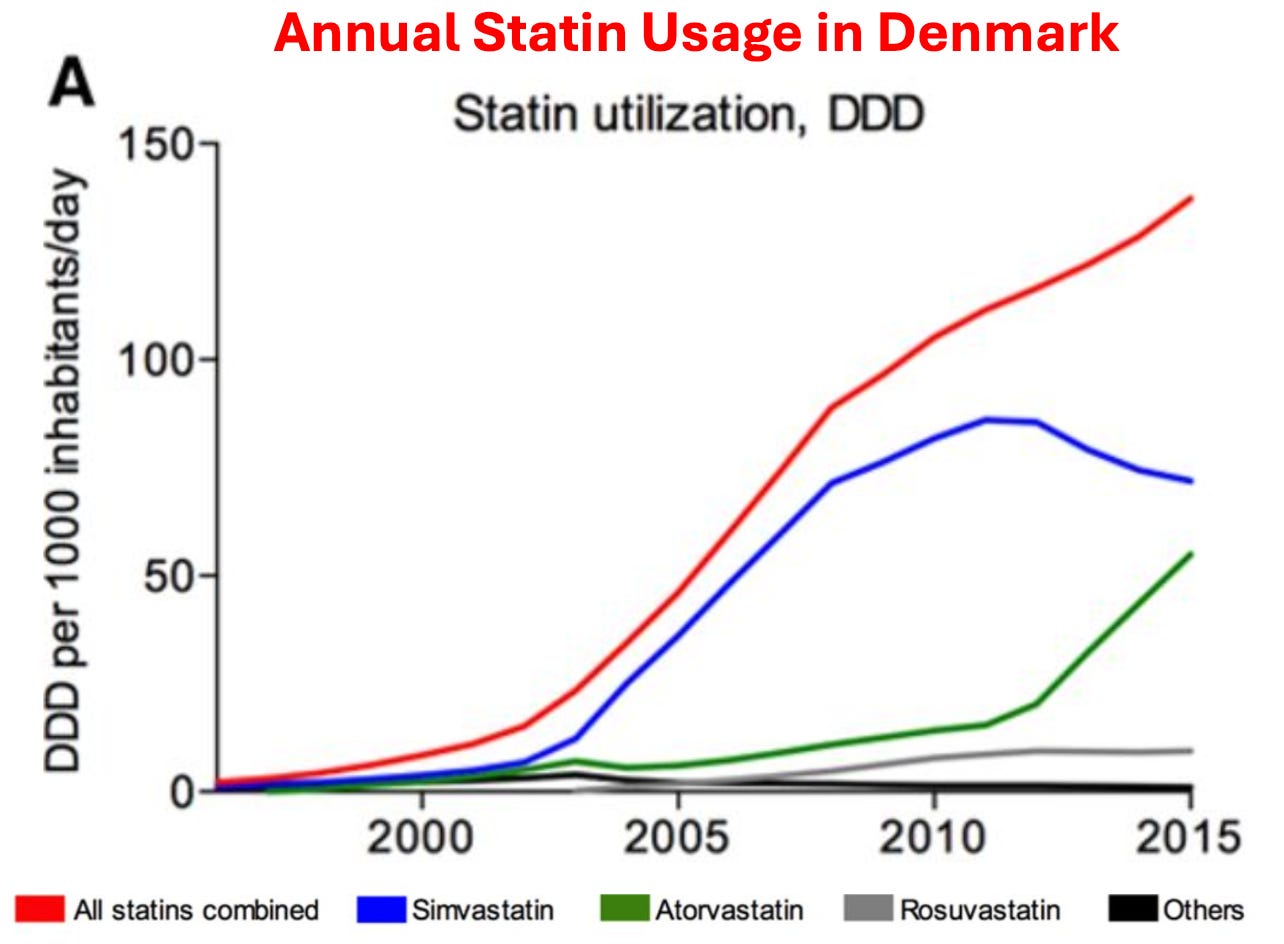

As you would expect, similar increases also occurred within the USA. For example, in 2008-2009, 12% of Americans over 40 reported taking a statin, whereas in 2018-2019, that had increased to 35% of Americans.

Given how much these drugs are used, it then raises a simple question—how much benefit do they produce?

As it turns out, this is a remarkably difficult question to answer as the published studies use a variety of confusing metrics to obfuscate their data (which means that the published statin trials almost certainly inflate the benefits of statin therapy), and more importantly, virtually all of the data on statin therapy is kept by a private research collaboration which consistently publishes glowing reviews of statins (and attacks anyone who claims otherwise) but simultaneously refuses to release their data to outside researchers, which has led to those researchers attempting to get this missing data from the drug regulators.

Note: as you might have guessed, that collaboration takes a lot of money from the pharmaceutical industry.

Nonetheless, when independent researchers looked at the published trials (which almost certainly inflated the benefit of statin therapy) they found that taking a statin daily for approximately 5 years resulted in you living, on average, 3-4 days longer. Sadder still, large trials have found this minuscule “benefit” is only seen in men. In short, most of the benefit from statins is from creative ways to rearrange data and causes of death, not any actual benefit.

Note: this is very similar to Pfizer’s COVID vaccine trial which professed to be “95% effective” against COVID-19, but in reality only created a 0.8% reduction in minor symptoms of COVID (e.g., a sore throat) and a 0.037% reduction in severe symptoms of COVID (with “severe” never being defined by Pfizer). This in turn meant that you needed to vaccinate 119 people to prevent a minor (inconsequential) case of COVID-19, and 2711 to prevent a “severe” case of COVID-19.

Furthermore, a clinical trial whistleblower later revealed that these figures were greatly inflated as many individuals in the vaccine group who developed COVID-19 like symptoms were never tested for COVID-19. Likewise, these benefits were fleeting as it was shown the “efficacy” of vaccines rapidly waned (disappearing a few months after vaccination). Worse still at six months of follow-up in both Pfizer's and Moderna's trials, more vaccinated than unvaccinated individuals died, and similarly a peer-reviewed reanalysis of Pfizer and Moderna's trial data showed that one was more likely to suffer a severe adverse event from the vaccine than a hospitalization from COVID-19.

In circumstances like these where an unsafe and ineffective but highly lucrative drug must be sold, the next step is typically to pay everyone off to promote it. For example, to quote Chapter 7 of Doctoring Data:

The National Cholesterol Education Programme (NCEP) has been tasked by the National Institutes of Health to develop guidelines [everyone uses] for treating cholesterol levels. Excluding the chair (who was by law prohibited from having financial conflicts of interest), the other 8 members on average were on the payroll of 6 statin manufacturers.

In 2004, NCEP reviewed 5 large statin trials and recommended: “Aggressive LDL lowering for high-risk patients [primary prevention] with lifestyle changes and statins.”

In 2005 a Canadian division of the Cochrane Collaboration [who were not paid off] reviewed 5 large statin trials (3 were the same as NCEP’s, while the other 2 had also reached a positive conclusion for statin therapy). That assessment instead concluded: “Statins have not been shown to provide an overall health benefit in primary prevention trials.”

Note: the primary reason no cure for COVID-19 was ever found was that the guideline panel for COVID-19 treatments was handpicked by Fauci, comprised of academics taking money from Remdesivir’s manufacturers. Not surprisingly, the panel always voted against recommending any of the non-patentable treatments for COVID-19, regardless of how much evidence there was for them.

Likewise, the American College of Cardiology made a calculator to determine your risk of developing a heart attack or stroke in the next ten years based on your age, blood pressure, cholesterol level, and smoking status. In turn, I’ve lost track of how many doctors I saw proudly punch their patient's numbers into it and then inform them that they were at high risk of a stroke or heart attack and urgently needed to start a statin. Given that almost everyone ended up being “high risk” I was not surprised to learn that in 2016, Kaiser completed an extensive study which determined this calculator overestimated the rate of these events by 600%. Sadly, that has not at all deterred the use of this calculator (e.g., medical students are still tested on it for their board examinations).

Note: one of the most unfair things about statins is that the healthcare system decided they are “essential” for your health, so doctors who don’t push them are financially penalized, and likewise patients who don’t take them are as well (e.g., through life insurance premiums).

So, despite the overwhelming evidence against their use, many physicians believe so deeply in the “profound” benefits of statins that they do things like periodically advocating for statins to be added to the drinking water supply.

In tandem, a cancel culture has been created where anyone who challenges the use of Statins is immediately labeled as a “statin denier” accused of being a mass murderer and effectively canceled. Recently, one of those dissidents, Dr. Aseem Malhotra British cardiologist who has also spoken out against the COVID vaccines went on Joe Rogan where he discussed that dirty industry and the remarkable parallels between how Statins and the COVID vaccines were pushed on the world:

Note: one of the most remarkable facts Aseem shared was that the previously mentioned statin collaboration (which militantly insists less than 1% of statin users experience side effects) also created a test one could utilize to determine if one was genetically at risk for a statin injury—and in their marketing for the test said 29% of all statin users were likely to experience side effects (which they then removed once attention was brought to it).

In addition to doctors being forced to follow these guidelines, patients often are too. Doctors often retaliate against patients who do not take statins (similar to how unvaccinated patients were denied essential medical care during COVID-19). Employers sometimes require cholesterol numbers to meet a certain threshold for employment (although they never did anything on the scale of the COVID-19 vaccine mandates placed on workers around America). Similarly, life insurance policies often penalize those with "unsafe" cholesterol numbers.

Statin Injuries

My primary issue with the statins is not the fact we waste billions each year on a useless therapy (approximately 25 billion per year in America alone). Rather, it’s the fact that they have a very high rate of injury. For example, the existing studies find between a 5-30% rate of injuries, and Dr. Malhotra, having gone through all the existing evidence estimates that 20% of statin users are injured by them.

Likewise, statins are well known for having a high percentage of patients discontinue the drugs due to their side effects (e.g., one large study found 44.7% of older adults discontinue the drugs within a year of starting them, while another large study of adults of all ages found 47% discontinued within a year)

Statins in turn, are linked to a large number of complications that have been well-characterized (e.g., mechanistically) and described throughout the medical literature.1, 2, 3, 4, 5, 6

One group of side effects are those perceived by the patient (which often make them want to stop using the medications). These include:

Psychiatric and neurologic issues such as depression, confusion, aggression, and memory loss1, 2, 3, 4, 5, 6, 7, 8, 9

Severe irritability1

Sleep Issues2

Sudden (sensorineural) hearing loss1

Gastrointestinal distress1

The other group are those not overtly noticed by the patient. These include:

ALS-like conditions and other central motor disorders (e.g., Parkinson’s disease and cerebellar ataxia)1, 2, 3, 4, 5

Lupus-like syndrome1

Interstitial cystitis1

Polymyalgia rheumatica1

Renal failure1

From the moment I first encountered statin patients, I quickly noticed that they would report either numbness in their body, muscle weakness and pain, or impaired cognition, which began after they started the statin and resolved once they stopped using it. Remarkably, we also noticed that whenever they (or we) pointed this out to their doctor, the doctor would become extremely hostile, and then insist that the statin could not be causing the symptom (e.g., “because in all their years of practice, they had never had a patient who was injured by a statin”) and that even if it was harming them, the patient needed to stay on it because otherwise they would get a heart attack and die.

In turn, as the years went by, I saw increasingly elaborate excuses being created to protect the statins from an ever-increasing awareness of their dangers. For example, I lost count of how many doctors I knew who cited this 2016 study when patients stated they had been injured:

The nocebo effect, the inverse of the placebo effect, is a well-established phenomenon that is under-appreciated in cardiovascular medicine. It refers to adverse events, usually purely subjective, that result from expectations of harm from a drug, placebo, other therapeutic intervention or a nonmedical situation. These expectations can be driven by many factors including the informed consent form in a clinical trial, warnings about adverse effects communicated by clinicians when prescribing a drug, and information in the media about the dangers of certain treatments.

The nocebo effect is the best explanation for the high rate of muscle and other symptoms attributed to statins in observational studies and clinical practice, but not in randomized controlled trials, where muscle symptoms, and rates of discontinuation due to any adverse event, are generally similar in the statin and placebo groups. Statin-intolerant patients usually tolerate statins under double-blind conditions, indicating that the intolerance has little if any pharmacological basis. Known techniques for minimizing the nocebo effect can be applied to the prevention and management of statin intolerance.

Which, when translated into plain English means that the only reason people believe statins injured them is because they were tricked into imagining the injury, so the best solution is to tell them the symptoms are in their head. What I found remarkable about this study was that the doctors who cited it never considered that the nocebo effect could not apply as their patients were not aware things like muscle pain were associated with statins until they experienced them (and then looked up what was happening) or that the discrepancy in the observed rate of adverse events could also be explained by the fact the randomized controlled trials are always funded by the pharmaceutical industry and hence consistently cover up injuries that occur there.

Similarly, the thing that finally made me realize how impressive the marketing for these drugs had been was the recurring battle I would have with relatives. In each case, I would take them off a statin and provide a strong argument with data supporting why they should not be on the drug. At some point later, they would go to their doctor and inform them that their relative (me), who was a doctor, had taken them off the statin.

Their doctor (often a cardiologist), in turn, would tell my relative I was incredibly ignorant, insist they knew the data much better than I did, say I was endangering my relative’s health, and promptly restart the statin, to which my relative dutifully complied. In many cases, I would provide the cardiologist with literature supporting my argument. In each case, they would make an excuse not to read it while simultaneously asserting that they knew all the data and that I, not being a cardiologist, was unqualified to have an opinion on this subject. This made me appreciate just how challenging a situation patients (without access to the resources my relatives had) were in.

If you take this story and replace “statin” with COVID-19 vaccines, you will see it is essentially what everyone has experienced over the last three years with the vaccines. I suspect this is because, before the COVID-19 vaccines, statins were one of the most profitable medical franchises and, thus amongst the medications most aggressively pushed on patients.

Note: two adverse event reporting systems exist for adverse reactions to pharmaceuticals, MedWatch and FAERS. Like VAERS, they suffer from severe underreporting (it is estimated only 1-10% of adverse events are reported to them). The author in the next section was able to find hundreds to thousands of reports for many of the statin injuries in MedWatch that matched what he had personally observed. However, despite these reports existing, nothing has been done with them, and there is almost no knowledge within the medical community that these adverse events exist.

The Statin Damage Crisis

Throughout this publication, I have tried to make the point that less severe reactions to a toxin are much more common than severe ones. Because of this, if you see a cluster of severe reactions, it indicates that far more, less severe reactions are occurring as well (which is how after learning of a few people in my circle dying suddenly from the COVID vaccines, I was able to correctly predict the scale of the non-fatal injuries that would hit America).

Likewise, if you see a large number of less severe reactions to a pharmaceutical (e.g., the statin-induced muscle and nerve damage), you can predict far more severe injuries are lurking in the background. As the longer list of adverse events I shared above demonstrates, this unfortunately is true for statins. In the next two sections, I will quote one of the best books I have found on this subject:

“Many statin victims say that abruptly, almost in the blink of an eye, they have become old people.”

Duane Graveline MD was started on a statin and soon after developed global amnesia (which is really scary). He decided to stop the statin and recovered.

When I suggested, on the basis of my 23 years as a family doctor, that perhaps my new medicine was the cause of my amnesia, the neurologist replied, almost scoffingly, that "Statins do not do that." He and many other physicians and pharmacists were adamant that this does not occur.”

Eventually, he was persuaded to try again.

The year passed uneventfully and soon it was time for my next astronaut physical. NASA doctors joined the chorus I had come to expect from physicians and pharmacists during the preceding year, that statin drugs did not do this and at their bidding I reluctantly restarted Lipitor at one-half the previous dose. Six weeks later I again descended into the black pit of amnesia, this time for twelve hours and with a retrograde loss of memory back to my high school days.

Later he discovered:

Perhaps stockholder loyalty explains why Pfizer management knew over a decade ago, during the first human use trial of Lipitor, of the cognitive impact to come when Lipitor was released to the public. Of their 2,503 patients tested with Lipitor, seven experienced transient global amnesia attacks and four others experienced other forms of severe memory disturbances, for a total of 11 cases out of 2,503 test patients. This is a ratio of 4.4 cases of severe cognitive loss to result from every 1000 patients that took the drug. Not one word of warning of this was transmitted to the thousands of physicians who soon would be dispensing the drug.

Because of this and other debilitating long-term complications (e.g., previously an extremely fit individual, he developed chronic exhaustion), Graveline became an expert on statin injuries and, in 2014, wrote The Statin Damage Crisis. Many of the points he raised there explain why statins are so dangerous, but unfortunately, are virtually unknown within the medical field.

Statin Mechanisms of Harm

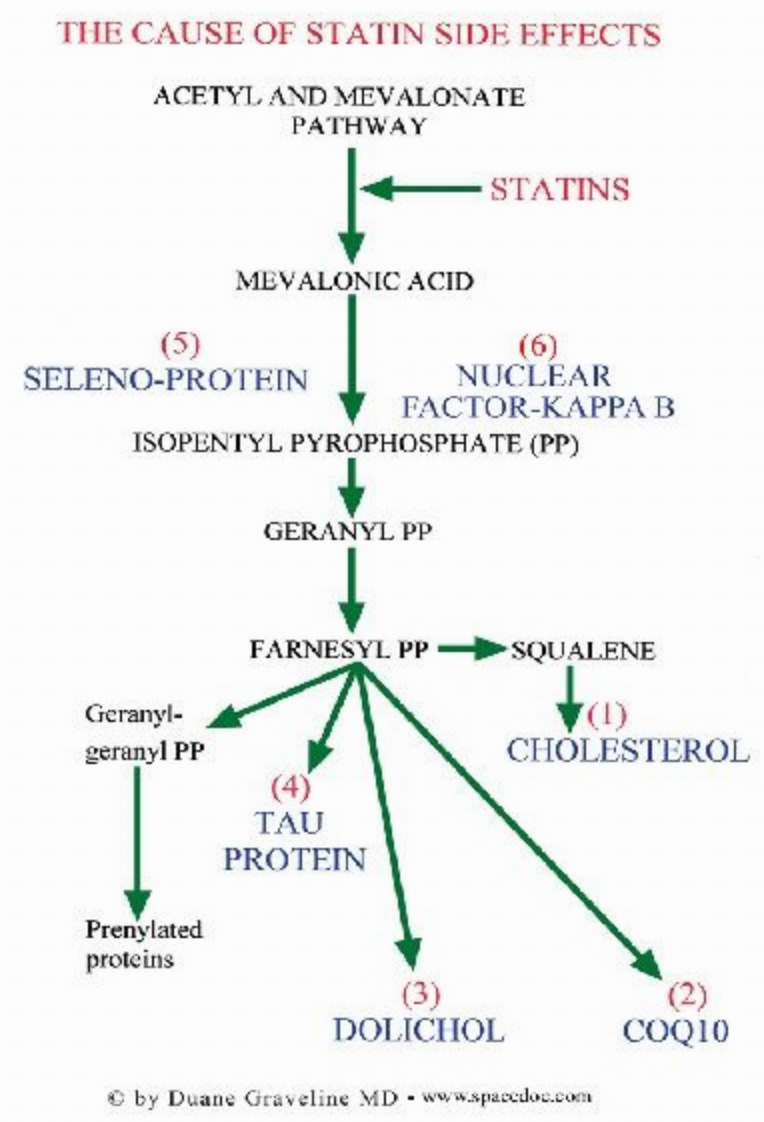

Statins work by inhibiting an easy to target enzyme that is necessary for the production of cholesterol. Unfortunately, blocking that enzyme disrupts a variety of other vital physiologic processes. Let’s review what that enzyme does:

As these compounds are essential for the body, understanding statin toxicity hence requires us to understand what happens when each of these goes missing.

Cholesterol

Cholesterol has a few different essential functions in the body. These include:

• It is the precursor to many different hormones.

• The brain’s synapses (which, amongst other things, form memories) require cholesterol to function. Since cholesterol is too big to enter the brain, glial cells (support cells of the nervous system) synthesize it within the brain. Statins, unfortunately, inhibit glial cell production of cholesterol.

• Cognition, in turn, is highly dependent upon cholesterol. For example, one study found that minor cognitive impairment could be detected in 100% of statin users if sufficiently sensitive testing was done (which again illustrates how minor injuries are more common than severe ones). Likewise, a variety of more severe adverse effects on cognition are also observed such as amnesia, forgetfulness, confusion, disorientation, and increased senility.

Their patient’s rapid descent into dementia after a statin is started is much too often written off by their doctor as senile brain changes or beginning Alzheimer's when the real culprit is their statin drug.

Note: one of the sadder side effects we have frequently observed from the COVID-19 vaccines has been a rapid cognitive decline in the elderly (who cannot often advocate for themselves). When this happens, like statin damage, it is always assumed to be due to “their age” and ignored.

In addition to cognitive impairment, numerous studies have found a significant association between low or lowered cholesterol levels and violence. Likewise, statin dementia is often characterized by aggression.

Finally, one of the most concerning side effects of statins is their tendency to cause ALS (a truly horrible rare disease—curiously also seen in association with the COVID-19 vaccines). This correlation is further supported by many reports of statin ALS improving once the statin is stopped.

Unfortunately, while statin cognitive decline frequently improves when the statin is stopped, in many cases, it instead persists.

CoQ10

CoQ10 is an essential nutrient that both the mitochondria (which power the human body) and the stability of our cell walls depend upon. CoQ10 deficiency caused by statins is generally considered the most common cause of their side effects. This is really sad because those side effects could have been prevented if CoQ10 had been given with the statin. Unfortunately, this is unlikely ever to happen, as doing so would be equivalent to an admission statins could cause harm.

Note: the best parallel I know to this is that the primary cause of childhood vaccine toxicity is too many vaccines being given too close together for a child's developing circulatory and nervous systems. Most of the harm can be avoided if vaccines are spaced apart and given later in a child's life—but sadly doctors who promote this approach are routinely targeted (as it is tantamount to an admission vaccines are not 100% safe).

Some of the common energy-related side effects of statin CoQ10 deficiency include:

• Mitochondrial damage

• Lack of Energy

• Chronic Fatigue Syndrome

• Congestive Heart Failure and Fluid Retention

• Shortness of Breath

• Gout

Some of the side effects of statin CoQ10 deficiency weakening cell wall integrity include:

• Hepatitis (interestingly, Graveline noted that the enzyme threshold needed to diagnose statin-induced liver damage was significantly raised after this issue began being commonly reported following statin usage).

• Pancreatitis

• Rhabdomyolysis (rapid breakdown of skeletal muscle tissue)

• Tendon and ligament inflammation and rupture.

Note: this side effect is commonly reported with fluoroquinolone antibiotics, which are known to damage the mitochondria. I suspect it's linked to mitochondrial damage—a subject I discussed further here—as ligamentous laxity often goes hand in hand with vaccine injuries.

Two of the most common consequences of statins CoQ10 depletion are myopathy (muscle pain, tiredness, weakness, and cramps) and peripheral neuropathy (numbness, tingling, or burning sensations, particularly in hands and feet).

Although myopathy is the most commonly reported side effect of statin usage, much of it (e.g., myositis) goes undetected. This is because the symptoms are often not accompanied by blood work showing muscle enzyme elevations and can only be detected by biopsies (which are rarely done relative to blood work). In many cases, this condition is permanent (one expert in statin injury found it was permanent for 68% of her patients, while Graveline found it was for 25% of his). Sadly, in some cases, like statin neuropathies, the myopathies will continue to progress even if the statin is stopped.

One of the sadder things about statins is how aggressively they are pushed on diabetics (under the logic that since diabetics have an increased risk of heart disease, it is critical they take a statin to prevent them from having a heart attack). To highlight the absurdity of this, statins are well known to significantly increase your risk of diabetes (multiple studies have found this), which I suspect is again due to them impairing mitochondrial function.

Similarly, peripheral neuropathy is a condition diabetics are well known to be at a high risk of. In one study, it was found that the risk of neuropathy (i.e., burning pain with tingling or numbness of the extremities) was increased by 14 to 26 times (depending on the type) for long-term users of statins. Furthermore, other nerve issues, such as neurodegeneration, can be caused by statins.

Combinations of myopathy and neuropathy also occur in statin users, such as progressive pain, weakness, and incoordination throughout the body, alongside trouble rising from a seated position, unsteadiness, and a tendency to fall. Muscles are also observed to develop a distinctive weakened and mushy characteristic and gradually shrink.

Note: in addition to preventing adverse effects from statins, CoQ10 is also one of the more helpful supplements for preventing heart disease.

Dolichol

Very few physicians know of the dolichols, which play a pivotal role in synthesizing proteins, and Graveline argues, neuropeptides throughout the body. Since neuropeptides are pivotal in your thoughts, emotions, and sensations, statins blocking their production can lead to significant issues. Dolichol abnormalities have also been linked to Alzheimer’s disease. Additionally, the part of the brain where Parkinson’s disease develops has a very high concentration of dolichols.

Graveline in turn asserted that inhibition of dolichol production and therefore neuropeptide production accounts for the aggression, hostility, irritability, road rage, homicidal ideation, exacerbation of alcohol and drug addiction, depression, and suicides that are associated with statin use. These side effects are one of the sadder complications of statins I observe in families affected by them.

Note: I have not been able to verify the link between dolichols and neuropeptides. As far as I can tell, there are many unknowns about dolichols as they are an area of physiology which have not been extensively researched.

Tau Protein

Many neurological disorders (e.g., Parkinson's, Alzheimer's, ALS, MS) are thought to result from misfolded proteins. Because statins interfere with mevalonate synthesis, Graveline theorized that the production of Tau protein would be altered, which provides a potential explanation for the neurological diseases associated with statin usage. I briefly researched this theory when writing this article, and like the previous one, I am unsure if the existing evidence supports it.

Note: There is a strong association between the COVID-19 vaccine and misfolded proteins in the body.

Seleno-protein

To quote Glaveline:

Deficiency of selenoproteins has been proven to result in various types of myopathies formerly seen only in areas known to be deficient in this trace element. Additionally cognitive dysfunction is known to be associated with selenium deficiency.

Note: selenium deficiency is also associated with other diseases such as impaired immune function.

Nuclear Factor-Kappa B

The small cardiovascular benefit observed from statins may not be because they reduce cholesterol but rather because they have anti-inflammatory properties (inflammation causes heart disease), as they inhibit NF-kB, a vital part of the immune system.

Note: statins also lower the C-reactive protein (another inflammatory protein).

Since this suppresses the immune system, it leads to various potential issues such as reduced protection from infectious disease. For example, many common infectious organisms target NF-kB to assist in infecting their host. However, the more significant issue is that Nf-kB inhibition appears to be linked to cancer.

At five hospitals in Tokyo a group of Japanese researchers studied whether cancer patients had been treated with statins more often than other people. To that end they selected patients with various forms of lymphoid cancers and control individuals of the same age and sex without cancer admitted to other departments at the same hospitals during the same period. A total of 13.3 percent of the cancer patients, but only 7.3 percent of the control individuals were or had been on statin treatment.

In PROSPER [a major statin trial], men and women aged 70-82 were included only. All of them had either vascular disease or had a raised risk of such disease. At follow-up, 4.2 percent had died from a heart attack in the control group, but only 3.3 percent in the treatment group. This small benefit was neutralized by a higher risk of dying from cancer. Indeed, there were 28 fewer deaths from heart disease in the pravastatin group, but 24 more deaths from cancer. If we include non-fatal cancer in the calculation, the cancer difference between the two groups became statistically significant; 199 in the control group and 245 in the pravastatin group. Furthermore the difference between the two groups increased year for year.

In addition to this arguing that some of the benefit of statins “preventing heart attacks” is due to them causing a fatal cancer before you have time to have a natural heart attack, this situation is somewhat analogous to what was seen with the COVID vaccines (which also cause cancer). There, the “benefit” of the COVID vaccines preventing COVID was outweighed by them causing serious conditions such as heart attacks and strokes, but if one only focused on them preventing COVID (which many did), the vaccines could be portrayed as life-saving, even though they overall did the opposite.

Note: although statins appear to increase cancer, one of the few benefits I have seen a lot of evidence for is their prevention of fatal prostate cancer. My best guess is that this is due to them blocking the production of hormones in the body, and that outweighs the effects of them inhibiting NF-kB.

“Cholesterol” Plaques

One of the tricks to creating a lucrative drug market is to instill a belief throughout the population that everyone can relate to which sells your product. For example, the antidepressant industry spent years convincing the public depression was due to a “chemical imbalance” and because of how successful this campaign was, many sincerely believe it to be true even though it is a complete and utter fabrication.

One of the cleverest campaigns I’ve seen within the medical industry is the widespread belief that heart disease is due to fat clogging the arteries much like they do for a drain pipe.

This marketing slogan in turn is remarkably persuasive as it is easy to understand (to the point that people without a medical background will feel confident repeating it to others), easy to visualize, and highly likely to elicit an immediate sense of disgust.

However, given that there is no link between cholesterol and heart disease, is it necessarily true?

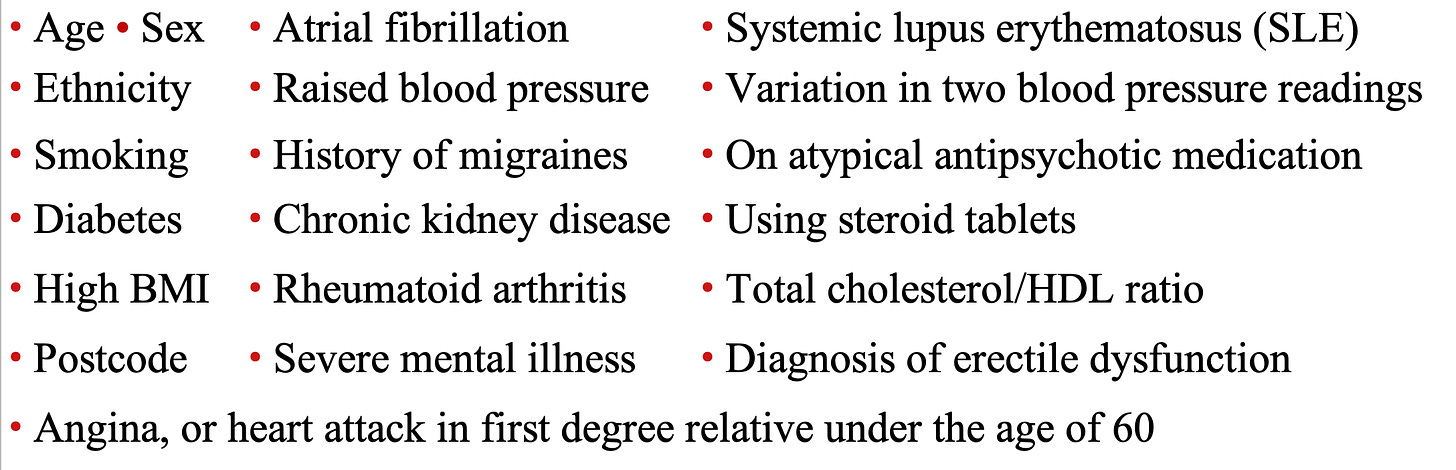

As one of my favorite authors in this field (Malcolm Kendrick) was pondering this question, he looked at another mystery of cardiology—the fact that there is no common thread between the well-known risk factors for heart disease. For example, to calculate the risk of heart disease, England uses a calculator that combines the adjustable risks for heart disease (e.g., age) with the conditions commonly associated with causing heart disease.

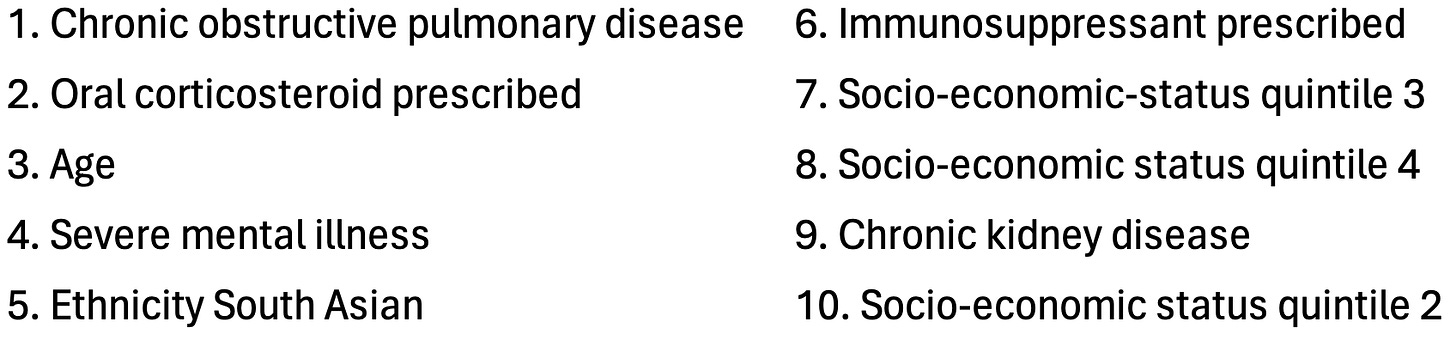

Likewise, in a 2017 study, the records of 378,256 English patients were analyzed by an AI system to determine what characteristics put them at the highest risk for a cardiovascular incident in the next 10 years. From that, they found that the ten greatest risk factors (in order) were:

From this list, Malcolm Kendrick concluded that the common thread was that many of these (e.g., lupus or cortisol) are associated with damage to the blood vessels and impaired microcirculation (a consequence of damaged blood vessels).

Note: a more detailed explanation of the connection between these factors and heart disease can be found within Kendrick’s book (which inspired a significant portion of this article).

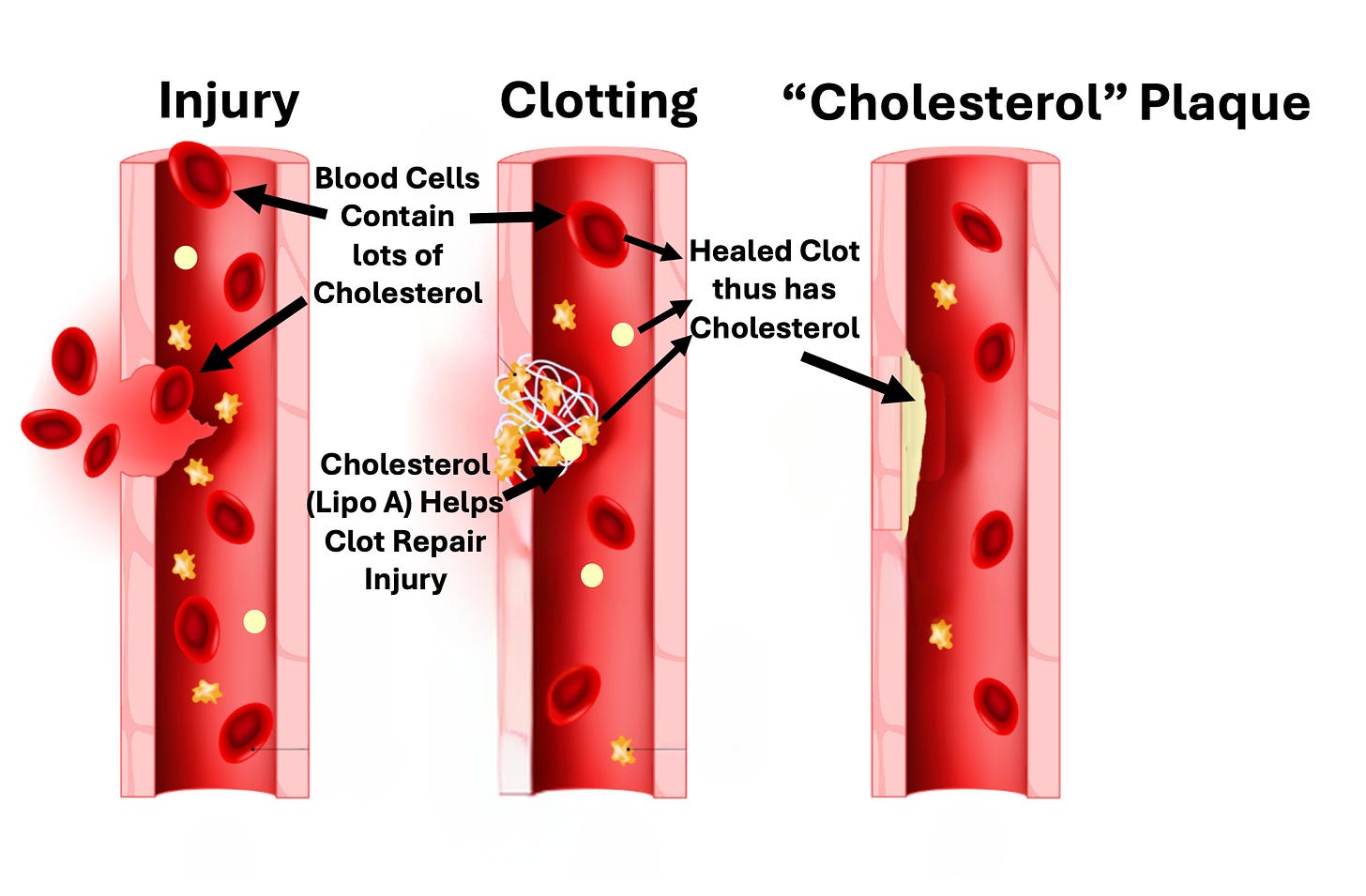

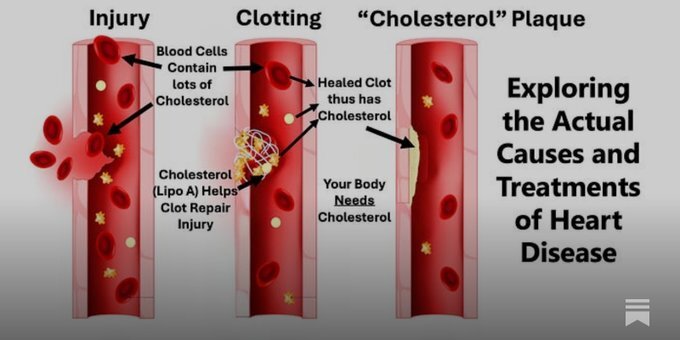

Presently, we believe cholesterol somehow gets into a blood vessel and then damages it, leaving an atherosclerotic plaque. Kendrick in turn argued that a competing model (that the medical profession largely buried) provides a much better explanation of the actual causes of heart disease. It is as follows:

1. Blood vessels get damaged.

2. The body repairs those damage with clots.

3. As clots heal, they are pulled inside the blood vessel wall, and a new layer of endothelium (blood vessel lining) grows over them.

4. As this occurs multiple times in the same area, the damage (plaques) under the blood vessel becomes more abnormal.

Some of the key points of evidence he uses to support this argument are:

• Most of the risk factors for heart disease overlap with things that would be expected to damage the blood vessel lining (endothelium).

• Plaques tend to form at arterial branch (junction) points, which are the parts of the artery which are subjected to the greatest shear stress).

• When you examine the components of a plaque, they are found to contain the same debris found in blood clots (see this study and this study).

• There is no established mechanism for how cholesterol from the blood stream can get under the endothelium (even though the existing model depends upon that somehow happening). However, red blood cells (which play a key role in forming clots) contain a large amount of cholesterol (50% of the total amount in the bloodstream), and hence will bring it into the clot as it forms.

• Plaques contain cholesterol crystals. These crystals can only form from free cholesterol, something contained within red blood cells, but not the “bad” cholesterol that circulates in the blood stream (contained within lipoproteins). Likewise, much of the cholesterol found in atherosclerotic plaques is free cholesterol.

• The remnants of lipoproteins that are found in plaques are not cholesterol lipoproteins, but rather lipoprotein A, something the body uses to repair damage to the arterial walls. This is supported by the fact elevated blood lipoprotein A levels are associated with increased lipoprotein remnants in plaques and that the specific marker of lipoprotein A is found to concentrate in atherosclerotic plaques. Lipoprotein A in turn is problematic because while it can patch and repair arterial damage, it also makes clots resistant to subsequent degradation, guaranteeing that they will eventually be pulled under the endothelium and transformed into an atherosclerotic plaque (which may in turn explain why elevated lipoprotein A levels are associated with a three-fold increase in the risk of a heart attack or stroke).

Note: another key piece of evidence for the cholesterol hypothesis is that fatty streaks on the lining of healthy blood vessels are thought to serve as the precursors to atherosclerotic plaques. However, when this was extensively researched, that progression was never observed to occur.

In short, a good case can be made that our entire heart disease model is based on a variety of correlations that were erroneously assumed to demonstrate causation. Sadly, while the “correlation is not causation” mantra is frequently used to dismiss anything which challenges the orthodoxy, you will frequently find overtly false correlations that support the medical industry’s bottom line being treated as unquestionable dogmas.

For example, vaccines are credited with eliminating the infectious diseases that plagued humanity, but it is seldom mentioned that some of the deadliest diseases (e.g., scarlet fever) which had no vaccine also disappeared or that the diseases were already disappearing once the vaccines were introduced (in many cases having almost completely disappeared) and that it is very likely they would have been eliminated regardless of if a vaccine appeared. Conversely, many of the activists at the time felt the primary cause of these diseases was poor public sanitation (as it caused infectious diseases to rapidly spread through the population), so many hard battles were fought to attain it, and many (myself included) believe the vaccination industry essentially stole the credit for what those activists accomplished by getting us public sanitation.

The Causes and Treatments of Heart Disease

Kendrick’s model essentially argues the following:

• Most cardiovascular disease is a result of the blood vessel lining becoming damaged (due to the atherosclerotic lesions) and losing the ability to perform the normal functions (e.g., nitric oxide secretion) that allow it to protect the circulation.

• Inflammation and periods of prolonged and severe stress (e.g., from mental illness, cigarettes, or extreme social oppression) frequently damage the endothelium and hence contribute to heart disease.

• Heart attacks are due to blood clots (which frequently are a result of damaged endothelium) interrupting a critical blood supply to the heart.

In turn, I deliberately presented Kendrick’s points in this manner to emphasize that much of his model is in complete agreement with the conventional cardiovascular disease paradigm. However, the key distinctions are that he does not believe cholesterol is the cause of the damage to the blood vessel lining and that he thus believes the other damaging factors (e.g., stress) should receive a greater focus. Likewise, he prioritizes treating the functional impairments of the blood vessels (e.g., reduced nitric oxide synthesis) rather than having a narrow focus on reducing cholesterol.

Note: statins also to some extent have anti-inflammatory effects and increase endothelial nitric oxide. In turn, it is very likely that many of the (small) benefits attributed to statins are a result of these effects rather than their lowering of blood cholesterol.

Furthermore, since his focus is not on cholesterol, that allowed him to identify other factors which may be playing an immense (but largely unappreciated) role in heart disease.

For example, smoking is well recognized to cause heart disease because it damages the blood vessels (e.g., by creating plaques and impairing their ability to make nitric oxide), but much less thought is given to why it does. However, it’s been repeatedly demonstrated that fine particulate matter (which is found in cigarette smoke) directly causes these changes, evidenced by the fact similar damage occurs from breathing in pollution particulates such as those in coal mines, crowded cities (see this study and this study), cooking with a wood burning stove or being exposed to wildfire smoke.

Likewise, lead is quite damaging to the endothelium (e.g., see this study and this study), something many of us were exposed to due to it being added to gasoline, and lead rapidly entering the bloodstream once inhaled. In turn, as lead was phased out between 1975 to 1996 (although its use is still allowed for certain applications such as aircraft, race cars, farm equipment, and boats—where it is occasionally used), a variety of interesting trends exist, such as the fact heart disease exploded in America after we started using it (and this then happening in other European nations). Currently, it is estimated that around 400,000 deaths each year in America are due to lead exposure and in a study of 868 men, it was observed that high levels of lead exposure (assessed by its presence in the bones) increased their risk of dying by over 700 percent.

Note: as lead absorbed earlier in life tends to leach from the bones back into the bloodstream, many have suspected a key cause of aging (e.g., heart disease) is that lead returning without anything being done to address it.

Sadly, as you cannot sell drugs for any of these causes of heart disease, they rarely get mentioned and instead almost all of the research and discussions on heart disease are directed at cholesterol.

Overall, I think Kendrick’s model is accurate, and it is my sincere hope that at some point, the medical profession will begin to seriously consider it (although given how much has been invested into the cholesterol hypothesis, it’s doubtful the industry will ever be willing to let that market go).

If you want to eat healthy, just turn the food pyramid upside down, basically the opposite of everything you have been programmed to believe. Have a read: https://richardweberg.com/the-usda-food-pyramid-is-upside-down/

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.