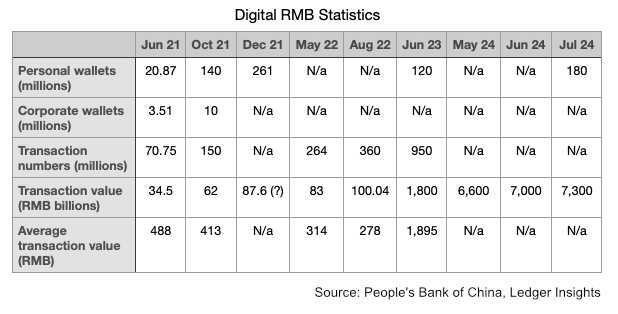

Mu Changchun, who heads the Digital Currency Research Institute at the People’s Bank of China (PBoC), provided an update on the roll out and adoption of its central bank digital currency (CBDC) pilot. As of July there were 180 million personal wallets, which represents about one in eight of the 1.4 billion Chinese population. The cumulative transaction volume reached RMB 7.3 trillion. Based on previous reported figures, that means transactions totaled around RMB 300 billion ($42 billion) for the month of July. However, these are not all retail transactions as the digital RMB is also used for high value securities and trade transactions.

Mr Mu emphasized the two-tier nature of the CBDC, with the central bank at the core and commercial banks as the consumer interface. But some of his comments may hint at a potential shift in the balance. The use cases will continue to expand beyond retail to wholesale. However, he also said the application scenarios would include “deposits, loans, foreign exchange, and investment.” It’s one thing if commercial bank deposits at the central bank take the form of digital RMB, but consumer and business deposits are another matter.

Other central banks such as Europe and the UK don’t want to encourage too much migration of bank deposits towards CBDC, worrying that this could affect bank lending. It’s unclear to what extent the Chinese objective is to encourage such a move.

Cross border CBDC

Amongst many other topics, Mr Mu also covered the cross border potential for the digital RMB. He noted its modular design that can “flexibly connect to the infrastructure of (a) foreign central bank”.

He mentioned mBridge, the cross border CBDC project with the central banks of Hong Kong, Thailand, the UAE and Saudi Arabia. The project has reached the minimum viable product (MVP) stage and the number of observers has surpassed 30.

However, he still sees scope for bilateral digital RMB connectivity outside of mBridge, “and interconnection with relevant friendly economies such as the countries participating in the construction of the ‘Belt and Road’.” He also emphasized the use of the digital RMB for shipping and trade digitalization via the Shanghai International Financial Center.

Meanwhile, last week the central bank published a quarterly report on the progress of the internationalization of the RMB. It didn’t mention mBridge or the digital RMB.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.