November has arrived, and Ripple has shocked the market, preparing what could be its largest monthly dump in seven years. The company, XRP Ledger (XRP)’s core developer and largest holder, reserved 470 million XRP to sell, worth $240 million.

Every month since 2017, Ripple unlocks 1 billion XRP and reserves part of it – usually 200 million XRP – to sell. In November, Ripple unlocked the 1 billion but for the first time in years, reserved above two times the usual amount.

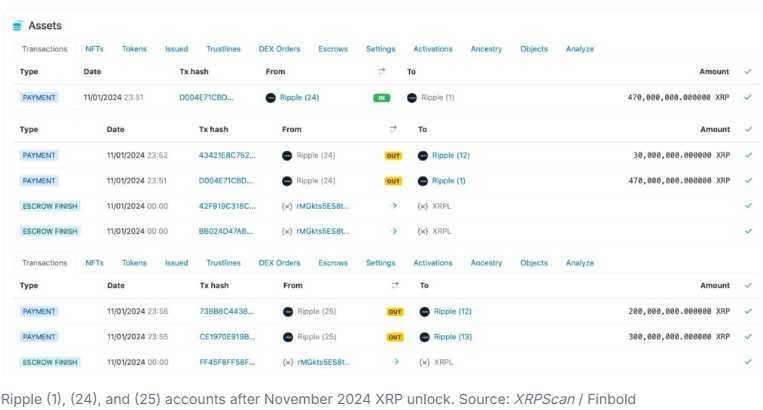

This month’s escrows finished within Ripple (24) and Ripple (25) accounts, unlocking 500 million XRP each, as usual. Ripple (25) re-locked it all in escrows for 2028 within Ripple (12) and Ripple (13) accounts, as usual.

However, Ripple (24) re-locked only 30 million XRP within Ripple (12), unprecedentedly sending 470 million XRP to Ripple (1). This is the account used for the monthly dumps throughout the years. The company’s move raised concerns as such a large sell-off could drastically impact the token’s price, punishing XRP investors.

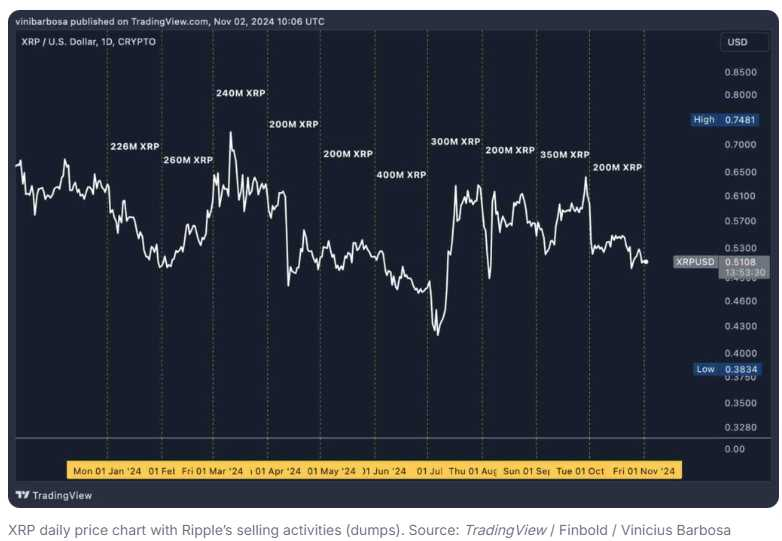

Ripple’s unlocks and largest XRP dumps history

Notably, Ripple’s previous largest dump occurred in June after reserving 200 million XRP and adding an extra 200 million from the idle account Ripple (35), as Finbold reported. The massive and unprecedented sell-off concluded on June 20, which we also covered, totaling 400 million XRP sold.

On this occasion, the XRP price dropped nearly 20% from June 1 to July 7, highlighting the nefarious financial effects. There are no records of such a high dump since 2017 when Ripple implemented the escrow system for more transparency.

Currently trading at $0.511, XRP has accumulated 18.70% losses year-to-date. Interestingly, Ripple sold 2.576 billion XRP in 2024 so far. The largest sales to date occurred in June (400 million), September (350 million), and July (300 million).

What’s next for XRP as Ripple could sell over 470 million tokens

Yet, in all these previous months, Ripple had only reserved the usual 200 million XRP from the escrow unlock. The additional selling pressure came from idle accounts throughout the month – differently from what we are observing now, in November.

Therefore, it is possible that Ripple could add even more selling pressure to the already record-high 470 million XRP. On that note, this month’s activity happens a few days before the U.S. Presidential Election. Chris Larsen, Ripple co-founder and CEO, disclosed a $10 million donation to Kamala Harris’s campaign, which came after the sales.

“It’s time for the Democrats to have a new approach to tech innovation, including crypto. I believe Kamala Harris will ensure that American technology dominates the world, which is why I’m donating $10M in XRP in support of her.”

– Chris Larsen

While Ripple has not disclosed any of these sales, in particular, the company has already disclosed its selling model on many occasions. According to sources, its XRP sales go through an On-Demand Liquidity (ODL) model, selling at market price to willing customers.

Moreover, the cryptocurrency community expects this election’s results to have a profound impact on the market. XRP investors and traders should carefully watch Ripple’s next moves depending on the outcome in the next few days.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.