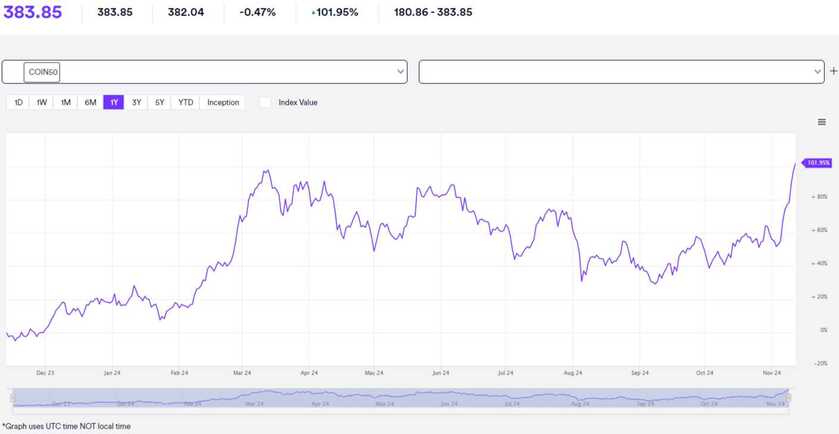

Coinbase has announced its ambitious new market benchmark, the Coin50, which could dramatically shift how investors track and contextualize the cryptocurrency market's performance.

"What we’re trying to do is establish a benchmark that is not specific to any asset," said Greg Tusar, Head of Institutional Products at Coinbase. The index weighs Bitcoin 50%, Ethereum 28%, Solana 6%, XRP 3%, Dogecoin 2%, and has the remaining percentage with 45 additional tokens.

The initiative comes at a very opportune time in the development of cryptocurrency, with Bitcoin near the $90,000 mark and institutional interest continuing to ramp up. Traditionally, Bitcoin has been the indicator of the market, but Tusar thinks this is an oversimplified metric for an already-oversized industry.

While the Coin50 includes a trading component in the form of a perpetual future, regulatory constraints mean that this aspect will remain unavailable to U.S. investors for now. However, Tusar was quick to declare that the index is not just for trading, but also to be used by investors as a better insight into the market trends and movements.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.