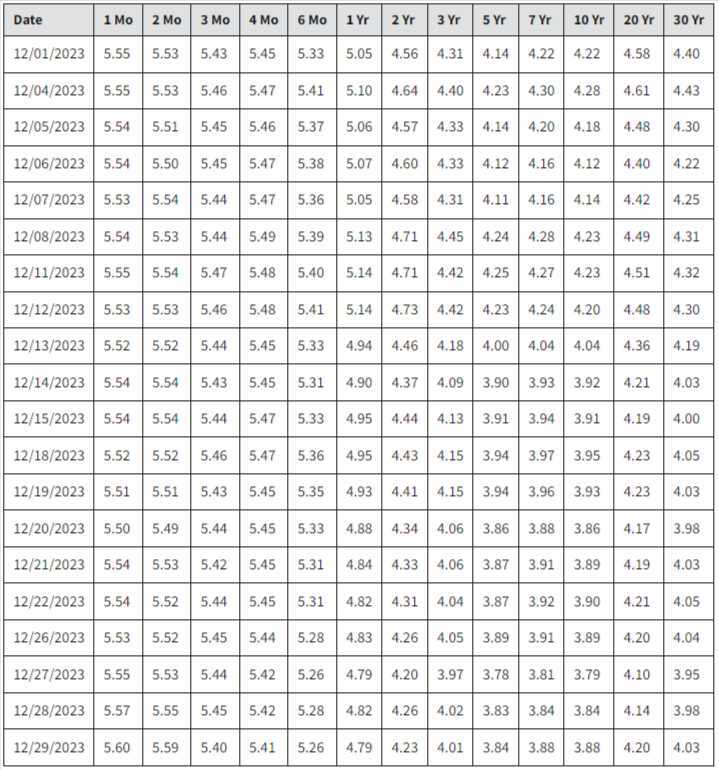

As of early December 2023, the U.S. Treasury yield curve remains inverted, with yields on 10-year bonds falling below those on 2-year bonds—a condition now persisting for around 17 months. This inversion, where the spread between the two yields currently sits at 48 basis points, can be viewed from two key perspectives. 📊

The first perspective focuses on the Federal Reserve’s impact on short-term rates, highlighting the central bank's move to raise these rates. This approach suggests that rising short-term borrowing costs could slow economic activity, aiming to balance inflation control with economic stability. 💹 On the other hand, the second perspective examines long-term market expectations. Lower yields on medium- and long-term bonds often reflect lower desired investment and subdued growth projections for the future, signaling that the economy may face a period of slower expansion. 📉

Why are these perspectives significant? 🤔 Yield curve inversions traditionally act as a signal for economic health assessment, often preceding recessions. However, considering the duration and flattening of the current yield curve, investors might find this an opportune moment to re-evaluate their portfolios. By analyzing the shifts in yield spread steepness alongside other market indicators, investors may gain deeper insights into the economic landscape and make informed strategic decisions for the road ahead. 📈

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.