Key Takeaways:

⚈ Two major Aave delegates are preparing to vote for quitting the popular blockchain.

⚈ Polygon Labs CEO said Aave is exerting 'anti-competitive behaviour.'

⚈ Critics have slammed a recent proposal to invest idle stablecoins on the Polygon bridge.

Aave, the largest lending protocol in decentralised finance, is set to leave the Polygon blockchain after leaders at both organisations traded barbs over a proposal to invest $1 billion in idle crypto on the Polygon-Ethereum bridge.

Two major delegates at Aave DAO, the digital cooperative that manages the Aave protocol, told DL News they will vote to leave Polygon when the question goes before Aave DAO members.

One of those delegates, longtime Aave contributor Marc Zeller, first proposed the split. A preliminary vote is expected to go online next month, he said.

The other, who goes by the pseudonym EzR3aL, said they too would support the measure.

Dramatic blow

Together, they have enough votes to decide the outcome of any proposal that comes before Aave DAO, if recent voting patterns continue into the new year.

Representatives from other major Aave delegates did not return DL News’ request for comment or declined to comment.

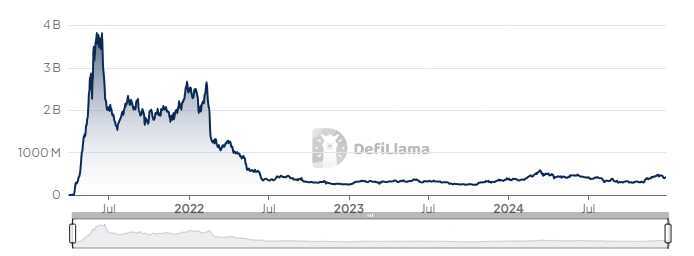

Aave accounts for some 40% of the crypto locked in Polygon’s myriad DeFi protocols, and its departure would be a dramatic blow to the popular blockchain.

The spectre of Aave’s departure has led to accusations its leaders have used monopolistic tactics to undermine a rival.

The investment proposal was in a preliminary stage and many months from becoming a reality, Polygon Labs CEO Marc Boiron told DL News. Moreover, despite Aave’s outsize share in the Polygon ecosystem, Polygon accounts for a mere 1.5% of Aave revenue.

“‘We have the power to hurt them’ — that’s what that statement says. ‘We have all the power here, as the big dog,’” Boiron said.

“That to me is pure anti-competitive behavior, when you combine those two things.”

Aave’s leadership, in turn, said it is simply taking a hard line against an unpopular, high-risk proposal and its architects.

Polygone?

Moving crypto from one blockchain to another typically requires software known as a bridge, which holds crypto from the origin chain and mints new tokens on the destination chain.

The new tokens are always redeemable for those sitting on the bridge and, as such, trade at par on the destination chain.

Almost $4 billion in crypto sits in the Polygon’s built-in bridge, according to L2BEAT.

Two weeks ago, risk management firm Allez Labs, along with DeFi projects Morpho and Yearn, proposed transferring about $1.3 billion of that crypto — all dollar-pegged stablecoins — to Morpho, where it could be borrowed at interest.

Rather than sit idle in Polygon’s bridge, the stablecoins should generate a revenue stream estimated at $70 million per year, according to Allez Labs and its partners.

Polygon could, in turn, use the money to lure new developers to its ecosystem.

It was controversial from the start.

But the proposal went viral after Zeller’s Aave Chan Initiative, a service provider that contributes to the development and management of Aave, suggested the lending protocol withdraw from Polygon “to mitigate risk.”

Zeller shared his counter-proposal on X with a brief comment: “Operation Polygon(e).”

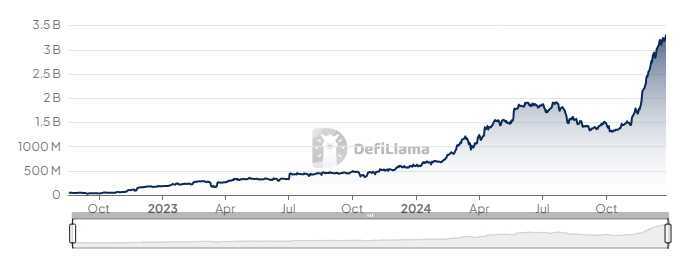

Allez’ proposal, and Zeller’s reaction, sparked a furore on social media. Some saw in Zeller’s response an attempt to discredit Morpho, a fast-growing competitor he has relentlessly criticised over the past year.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.