What is Grass Network?

Grass Network is a decentralized web scraping protocol DePIN (Decentralized Physical Infrastructure Network), that enables users to monetize their unused internet bandwidth. By connecting users with AI labs and retailers, Grass creates a mutually beneficial ecosystem where participants can earn rewards while contributing to the development of transparent AI models.

Having secured $4.5 million in seed funding led by Polychain Capital and Tribe Capital in December 2023, Grass has positioned itself as a key player in democratizing AI development. The project operates on the Solana blockchain, leveraging its speed and scalability while maintaining robust security through zero-knowledge (ZK) technology.

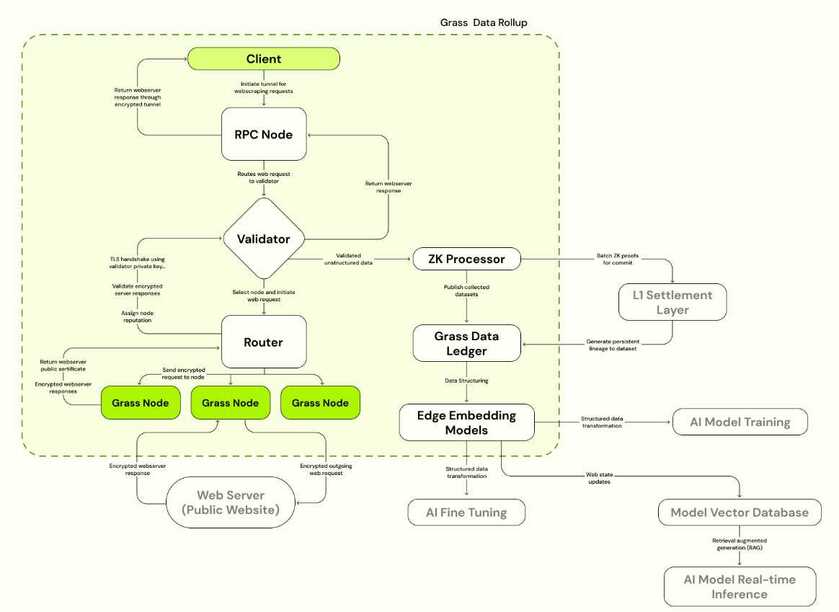

Grass Network Technology Overview

The Grass Network consists of several key components:

- Grass Nodes: Process web scraping requests using unused residential bandwidth

- Validators: Verify transactions and generate zk-SNARK proofs

- Routers: Maintain secure connections between nodes and validators

- ZK Processors: Generate validity proofs and create immutable records

- Data Ledger: Store and manage structured datasets

- Edge Embedding Models: Transform scraped data for AI training

Grass Stage 1 Airdrop Claim Details

The initial stage of the Grass airdrop has concluded with remarkable success, becoming the most widely distributed airdrop on Solana with 2.8 million users across 190 countries. A total of 100 million GRASS tokens have been allocated for distribution.

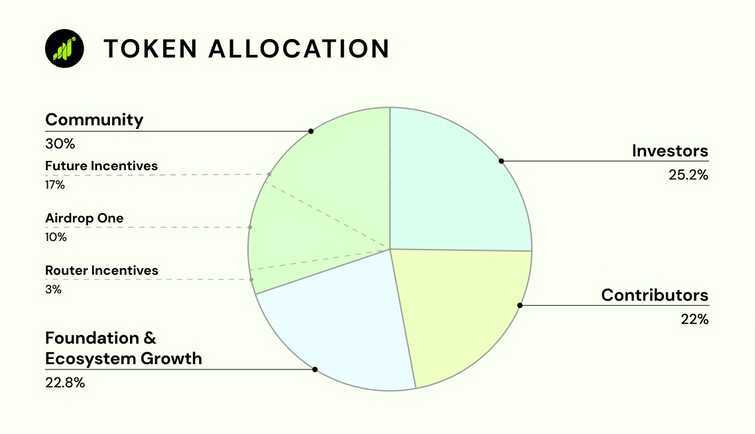

Token Allocation:

- 9% to users who earned Grass points

- 0.5% to GigaBuds NFT holders

- 0.5% to Desktop Node/Saga Application users

Circulating Supply:

Community — 300,000,000

The GRASS community allocation is broken down into the following categories:

Future Incentives - 170,000,000

Future Incentives will focus on retroactive programs that recognize early contributors and compensate creators who build valuable content or tools for the network.

- Router Rewards — 30,000,000

- An initial pool of rewards has been set aside to incentivize routers and support early infrastructure development. This pool will help ensure that routers, which facilitate bandwidth traffic and reduce latency, are properly incentivized until the network matures and can sustain itself through network fees.

- Airdrop One — 100,000,000

- The first airdrop is one of the most widely distributed airdrops in history and represents a crucial step toward building the first user-owned map of the Internet.

Foundation & Ecosystem Growth — 228,000,000

The foundation allocation of GRASS will be held by the foundation to support the ongoing operations of the Grass Network. The ecosystem allocation will be aimed at scaling the Grass ecosystem, through supporting community and growth initiatives like network upgrades, partnerships, research and development. This will be reserved for use as directed by DAO governance.

Early Investors — 252,000,000

Early supporters with a 1-year cliff and a 1-year vesting period. Locked tokens cannot be staked until they are vested.

Contributors — 220,000,000

Core contributors with a 1-year cliff and 3-year vesting, which includes current and future contributors. Locked tokens cannot be staked until they are vested.

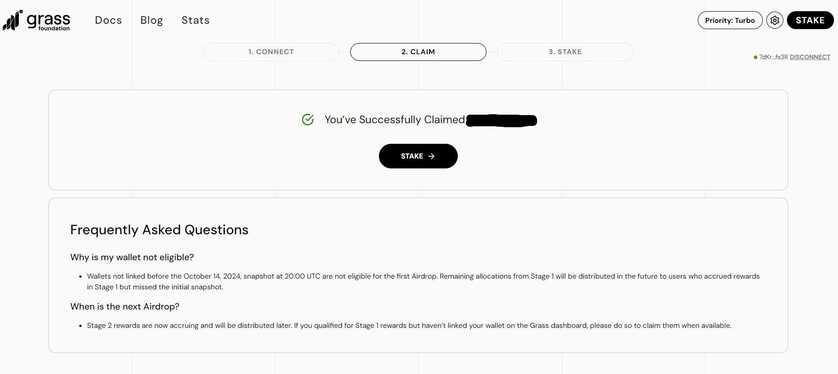

How to Claim Stage 1 Rewards

- Visit the official Grass airdrop claim page

- Connect your eligible Solana wallet

- View your claimable token amount

- Accept the terms and conditions

- Complete the claim process

Important Notes:

- Claiming deadline: January 15, 2025

- If experiencing network issues, try switching to QuickNode RPC

- Multiple wallet attempts may help resolve claim issues

Grass Stage 2 Airdrop Details

Building on the success of Stage 1, Grass has launched Stage 2 with enhanced rewards and new features. This phase allocates 17% of the total GRASS supply for future incentives, offering 50% more rewards compared to Stage 1.

New Features in Stage 2:

- Live Context Retrieval (LCR)

- Hardware innovations

- Mobile app launch

- Enhanced earning opportunities

How to Participate

Visit the Grass Website and Register

- Create an account with email and password

- Click the “Connect” button

- Install Required Components

- Download the Grass browser extension

- Optional: Install Desktop Node for 2x mining rewards

- Mobile users can use Mises or Kiwi browsers

- Complete Verification

- Verify your email address

- Connect your Solana wallet (Phantom or Solflare recommended)

Maximizing Your Grass Rewards

To optimize your earning potential:

- Run Multiple Components

- Use both browser extension and Desktop Node

- Keep your connection active consistently

- Referral Program

- Earn 2500 bonus points per referral

- Receive 20% of referred users’ points

- Share your referral code widely

- Engagement Strategies

- Participate in community activities

- Stay updated with official announcements

- Maintain regular network activity

FAQ

Is Grass Network secure?

Yes, Grass implements multiple security measures including external audits and strict public-only data collection policies.

Can I participate using mobile devices?

Yes, mobile users can participate using compatible browsers like Mises and Kiwi.

Where can I trade GRASS tokens?

GRASS is available on exchanges including Bybit, Bitget, Gate.io, and XT.COM.

Q: How long will Stages last?

The exact duration hasn’t been announced, but regular updates are provided through official channels.

Conclusion

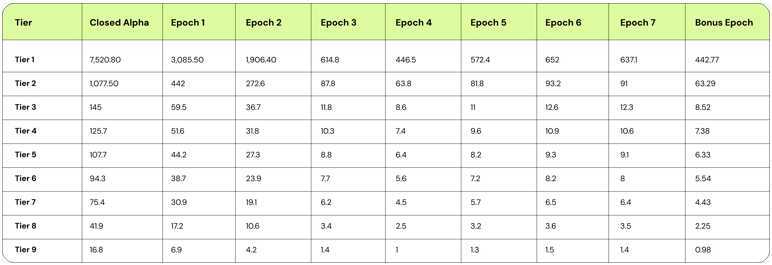

Grass Network represents a massive opportunity in the decentralized AI data space, with its Eight-Epoch airdrop program offering substantial rewards to participants. Whether you’re claiming Stage 1 rewards or just joining, the platform provides multiple ways to earn while contributing to the development of transparent AI systems.

Remember to stay active in the ecosystem, utilize all available earning methods, and keep your node running to maximize your benefits from ALL EPOCHS of the airdrop program.