Here are my predictions for 2025.

Total Crypto Market Capitalization Hit $4.5 Trillion

Circle Gets Acquired or Forced to IPO/Go Public

Stablecoin Supply Hit $300B

ICO Platforms Raised More $ Than IDO Platforms

AI Agents Market Cap Hit $50B

Solana ETF Approved

TON and Bitcoin Season 2 (TVL 2x by End of 2025)

1. Total Crypto Market Capitalization Hit $4.5 Trillion

As of the time of writing, we’re sitting at ~$3.5T. The basis of this prediction is simple. I’m betting that there’ll be one last leg in the bull market which will happen in 2025 or early 2026.

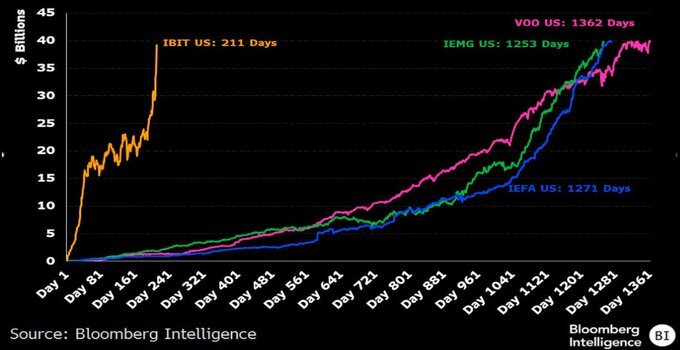

One of the reasons is that in 2026 Trump will be a lame-duck president and the pro-crypto/Republican effect that will impact the US financial market’s sentiment towards Bitcoin will be reverting to the mean by then. Meanwhile, 2025 is poised to become the year when more US-based institutional players will FOMO into crypto, given that many of them needed more preparation on the regulatory front and couldn’t just jump the gun in the last month of 2024 post-Trump’s victory. On top of that, we have the most successful ETFs ever and MicroStrategy’s contribution to the TradFi (3,3).

$150,000 per BTC will increase the total market cap by $1 Trillion. Not counting all the other altcoins’ contributions to the total industry market cap. $150,000 USD is roughly 1M RMB so maybe there’s some reflexivity there just like $100,000 BTC.

2. Circle Gets Acquired or Forced to IPO/Go Public

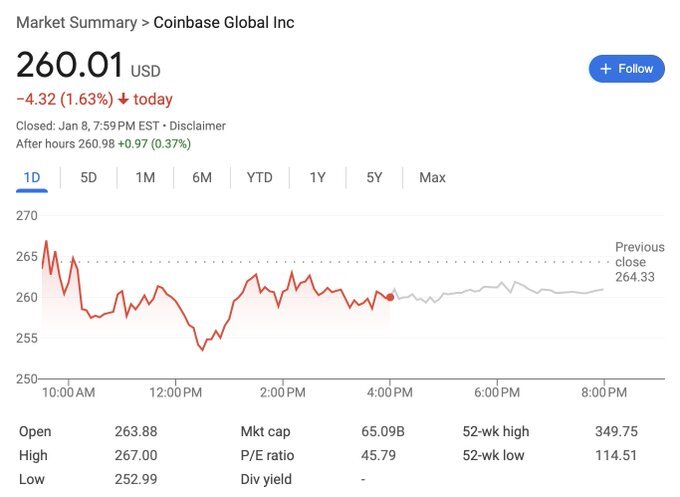

Circle is the issuer of the second largest stablecoin in the world, USDC. Despite being the runner-up, it doesn’t enjoy the same business moat as Tether. This is because the primary role of a stablecoin, at least in its current iteration, is as a digital-native eurodollar and shadow bank. Circle, given its tie to Coinbase and its preference for becoming the most compliant, US-first, regulatory-abiding entity, also relinquishes the large majority of its moat as a business.

The company tried going public via SPAC once, and then there was a rumor around its IPO, but I think the year 2025 will finally be it.

There are signs.

First, its move to New York is nothing but a branding exercise. I don’t think further explanation is necessary.

Second, its partner, Coinbase, is currently worth $66B. Less than 10% of Coinbase's market cap is enough to acquire Circle. The reason why they haven’t done this is to try and get an even better price from the Circle’s team. Cha-Chink!

3. Stablecoin Supply Hit $300B

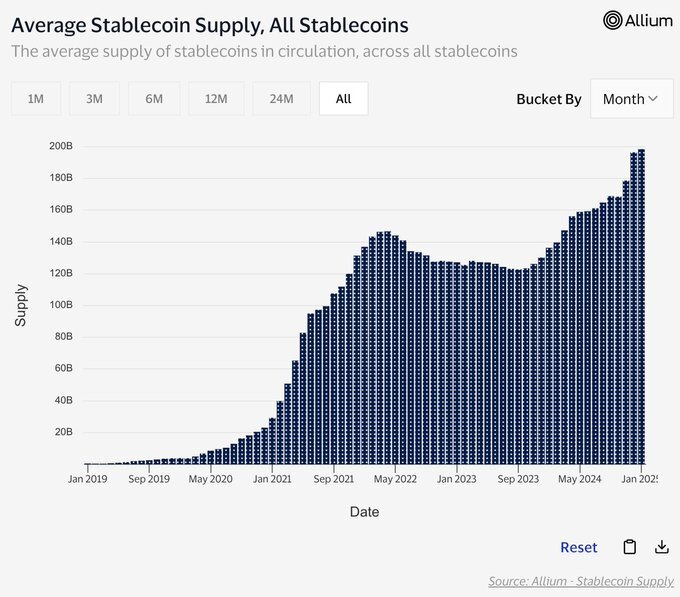

Stablecoin is crypto’s top PMF. While some might say that it’s no longer nascent, remember that there were people who said that about crypto in 2017. TLDR — stablecoin’s market share as a percentage of the worldwide financial market is still tiny.

Last year I predicted that this number would hit $250B. It didn’t hit my target but the direction is correct. Stablecoin supply went from $136B in January 2024 to ~$200B by the end of the year. In 2025, I predict this trend will continue to rise exponentially and hit $300B. It’s the lowest-hanging fruit that US-based projects will try to expand into, given the incoming administration’s regulatory friendliness, with a stablecoin bill already in the works.

4. ICO Platforms Raised More $ Than IDO Platforms

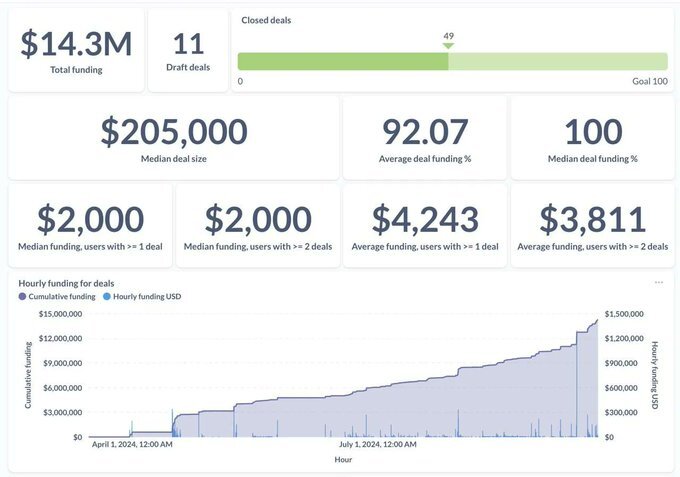

We’re starting to see the comeback of fundraising platforms such as Echo and Legion. This does not consider the great work that experienced players such as CoinList have been doing. Still sticking to the same theme of a friendlier regulatory environment, I predict that these ICO platforms will raise more capital than IDOs in 2025.

Data from Cryptorank shows:

IDO platforms raised $650M+ in 2024, mostly dominated by Jupiter and Fjord.

ICO platforms raised $130M+ in 2024, mostly dominated by CoinList.

Echo’s data as of September 2024.

5. AI Agents Market Cap Hit $50B

At this point, you might be tired of hearing another VC pontificating about AI agents. But hey, you’re already here, so…

Ever since GOAT unlocked the imagination of developers, the number of new crypto x AI agents that are conducting interesting onchain experimentation have skyrocketed. Having said that, I do think that this trend will continue into 2025 as it’s the only other “macro factor” other than the institutionalization of Bitcoin.

AI is the only “macro tech” story — and unsurprisingly it’s impacting crypto, specifically on the agentic side because onchain transaction enables developers to experiment with crazy ideas much faster. Without permissionless blockchains, it would take ages for developers to file the necessary paperwork and legality around what they’re trying to achieve.

I’m predicting AI agents' market cap will do 4x by the end of 2025, surpassing the total market cap of memes excluding the big three.

6. Solana ETF Approved

Solana is also the biggest winner of this cycle. SOL price went from $20 to $200 within six months, and there’s a huge slew of memecoin trading infrastructure, printing 9-figure in annual net profit, built on top of Solana. Think PumpFun, Photon, GMGN, and many more.

“But sir those are all just speculation!” — if this is your gut reaction after reading the last sentence please do some more reflection.

Anyway, on the “real product” side, Solana is also pushing ahead with its PayFi narrative. They’re aware that DeFi is a perpetually onchain game with some offchain components, and that crypto won’t truly become mainstream without more “payment” focus use cases. You can see their initiatives by integrating with a lot of stablecoin providers (PYUSD incentives) and supporting projects that would support further stablecoin growth.

This strategy also aligns with Solana being a relatively US-centric project. Stablecoin is the lowest hanging fruit in Trump’s administration for anything crypto, and one of Solana’s biggest backers, Multicoin Capital, has a very strong friend in the white house. David Sacks, the White House’s AI and Crypto Czar, is one of Multicoin’s first investors (LP).

Thus, Solana has too much political goodwill in the White House, and it would be foolish to not capitalize on this momentum. The most EV+ positive action they can take is by pushing for Solana ETF. With Gensler out of the picture and the increasingly available compliant tools on the Solana blockchain, it shouldn’t be an impossible task. Hint: it will also help a lot with future unlocks ;)

7. TON and Bitcoin Season 2 (TVL 2x by End of 2025)

We had a decent stint of Bitcoin and Telegram/TON ecosystem mania in 2024, but those are quite short-lived. Since Q4, all attention has shifted to AI agents and meme trading instead. However, I do believe that it’s not over for these two ecosystems and what we witnessed last year was simply season 1, the appetizer that will prepare us for the main course in 2025.

At the time of writing, TON and Bitcoin ecosystem hold $270M and $6.5B in TVL respectively. I’m predicting this number will 2x by the end of 2025. Here are a few catalysts:

There’ll be an increasing effort in activating the capital currently owned by the OG Bitcoin whales. We’re already seeing an increasing number of protocols, both DeFi and new infrastructure, that are tapping into these cohorts. Ultimately, people want yield, even if their background might be a bit of a hard-money maxi. One of the better ways to convince these maxis is by showing that you don’t need to trust, just verify. The cryptographic technology in our space is already getting there with more tools such as TEE, FHE, and zkTLS potentially enabling new design architecture that will excite Bitcoin OG into participating.

Mandatory portco shill: TON is just starting and they’re cooking a lot of stuff. One of them is TAC, a new infrastructure that will make it seamless for users to interact between TON and EVMs. With more of these initiatives coming in 2025, I predict another mania created around TON/Telegram and will propel their TVL even higher.

Honorable mentions:

Restaking-Fi Makes a Comeback. I’m still betting that there will be some ponzinomics created on top of restaking-fi or LRT-fi as restaking protocols are forced to look for ways to enhance their yield.

A Berachain App Creates a New DeFi Ponzinomics. Proof-of-Liquidity will bring experimentation back to DeFi. The key is how to expand this excitement to more than just the DeFi nerds (please don’t be another Curve war).

OP & ARB Lose TVL to New L2s and L1s. New chains such as Movement, Bera, Monad, and others will have more TVL than Optimism and Arbitrum by the end of 2025.

No Significant Stabelcoin Acquisition. After Bridge acquisition by Stripe, the mid curve take is to think that such an acquisition will be a “standard” moving forward. Reminder: Bridge is a unique case (exceptional founder, hard to get licenses, and somewhat of an acquihire) — most stablecoin founders are best serving the eurodollar offshore market.

Move Is The Next Rust. Movement, Sui, and Aptos will lead the way for a new generation of onchain applications. The language and ecosystem will foster its own developer culture, similar to Solana and Rust in the early days.

2025 will be an even more exciting year for crypto.

Now that regulatory concerns are somewhat out of the way, we have a lot of work to do. We're truly in the roaring 2020s (have you seen CES?!), and it would be a shame if crypto is not further integrated with other technologies of this decade.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.