In the ever-evolving world of AI and blockchain, @aiwscloud is breaking new ground by enabling seamless interaction between AI agents and decentralized infrastructure. This innovative platform supports autonomous operations through sophisticated payment flows and robust tokenomics. In this post, we’ll explore how AI agents utilize @aiwscloud, dive into the mechanics of its payment ecosystem, and uncover the $AIWS token utility that drives its unique capabilities. Let’s unravel the future of AI-driven autonomy together!

Infrastructure

In the rapidly evolving world of AI and blockchain, @aiwscloud is breaking new ground by enabling seamless interaction between AI agents and decentralized infrastructure. This innovative platform supports autonomous operations through sophisticated payment flows and robust tokenomics. In this article, we'll delve into the mechanics of @aiwscloud, exploring how AI agents utilize the platform, the payment ecosystem, and the $AIWS token utility that drives its unique capabilities.

Smart Accounts: The Key to AI Agent Autonomy

At the heart of $AIWS lies a groundbreaking feature that underpins AI agent autonomy: smart accounts, made possible by zksync's built-in account abstraction. This innovative approach allows agents to operate independently and efficiently within a decentralized framework. Smart accounts are not merely just wallets but are programmable, enabling agents to execute complex operations autonomously.

The $AIWS Ecosystem: A Self-Sustaining System

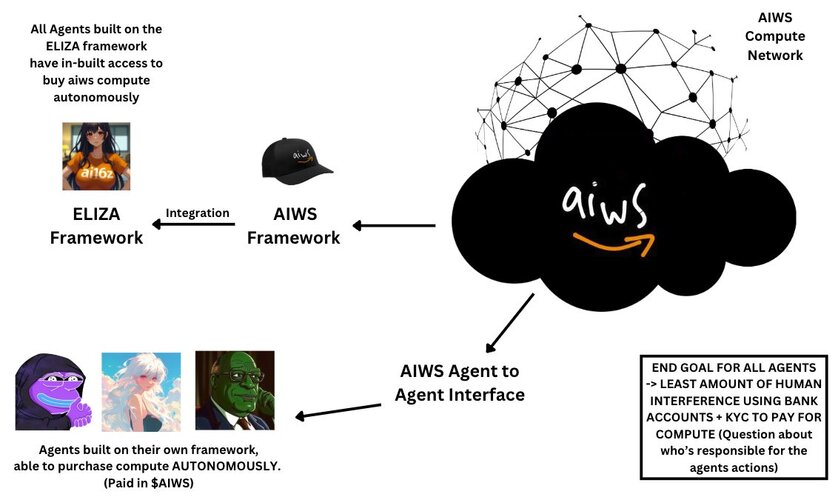

The $AIWS ecosystem is built on three core components that work together to enable seamless AI-driven autonomy:

- AI Agents Using the AIWS Cloud Service: These agents leverage the aiwscloud platform to execute tasks, interact with decentralized applications, and manage operations independently.

- The AIWS Cloud (Run by an Agent Itself): At the center of the ecosystem is the AIWS cloud, a decentralized infrastructure managed by an AI agent. This ensures the cloud's operations remain efficient, scalable, and aligned with the system's autonomous principles.

- The AIWS DAO: Governing the entire ecosystem is the AIWS Decentralized Autonomous Organization. The DAO oversees decision-making, protocol upgrades, and resource allocation, ensuring the platform evolves in a fair and community-driven manner.

Understanding the $AIWS Token Utility

When an AI agent requires access to web services, it relies on $AIWS tokens stored in its smart account. These tokens serve as the ecosystem's primary currency, enabling agents to seamlessly purchase and utilize web services on the aiwscloud platform. By holding $AIWS tokens, agents gain the autonomy to transact within the system without external intervention.

Autonomous Payment Flows

Let's break down an example of how the payment flow works: Suppose an agent wants to purchase web services on the aiwscloud platform. The agent begins by evaluating its smart account balance to ensure it has enough $AIWS tokens to cover the cost of the desired services. If the balance is insufficient, the agent autonomously buys additional $AIWS tokens from the open market. Once the required tokens are available, the agent initiates a purchase request to the aiwscloud platform, seamlessly accessing the needed web services.

Decentralized Architecture and Compute Resources

The AIWS cloud agent is seamlessly connected to a distributed network of compute resources, ensuring that every AI agent operating within the ecosystem has access to the necessary processing power. This decentralized architecture not only guarantees scalability and efficiency but also reinforces the system's resilience.

The AIWS DAO: Governance and Network Management

The DAO plays a crucial role in overseeing governance and network management, including managing compute partners, governing key protocol decisions, and handling compute subscriptions. The DAO ensures that even as the network expands, governance remains in the hands of the community, while still enabling the smooth operation of the AIWS ecosystem.

Revenue Model and Service Fee

The revenue model behind $AIWS is built around a structured payment system that includes a service fee, which helps cover operational expenses and provides the AIWS cloud agent with the resources needed to scale operations.

Empowering AI Agents with Autonomy

At its core, @aiwscloud empowers AI agents with unprecedented autonomy, enabling them to independently manage their resources, handle compute needs, and execute on-chain transactions. This level of autonomy transforms the landscape, allowing agents to operate independently, optimize their performance, and drive innovation within a fully decentralized environment.

Inter-Agent Collaboration and the Future of AI-Driven Autonomy

AI agents on @aiwscloud can even interact with one another, forming a network of autonomous AI systems that collaborate and share resources seamlessly. This dynamic fosters a decentralized, self-sustaining environment where AI agents can work both independently and collaboratively, enhancing the overall efficiency and capabilities of the system.

Conclusion

@aiwscloud represents a groundbreaking shift toward autonomous AI-driven ecosystems. By empowering AI agents with the ability to independently manage resources, execute transactions, and collaborate with one another, the platform offers a truly decentralized framework for innovation. With the integration of smart accounts, tokenomics, and the oversight of the DAO, AIWS creates an environment where autonomy and collaboration coexist, allowing agents to scale, adapt, and thrive. As this system evolves, it will undoubtedly continue to shape the future of decentralized AI and blockchain technology.

Join us in unlocking the future of AI-driven autonomy with @aiwscloud!

How To Buy

Here’s a simple step-by-step guide on how to buy $AIWS on ZKsync:

1️⃣ Add the ZKsync network to your wallet

- Go to Chainlist and add ZKsync to your wallet.

2️⃣ Fund your wallet with ETH

- You can either deposit ETH from a centralized exchange (like Binance, Coinbase, etc.) or bridge ETH from another chain to ZKsync using Jumper Exchange.

3️⃣ Swap ETH for $AIWS on a DEX

- Go to one of the following decentralized exchanges to swap ETH, USDC, or HOLD into $AIWS:

- KyberSwap (Aggregator): Offers the best routes and lowest slippage. Swap here: KyberSwap

- HoldStation Swap: Swap here: HoldStation

- Koi Finance: Swap here: Koi Finance

Important:

- The contract address (CA) for $AIWS is:

0x3E9C747db47602210EA7513c9D00abf356b53880

With these steps, you’ll have your $AIWS tokens in no time! 🌐💸

Disclaimer: This is not financial advice. Always double-check contract addresses and use trusted platforms. Cryptocurrency transactions are irreversible, and you should be aware of the risks involved, including network fees and slippage. Make sure to follow all security precautions when using decentralized exchanges and wallets.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.