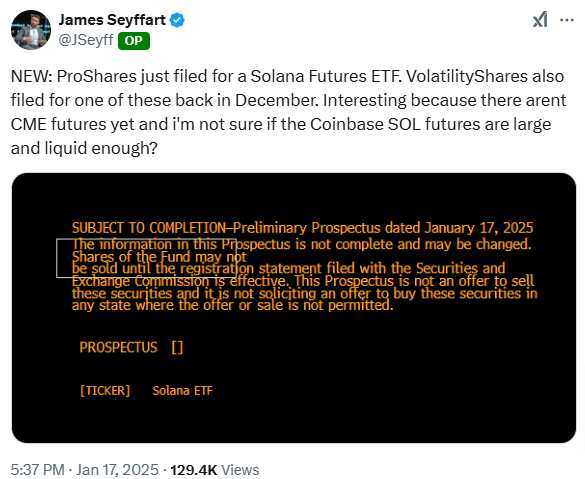

On Jan. 17, just days before Gary Gensler's final day as SEC chair, a flood of cryptocurrency ETF filings were submitted to the U.S. Securities and Exchange Commission (SEC). The filings come as the crypto industry anticipates a shift in regulatory approach with the incoming administration of President-elect Donald Trump, expected to adopt a more crypto-friendly stance.

CoinShares, formerly Valkyrie Funds, also submitted a proposal for a “CoinShares Digital Asset ETF,” which would track its proprietary Compass Crypto Market Index. Meanwhile, ProShares submitted filings for additional leveraged, inverse, and futures ETFs tied to XRP. Other firms like Bitwise, Canary Capital, 21Shares, and WisdomTree had already filed proposals for spot XRP ETFs.

Tidal DeFi, a firm focused on decentralized finance, filed for the Oasis Capital Digital Asset Debt Strategy ETF (DADS). This fund is set to invest in debt instruments related to crypto firms, including miners, utilities, and payment platforms. On Jan. 15, VanEck submitted its application for the “Onchain Economy” ETF, aimed at investing in a range of crypto-focused companies such as software developers, mining firms, and payment providers.

Gensler’s exit on Jan. 20 comes after a tenure marked by high-profile regulatory actions, including lawsuits against Coinbase and an aggressive crackdown on unregistered securities offerings. These filings were seen as a strategic move by the crypto industry to take advantage of the expected changes in the regulatory environment under the new administration.

These developments indicate that the crypto industry is bracing for a potential shift in regulation, with many looking to seize opportunities in a more crypto-friendly environment.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.