This year, Xahau Network intends to receive powerful updates across scalability, accessibility, security, and innovation.

Here’s what’s coming:

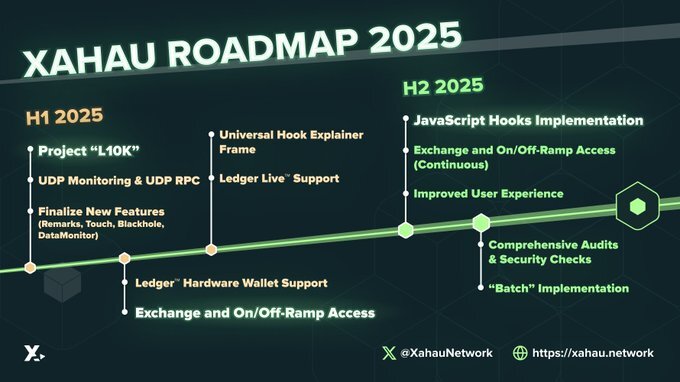

- Project "L10K" Improve core technology efficiency to boost transaction capacity to 10,000 transactions per ledger for better efficiency and security. A milestone in performance for the Xahau ecosystem!

- Improve UDP Monitoring & RPC Connection-less monitoring and RPC features for node operators optimize performance and scalability across the network. Allowing for efficient, passive monitoring of single or multi-node environments - significantly reducing the overhead.

- Finalized New Features (Remarks, Touch, Blackhole, DataMonitor) Complete development and integration of these cutting-edge features, improving interaction with Xahau for developers as well as end-users through products built by developers.

- Ledger Hardware Wallet Full Support for Xahau Ensure secure, streamlined Xahau transactions with Ledger Hardware Wallet compatibility, opening up accessibility to Xahau worldwide.

- Exchange and On/Off-Ramp Access Xahau is intended to become more accessible through exchanges and on/off-ramp platforms, supporting broader participation and integration within the ecosystem.

- LedgerLive Support Xahau integration with Ledger Live, enabling easy access and management using the popular Ledger Live product.

- Universal Embeddable Hook Explainer Frame Allowing any wallet to easily integrate a clear explanation of the influence of Hooks on transactions (web, mobile, desktop) with clear, integrated visuals for HookSet transactions, ensuring easier adoption.

- JavaScript Hooks Implementation Pending audit approval, bring JavaScript-based Hooks and tooling to tens of millions of developers around the world to develop using Xahau for advanced on-chain logic and programmable transaction capabilities.

- Comprehensive Audits & Security Checks Complete audits for all major 2025 features to demonstrate the security and stability of the network, providing verifiable assurance to the world as we head into 2026.

- Improved User Experience Guided by feedback, the Xahau ecosystem is set to ensure seamless integration and usability across all wallets and applications.

- Batch Implementation Enable efficient multi-transaction verifications, ensuring either all or no transactions occur while allowing service providers to incorporate workflow-specific operations seamlessly into the transaction flow.

2025 is the year Xahau becomes easier to access, use, leverage, and build on while scaling smarter, faster, and stronger.Ready to build the future of on-chain innovation? Start exploring, contributing, and creating today. Learn more: https://xahau.network

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.