What Is Payment Finance (PayFi)?

Payfi, or Payment Finance, is a broad term that generally refers to the intersection of financing payments and decentralized finance (DeFi). It leverages blockchain to offer faster, more efficient, and potentially cheaper financial transactions to unlock the time value of money.

Key Takeaways

PayFi focuses on real-time settlement and bridging DeFi with real-world assets (RWAs), addressing the limitations of both ecosystems.

PayFi enables users to unlock TVM (Time Value of Money) through decentralized finance, offering instant access to future cash flows for reinvestment.

Solana supports PayFi with high performance (400ms block times), deep liquidity, and a growing developer community.

PayFi use cases include accounts receivable financing, creator monetization, and "Buy Now Pay Never" models that leverage interest for payments.

Satoshi Nakamoto's whitepaper introduces Bitcoin as peer-to-peer (P2P) electronic cash for online payments among peers without third-party intervention. Fast-forward 15 years, Bitcoin is still not widely used as a digital payment medium for daily activities.

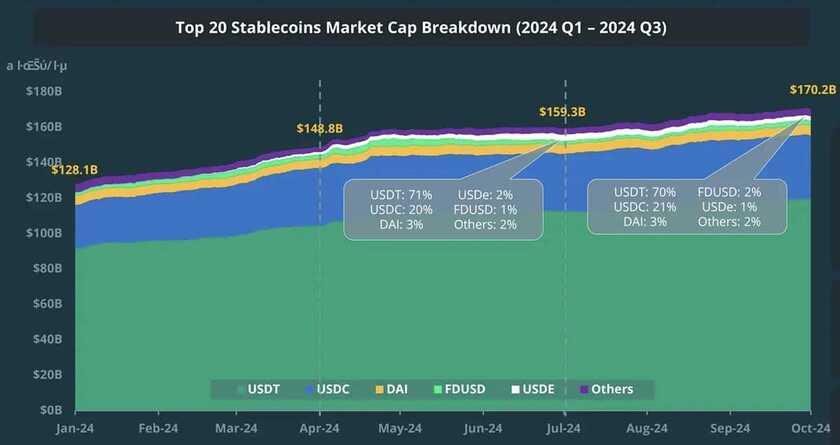

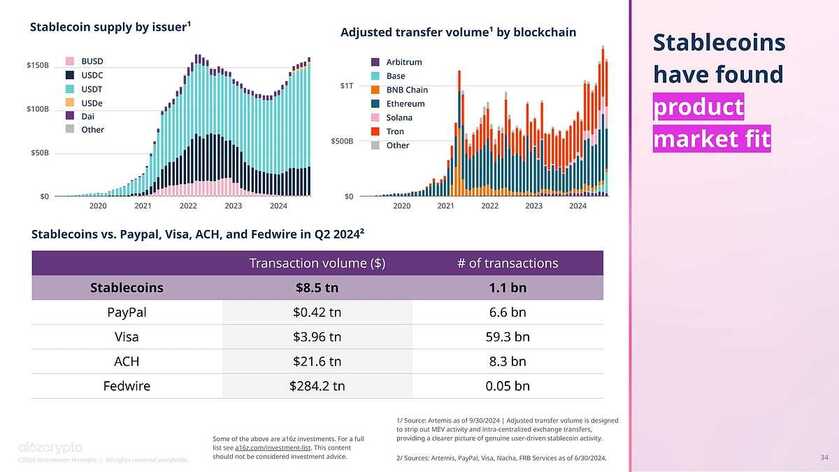

Instead, stablecoins’ popularity seemed to have found a better product-market fit (compared to L1 tokens like BTC) for settlements, and since 2020, they’ve grown to a market cap of over $170 billion (as of October 2024).

For instance, stablecoins’ transaction volume is more than double that of Visa’s in the second quarter of 2024, according to a report by Andreessen Horowitz.

However, while stablecoins have facilitated everyday transactions, they haven't fully bridged the gap between traditional finance and the decentralized world. More importantly, they have not addressed the challenge of realizing the time value of money.

This is where Payfi comes in.

PayFi's solutions aim to make real-world financial transactions more efficient through innovations in cross-border payment financing and instant settlement for real-world assets (RWAs).

Understanding PayFi: DeFi Meets Payments Financing

Lily Liu, President of the Solana Foundation, is credited with coining the term PayFi, which she describes as the creation of new financial markets centered on the time value of money. Liu asserts that on-chain finance can unlock innovative financial products and experiences that are not possible in traditional or web2 finance.

While DeFi provides a vast array of financial services, think staking, lending, and more, PayFi's primary focus is on real-time settlement to help individuals and businesses access and utilize the time value of money more efficiently.

Also mentioned in Messari's "The Crypto Theses 2025" report, PayFi helps to bridge two highly potential ecosystems, RWA and DeFi, by tackling their major challenges. RWAs’ illiquidity, despite its massive value and DeFi's detachment from the real econhttps://x.com/humafinance/status/1844510148082929797omy, can potentially be addressed with the efficient implementation of PayFi solutions.

Time Value of Money (TVM): PayFi's Core Concept from The Financial Industry

Time Value of Money (TVM) is a fundamental financial concept that emphasizes the idea that a dollar's value today is greater than its value in the future. This concept is relevant in today's world because money invested now has the potential to generate higher returns compared to money received at a later time, as its value decreases over time due to inflation.

For example, suppose a person won a prize of $100,000 and needs to choose between receiving the full amount today or receiving it in equal monthly installments over the next five years. According to the TVM principle, taking the lump sum today would likely be more beneficial than opting for a monthly passive income, as the money can be invested immediately to generate returns, whereas the future installments would lose purchasing power due to inflation.

PayFi uses blockchain’s ability to be borderless to help users realize TVM via decentralized money markets. Besides reducing transaction costs, users can benefit from faster transaction times to reinvest their money or assets effectively.

Solana With PayFi: Transforming Global Financial Markets

According to Solana Foundation President Lily Liu, there are three key requirements for a blockchain for PayFi-based applications to flourish on the network:

High performance

Large capital liquidity

Ample talent liquidity

1. Performance

Near-instant settlements and T+0 cross-border transaction times are some of the biggest USPs of PayFi. To achieve such performance, a fast and reliable blockchain infrastructure is paramount.

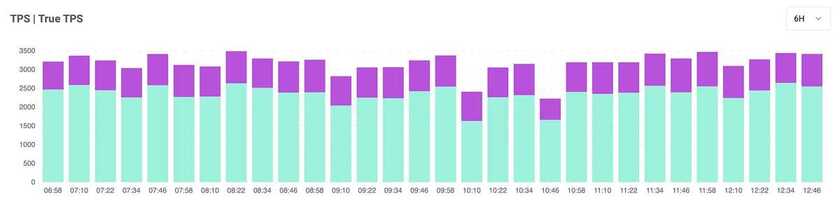

Through Proof of History (PoH), Solana achieves block times of 400 milliseconds, allowing it to process (theoretically) over 100,000 transactions per second (TPS).

Along with this performance, the transaction fee of below $0.01 makes the blockchain more attractive for users and projects to try their hands on PayFi.

2. Capital Liquidity

The availability of highly liquid capital is crucial for smooth operation, including real-time transactions, which the Solana ecosystem effectively provides. Solana has a total value locked (TVL) above $6 billion, ensuring ample liquidity for PayFi transactions.

USD Coin (USDC), the largest stablecoin on Solana, with a market cap of close to $2.5 billion, makes it a key pillar in maintaining liquidity and helping PayFi networks like Huma facilitate on-demand, cross-border lending, and remittances.

3. Talent Liquidity

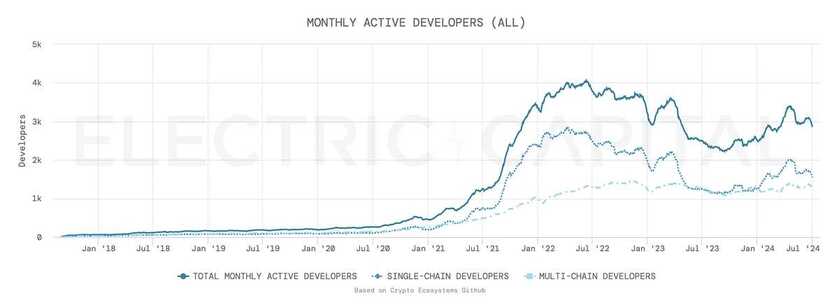

A strong developer community is essential for building PayFi for a larger number of crypto users. Solana has a growing number of monthly active developers in the crypto ecosystem. To emphasize, the number of total monthly active Solana developers rose from 244 in April 2020 to more than 3,300 in April 2024.

Considering these, Solana is a suitable blockchain for practical PayFi use cases. The chain is capable of combining the best performance with low fees, capital liquidity, and an active developer community.

Potential Applications Of PayFi

According to Mordor Intelligence, the global payment financing market is expected to reach $2.85 trillion in 2024 and grow to $4.78 trillion by 2029. The Asia Pacific region is expected to grow the fastest during this period and account for the largest market share.

This immense growth highlights the critical need for efficient, scalable, and accessible financial infrastructure — exactly what PayFi aims to deliver.

Here are some potential applications of PayFi that can reshape the future of finance.

Buy Now Pay Never

Buy Now Pay Never allows users to benefit from the time value of money principle, where users can buy a product or service without the need to pay for it later. In this case, the user deposits an adequate amount of funds to PayFi-supported products and uses its interest as a payment method.

Imagine you want to buy a new phone that costs $1,000. Instead of paying upfront or taking out a traditional loan, you could use a PayFi platform to commit a portion of your future earnings toward the purchase. Let's say you agree to pay $100 per month from your salary.

Here's where yield-bearing stablecoins come in. These stablecoins generate interest while they are held. The PayFi platform could use your committed $100 monthly payments to purchase these stablecoins. These stablecoins are then locked into a smart contract that automatically generates yield. Over time, the accumulated interest and principal from the yield-bearing stablecoins will eventually cover the cost of the phone.

Once the total amount reaches $1,000, the smart contract automatically executes the final payment to the seller, and you officially own the phone without ever having to make a lump-sum payment.

Account Receivable

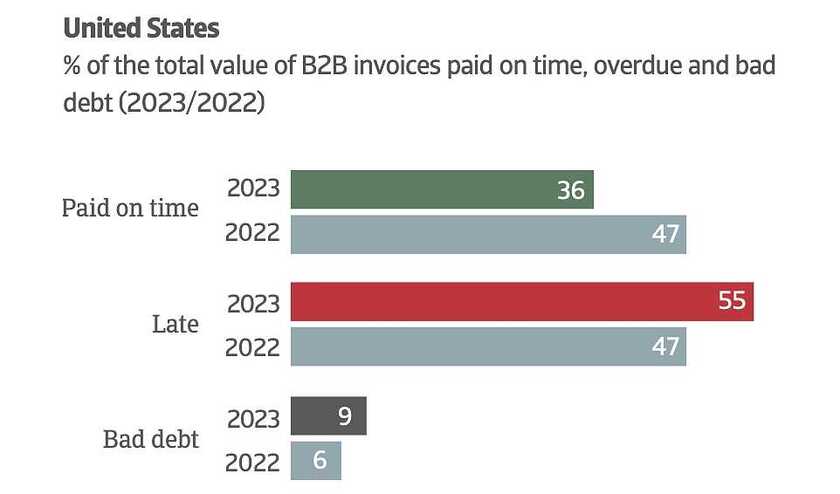

Accounts receivable financing bothers the majority of businesses without surplus funding or financial institutions' backup, which might even lead to operational failures due to a lack of money. According to the Atradius report, 55% of businesses in the US receive late invoice payments, and 9% face bad debt.

To address this issue, PayFi introduces a decentralized and automated approach to accounts receivable financing. Traditional invoice financing relies heavily on intermediaries such as banks or financial institutions, causing delays, added fees, and restrictive credit evaluations. With PayFi, businesses can access instant liquidity by tokenizing their invoices or receivables and using them as collateral on blockchain-based platforms.

The availability of faster funds helps businesses maintain a safety cushion, allowing them to have a runway fund for unexpected expenses or to expand their growth opportunities without the constraints of delayed payments.

Creator Monetization

The creator economy is on a rapid upsurge with the global market size expected to surpass $500 billion by 2030. However, even on popular platforms, creators have to wait weeks to earn revenue for their latest videos.

In this scenario, PayFi can help content creators finance their video production by providing funds beforehand to create the complete video, which they can return automatically based on the return generated from streaming revenue.

This PayFi service allows creators, especially micro-influencers, to continuously deliver videos without waiting until their next pay.

Notable Players In PayFi Space

As slow remittances and settlement times continue to slow down commerce, many teams are coming together to tackle the challenges head-on.

Here, we will look at three notable projects in the PayFi ecosystem:

Huma Finance

PolyFlow

TLay

1. Huma Finance

Huma Finance is an innovative platform focusing on bridging DeFi with real-world financial applications, particularly through income-backed lending and payment financing solutions.

The project positions itself as a pioneer in the Payment Finance (PayFi) space, using blockchain’s capabilities to offer real-time, borderless liquidity for businesses and individuals.

Huma Finance provides an on-chain factoring market, allowing businesses to borrow against future income or invoices. This solution helps companies with cash flow challenges, offering immediate liquidity by transforming receivables into digital assets on the blockchain.

The platform's integration with networks like Circle, Superfluid, and Request Network showcases its focus on making decentralized invoice financing accessible and efficient for various stakeholders.

With recent funding of $38 million and a partnership with Arf to expand liquidity offerings, Huma is growing its PayFi network across blockchains like Stellar and Solana. Its approach enables faster settlements and makes financial services more accessible by moving away from asset-based lending towards cash-flow-based underwriting.

Core Focus

PayFi: Huma is a pioneer in the PayFi space, aiming to bring traditional payment financing processes onto the blockchain. This includes invoice financing, supply chain financing, and more.

Global lending: They facilitate cross-border lending and borrowing, making it easier for businesses and individuals to access capital regardless of location.

Real-world assets (RWAs): Huma is working to connect real-world assets to the blockchain, enabling new financing opportunities and unlocking liquidity for previously illiquid assets.

2. PolyFlow

PolyFlow is a blockchain-based infrastructure designed to improve the Payment Finance (PayFi) ecosystem by integrating DeFi with real-world payments and assets. Its primary goal is to address the limitations of traditional and blockchain-based payments by improving compliance, scalability, and transparency.

PolyFlow introduces two key elements:

Payment ID (PID): This decentralized ID system securely manages transaction flows, protecting user privacy through zero-knowledge proofs while ensuring regulatory compliance. PID functions similarly to a digital wallet, containing various elements like payment methods, digital identities, or NFTs, enhancing cross-functional use.

Payment Liquidity Pool (PLP): This component facilitates the secure and efficient movement of funds without relying on centralized institutions. Using smart contracts, PLP automates fund flows, reducing settlement risks and enhancing capital utilization for both TradFi and DeFi systems.

PolyFlow is working to create a unified financial infrastructure by decoupling the information and fund flows, which were traditionally managed by centralized systems. This modular framework ensures compliance with regulatory requirements and mitigates custodial risks.

The project is already collaborating with partners like OKX Wallet and exploring innovative use cases like “Scan to Earn”.

Core Focus

PayFi infrastructure: PolyFlow is developing basic infrastructure for the PayFi ecosystem. They're focused on bridging the gap between traditional payment systems and decentralized finance (DeFi).

Regulatory compliance: A key aspect of their approach is ensuring regulatory compliance. They aim to build a system that meets regulatory requirements while still making the best of what blockchain has to offer.

Security and efficiency: PolyFlow prioritizes security and efficiency in its design to support net settlements and micropayments on blockchain networks, reflecting Bitcoin’s original vision.

3. TLay

TLay (Trust Layer for DePIN) is a decentralized infrastructure layer designed for Decentralized Physical Infrastructure Networks (DePIN). Its goal is to bridge the physical and digital worlds by offering modular tools that facilitate large-scale collaboration among machines and devices, and enabling the management of RWAs through blockchain-based solutions.

TLay integrates various technologies, including trusted chipsets, IoT oracle services, and DePIN-specific appchains. This structure simplifies the development process for projects in the DePIN ecosystem by providing ready-to-use frameworks and tools for bootstrapping new applications. Developers can use these components to quickly launch innovative distributed digital finance and business solutions.

One of TLay’s main objectives is to ensure data authenticity, privacy, and transparency. For example, its BoAT3 IoT Oracle Service authenticates data from physical devices directly onto the blockchain, preventing data manipulation while supporting privacy. This setup is crucial for creating trust within DePIN ecosystems, where accurate real-time data feeds are necessary.

In collaboration with partners like Huma Finance, TLay also plays a role in PayFi (Payment Finance) innovations by ensuring trust and data security. This partnership allows PayFi systems to leverage trusted on-chain data to provide credit and real-time lending solutions, helping drive the development of machine-based economies where automated payments and financing are key drivers of growth.

Core Focus

DePIN infrastructure: TLay focuses on decentralized physical infrastructure networks, which include things like wireless networks, renewable energy grids, and sensor networks.

Digital twin technology: They create digital representations (or "digital twins") of physical assets on the blockchain. This allows for secure and transparent tracking, management, and monetization of these assets.

Data integrity: TLay ensures the integrity of data coming from physical assets using cryptographic proofs and decentralized consensus mechanisms. This is crucial for building trust and reliability in DePIN networks.

Conclusion

Payment Finance (PayFi) changes the way payments are conducted in the financial space, including traditional decentralized finance. With the proper implementation of PayFi solutions, users can access future capital “now” and finance their other interests.

We're still in the early stages of the PayFi revolution, but the potential is enormous. By connecting RWAs, automating payments, and merging DeFi with TradFi, PayFi is transforming the financial landscape.

Further, with events like the 2024 PayFi Summit, co-hosted by Solana, the word is spreading rapidly and community growth is accelerating. Given the nature of the technology, PayFi applications will very quickly go beyond the virtual world and impact the real-world economy.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.