Yesterday Korea’s Financial Services Commission announced a roadmap to broaden access to cryptocurrencies for corporates, which have not been allowed to trade since 2017. During the first half of this year, non profits, universities, law enforcement agencies and crypto exchanges will be allowed to convert ‘virtual currency’ to cash. This is mainly amounts received as donations, or fees in the case of exchanges. In the second half, 3,500 listed corporates and registered corporations classified as qualified professional investors will be allowed to transact with cryptocurrencies.

However, the FSC is still concerned about contagion, which is why it won’t allow access to financial institutions. Instead, for financial companies it wants to focus on planned legislation for security token offerings.

Regarding the corporates, to qualify for access they must have at least KRW 5 billion ($3.5m) in existing financial investments if they are externally audited, otherwise they must have KRW 10 billion ($7m). Notably, the FSC compared this to Hong Kong, which requires corporates to have HKD 8 million in financial investments and a total assets of over HKD 40 million. Allowing access to other non-financial companies is considered a mid to long term objective.

The regulator cited keeping up with other jurisdictions as one of the reasons for relaxing rules. Its 2017 ban was partly driven by concerns around consumer protection and overheating the market. Some of those issues have been addressed by consumer focused legislation that came into force last year.

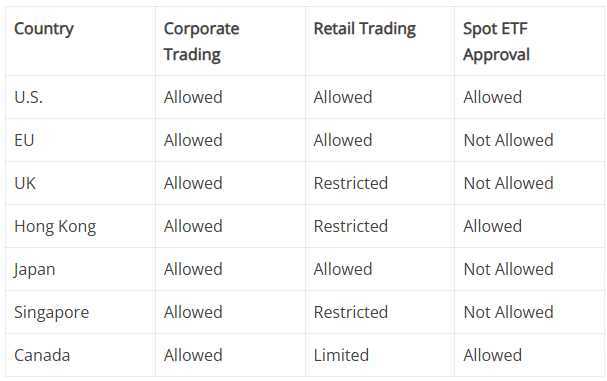

As part of its work, the FSC elaborated on approaches in other jurisdictions:

New task force for corporate crypto

Banks and crypto exchanges will vet which corporates can have access. Hence, the FSC is setting up a task force consisting of the Financial Supervisory Service (FSS), Korea Federation of Banks (KFB), and Digital Asset Exchange Alliance (DAXA) to establish standards and guidelines. The FSC also suggested that professional investors should use third party custodians and have access to better disclosures.

Security token legislation

The FSC confirmed that legislation is in progress to classify tokenized securities as electronic securities. It will also establish requirements for issuer “account managers” that want to issue tokens directly without using a securities firm as an intermediary. This may be similar to German registrars or Luxembourg’s control agents, but it remains to be seen.

Meanwhile, the crypto exchange market in Korea is very concentrated, with Upbit taking a market share of 70%-80% and Bithumb the only serious competitor. Together they control around 97% of the market. Yonhap news explored whether the situation might change, without coming to a definitive conclusion. However, there’s apparently quite a bit of juggling related to bank partners, in preparation for corporate onboarding.

Yonhap reported that Bithumb is planning to change its KRW onboarding and offboarding bank to Kookmin Bank and Upbit may move to Hana Bank. Until now Upbit has used KBank for onboarding, and made up a massive proportion of KBank’s business.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.