Both State Street and Citi are planning to enter the crypto custody space, according to The Information, with State Street planning to launch next year. While the timing is new, State Street’s entry into crypto custody is not. Last year it partnered with Taurus for custody technology. With $46.6 trillion in assets under custody (AUC), State Street is the world’s second largest custodian and Citi is fourth with $25 trillion.

The SEC’s accounting rule SAB 121 blocked US banks from participating in digital asset custody for almost three years. Hence, State Street had an on-and-off relationship with digital assets. Now that SAB 121 has been rescinded, banks can engage in digital asset custody.

The bank launched State Street Digital in 2021 and partnered with UK based Copper for custody technology the following year.

A combination of factors led to custody taking a back seat. The SEC introduced SAB 121 in early 2022. Later that year, State Street Digital leader Nadine Chakar moved to Securrency. And the Copper relationship was subsequently shelved. Early last year there were layoffs with the remaining team integrated into the asset servicing division.

During the launch of Bitcoin ETFs in early 2024, SAB 121 sidelined all bank custodians. Given the volumes involved, custodian banks were keen to participate. Hence, the strong push to get SAB 121 overturned by Congress, which ultimately failed. However, the result was the SEC started to grant exceptions to qualifying banks, making the opportunity more accessible.

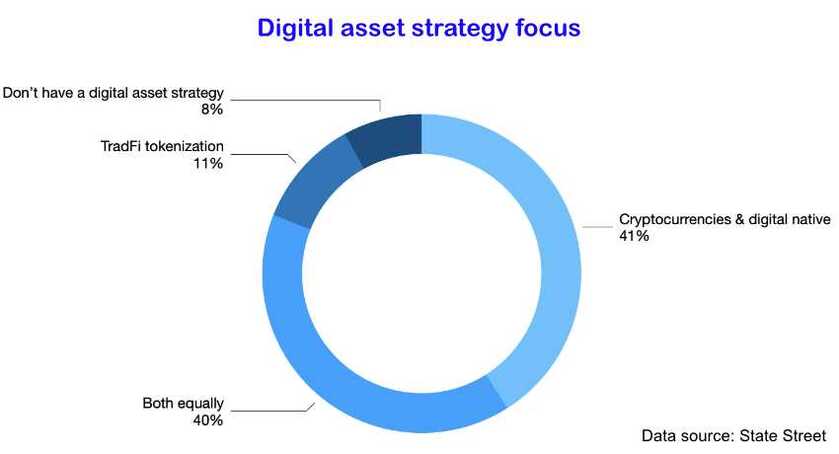

A State Street survey in the middle of last year showed a strong client appetite for digital asset custody – both tokenization and crypto, but more for crypto.

Hence, the bank started making moves months before the US election, partnering with Taurus in August, and appointing a new digital assets leader in October.

Citi and digital assets

Meanwhile Citi was first involved with providing custody for digital assets years ago with BondbloX, a Singapore start up that enables fractional access to bonds. Last year the bank launched the Citi Integrated Digital Assets Platform (CIDAP), rolled out its Citi Token Services for corporate tokenized deposits and engaged in various public blockchain experiments.

For digital asset custody it partnered with Metaco in 2022, which was subsequently acquired by Ripple. Shortly afterward there were rumors that Citi was looking to move to another provider. Otherwise, the bank’s involvement with crypto to date has been relatively quiet.

That contrasts with three other banks which leaned in early. BNY Mellon, the largest global custodian, was the first bank to get an exception to SAB 121 last year. Northern Trust, the fifth largest custodian bank, co-founded Zodia Custody in 2020, with Standard Chartered’s SC Ventures as the majority shareholder. While Standard Chartered is not amongst the world’s largest custodians, it is leaning heavily into crypto custody, both indirectly via Zodia and also directly.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.