Tether is reportedly working with members of the US House Financial Services Committee, specifically Representatives Bryan Steil and French Hill, to shape federal stablecoin regulations.

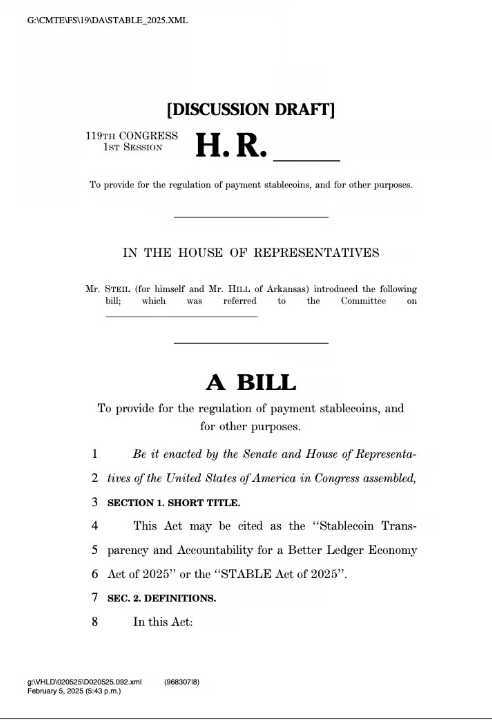

This includes contributing to the STABLE Act introduced by both lawmakers in early February, as well as offering input on two additional stablecoin bills.

According to Tether CEO Paolo Ardoino, the company wants its perspective heard during the legislative process and is prepared to adapt to US rules.

The new rules may include requirements like monthly reserve audits and 1:1 collateral backing.

Tether’s involvement comes amid broader regulatory discussions, including meetings between crypto industry leaders and the SEC, and the push to bring stablecoins onshore.

Meanwhile, the Federal Reserve is warming to stablecoins as a means of preserving the US dollar’s global dominance but remains concerned about risks such as de-pegging events and market fragmentation.

What’s Next: Tether’s collaboration with lawmakers suggests that stablecoin regulations could soon take a more defined shape and may introduce stricter compliance measures, including mandatory audits and full collateral backing.

Why it Matters: If lawmakers strike the right balance, stablecoins could cement their role in global finance, benefiting both the crypto industry and the broader economy.

Our Take: If Tether and other stablecoin issuers adapt to US regulatory frameworks, it could bring legitimacy to the stablecoin sector, encourage institutional adoption, and integrate crypto more deeply into the traditional financial system.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.