Will the SEC Defend Its Alleged Fraud?

Motion to Vacate Puts Crypto Oversight on Trial

- March 14, 2025: opposition papers, if any, are served on the SEC

- March 21, 2025: reply papers, if any, must be served by the SEC

- Two weeks after disposition of Defendants’ FRCP 60(d)3 motion to vacate Consent Order and Judgment (DOC-61) for Fraud Upon the Court: opposition papers, if any, are served on the SEC;

- One week later: reply papers, if any, must be served by the SEC

The question now becomes, will the SEC defend "Fraud Upon the Court?"

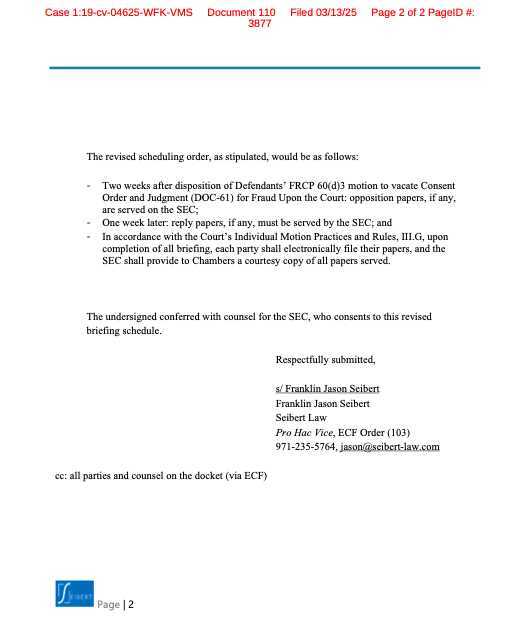

Digital Asset Securities

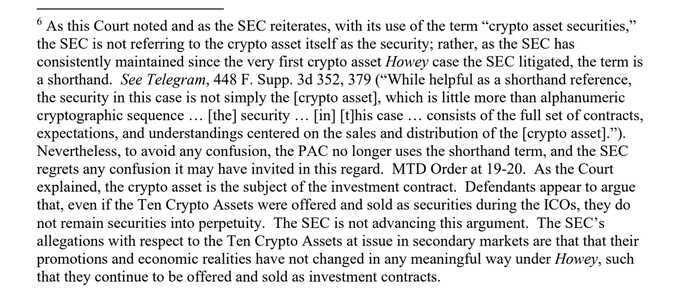

The SEC “regrets any confusion” caused by its characterization of these tokens as “crypto asset securities” and “no longer uses the shorthand term,” according to the Sept. 12 filing. Yet, this term was used to claim jurisdiction over the crypto industry raising questions over past cases, including that of Reggie Middleton.

"...by using imprecise language we've been able to suggest the token itself is a security, apart from that investment contract, which has implications for Secondary Sales, it has implications for who can list it...We've fallen down on our duty as a regulator not to be precise. So, tucking into a footnote that yes we admit that now that the TOKEN ITSELF IS NOT A SECURITY..." ~ SEC Commissioner @HesterPeirce

The SEC's Smoking Guns: Fraud on the Court Allegations

1 - Falsely Claimed Patents were "not novel", "stalled" and would never be granted, claiming Reggie "misled investors about the status of Veritaseum’s IP". A total of 7 patents have since been granted with 3 in the US (US11196566B2, US11895246B2, US12231579) and 4 in Japan (JP6813477B2, JP7204231B2, JP7533974B2, JP7533983B2). These patents titled "Devices, systems, and methods for facilitating low trust and zero trust value transfers" are foundational to DeFi, Tokenized Assets, NFT's, Stablecoins, Proof of Stake and Proof of Work.

Timeline of Events

Other Articles exploring this topic in more detail

Source links:

- Footnote in SEC v Binance - Token itself is not a security https://storage.courtlistener.com/recap/gov.uscourts.dcd.256060/gov.uscourts.dcd.256060.273.1.pdf

- SEC admits in a footnote "that a token itself is not a security" revealing that "Digital Asset Securities" is a made up term used to claim jurisdiction over digital assets https://x.com/SovereignRiz/status/1881316167987388904

- Aug 19, 2019: SEC's Complaint against Reggie Middleton

- Tom Emmer introduces the "Securities Clarity Act" stating Tokens are separate from an investment contract https://x.com/GOPMajorityWhip/status/1633970248549269511

- Patent US11196566B2 https://patents.google.com/patent/US11196566B2/en

- Patent US11895246B2 https://patents.google.com/patent/US11895246B2/en

- Patent US12231579 https://patents.google.com/patent/US12231579B2

- Patent JP6813477B2 https://patents.google.com/patent/JP6813477B2/en?oq=JP6813477B2

- Patent JP7204231B2 https://patents.google.com/patent/JP7204231B2/en?oq=JP7204231B2

- Patent JP7533974B2 https://patents.google.com/patent/JP7533974B2/en?oq=JP7533974B2

- Patent JP7533983B2 https://patents.google.com/patent/JP7533983B2/en?oq=JP7533983B2

- Coinbase IPR Challenge https://ipfs.veridao.io/ipfs/QmYVWQ8H27hKUKbcSZ65c3cW5mKFqYoZNeEbFyyPUKU7zw

- VeADIR Platform Functionality https://x.com/SovereignRiz/status/1895966806294347820

- VeADIR Platform Functionality - VeTest Channel on YouTube https://www.youtube.com/@VeTest

- John Doe Affidavit - Coercion and Threats to cease YouTube Channel https://ipfs.veridao.io/ipfs/QmWUBhbCdjxcw7YqgVZgoi3tLgjRjaB2TbuKK9GFLqfW4X

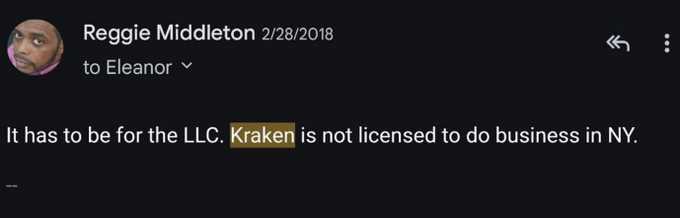

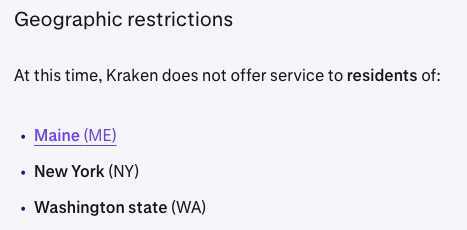

- Kraken Geographic Restrictions - https://support.kraken.com/hc/en-us/articles/where-is-kraken-licensed-or-regulated

- FOIA Requests - https://veridao.io/portal/doc/foia/

- Tenreiro Failed to correct the record after Doody admitted the Kraken account was in the name of Veritaseum LLC https://drive.google.com/file/d/13EWiq0vTC45vVL_ba1MyQ3LlBgu9AeyN/view

- Veritaseum's 423 page reply to the SEC's TRO https://www.docdroid.net/aoxUsn9/veritaseum-reply-to-sec-emergency-tro-pdf

- Jamaican Stock Exchange - MOU https://ipfs.filebase.io/ipfs/QmavFmoLjENn3HMDbqDfaWYSyBTXMoFCvitX1mUg2MFs1W

- Nigerian Stock Exchange Joint Venture Agreement https://ipfs.filebase.io/ipfs/QmfKmjuVMx5BZQheh3d2gbgaNRD46e1xDgwvcjhG5QFSFW

- SEC Memo of Law in Further Support of TRO - https://ipfs.filebase.io/ipfs/QmNTUU5RDahZmdBNxAHSvWDrTA2SRqoDgKuLdteUpVqKWq

- Bar Complaint against Jorge Tenreiro https://veridao.io/portal/guide/tenreiro/complaint/

- Lloyd Cupp Affidavit https://ipfs.filebase.io/ipfs/QmbWKzr7PtPXU8US6yeuTJAGzRc8tBm63AsHMS4hZ48K63

- Letter from JD Vance to Gary Gensler regarding the Debtbox case https://ipfs.filebase.io/ipfs/QmTJ3WXTGPqqUwq7bNQer2cPR9DdPnxhtoqQbNsBHt9NcH

- Parallels of the TRO issued in the Debtbox and that of Veritaseum - https://x.com/SovereignRiz/status/1820449919741694380

- SEC Press Release https://www.sec.gov/newsroom/press-releases/2019-150

- Jorge Tenreiro argued the case against Ripple's Christian Larsen https://docs.justia.com/cases/federal/district-courts/new-york/nysdce/1:2020cv10832/551082/56

- SEC v Reggie Middleton Case Information https://www.sec.gov/enforcement-litigation/distributions-harmed-investors/sec-v-middleton-et-al-case-no-19-cv-4625-edny

- Finance Magnates Debtbox Article https://www.financemagnates.com/cryptocurrency/gross-abuse-of-power-us-court-sanctions-sec-for-actions-against-debt-box/

- US Court sanctions SEC in Debtbox case https://www.govinfo.gov/content/pkg/USCOURTS-utd-2_23-cv-00482/pdf/USCOURTS-utd-2_23-cv-00482-3.pdf

- Letter to AGC https://veridao.io/portal/guide/tenreiro/response/

- WSJ Article - "SEC ousts top litigator who battled with crypto giants" https://www.wsj.com/finance/currencies/sec-ousts-top-litigator-who-battled-with-crypto-giants-558548a8

- Did the SEC commit Fraud? https://x.com/SovereignRiz/status/1846228535666790632

- The VeriDAO's ProjectSunlight: The SEC Revelation https://x.com/SovereignRiz/status/1852060316059803719

🙏 Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Just scan the QR code 📲

🔗 Crypto – Send contributions via Coinbase Wallet to: Dinarian.cb.id

Your generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

.

.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.