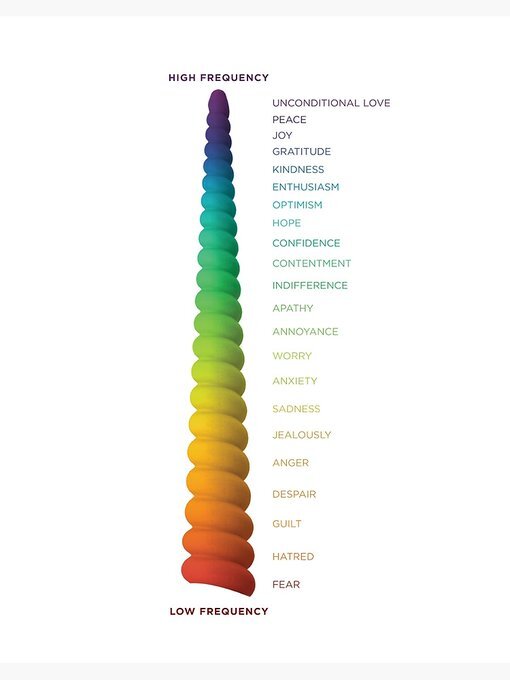

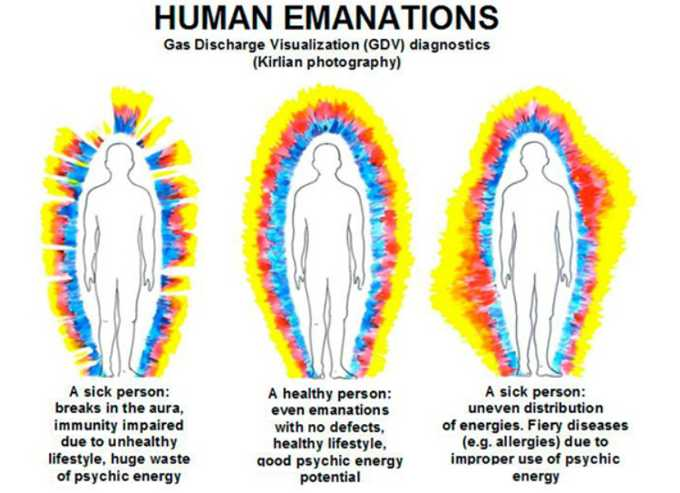

HONEY IS LITERALLY ALIVE Under Kirlian photography, Honey shows one of the strongest energy fields of any natural substance (GOLDEN AURA). One of the only substances on Earth that can RAISE the HUMAN AURA & activate dormant DNA Its a DIVINE superfood we cannot even fathom.

Science cannot explain this. Honey never spoils. Jars of honey found in Ancient Egyptian tombs (over 3,000 years old) are still perfectly edible today. It defies bacterial growth, decay, and entropy itself. Almost like it exists outside of time.

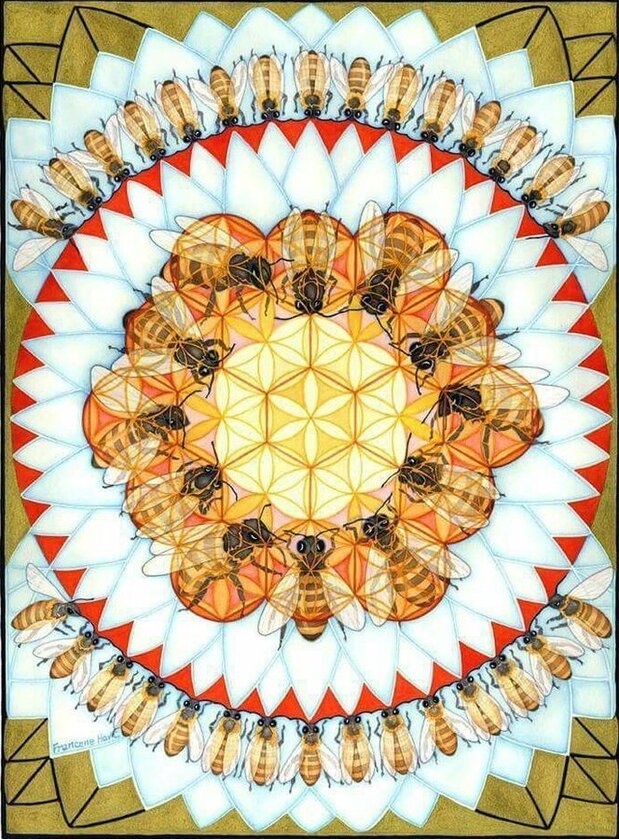

Honeys produced through alchemy. Bees collect sunlight codes from flowers. Nectar holds the frequency of the flower's essence. Bees transmute this into honey through sacred geometry (the hexagonal honeycomb) and vibrational frequency. If you've done DMT you've seen this geometry.

The hexagon is the most stable shape in the universe. It represents perfect balance in sacred geometry. This is why honey holds higher vibrational information. The bees are working with some sort of divine mathematics. Bees are literally building fractal reality.

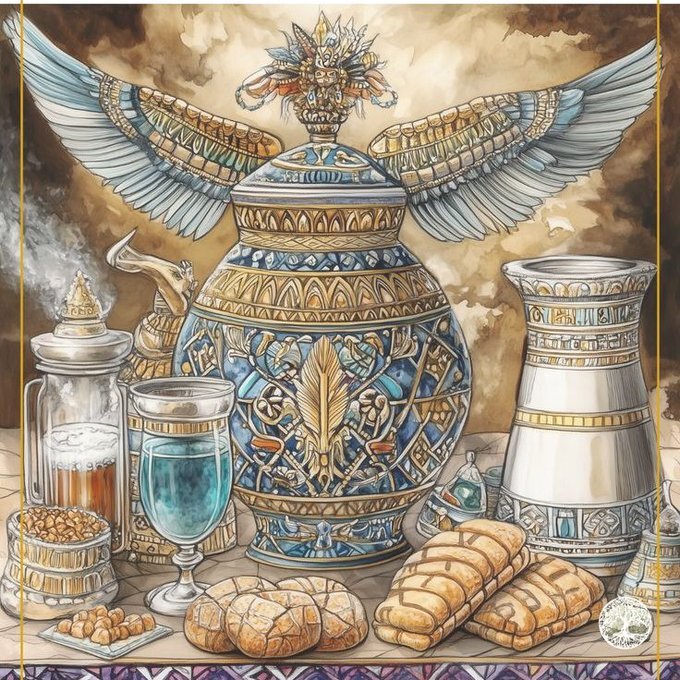

Honey was seen as sacred by ancient civilizations. Egyptians called it "the tears of Ra". Sumerians said honey was the food of the gods. Its mentioned 61 times in Bible "Promised Land flowing with milk & honey" Exodus 3:8, representing prosperity + abundance. It is also in The Quran.

Honey is liquid sunlight. Plants absorb photonic light energy from the sun. Bees extract the essence of this light frequency from flowers and encode it into honey. When you eat honey, you're literally consuming light codes.

Honey is HIGHLY intelligent! If you put a jar of honey in a room, it will: - Absorb negative energy - Clear the frequency of the space - Protect from low vibrational entities

The frequency of honey resonates at 540 Hz. This is the frequency of love, harmony & healing. It's one of the only substances on Earth that can RAISE the HUMAN AURA and activate dormant DNA.

Honey heals at the quantum level. Studies show honey: - Repairs DNA - Boosts stem cell production - Activates the pineal gland (third eye) - Opens the heart chakra.

Modern science is only scratching the surface: - Honey contains over 200 bioactive compounds. - It has natural antibiotics MORE POWERFUL than pharmaceutical drugs. - It can heal wounds instantly. - It protects the body from radiation damage.

Bees are interdimensional beings. They exist between physical and etheric planes. Honey is the physical manifestation of divine energy brought into 3D form through bees.

Even modern scientists have no idea how it works exactly. Honey "contains unknown quantum properties" that scientists can't yet explain. It's the only food on Earth that contains the full spectrum of light.

So when you eat RAW local honey... You are literally consuming: - Solar energy - Cosmic intelligence (monks fasted on honey) - Divine frequency. This is why honey cannot be replicated in a lab. It is encoded with universal intelligence that exists beyond the material world.

Endless benefits:

- Powerful antioxidant and immune booster.

- Honey repairs DNA and protects against cancer.

- Feeds the gut microbiome

- Natural nootropic

- Honey neutralizes heavy metals and toxins in the body

- Heal wounds and regenerate skin cells

- Protects against heart disease and strokes

- Activates stem cells and accelerates physical healing

- Protects against radiation and EMF damage

- Contains over 200 bioactive compounds that modern science cannot fully identify

- Natural anti anxiety / anti depressant properties

- Natural sleeping aid

Honey literally heals the body, mind + spirit. Its the only food on Earth that contains the perfect ratio of fructose & glucose. This allows it to feed the brain, nourish the cells, and detoxify the body simultaneously.

🙏 Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Just scan the QR code 📲

🔗 Crypto – Send contributions via Coinbase Wallet to: Dinarian.cb.idYour generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.