Theta EdgeCloud has now deployed a suite of Agentic AI tools, designed to support AI developers building on Theta blockchain. These tools are a critical step to building out the functionality and usability of EdgeCloud, enabling it to become the leading Decentralized Cloud for AI, media & entertainment use cases.

The tool-use capability of large language models (LLMs) extends their functionality far beyond static text generation, enabling them to interact dynamically with external systems, APIs, databases, and software tools. By leveraging these tools, LLMs can perform real-time data retrieval, code execution, complex calculations, image generation, and more. This unlocks powerful possibilities such as autonomous agents that can reason and act in the real world, AI assistants that can build applications or analyze data on the fly, and domain-specific systems that combine language understanding with external knowledge and computation — paving the way for more capable, adaptable, and interactive AI systems and agent-driven AI workflows.

Now, Theta EdgeCloud has released the “Agentic Tools” feature for its RAG chatbot product, marking a major step forward in agent-driven AI workflows. With Agentic Tools, developers can now equip their chatbots with external capabilities such as web search, API calls, code execution, and document manipulation — enabling the bots to reason, plan, and act beyond static retrieval. This opens the door to more intelligent, goal-directed assistants that can automate complex tasks, integrate with enterprise systems, and dynamically adapt to user needs. For developers, it means faster prototyping, more powerful applications, and a seamless path from natural language to real-world action.

The initial release of the Agentic Tools feature also supports user-defined Custom Tools, enabling developers to specify external API endpoints, define when these APIs should be invoked, and configure the parameters to be used — all based on the chatbot’s conversation context. In addition to custom tools, the release includes several powerful built-in tools such as Web Search and Text-to-SQL, which offer immediate utility for a wide range of applications. This blog provides an overview of these new capabilities and how to leverage them for building more dynamic, context-aware AI agents.

1. Custom Tools

To set up the Agentic Tools for a RAG chatbot you have created, navigate to the details page of the chatbot, and click on the “Agentic Tools” tab. Here you can add custom tools or use built-in tools such as Web Search or Text-to-SQL. Below we provide a few examples of how to configure custom tools that access external resources via GET, POST, and PUT requests.

1.1 GET Example

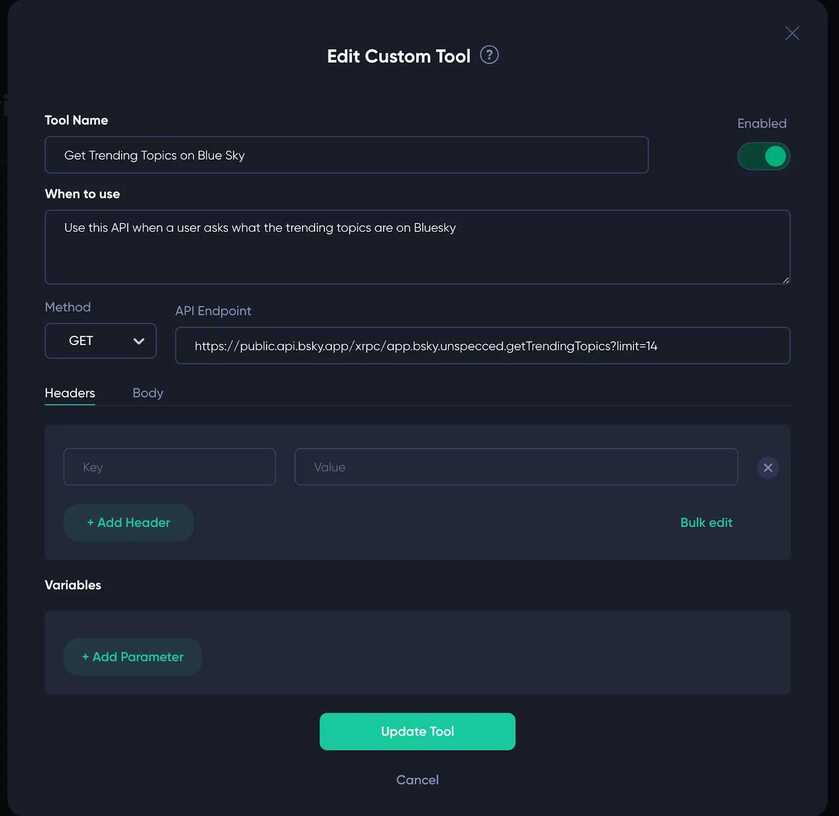

As an example, we can use BlueSky’s public API as a custom tool to look up trending topics in BlueSky:

- First click the “New” button which will pop up a modal for you to configure the custom tool

- In the “When to use” field, describe the conditions for the chatbot to call the API endpoint (see below) in natural language

- Select “GET” for the method, since in this example, we only need to retrieve the trending topics on Bluesky

- For the “API Endpoint” field, put in the Bluesky API endpoint for trending topics query

- Save the settings

Now, in the chat interface, ask what’s trending on Bluesky, and the chatbot will call the Bluesky API and then summarize the trending topics for you! It even provides links for each topic so you can simply click and open the link.

1.2 POST Example

You can also set up a custom tool that can execute a POST request similar to the one in the GET example. The only difference is that the POST request may require an API key or access token. You can set the access token via the “Headers” field as shown below. In the “Body” field you can set the fields for the JSON body to be sent for the POST request.

In this example, the user asks the chatbot to deploy a Jupyter notebook in Theta EdgeCloud in plain English. With the custom tool configured, the chatbot does the heavy lifting behind the scenes and returns the link to the Jupyter notebook, along with useful information such as the hardware specs of the node running the notebook.

1.3 PUT Example

Custom tools with PUT requests can be configured similarly to the ones for POST requests. In the following example, the custom tool uses the PUT request to update the existing Jupyter notebook deployment.

2. Web Search Tool

The “Web Search” tool allows your chatbot to search the internet for up-to-date information and enhance its responses. You can turn this feature on or off in the Web Search tab.

3. Text-to-SQL Tool

The “Text-to-SQL” tool allows your chatbot to convert natural language questions into SQL queries for database analysis. You can turn this feature on or off in the Text-to-SQL tab.

Looking Ahead

EdgeCloud’s Agentic Tools are the first step toward supporting Model Context Protocol (MCP), an open API protocol designed to let AI Agents access external tools, services, and data sources in a secure, standardized way. Think of MCP like a USB-C port for AI applications. Just as USB-C provides a standardized way to connect your devices to various peripherals and accessories, MCP provides a standardized way to connect AI models to different data sources and tools. Looking ahead, we may explore integrating MCP more deeply with the Theta EdgeCloud platform — for example, an interesting direction would be to create an MCP marketplace where users can spin up MCP servers and deploy MCP server code directly to the EdgeCloud network, leveraging both hosted and community-operated nodes. In this potential model, Edge Nodes that run MCP servers on behalf of other users could earn tokens as compensation for providing this service to the users of the MCP servers paying for the service.

🙏 Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Just scan the QR code 📲

🔗 Crypto – Send contributions via Coinbase Wallet to: Dinarian.cb.id

Your generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.