Flare mainnet is approaching the public Token Distribution Event (TDE). This document provides a recap of the token distribution and token economics.

There are two possible versions of the tokenomics, dependent on whether Flare Improvement Proposal 01 (FIP.01) passes:

- The original distribution scheme, planned under different market conditions when the purpose of Flare was to provide a smart contract layer for XRP only.

- The proposal encapsulated in FIP.01, which factors in new market conditions and the far larger vision of Flare to present developers and users with a simple and coherent stack for decentralized interoperability.

Charts and descriptions are shared for both versions below. To avoid confusion, charts pertaining to the tokenomics after approval of FIP.01 have a green border, and those pertaining to a rejection of FIP.01 have a red border. This document covers each in turn. For more details of the specific differences between the versions, please see the FIP.01 blog article.

Headline Figures

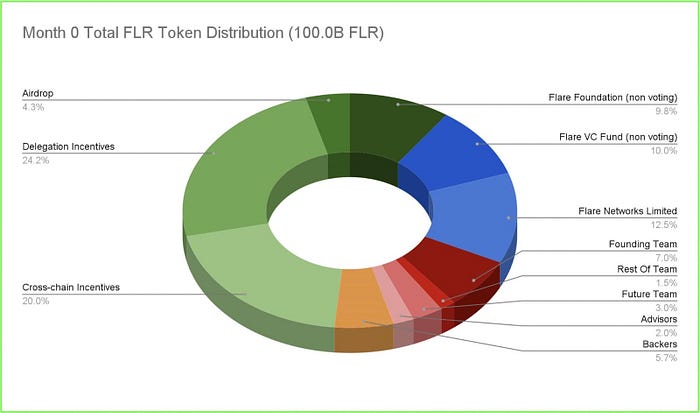

Full details and vesting information are in tables further down, but TL;DR, the most important numbers to know are below. The figures are the same for both potential distribution versions.

Total token distribution on day 1:

- 100 Billion FLR tokens.

Community FLR allocation:

- 28.5 Billion FLR distributed direct to community members over 36 months.

- 20 Billion FLR available for community members who bring value onto the Flare network by using Flare’s cross-chain bridges (FAssets & Layer Cake).

- 9.8 Billion FLR allocated to the Flare Foundation for community & ecosystem initiatives.

- TOTAL 58.3 Billion FLR.

Team, advisors & backers:

- 5.7 Billion FLR to be provided to early stage backers, vesting from month 6.

- 13.5 Billion FLR allocated to existing and future team members, plus advisors. The team is restricted from selling any FLR in the first 6 months, no more than 10% of their holdings in the first 12 months, and no more than 25% (inclusive of the initial 10%) of their holdings within the first 18 months.

- TOTAL 19.2 Billion FLR.

Flare entities:

- 12.5 Billion FLR allocated to Flare Networks Limited, which is responsible for native product development on Flare (e.g. Layer Cake bridges).

- 10 Billion FLR allocated to the Flare VC Fund, which will invest in promising ecosystem projects.

- TOTAL 22.5 Billion FLR.

Summary:

Flare is the transactional token for Flare Network

- Network: Flare

- Token name: Flare

- Ticker: FLR

- Genesis supply: 100 Billion

- Decimals: 18

- Genesis date: 14 July 2022

- Anticipated Token Distribution Event (TDE): By 9 January 2023 🤑

Flare Token Utility

Flare is a Layer-1 blockchain built to connect everything. It presents a technology stack that will enable:

- Scalable EVM-based smart contracts.

- Highly decentralized price feeds.

- Secure state acquisition from other blockchains.

- Superior bridging for smart contract and non-smart contract assets.

- Secured data relay.

- Horizontal scaling through a fully interoperable multi-chain ecosystem.

Flare (FLR) is the network token and will provide support for each of these functions:

- Incentivized delegation to the Flare Time Series Oracle (FTSO) to support the provision of reliable decentralized price data.

- Collateral within Flare’s bridging applications, FAssets and Layer Cake, by operating as an Agent or Bandwidth Provider, respectively.

- Collateral for securing Data Relay.

- Collateral within third party decentralized applications built on Flare blockchains (cross-chain or solely native).

- Participation within network governance.

- Transaction fees in order to prevent spam attacks.

Definitions

* Explanations:

- Can delegate: Tokens that can be delegated to the Flare Time Series Oracle to earn standard inflationary rewards.

- Can earn: Tokens that can be wrapped in order to to receive a share of the public token distribution in the form of delegation incentives. This is only relevant if the governance proposal FIP.01 is passed by the community.

- Can vote: Tokens that can be used to participate in governance by voting on Flare Improvement Proposals.

Token distribution by exchanges

In both potential distribution outcomes, centralized exchanges have an important role to play in providing FLR tokens safely and efficiently to their customers. Flare has been communicating with the exchanges to assist them with their FLR integration and has requested confirmation that they will be ready to distribute FLR as close to the TDE date as possible.

Proposed updated distribution

This will be the token distribution should Flare Improvement Proposal 01 (FIP.01) be successfully passed by community governance. The full details of the changes are available in the FIP.01 blog post. Important highlights are:

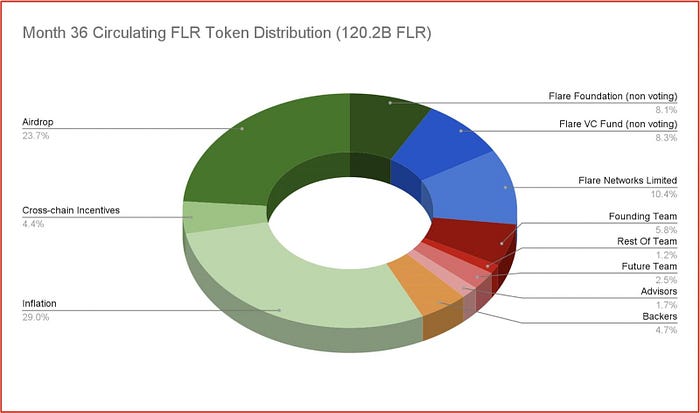

- The 28,524,921,372 FLR public distribution will be split into two parts. The first 15%, which equates to 4,278,738,206 FLR, will be distributed during the Token Distribution Event (TDE) to wallets that held XRP on 12.12.20. The remaining 85% or 24,246,183,166 FLR will then be distributed in 36 monthly amounts directly to token holders who have wrapped their FLR into WFLR. There will be 35 monthly distributions of 2.37% of the total (676,040,637 FLR) and a final distribution of the remaining 2.05% of the total (584,760,871 FLR) in month 36.

- Annual inflation will be calculated based on circulating supply rather than total supply in order to avoid excess liquidity in the early stages after TDE. Furthermore, instead of inflation running at 10% ongoing, it will be 10% in year 1, 7% in year 2, and then 5% from year 3 onwards.

- The cross-chain incentive pool payout will be changed to include all cross-chain participants on Flare (i.e. Layer Cake as well as FAssets). The rate of payout will be adjusted from being split equally over 120 monthly payouts to being the lesser of 3% of circulating supply per year or 10% of the remainder of the cross-chain incentive pool. This will provide a better balance of payout as participation grows, while avoiding payouts escalating too high and therefore draining the pool too fast.

Vesting detail for proposed distribution update

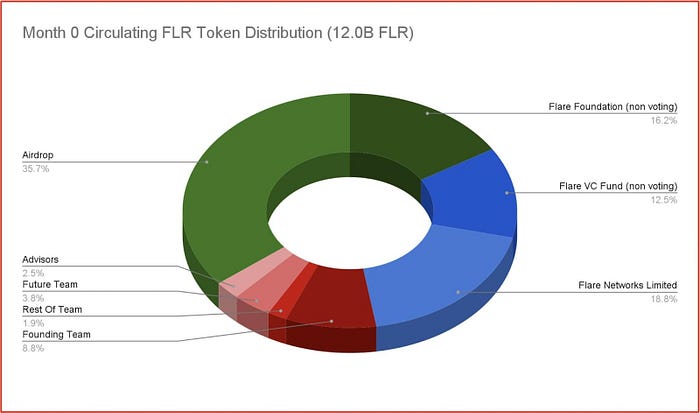

Charts visualizing the token distribution should FIP.01 be approved by the community

Legacy distribution

The legacy token distribution will be followed if Flare Improvement Proposal 01 is not passed. The full details of the changes are available in the FIP.01 blog post. Important highlights are:

- The entire 28,524,921,372 FLR public distribution will be carried out by airdrop over 36 months. During the Token Distribution Event (TDE) the first 15%, which equates to 4,278,738,206 FLR, will be provided by airdrop to wallets that held XRP on 12.12.20. There will then be 35 distributions of 2.37% of the total (676,040,637 FLR) and a final distribution of the remaining 2.05% of the total (584,760,871 FLR) in month 36, all to the same wallets that received the initial TDE distribution.

- Annual inflation will be calculated as 10% of fully diluted supply per annum, resulting in far greater liquidity in the early stages of Flare’s growth than if FIP.01 is passed.

- The cross-chain incentive pool will be paid out in 120 equal amounts over 120 months, equating to 166,666,667 FLR per month.

Vesting detail for the legacy distribution

Charts visualizing the token distribution should FIP.01 be rejected by the community

Summary of public token distribution options

The total amount of tokens allocated to the public distribution is the same regardless of whether FIP.01 is passed or not: 28,524,921,372 FLR.

The first portion of these tokens (15%) will be distributed prior to the FIP.01 governance vote taking place. Therefore, at the Token Distribution Event, exchanges and self-custody wallets will receive 0.1511 FLR for every 1.0000 XRP held for both YES and NO vote tokenomics.

If FIP.01 passes, there will be no additional airdrops. The remaining public allocation of 24,246,183,166 FLR will be distributed in 36 monthly amounts directly to token holders who have wrapped their FLR into WFLR.

If FIP.01 does not pass, there will be 36 additional monthly distributions to each address that participated in the December 2020 snapshot. The first 35 of these distributions will be in the ratio of 0.0239 FLR for every 1.0000 XRP held at the time of the snapshot. The final distribution will be in the ratio of 0.0206 FLR for every 1.0000 XRP.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.