(Dinarian Note: Interesting but not surprising that Accenture is one of the key stocks they are loading up on. In case you do not know what/who Accenture is, THEY are fusing the current world & finance with artificial intelligence and digital assets. Yes, cryptos.. they were never made for you and I, they were made for AI to use. This is and always has been the plan, from the beginning...https://www.accenture.com/us-en/services/ai-artificial-intelligence-index This is all a part of Agenda 2030 now relabeled as Sustainability Development https://www.weforum.org/agenda/sustainable-development)

The Swiss National Bank has spent years creating Swiss francs, buying dollars, euros, and other currencies with those francs, and then buying assets denominated in those currencies – including a vast portfolio of US stocks.

But that gig is up, it seems. Asset prices have fallen sharply, and the SNB is unloading. It doesn’t disclose details on its balance sheet, but it has to disclose its US stock holdings in quarterly regulatory filings with the SEC, and it now filed its Form 13F for its Q3 holdings. We’ll get to those in a moment.

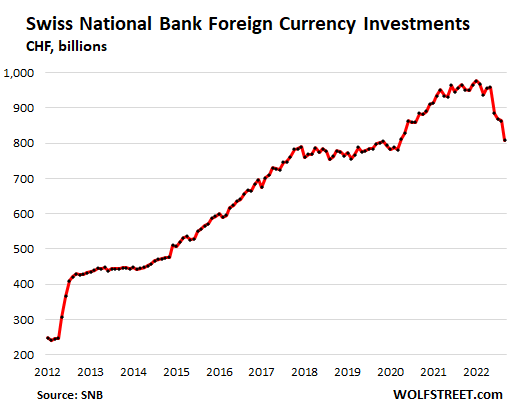

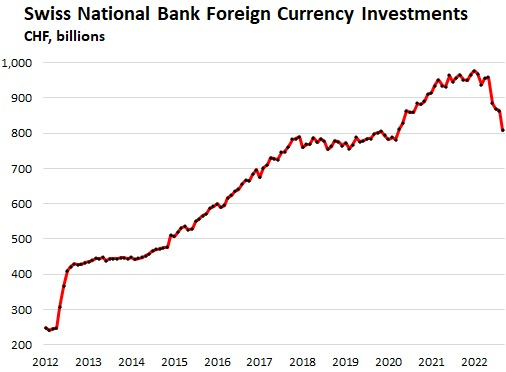

The total of “Foreign currency investments” on its balance sheet – which includes US stock holdings plus its other foreign currency investments – peaked in February 2022 at CHF 977 billion ($1.04 trillion at today’s exchange rate). By the end of September 2022, they’d plunged by 17%, or by CHF 160 billion, to CHF 808 billion, the lowest since March 2020:

The composition of the CHF 160 billion plunge in its holdings is a mix of market prices, asset sales, and exchange rates of the CHF to the currencies involved.

The SNB’s US stock holdings.

From the SNB’s filings of Form 13F with the SEC, we can see that the SNB not only took losses from the price declines of its US stock holdings, but that it also sold down most of its largest positions, reducing the number of shares it holds in Apple, Microsoft, Alphabet, Amazon, Meta, etc.

From June 30 through September 30, the value of the SNB’s US stock holdings fell by 8.0 billion, or by 5.4%.

From March 31 through September 30, which had been the peak in terms of the quarterly filings, its US stock holdings fell by $37.5 billion, or by 21.2%.

The value of its US stocks had peaked at the end of Q1 at $177 billion, and by September 30, they’d dropped to $139.8 billion.

Q3 spanned the powerful bear-market rally-and-bust over the summer, with the end effect that the S&P 500 fell 5.3% from June 30 through September 30, and the Nasdaq Composite fell 4.1%.

The SNB is broadly invested in the US stock market. At the end of Q3, it held about 2,770 stocks, including a whole bunch that have become penny stocks, and a slew that went public via merger with a SPAC or via IPO over the past two years and that are now populating my pantheon of Imploded Stocks, such as Carvana.

Let’s take Carvana:

- December 31, 2021: SNB held 289,105 shares, $67.01 million, at $231.79 per share.

- September 30, 2022, down to 213,300 shares, at $4.33 million, at $20.30 per share (-91% per share).

- Today, Carvana closed at $11.88 (up 56% in two days, LOL, but down 96% from its high, and down 41% from the SNB’s booked price on Sep. 30).

The SNB loaded up with these types of stocks that then imploded. It’s kind of funny that it helped enable the craziest US stock market bubble ever. But now it’s trying to unload them.

Top 50 stock holdings by value.

The SNB cut its holdings (reduced the number of shares) in 42 of the top 50 stocks by value in its portfolio from June 30 through September 30.

The SNB started cutting it holdings of some stocks in Q2 already, such as Apple, Meta, Alphabet, and a bunch of others.

But it was still adding to its holdings in Q2 of stocks that it then started to unload in Q3, such as Amazon, Chevron, etc.

Even Apple is on the chopping block: The SNB cut its holdings since June by 649,000 shares, and since March 31 by 918,000 shares, to 70.14 million shares.

It also has some big winners on the list: oil companies, and it’s also unloading them.

It added to its position in Q3 in only 8 of the top 50 stocks, including of Tesla, whose stock is down 52% from its high. The 8 positions that where it increased the share count since June 30 are marked in bold.

| Top 50 Holdings by value | As of Sep. 30 | Share Count change since | ||

| $ Million | # shares | Jun 30 | Mar 31 | |

| APPLE INC | 9,694 | 70,142,608 | -649,000 | -918,100 |

| MICROSOFT CORP | 7,171 | 30,791,655 | -102,700 | -101,500 |

| AMAZON COM INC | 4,484 | 39,684,040 | -47,400 | 144,600 |

| TESLA INC | 3,037 | 11,448,877 | 16,600 | 357,100 |

| ALPHABET INC | 4,844 | 50,514,240 | -222,300 | -314,300 |

| UNITEDHEALTH GROUP | 2,053 | 4,065,726 | -15,700 | -13,700 |

| JOHNSON & JOHNSON | 1,863 | 11,403,816 | -1,600 | 1,300 |

| EXXON MOBIL CORP | 1,594 | 18,256,191 | -108,500 | -80,600 |

| META PLATFORMS | 1,349 | 9,939,610 | -77,000 | -309,400 |

| NVIDIA CORPORATION | 1,317 | 10,851,824 | 7,200 | 23,600 |

| PROCTER AND GAMBLE | 1,313 | 10,397,973 | -200 | -83,500 |

| VISA INC | 1,267 | 7,132,219 | -61,800 | -99,900 |

| HOME DEPOT INC | 1,229 | 4,453,966 | -75,800 | -68,900 |

| CHEVRON CORP NEW | 1,162 | 8,089,332 | -358,900 | -260,000 |

| LILLY ELI & CO | 1,132 | 3,500,048 | -11,400 | -21,700 |

| MASTERCARD | 1,070 | 3,763,457 | -22,400 | -36,100 |

| PFIZER INC | 1,064 | 24,316,241 | -77,200 | 5,300 |

| ABBVIE INC | 1,028 | 7,658,375 | -14,300 | 1,200 |

| COCA COLA CO | 1,000 | 17,847,594 | -18,700 | 74,400 |

| PEPSICO INC | 978 | 5,992,804 | -8,400 | 4,200 |

| MERCK & CO INC | 944 | 10,959,232 | -5,700 | 18,700 |

| COSTCO | 907 | 1,919,999 | -3,600 | 6,300 |

| THERMO FISHER SCIENTIFIC | 860 | 1,696,527 | -400 | -10,200 |

| WALMART INC | 851 | 6,561,583 | -56,400 | -81,200 |

| BROADCOM INC | 777 | 1,750,042 | -26,800 | -32,700 |

| DANAHER CORPORATION | 773 | 2,993,270 | 45,300 | 207,700 |

| DISNEY WALT CO | 745 | 7,893,971 | -3,700 | 21,200 |

| MCDONALDS CORP | 740 | 3,204,957 | -20,600 | -31,600 |

| ABBOTT LABS | 734 | 7,588,265 | -61,600 | -70,700 |

| CISCO SYS INC | 718 | 17,945,820 | -74,300 | -321,800 |

| ACCENTURE PLC IRELAND | 706 | 2,744,938 | 3,400 | 9,100 |

| VERIZON | 691 | 18,200,201 | -9,300 | 267,900 |

| NEXTERA ENERGY | 668 | 8,513,682 | -500 | 15,100 |

| BRISTOL-MYERS SQUIBB | 656 | 9,226,857 | -228,400 | -387,000 |

| SALESFORCE | 620 | 4,307,331 | 34,500 | 67,000 |

| TEXAS INSTRUMENTS | 619 | 3,996,283 | -9,900 | -3,700 |

| LINDE | 587 | 2,178,568 | -44,800 | -41,400 |

| CONOCOPHILLIPS | 574 | 5,605,529 | -31,600 | -107,200 |

| COMCAST | 568 | 19,374,429 | -249,200 | -374,000 |

| ADOBE SYSTEMS | 564 | 2,047,689 | 1,500 | -13,100 |

| PHILIP MORRIS | 558 | 6,717,922 | -5,000 | -25,100 |

| QUALCOMM | 548 | 4,853,622 | -35,200 | 2,600 |

| CVS HEALTH | 542 | 5,683,010 | -10,500 | -34,600 |

| UNION PACIFIC | 531 | 2,723,316 | -39,500 | -61,100 |

| RAYTHEON | 528 | 6,445,414 | -28,100 | -37,500 |

| AMGEN | 522 | 2,315,026 | -101,300 | -124,600 |

| LOWES COS | 520 | 2,769,839 | -136,500 | -148,400 |

| UNITED PARCEL SERVICE | 514 | 3,182,818 | 5,100 | 24,600 |

| HONEYWELL | 493 | 2,950,055 | -24,900 | -31,700 |

| AT&T | 476 | 31,025,262 | 40,300 | 95,600 |

A note about this racket.

All its operations combined generated a massive loss of CHF 142 billion in the first nine months of the year, nearly all of it due to these foreign currency investments, which include the losses related to the decline in prices of the stocks and bonds and CHF 24 billion in losses related to exchange rates.

When the SNB was printing Swiss francs to buy foreign-currency-denominated assets, it wasn’t actually doing QE in Switzerland; it was more like doing QE in other countries.

The SNB’s purchases of US stocks – with dollars that were bought with francs that it had created out of nowhere – had a similar effect as if the Fed had bought US stocks.

So now the process is reversing – a form of QT in other countries as the SNB is shedding some of its assets, and losing its butt on others.

What the SNB did was one of the most fabulous central-bank rackets ever, empowered by global speculators and investors that kept buying these Swiss francs that the SNB was creating and selling, and their appetite was driving up the currency’s exchange rate, and the SNB took advantage of it to print more francs, sell more of them for foreign currency – ostensibly to push down the exchange rate of the CHF against the euro, the dollar, and other currencies – and buy more stocks and bonds denominated in other currencies.

So now this tiny country has a $1 trillion portfolio of foreign assets that it has purchased at essentially zero cost – meaning with money it created at zero cost – and its paper losses are just squandering some of the cream of that wondrous racket.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.