The XDC Network (XDC) is an enterprise-ready, open-source, hybrid blockchain protocol specializing in tokenization for real-world decentralized finance. The company behind the technology, XinFin Fintech, created the XDC Network in 2017. The network is currently governed by the XDC Foundation, a non-profit entity incorporated to support the growth, development, and adoption of the XDC Network through community-driven efforts.

The XDC Network is designed to support a wide range of novel blockchain use cases by offering interoperable smart contracts, near-zero-fee transactions, and high security. XDC Network supports all EVM-compatible smart contracts, protocols, and atomic cross-chain token transfers. It also fully complies with the ISO-20022 message standard and its applications in trade finance and other payment sectors.

This innovation has resulted in the world’s first NFT (as a single XRC20 token) backed by trade finance assets being deployed on XDC Network in September 2021. The NFT was created by Tradeteq, a member of the World Economic Forum: Global Innovators Community, alongside Accelerated Payments, an invoice financing company, as the asset originator. Despite being a token, the asset is still compatible with trade finance industry messaging standards and demonstrates how trade finance assets could be made available through blockchain-based systems to those interested in this lower-risk investment sector.

XDC Network’s capabilities in enterprise applications, and specifically trade finance, garnered the attention of the broader global trade industry. In 2021, TFD Initiative, DNI Initiative, and the International Trade & Forfaiting Association selected XDC Network as their first blockchain member.

For developers looking to set up their projects on the XDC Network, it offers a no-code token creation app, known as Origin, as well as software development kits to assist developers in building on XDC Network. Being an EVM-compatible network, developers on other networks can seamlessly create or port over their EVM projects. Ordinary users can learn XDC concepts in the complimentary XDC Basics of Blockchain Workshops, consisting of 2 parts; Part 1 — Fundamental Concepts and Part 2 — Advanced Concepts. Conversations on XDC’s development are actively held on XDC.dev, a community for blockchain developers. It acts as one of the resource centers for blockchain engineers, including a knowledge base, tools, and support.

While the current XDC Network runs on a Distributed Proof-of-Stake (DPoS) consensus algorithm, a novel consensus engine developed exclusively for XDC, XDPoS 2.0, has been released in testnet. This upgrade, which is entirely backward-compatible in terms of APIs and is based on the latest Byzantine Fault Tolerance consensus mechanisms, maintains the security and performance of the XDC Network, while minimizing the amount of resources required to operate. Additionally, the new consensus layer will serve as the foundation for the next phase of XDC Network’s future development.

As of 1st June 2022, XDC Network celebrated three years of achievements since the launch of its mainnet back in 2019. The network has seen upwards of 372M transactions and the creation of over 865,576 accounts, with more than 12,400 smart contracts deployed on the network. Currently, the native XDC token has a market cap of $500M and a fully diluted valuation (FDV) of $1.54B. The circulating supply of XDC is ~13.81 B out of a total of 37.81B tokens. You can check out the list of exchanges to trade XDC on CoinGecko.

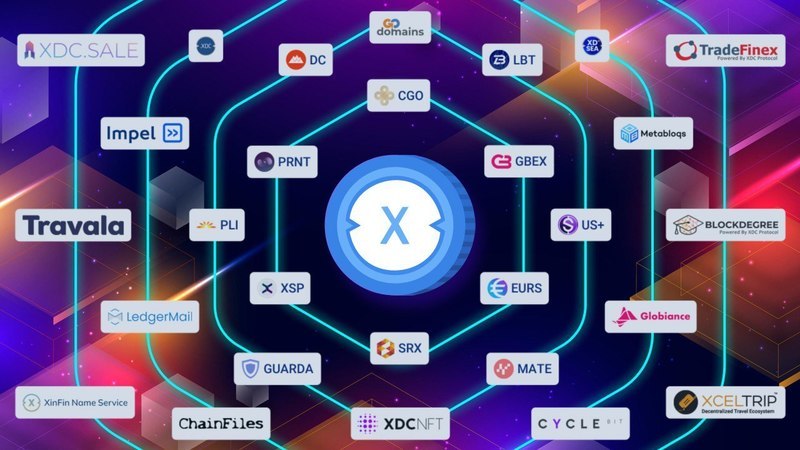

The XDC community continues to expand and develop projects centered on NFTs, the metaverse, financial enterprise applications, and DeFi — all on XDC. The XDC token is listed on over 40 exchanges, including several top exchanges such as Kucoin and Huobi, with more than 20 wallets supporting native XDC and XRC20 tokens, including custodial wallets such as Fireblocks, Propine, Copper, and Bitpanda. With easy-to-use tools such as Origin for token creation, XinFin Remix. The welcoming environment for new projects on the XDC Network has contributed to the ecosystem's rapid growth. With so many assets currently available on the network, you can head over to the XDC Ecosystem category on CoinGecko to check them out.

Assets on XDC Network

StorX Network

StorX (SRX) is an open-source trustless, censorship-resistant decentralized cloud storage network. StorX empowers users to store their data securely in a decentralized manner.

Comtech Gold

The Comtech Gold token (CGO) is a stable asset pegged to the price of one gram of pure gold, which is fully backed and redeemable for physical gold. Comtech is registered in the UAE and complies with Shariah principles.

Plugin

Plugin (PLI) is a decentralized oracle platform that provides cost-effective solutions to any smart contract. The plugin enables the smart contract to connect to real-time data off-chain. The data feeds are trustable and maintained with high security.

Law Blocks

Law Blocks (LBT) has launched an application for digitally transforming how organizations or people prepare, e-sign, act on, and manage agreements using blockchain technology. The platform is free to use, allowing users to upload their contracts to the Law Blocks platform, e-sign documents cryptographically, and store them on XDC Blockchain Network.

XSwap Protocol

XSwap protocol (XSP) is an automated market maker for XRC20 tokens built on the Xinfin Network. XSWAP is focused on building the challenger to BSC-based PancakeSwap and Ethereum-based Uniswap. Its primary focus is to empower crypto enthusiasts with secure, fast, and resource-efficient instruments for exchanging digital assets.

Prime Numbers

Prime Numbers (PRNT) is an ecosystem composed of various DEFI and NFT protocols that generate revenue for its community from the Primeport.xyz NFT marketplace and the first lending and borrowing protocol on the XDC blockchain.

Globiance (GBEX)

Globiance (GBEX) is a fintech platform with a centralized exchange, banking services, payment gateways, stablecoins, and a decentralized marketplace. It offers fully-regulated services for corporate and retail customers in several countries on five continents, integrating crypto solutions into the traditional banking system.

Datachain Foundation

Datachain Foundation (DC) was launched on September 3, 2017, by BRAINCITIES LAB, a software editor based in Paris, France. The Datachain Foundation is a distributed data management platform that enables developers to build decentralized networks of AI-augmented objects and infrastructures like public lights or roads.

STASIS EURO

STASIS (EURS) is a revolutionary step towards combining the vast potential of the cryptocurrency market with the stability and reliability of traditional currencies. The tokenized assets EURS are always backed 1:1 by collateral held in reserve accounts.

US+ Stablecoin

Fluent Finance Inc. is a U.S. blockchain development and fintech company that bridges traditional and digital assets with US+. US+ includes real-time audits, smart contracts and maintains a 1:1 ratio with the U.S. Dollar.

Projects Built on XDC Network

Besides the large variety of tokens on the XDC Network, several noteworthy projects are also making use of the network’s powerful technology, allowing users to access various options.

Impel

Impel, a fintech platform that uses blockchain technology to deliver financial messages and payments, has developed the R3 Corda bridge to connect future-facing banks and institutions to the XDC Network.

LedgerMail

LedgerMail combines the power of blockchain, XDPoS consensus, cryptographic algorithms, and zero-trust mechanisms to provide a decentralized email service.

Metabloqs

In a metaverse powered by XDC Network, users can roam around the virtual world of Metabloqs and engage in various activities such as picking up new skills, networking, or playing exciting games. By creating a unique ecosystem, Metabloqs is creating a world where users can create and monetize their experiences using their own native utility token.

Blockdegree

Blockdegree provides online blockchain training to engineers and professionals. Users can explore a variety of basic and advanced courses from Blockdegree to begin their journey as a developer on XDC.

Go Domains

GoDomains is a decentralized name service solution offered by Go Domains that enables you to easily generate collectible self-owned unique public addresses. With a catchy domain name and a cryptocurrency-focused domain extension, Go Domains can be used to replace your lengthy wallet addresses.

XDC Web3 Domains

Similarly, XDC Web3 Domains allows user to build their identities by owning a .xdc domain. NFT domains can not not only be used to identify wallets but also function as web addresses.

Chainfiles

ChainFiles aims to be an online notarization service powered by blockchain technology. Digital notarization is one of blockchain technology's best use cases because of its immutable nature and timestamping accuracy.

TradeFinex

TradeFinex.org is a P2P trade finance platform to create trade instruments of value between buyers and sellers in the Trade Finance market. It is an open protocol for banks, institutions and users consortium-led governance making it truly decentralized.

XinFin Name Service

XinFin Name Services is a domain name service for the XDC Blockchain. Mint your blockchain domains as NFT assets that will bind the domain to your wallet address.

Mateico

Mateico is a platform that combines art, culture, investments, and charity. The Mateico ecosystem will bring about innovative solutions based on blockchain technology, virtual reality, and augmented reality, with features and services that will help artists and creators.

NFT Platforms on XDC Network

Primeport is the only NFT marketplace that allows users to trade all the NFTs in the XDC network. On the other hand, XDCNFT and XDSea allow users to trade NFTs from their respective marketplaces on the XDC network.

Launchpads on XDC Network

There are two launchpads available for the new projects built on the XDC network, namely XSwap Launchpad and Globiance Launchpad.

Other XDC Network Utilities

The XDC token acts as a settlement mechanism for dApps built on top of it, adding further utility to the XDC Network.

Travala

As one of the few travel-booking portals which accept crypto assets, Travala also accepts XDC as payment for booking hotel rooms and flight tickets.

Guarda Visa Card

Get your own Prepaid Visa Card by Guarda. Top it up using your XDC crypto and use it as a regular bank card anywhere in the world, and easily spend XDC. Guarda Visa card is available as a virtual or physical card.

Cyclebit

Cyclebit is a tool for retailers to accept digital payments in-store, online, or on the go. Any product can be paid for using $XDC tokens, with the whole transaction taking just a few seconds.

XcelTrip

XcelTrip is with the intent to disrupt the travel industry, and XcelTrip users can pay for their travel needs using XDC tokens.

These are just a few of the many projects building on XDC, and there will be many more as the XDC Network continues to expand. The XDC Network ecosystem is constantly growing and expanding, with new projects and partnerships being added to it. This helps to drive innovation, increase adoption, and strengthen the overall network.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.