As lines (real and virtual) full of anxious depositors grew last week outside of Silicon Valley Bank branches around the world, and reassurances of "liquidity" were gushed from the C-Suite, three individuals within the firm were perhaps less troubled than those seeking their hard-earned cash back from the soon-to-be-failed bank.

12 days ago (on Feb 27th), Gregory Becker, the CEO of Silicon Valley

Bank, sold $3.6 million worth (11%) of his shares...

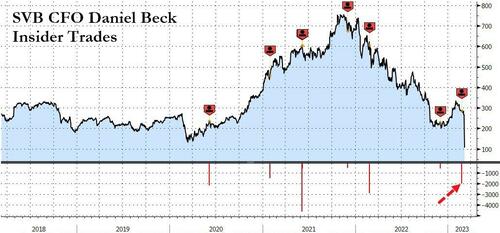

Daniel Beck, the CFO, sold 32% (around $600,000) of his holdings...

And finally, CMO Michelle Draper sold 28%...

Notice that none of them had sold anything sizable for a year or so before this most recent (pre-collapse) sale (so it is a stretch to call this a pre-planned sale).

Additionally, Silicon Valley Bank on Friday paid out annual bonuses to eligible U.S. employees, just hours before the bank was seized by the U.S. government, Axios has learned from multiple sources.

But hey, we are sure it's probably nothing to worry about, right?

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.