The new Fantom Wallet (fWallet) brings new staking features, governance proposal creation, integrated bridge and swap, and more! Begin your Fantom journey.

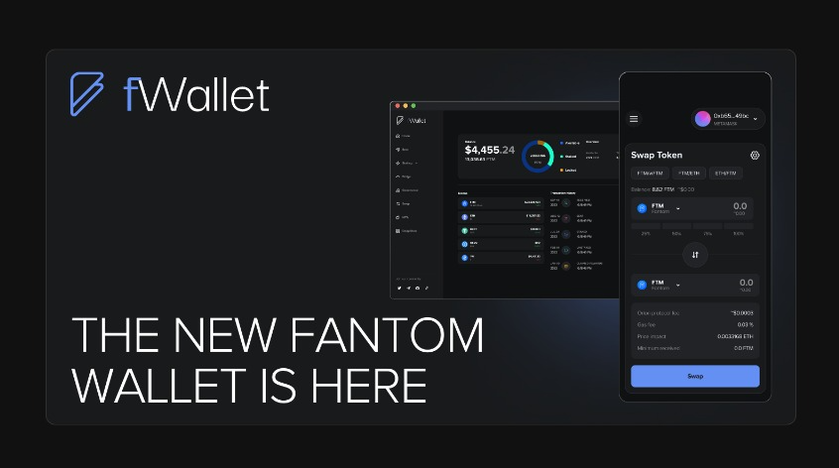

The new Fantom Wallet (fWallet) is here! We are excited to bring you a brand new way to experience Fantom.

With a fresh and user-friendly design based on user feedback, the fWallet is packed with new features and offers a seamless way to navigate and interact with Fantom.

Take a look at some of the exciting new features and screenshots of the updated interface below!

Relock and Add Time to Delegation

If you have delegated your FTM tokens to a validator, you can increase your stake by adding more FTM to your existing delegation, which eliminates the need to create a new delegation.

For example, if you have 1 FTM staked and locked at the Beefy validator for 365 days, you can increase your stake by adding more FTM to the delegation at any time.

Staking has become more convenient with a new feature that allows you to add more time to your existing locked delegation instead of waiting for the lock period to end to relock your staked FTM.

Moreover, you can now unlock a partial portion of your staked FTM tokens if you only require a few. This provides more flexibility in managing your staked tokens.

The feature previously known as “claim and restake” has been rebranded to “compound” in the new wallet! The rebrand comes with a new feature that lets you compound the rewards for all your delegations with a single button, instead of manually claiming and restaking the rewards for each delegation separately — however, this feature still requires multiple transactions.

Create Governance Proposals

Play a part in Fantom’s future by creating governance proposals, which is now available directly in the governance section of the new fWallet!

To create a proposal, you must fill out the title, description, voting options, minimum participation, minimum agreement, and date options.

If your proposal’s description exceeds the maximum length, feel free to write a post on the Fantom Forum and link the post in your proposal’s description.

Learn more about governance on Fantom.

Integrated Bridge

Bridging your tokens has never been easier as the new fWallet now includes a built-in bridge that provides a smooth and effortless way to transfer tokens between Fantom and other compatible chains, including Ethereum, Binance Smart Chain, Polygon, Avalanche, and Arbitrum.

The bridge is powered by Multichain, which is a Web3 router that enables cross-chain interactions and transfers.

Integrated Swap

Experience seamless swapping with fWallet’s new integrated swap feature, which comes equipped with a convenient chart to provide you with an overview of the token’s price history before making a swap.

The swap feature is powered by OpenOcean, which is a DEX aggregator. Aggregators provide deep liquidity by aggregating prices across DEXs on Fantom to ensure users are offered the best prices on the market and can trade low liquidity tokens without any price impact.

Currently, OpenOcean’s swap feature draws liquidity and prices from over 20 DEXs on Fantom, but we have more DEX aggregators coming to the wallet in the future!

Improved Address Book

The built-in address book feature has been improved vastly.

With its own dedicated section in the wallet, the address book now offers a search function to filter through your contacts with ease.

When creating a new contact, you are able to add a description, which is helpful to note down important details about the contact.

All contacts can now be deleted with a single click, or you can encrypt all contacts with a password for increased privacy and security.

Most importantly, you are now able to import external contacts directly into the fWallet or export your current contacts for use elsewhere, which brings unparalleled convenience.

Integrated Unstoppable Domains

Are you looking for a more user-friendly way to share your Fantom address, such as using a human-readable domain like ash.NFT? The new fWallet now offers an integration with Unstoppable Domains, making it simple to register a Web3 domain that points directly to your crypto address.

Unstoppable Domains is a blockchain-based domain system that enables users to create and manage decentralized domains. These domains are stored on a blockchain, making them censorship-resistant and immune to government or third-party intervention.

Unlike traditional domain names that are centrally managed by organizations like ICANN, Unstoppable Domains allows users to have complete control over their domains, and they can use them to build decentralized websites and applications. These domains are also compatible with cryptocurrency wallets, allowing users to receive payments using their domain names instead of long, complicated wallet addresses.

And Much More!

Add multiple wallets and switch between them with ease!

Choose between multiple currencies to display in the wallet!

Multiple languages are coming to offer better accessibility for users around the world!

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.