Good day everyone, the Dinarian here, this morning I started out with what I thought was going to be a quick research on Michelle Whitedoves Couger prediction. If your familiar with her prediction, you know that this asset is predicted to outperform even THETA. Time will tell...

Lets get started shall we...

I first looked up Couger on Linkedin and went to the "about" page. On this page I noticed a funding company known as the Itochu Corporation, which turned out to be a very large venture capital firm in Tokyo, Japan.

Upon searching a bit further I discovered that Itochu Corporation is invested in over 163 different investments. They have been around since 1999, and are on the Tokyo stock exchange. ITOCHU Corporation is registered under the ticker TYO:8001. This being important, as they are not a fly by night company by any means.

The history of ITOCHU Corporation (hereinafter "ITOCHU") dates back to 1858 when the Company's founder Chubei Itoh commenced linen trading operations. Since then, ITOCHU has evolved and grown over 150 years into a sogo shosha, engaging in domestic trading, import/export, and overseas trading of various products such as textiles, machinery, information and communications-related products, metals, products related to oil and other energy sources, general merchandise, chemicals, and provisions and food. In addition, ITOCHU has made multifaceted investments in insurance agencies, finance, construction, real estate trading, and warehousing as well as operations and businesses incidental or related to those fields.

From here I dug into their recent investments to see how they are tied to Couger. I discovered on March 31, 2023, just about the same time Connectome revamped their token to CNTM(2), they funded a partnership between FamilyMart - a group subsidiary FamiPay which has 24,523 stores, and Couger.

Coincidence? No, there are no coincidences as you will see...

They plan on installing Virtual Assistants in 5,000 stores to start, eventually these Couger Virtual Assistants will be in all 25,000 stores worldwide. The Virtual Assistants use blockchain and the Ethereum blockchain, and I am speculating Connectome (CNTM).

How do I come to that conclusion?

I know Cougers VHAs are Connectomes VHAs, the images are the same, the CEO of both companies is Atsushi Ishii. I have shown all the connections in the past. Here is Cougers virtual lab, its the same virtual assistant "Rachel" as in connectomes. https://virtualhumanlab.io/en

Here is the CEO Atsushi Ishii speaking at Ethereum Alliance 8 months ago:

And then here is Atsushi who is currently leading the development of “Connectome” using AI, AR and Blockchain as per the video description and from the man himself:

And then well, there was this:

Conclusion:

My research conducted regarding Couger and ITOCHU Corporation has led to a fascinating discovery about the integration of Virtual Human Agents (VHAs) into FamilyMart's FamiPay system. The plan to integrate VHAs into 5,000 stores in 2023 suggests that they may be looking to replace cashiers with this technology, starting with a trial run. I linked Couger's VHAs to Connectome's VHAs, highlighting the same CEO and images used in both. The CEO, Atsushi Ishii, has spoken about Connectome's development using AI, AR, and Blockchain, which adds to the credibility of the connection between the two companies. This discovery offers a glimpse into the future of retail technology and how AI and blockchain can shape the way we interact with stores.

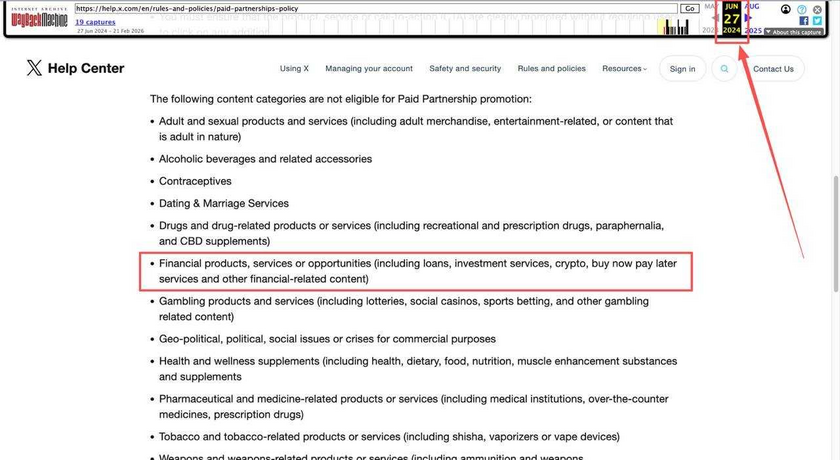

There is only one place to get the current CNTM, it is on MEXC exchange, and has only been available in its new form for a week or so.

Please note that the information presented in the above conclusion is for educational and informational purposes only. It should not be considered as financial or investment advice. The author is not a financial advisor, and this content should not be used as a basis for making financial decisions. Any investment decisions made based on this information are done so at your own risk. Please conduct your own research and consult a licensed financial advisor before making any financial decisions.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.