"Banking should be boring," said Warren recently. While the name Warren might bring to mind Warren Buffet, this time it was Senator Elizabeth Warren who spoke out in late March following the collapse of Silicon Valley Bank and Signature Bank. She called for stricter regulations for all banks, arguing that banking should not be a sector that attracts risk-takers. Coincidentally, Warren's words had barely cooled when Apple issued a press release that made headlines worldwide. The Cupertino-based technology company announced that Apple Card users can now open a savings account with an annual return of 4.15%. There are no fees, no required minimum deposit, and no minimum balance.

Let's take a closer look at the details of this announcement.

Apple is known for producing iPhones, iPads, Macs, AirPods, and Apple Watches, as well as software such as operating systems and apps like iTunes, Apple Music, and iCloud. But what does a technology company have to do with a savings account? Well, Apple has nearly 10 years of experience in financial services.

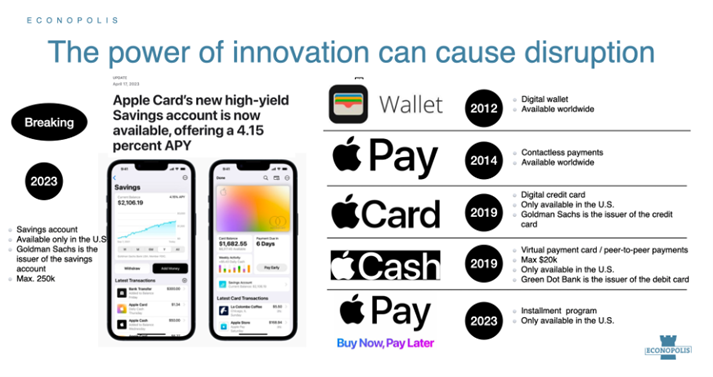

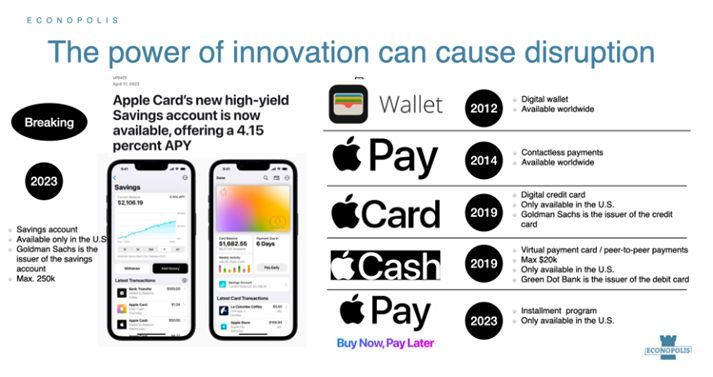

Apple's Exponential Evolution in the Financial Sector

Apple's foray into the financial sector began in 2012 with the launch of Apple Wallet, which was originally called Passbook. This digital wallet app allows users to manage digital versions of credit cards, debit cards, gift cards, boarding passes, and other documents. Two years later in 2014, Apple Pay followed, which not only allowed users to store their credit card or bank card information in the Wallet app on their Apple device, but also to make payments by bringing their device close to a contactless payment terminal. 2019 saw the launch of Apple Card, an Apple specific credit card that integrates with Apple Pay and the Wallet app on iPhones, allowing users to view and manage their spending and payment history. For this, Apple partnered with Goldman Sachs, which is the card's issuing bank, and Mastercard, which ensures that payments can be made using the card worldwide. In the same year, Apple introduced Apple Cash, a peer-to-peer payment service that allows users to send and receive money via iMessage, split restaurant bills, and pay friends. Apple collaborates with Green Dot Bank for this service, which is the issuer of the debit card. The maximum Apple Cash balance users may hold is $20,000, and Apple does not pay interest on this. Recently, in March 2023, Apple introduced Apple Pay Later, which allows users to split purchases into four payments due at different times without interest and fees. Apple finances the loan and bears the credit risk if the borrower does not repay. These small steps have led to Apple's exponential evolution in the financial sector.

And now, Apple Savings! The tech giant had already announced this service with a press release on October 13, 2022. With this week's announcement, the service is now effectively available, and the offered savings interest rate is known, a whopping annual return of 4.15%. Up to this point, the focus of most of the services mentioned above has been on facilitating digital payments and providing credit. With Apple Savings, they broaden their range of services by also attracting deposits. The maximum balance is $250,000. Technically, one should not prematurely conclude that Apple has now become a full-fledged retail bank, as those who read the fine print will find that the savings account is provided by Goldman Sachs.

You could compare this brand new offering with a similar approach in the telecom sector, where a Mobile Virtual Network Operator (MVNO) offers mobile telecommunication services but does not have its own mobile network. Instead, an MVNO buys network services from an existing mobile network operator and offers them to customers under its own brand name. An MVNO can differentiate itself from other providers by offering lower prices, targeting a specific audience or niche in the market, providing better customer service, offering innovative services and features, and/or building a strong brand. Apple certainly has some of those assets to call itself a full-fledged Virtual Mobile Bank (VMB).

It is important to note that, with the exception of Apple Wallet and Apple Pay, all of these financial services are currently only available in the US. Apple has over 1.3 billion active iPhone users worldwide, with about 10% located in the US. While there is a chance that Apple will expand these services to other regions, it is important to consider the differences in banking culture and consumer protection laws. For example, in Europe, despite the introduction of the Single Euro Payments Area (SEPA) in 2014, each country still has its own banking practices and regulations. To expand its financial services in these regions, Apple could potentially partner with a fintech player like Adyen, which has extensive knowledge and expertise in Europe, to offer payment services. Though, one thing is sure, the European payment space is a hard nut to crack.

Apple's new savings account: a win-win for customers and the company

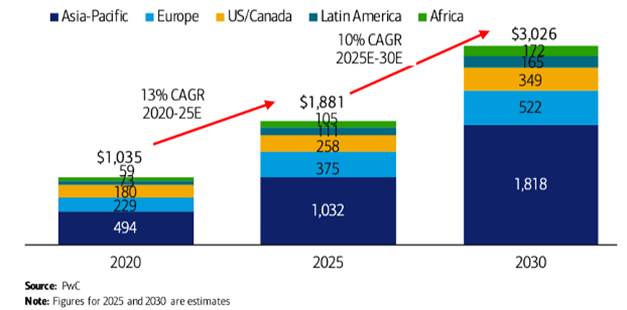

Without knowing the details of the agreement between Apple and Goldman Sachs, it is unlikely that this new deposit activity will generate significant net interest income for Apple in the short term. However, there are several reasons why Apple can extract added value from this partnership. Firstly, it can attract non-hardware users into its ecosystem through attractive financial services. Secondly, Apple can leverage the data it can access through the digital savings account. Lastly, it can strengthen customer loyalty through the ecosystem of services it offers. As shown in the overview below, the market for cashless payments is rapidly growing in all regions where Apple's products are available. Therefore, it is not surprising that a giant like Apple wants to participate in this market.

Volume of cashless transactions (US$bn)

Apple's timely launch of its savings account solution

It is not a coincidence that Apple is launching its savings account solution now. The recent fall of Silicon Valley Bank has caused a significant shift in deposits, prompting depositors to think more about the risk they may be taking by putting all their money with one bank. Diversification is becoming increasingly important, not just for investment portfolios but also for banks. As a result, large financial institutions have seen a significant inflow of new deposits. With its new offering, Apple now positions itself among them. The Cupertino-based company can rely on a lot of goodwill from the American consumer, and it provides seamless digital integration of all its services.

The rapid interest rate hike by the US central bank (FED) presents an additional favorable opportunity for Apple to successfully launch this service. The FED's policy interest rate is currently 5 percent, which is indicative of the interest rate that banks can offer their customers. US banks now receive 5 percent interest when they park their money with the FED, while they only give on average 0.38% interest to the saver (according to https://www.fdic.gov/resources/bankers/national-rates/index.html). The difference between the interest banks receive from the FED and the interest they give to savers is significant. Normally, this difference should decrease due to competition. However, the rapid increase in interest rates by the FED means that this competitive dynamic has not yet fully materialized. Banks are also pleased to finally realize rich margins after years of zero interest rates and little or no interest income, which explains the incentive they have to drag their feet to increase the deposit rate they offer.

Apple's attractive annual return of 4.15% has everything to do with the fact that it does not have to take into account, unlike existing banks, the margins of the 'backbook' or the profits on existing customers. This allows them to embed themselves more deeply as a service provider in the financial market, using their innovative technological disruption and smart challenger technique.

Giants are becoming even more gigantic.

While the focus has recently been on smaller regional banks, the US financial regulator will have its hands full with this initiative, where tech and financial giants are gathering around the campfire. Tech giants such as Apple are expected to continue innovating in the financial sector. Some future developments to watch for include expansions into personal loans, health and life insurance, and possibly the introduction of cryptocurrency, funds, and stock transactions. These developments could provide consumers with more access to credit and affordable insurance, but there are also concerns about privacy and concentration of power. With their huge customer base, technological capabilities, and significant cash resources, these giants have the potential to disrupt the financial services sector. Therefore, it is important for regulators to strike a healthy balance between innovation and consumer protection in a rapidly changing financial sector. It is likely only a matter of time before they will face stricter regulations. Do I already hear calls for breaking up tech giants, following the example of Alibaba in China?

To end with a quote from Warren Buffet, "Banking is a good business, unless you do stupid things..."

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.