📌 What is Sui?

Sui is a Layer-1 blockchain that uses a proof of stake consensus mechanism and an object-centric data model to achieve high network throughput. The protocol is powered by Move, a language that enables parallel execution of transactions without increasing the complexity for node operators. Move also provides security and protection features that allow developers to create flexible programs.

Sui was originally conceived by Mysten Labs, a company formed by former contributors of Meta’s Diem project (formerly known as Libra) that had the vision to create a permissionless blockchain based on a new language called Move.

Sui improve scalability and can be able to handle a large amount of transactions per seconds by omitting consensus for simpler use cases such as payment transactions and asset transfers and enabling parallel agreement on casually independent transactions.

Sui uses Delegated Proof-of-Stake, which means that the voting power of a validator depends on the total amount of stake delegated to it.

💰 What does staking mean?

Staking is the process of locking up a digital asset to provide economic security for a public blockchain. You have the superpower to contribute to the network’s security and it grants you the right to vote on proposals and make decisions on the future of the blockchain.

When the staking transaction is complete, rewards will start to be generated immediately. At any time, stakers can send a transaction to claim their accumulated rewards.

Staking rewards are generated and distributed to staked holders in two ways:

- Through transaction fees collected by the network and distributed to stakers.

- Through the inflation rate, the total supply is inflated to reward stakers.

⚠️ Holders that do not stake don’t receive staking rewards, meaning their capital gets diluted over time.

📚 How to stake $SUI?

1. Create a SUI wallet

You first have to download the SUI wallet extension, you can use this link. Once downloaded, open the extension. You will see a window with different options.

Click on “Get Started” to begin the process of creating your SUI wallet.

You’ll be prompted to choose between creating a new wallet or importing an existing one. To create a new wallet, simply click on the “Create a New Wallet” option.

After choosing to create a new wallet, you’ll be asked to set a password for it. This password is essential to protect your funds, so choose a strong and unique one that you can remember.

Once you’ve set your password, you’ll be asked to review and agree to the wallet’s terms and conditions. If you agree, click on “Create Wallet” to complete the process.

After that, you’ll be able to see your recovery phrase. It’s essential to save this phrase in a secure place, such as a password manager or physical paper backup. If you lose your recovery phrase, you won’t be able to access your funds, so it’s important to take this step seriously.

Additionally, never disclose your recovery phrase to anyone, as this can compromise the security of your wallet and your funds. Keep it private and only share it with trusted individuals who need to access your wallet in case of an emergency.

The final step is to select the button that confirms you’ve saved your recovery phrase and click on “Open SUI Wallet”. This will take you to your newly created SUI wallet, where you can start managing your funds and transactions.

Congratulations, you’ve successfully created your SUI wallet! You’re now ready to receive and transfer SUI to and from your wallet. Make sure to double-check the wallet address before sending any funds to ensure they’re sent to the correct address.

2. Buy $SUI on an exchange

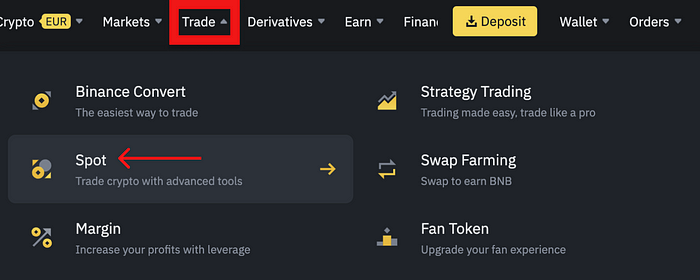

In this example, we’ll use Binance as the exchange to transfer SUI to your wallet. To get started, navigate to the “Trade” section on Binance and select “Spot”. From there, you’ll be able to see all the available tokens, including SUI.

Once you’re in the “Spot” section of Binance, you’ll see a search bar on the right-hand side. This search bar can be used to quickly find the token you’re looking for, such as SUI. Simply type “SUI” into the search bar, and it will filter the list of available tokens to show only SUI.

Once you’ve found SUI in the list of available tokens on Binance, you can decide on the amount of SUI you want to purchase. This example spent 20 USDT to buy 15.4 SUI at a price of 1.30 USDT per SUI.

Once the order is filled, you’ll be able to see the SUI tokens in your Binance portfolio.

3. Transfer your SUI tokens from Binance to your SUI wallet

From there, click on “Withdraw” to transfer your tokens

On the “Address” field of the withdrawal page on Binance, you’ll need to copy and paste the address associated with your SUI wallet.

Copy and paste that address:

Now withdraw your SUI tokens from Binance to your SUI wallet. After a few minutes, you will see the tokens on your SUI wallet.

Next, locate and click on the “Stake” button within the SUI wallet interface to begin staking your SUI tokens.

4. Select you validator

After clicking on the “Stake” button in the SUI wallet interface, you’ll be presented with a list of validators that you can stake your SUI tokens with. If you found this tutorial helpful and would like to support our work, you may consider staking your tokens with our validator, Imperator.co

After selecting Imperator.co as your validator to stake with, click on “Select Amount”

After completing the validator selection process, stake your desired amount of SUI tokens.

Be sure to keep some SUI tokens in your wallet to cover the transaction fee.

Important Note: It’s crucial to understand that the unbonding period for staked tokens lasts for a duration of 24 hours. This means that in the event you want to withdraw your tokens, you’ll need to wait for a full epoch of 24 hours.

To stake your SUI tokens, click on the “Stake Now” button

Now that the transaction is done, you will get a summary of your transaction.

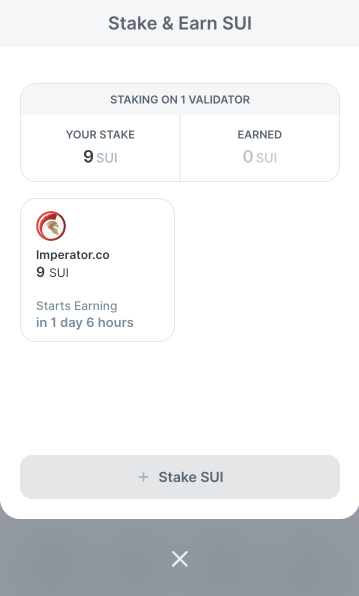

Upon completion of the staking process, the main screen of your SUI wallet will display the number of tokens that you have successfully staked.

Congratulations, you are now staking SUI 👏

Thank you for your support. If you found this article helpful, the best way to support our work is by staking with Imperator.co

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.