PayPal generated considerable excitement and curiosity when it unveiled its stablecoin PYUSD, which is backed 1:1 by cash and short term government securities. It will be operated by PayPal’s existing crypto partner Paxos, a New York regulated trust company.

Given the current regulatory cloud around crypto, some have questioned why PayPal chose to launch now. It was the first to acquire a crypto custodian (Curv) in 2021 and one of the first incumbent institutions to provide crypto services.

By making its move now, it will likely accelerate U.S. stablecoin legislation.

The money to be earned form stablecoins

Ultimately the motivation boils down to money. And there are at leat three potential revenue sources: interest on reserves, FX and merchant services.

People commented that PayPal is bigger than Tether, the largest stablecoin. Actually, it is. And it isn’t.

Tether holds more than twice as much in customer funds as PayPal. The market capitalization of the Tether stablecoin is $82 billion, whereas PayPal holds $39 billion of customer funds.

Yes, PayPal may have exponentially more staff and customers – 433 million active users compared to roughly 42 million Tether wallets if you count the 27 million on the Tron blockchain.

In the first quarter of 2023 Tether reported a profit of $1.48 billion, almost twice PayPal’s. A proportion is Tether’s returns on relatively risky assets (for a stablecoin) such as Bitcoin, Gold and loans. A more conservative company would have earned closer to half that figure.

To put that in context, PayPal’s first quarter revenues were $7 billion and its net income was $795 million. Based on PayPal’s accounting notes and the level of customer funds, we estimate it earned around $400 million in interest on customer balances in the first quarter.

So if PayPal could build its stablecoin to half the size of Tether’s, at current interest rates, that could add another $400 million in interest before other stablecoin related revenues.

But that’s quite a big ask (in the short term), given that PayPal users currently have crypto balances of less than $1 billion.

Revenues beyond interest

During a CNBC interview (below), PayPal’s SVP and crypto leader Jose Fernandez da Ponte said that crypto was the initial target use case but also identified games and remittances as potential real world applications.

On gaming, Fernandez noted that stablecoins could shorten settlement times for merchants so developers won’t have to wait a couple of weeks for funds to clear. PayPal is eyeing the mainstream $100 billion games market, not just web3 games.

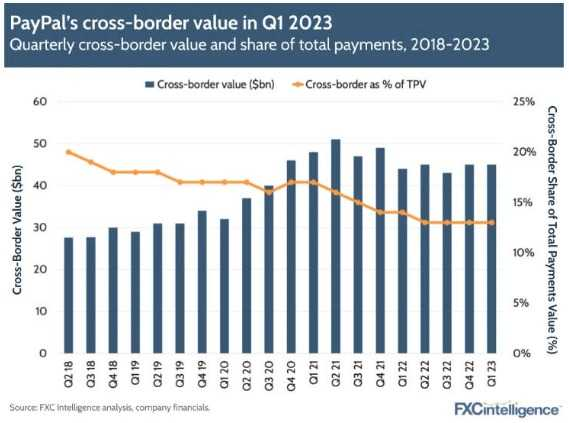

Turning to cross border payments, a recent analysis by FXC Intelligence shows that the proportion of PayPal cross border transactions have been falling for some time, and this is the most profitable segment because PayPal charges hefty margins on FX. I personally reduced usage of PayPal as I found the FX charges too steep.

Remittances are definitely a use case for stablecoins. But the true benefits can only be reaped if FX margins are narrower than PayPal charges. Otherwise there’s no comparative advantage. We’re assuming remittances will only kick in once PayPal deploys its stablecoin to blockchains with more affordable transaction costs compared to Ethereum.

Why Ethereum?

PYUSD hasn’t yet launched in earnest, but one of the test transactions in the past couple of days involved a transfer of $2.50, which cost more than $3 in Ethereum gas fees. And that’s on a good day for fees. We can think of a couple of reasons why Ethereum would be the first launch target.

Firstly, Fernandez said that the crypto ecosystem is the initial target market, and for high value transactions, a $3 or $10 gas cost is not that big a deal.

The second reason is speculation – it could be that PYUSD is only authorized for issuance on Ethereum.

The stablecoin partner is Paxos, the New York (NYDFS) regulated trust company. Paxos deserves credit for its role in continually raising the bar on stablecoin reserve quality that others have followed.

Paxos also operates the Binance USD (BUSD) stablecoin and earlier this year, when we asked it about the BUSD pegged stablecoins that Binance issued on other chains, this is what Paxos said:

“The NYDFS must approve our BUSD operations, including the blockchains on which BUSD tokens may be listed,” Paxos told us via email. “Today, BUSD is approved for issuance only on Ethereum. Paxos is not involved in the management or support of wrapped versions of BUSD.”

We asked Paxos whether PYUSD is authorized on other blockchains, but didn’t receive a response in time for publication.

By only permitting issuance on Ethereum, NYDFS is potentially limiting the audience to crypto users and throttling mainstream usage at this stage. But that strategy is a risky one. Because one of the biggest risks is wrapped stablecoins, where someone else locks an amount of PYUSD on Ethereum and matches the issuance on another chain.

Stablecoin KYC

The problem with wrapped coins is the core stablecoin issuer has far less control and influence, especially over transfer restrictions and KYC.

Theoretically, if one had a policy of not supporting wrapped stablecoins, you could warn anyone wrapping them that the coins will be frozen pending redemption (burning and refunding fiat currency). We also asked Paxos about the policy on wrapping.

The crypto community seemed to be up in arms about PayPal’s ability to freeze accounts, something that other stablecoins such as Tether and USDC also do.

KYC is one of the major unanswered questions. Will an established institution like PayPal really let its stablecoin transfer out of its walled garden with no safeguards?

Again, PayPal’s Fernandez told CNBC that he expected the stablecoin to be available at “exchanges, wallets, Dapps”.

We wondered about that from a KYC perspective. Because most wallets are traceable back to an onramp, so they’re not really pseudonymous. But some wallets are harder to trace. PayPal was an early investor in blockchain intelligence firm TRM Labs, so it could monitor transactions that use its stablecoin.

If remittances are a use case, it will eventually run into banking regulations – PayPal’s European operations are run as a bank in Luxembourg. While European stablecoins might not require KYC for small transactions with self hosted wallets, anything involving a bank would likely need to comply with banking regulations.

When asked about the advantages PayPal brings to the stablecoin party, Fernandez said there were three things. It has a massive two sided network, provides a linkage to the fiat currency world, and has a regulatory and compliance track record of almost 25 years.

Circling back to the headline. We suspect there isn’t a huge risk to PayPal – at this stage – because it’s likely to take it slow, which might not be it’s own choice. “It’s going to be a process in that we are on the way towards mainstream adoption, but I don’t think you’re going to be paying at your neighborhood store with a stablecoin any time soon,” said Fernandez da Ponte.

But the financial upside is pretty significant.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.