What are the 4 Types of Blockchain Technology?

Blockchain technology has emerged as a game-changer in various industries, offering unparalleled security, transparency, and efficiency. However, not all firms have the same requirements when it comes to adopting blockchain.

Developers have crafted various blockchain types to meet organizations’ diverse needs.

In this article, we will explore “What are the 4 Types of Blockchain Technology?”: public blockchain, private blockchain, hybrid blockchain, and consortium blockchain. Let’s dive in and understand each type in detail.

Overview

Blockchain, in its essence, is a decentralized database that is shared among computer network nodes. It enables the secure recording and verification of transactions using cryptographic hashes and a distributed ledger.

The technology eliminates the need for a central authority, ensuring data integrity and preventing fraud and data tampering.

What is Blockchain?

Blockchain is a decentralized database that allows for the secure recording and verification of transactions.

It operates on the principle of a distributed ledger, where transactional data is divided into blocks and linked together using cryptographic hashes.

This unique ID ensures data integrity and prevents tampering or unauthorized changes. Blockchain technology has gained popularity due to its ability to eliminate the need for intermediaries, increase transparency, and enhance security.

Why Do We Need Different Types of Blockchain?

Different organizations have distinct requirements when it comes to blockchain technology.

While some may prioritize openness and transparency, others may require more control over their network. To cater to these diverse needs, different types of blockchains have been developed.

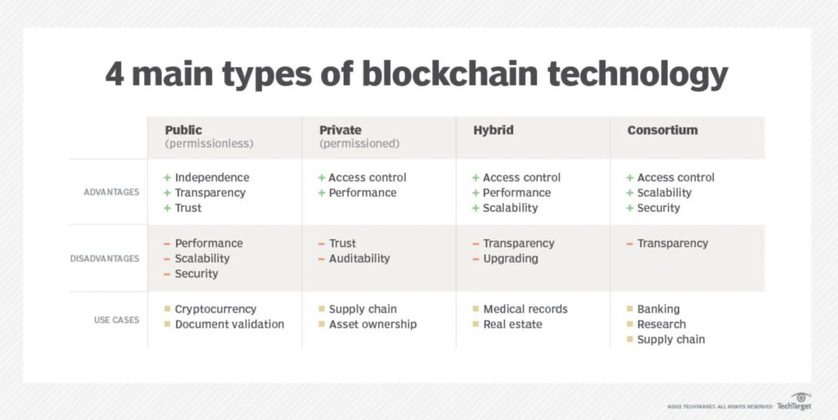

Each type offers specific characteristics and benefits, allowing organizations to choose the most suitable option for their operations. Let’s explore the 4 main types of blockchain technology in detail.

What are the four Types of Blockchain Technology?

Public Blockchain

A public blockchain, also known as a permissionless blockchain, is a distributed ledger where anyone with an internet connection can join and conduct transactions.

It is a non-restrictive form of blockchain, with each participating node having a copy of the entire blockchain.

This openness allows for transparency, as all authorized nodes can access and verify transactions.

Public blockchains often use consensus algorithms like Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions and secure the network.

Advantages of the Public Blockchain:

- Trustable: Public blockchains use consensus algorithms to ensure the authenticity of transactions and prevent fraud.

- Secure: A large number of participants in a public blockchain makes it highly secure, as hacking the entire network requires tremendous computational power.

- Open and Transparent: Public blockchains provide transparency, as all authorized nodes have access to the blockchain records.

Disadvantages of the Public Blockchain:

- Lower TPS: Public blockchains have a lower transaction processing speed as the consensus algorithms require time to validate transactions.

- Scalability Issues: As the network expands, the processing speed of public blockchains decreases, posing scalability challenges.

- High Energy Consumption: Proof of Work consensus algorithms, used in public blockchains like Bitcoin, consume significant energy. Energy-efficient consensus methods are essential for the future of public blockchains.

Uses of the Public Blockchain:

- Cryptocurrencies: Public blockchains like Bitcoin and Ethereum are widely used for mining and exchanging cryptocurrencies.

- Notarization: Public blockchains can be used for creating a fixed record with an auditable chain of custody, such as electronic notarization of documents.

- Social Support Groups: Organizations built on transparency and trust, such as social support groups, can benefit from the openness of public blockchains.

Private Blockchain

Private blockchains, often called permissioned blockchains, function within closed networks or under the control of a single organization.

In contrast to public blockchains, private blockchains are confined to a chosen group of participants.

Additionally, these participants are granted access to the blockchain network, which is often password-protected.

Private blockchains provide organizations with more control and privacy over their data, making them suitable for internal operations.

Advantages of Private Blockchain:

- Speed: Private blockchains outpace their public counterparts in transaction processing speed due to their restricted node count.

- Scalability: Organizations can easily scale their private blockchains to meet their specific requirements, making them highly scalable.

Disadvantages of Private Blockchain:

- Trust Building: In a private blockchain, trust extends only to participating nodes, which the controlling organization pre-approved.

- Lower Security: Private blockchains are more vulnerable to security breaches compared to public blockchains as they have a smaller number of nodes.

- Centralization: Private blockchains require a central Identity and Access Management (IAM) system, which can limit decentralization.

Uses of Private Blockchain:

- Supply Chain Management: Private blockchains can be used to manage supply chain operations within an organization, ensuring transparency and trust.

- Asset Ownership: Private blockchains can track and verify asset ownership, providing a secure and auditable record.

- Internal Voting: Private blockchains can enable internal voting processes within organizations.

Hybrid Blockchain

Hybrid blockchain combines the features of both public and private blockchains, offering the best of both worlds.

Furthermore, it allows organizations to create a private, permission-based system alongside a public, permissionless system.

Hybrid blockchains maintain private transactions and records, yet validation is possible via smart contracts when needed.

Advantages of Hybrid Blockchain:

- Secure: Hybrid blockchains operate within a closed environment, preventing external attacks on the network.

- Cost-Effective: Hybrid blockchains provide privacy while allowing communication with third parties. Transactions are inexpensive and quick, with better scalability than public blockchains.

Additionally, here are the disadvantages of Hybrid Blockchain:

- Lack of Transparency: Hybrid blockchains may lack full transparency as certain information can be hidden from public view.

- Less Incentive: Upgrading a hybrid blockchain can be challenging, and users may have little incentive to participate in or contribute to the network.

Uses of Hybrid Blockchain:

- Real Estate: Real estate companies can use hybrid blockchains to run their systems privately while offering certain information, such as property listings, to the public.

- Retail: Hybrid blockchains can streamline retail processes, ensuring secure and transparent transactions.

- Highly Regulated Markets: Industries like banking, which operate in highly regulated environments, can benefit from the privacy and security of hybrid blockchains.

Consortium Blockchain

Consortium blockchain, also known as federated blockchain, involves multiple organizations collaborating on a decentralized network.

Additionally, unlike public or private blockchains, consortium blockchains require consensus among predetermined nodes.

These nodes are responsible for initiating, receiving, and validating transactions within the network.

Advantages of Consortium Blockchain:

- Secure: Consortium blockchains offer enhanced security, scalability, and efficiency compared to public blockchains.

- Access Controls: Consortium blockchains provide access controls, allowing organizations to determine which nodes can validate transactions.

Disadvantages of Consortium Blockchain:

- Lack of Transparency: Consortium blockchains may have lower transparency compared to public blockchains, and a security breach can compromise the network’s functionality.

- Centralized Governance: Consortium blockchains require a centralized governance structure, which provides administrative and monitoring capabilities.

Uses of the Consortium Blockchain:

- Banking and Payments: Banks can form a consortium blockchain to collaborate on secure and transparent transactions.

- Research: Research organizations can use consortium blockchains to share data and outcomes securely.

- Supply Chain Management: Consortiums of organizations can utilize blockchain to track and verify supply chain operations.

Conclusion: What are the four Types of Blockchain Technology?

In conclusion, the 4 different types of blockchain technology cater to the diverse needs of organizations.

Furthermore, public blockchains offer openness and transparency, while private blockchains provide control and privacy.

Additionally, hybrid blockchains combine the benefits of both public and private blockchains, and consortium blockchains allow collaboration among multiple organizations.

Understanding the characteristics and use cases of each type is crucial for organizations to choose the most suitable blockchain for their operations.

As blockchain technology continues to evolve, it will reshape industries and revolutionize the way we conduct transactions and manage data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.