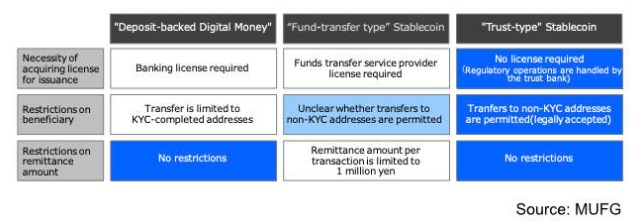

Earlier this year MUFG announced its Progmat Coin platform could be used to issue stablecoins by multiple banks, including on public blockchains. Today it revealed plans for a National stablecoin study group with numerous other institutions. MUFG advised that pseudonymous public blockchain transactions are possible for some types of stablecoins. In other words, know your customer is not a requirement. And for stablecoins issued via a trust bank, the issuer does not need a license.

Additionally, MUFG confirmed previously announced plans to incorporate Progmat Inc. on October 2, with MUFG retaining 49%. Japan’s second and third largest banks, SMBC (7.5%) and Mizuho (7.5%) are shareholders, as well as Sumitomo Mitsui Trust Bank (7.5%). Other owners include Tokyo Stock Exchange operator JPX (5%), SBI PTS Holdings (5%), NTT Data (13.5%) and Datachain (5%).

“Like the success of the Internet, which was achieved by using the same protocol (standard) across all boundaries, we hope that this one-of-a-kind partnership will lead to the creation of a national infrastructure to make the world of digital assets more convenient,” said Iwao Nagashima, President and CEO Mitsubishi UFJ Trust and Banking Corporation.

Progmat claims to be the largest digital securities issuing platform in the world. Companies often make such claims, but with Yen 127 billion ($868 million) in real world asset token issuances (mainly real estate), this one is accurate.

Now the platform is accelerating its utility token and stablecoin rollout.

No KYC needed for stablecoins

Earlier this year, MUFG announced a collaboration to circulate stablecoins across multiple public blockchains. At the time, we asked whether all transactions would require know your customer (KYC). And now we have the answer.

In June, Japanese legislation came into force supporting different types of stablecoins. Progmat Coin is for trust bank-issued stablecoins. This involves ringfenced balances at the trust bank, which makes them bankrupt remote. In other words, the assets are separate from the trust banks, so if the trust bank goes bust, the assets still belong to the token holders.

With this type of stablecoin, MUFG says that pseudonymous transfers on public blockchains are allowed and there are no transaction limits. It also says that to issue a stablecoin via a trust bank, no license is required. We’re guessing that’s because the controller or administrator of the stablecoin is a licensed trust bank. That’s not dissimilar to how Paxos Trust issued Binance USD in the United States.

Other types of stablecoins

In contrast to trust bank-issued tokens, for commercial bank-issued stablecoins, KYC is required and there are also no limits on transaction amounts. Unlike other jurisdictions that have partial government insurance, in Japan, insurance covers all deposits. Hence deposit tokens don’t have a significant disadvantage because the assets are not ringfenced.

Meanwhile, the public blockchain integration is being enabled by blockchain interoperability firm Datachain as well as TOKI. This will enable Progmat Coins to circulate across multiple public blockchains. They plan to start with Ethereum, followed by Cosmos, Polygon, Avalanche and others. TOKI takes on a role similar to USDC-issuer Circle’s Cross-Chain Transfer Protocol (CCTP), which enables coins to be burnt on one public blockchain and reissued on another.

Another key point is that Progmat Coin is not limited to Japanese Yen issuance. So this model can be used for a US dollar stablecoin. MUFG and the other Japanese banks have ambitions to be global players in this area.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.